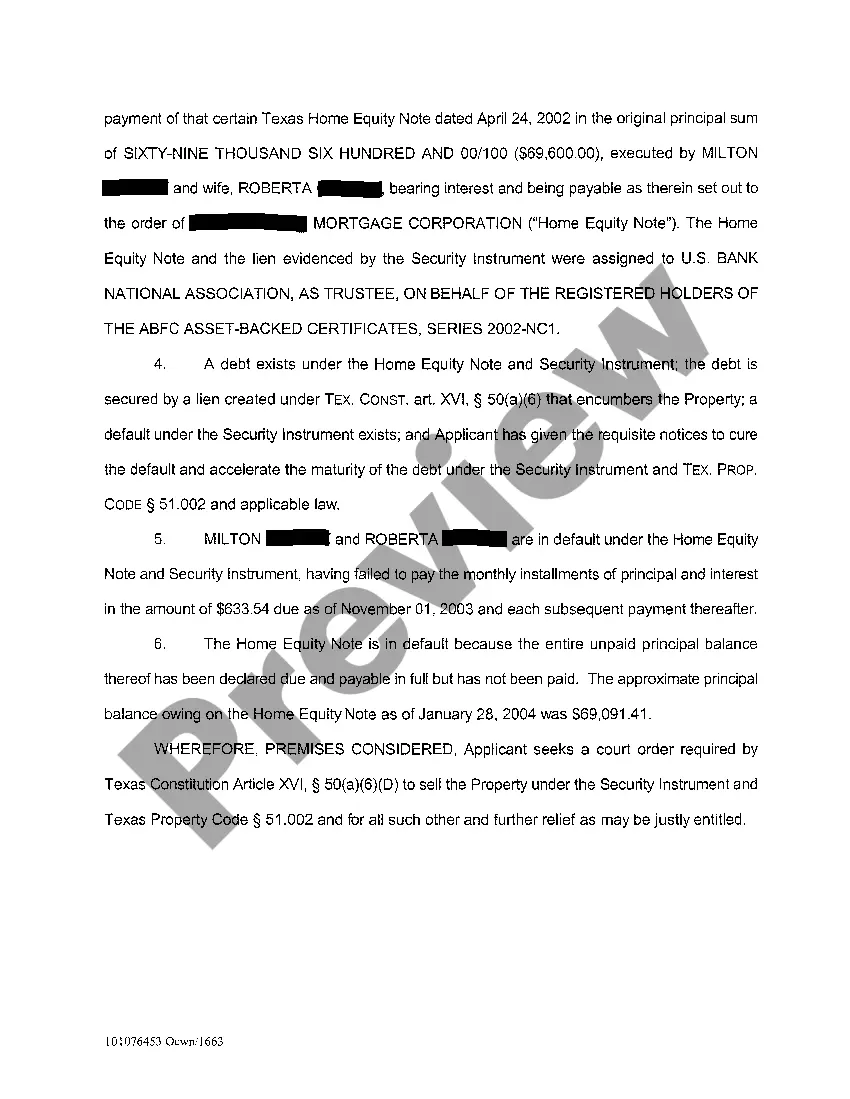

The Harris Texas Application for Expedited Foreclosure is a legal process through which a lender seeks to accelerate the foreclosure process in order to recover the outstanding loan amount from a defaulting borrower. This application is filed in the Harris County, Texas court system and is governed by specific laws and regulations. One type of Harris Texas Application for Expedited Foreclosure is the Application for Expedited Order of Foreclosure. This application is typically filed by a mortgage lender or lien holder, especially in cases of non-payment or default by the borrower. It allows the lender to request an expedited foreclosure process to recover the outstanding mortgage amount or collateral. Another type is the Application for Expedited Order of Sale. This application is commonly used when a lender wishes to sell foreclosed property at an auction to recoup the defaulted loan amount. The application requests the court's approval to proceed with an expedited sale process and sets forth the specific details of the foreclosure sale. The Harris Texas Application for Expedited Foreclosure requires various details and supporting documents to be submitted, including the promissory note, mortgage or deed of trust, loan payment history, default notices, and any other relevant foreclosure-related documents. The application also needs to demonstrate that the borrower has defaulted on the loan and that there are no valid defenses or counterclaims to prolong the foreclosure process. The key keywords relevant to the Harris Texas Application for Expedited Foreclosure include: 1. Harris Texas 2. Application for Expedited Foreclosure 3. Foreclosure process 4. Lender 5. Defaulted borrower 6. Mortgage lender 7. Lien holder 8. Accelerate foreclosure 9. Outstanding loan amount 10. Harris County court system 11. Laws and regulations 12. Application for Expedited Order of Foreclosure 13. Application for Expedited Order of Sale 14. Non-payment 15. Default 16. Collateral 17. Auction 18. Promissory note 19. Mortgage or deed of trust 20. Loan payment history 21. Default notices 22. Counterclaims

Harris Texas Application For Expedited Foreclosure

Description

How to fill out Harris Texas Application For Expedited Foreclosure?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law education to draft such papers from scratch, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our platform offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you require the Harris Texas Application For Expedited Foreclosure or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Harris Texas Application For Expedited Foreclosure quickly employing our trusted platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before downloading the Harris Texas Application For Expedited Foreclosure:

- Ensure the template you have chosen is suitable for your area considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a quick description (if provided) of scenarios the paper can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Harris Texas Application For Expedited Foreclosure as soon as the payment is through.

You’re all set! Now you can go ahead and print out the form or fill it out online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.