Title: Understanding Tarrant Texas Application for Expedited Foreclosure Introduction: Tarrant County, located in Texas, offers an Application for Expedited Foreclosure process to assist lenders in swiftly recovering their collateral in cases of loan default. This application involves a simplified and accelerated foreclosure process, aiming to expedite the resolution for lenders. This article will provide a detailed overview of the Tarrant Texas Application for Expedited Foreclosure, its purpose, eligibility criteria, and the possible types of expedited foreclosure available. Keywords: Tarrant Texas, Application for Expedited Foreclosure, foreclosure process, loan default, collateral, expedite resolution, lenders, eligibility criteria, types of expedited foreclosure. 1. Purpose of Tarrant Texas Application for Expedited Foreclosure: The Tarrant Texas Application for Expedited Foreclosure is designed to facilitate lenders in swiftly reclaiming their collateral when borrowers default on their loans. It offers an efficient process to minimize delays and associated costs, helping lenders regain possession of the pledged property promptly. 2. Eligibility Criteria for Application for Expedited Foreclosure: To avail the benefits of the Tarrant Texas Application for Expedited Foreclosure, lenders must ensure that certain requirements are met, including: — The borrower must have been in default on their loan payments. — The lender must possess a valid and perfected security interest or mortgage. — The lender must provide adequate evidence of the borrower's default. 3. Types of Tarrant Texas Application for Expedited Foreclosure: There are two common types of expedited foreclosure methods available in Tarrant County, Texas: 3.1. Expedited Nonjudicial Foreclosure: Also known as a power of sale foreclosure, this method allows the lender to sell the pledged property without court intervention. It usually requires a power of sale clause in the loan agreement, granting the lender the authority to initiate the foreclosure process independently. 3.2. Expedited Judicial Foreclosure: In cases where the loan agreement lacks a power of sale clause, lenders can resort to expedited judicial foreclosure. This entails filing a lawsuit against the borrower, seeking a court order to foreclose on the property, and subsequently initiating the sale. Conclusion: Tarrant County, Texas, streamlines the foreclosure process for lenders through the Application for Expedited Foreclosure. By following the specified eligibility criteria, lenders can choose between expedited nonjudicial or judicial foreclosure methods to efficiently recover their collateral. This streamlined process helps minimize delays and costs usually associated with traditional foreclosure proceedings, benefiting both lenders and borrowers. Keywords: Tarrant Texas, Application for Expedited Foreclosure, foreclosure process, loan default, collateral, expedite resolution, lenders, eligibility criteria, types of expedited foreclosure, power of sale foreclosure, expedited nonjudicial foreclosure, expedited judicial foreclosure.

Tarrant Texas Application For Expedited Foreclosure

State:

Texas

County:

Tarrant

Control #:

TX-CC-04-01

Format:

PDF

Instant download

This form is available by subscription

Description

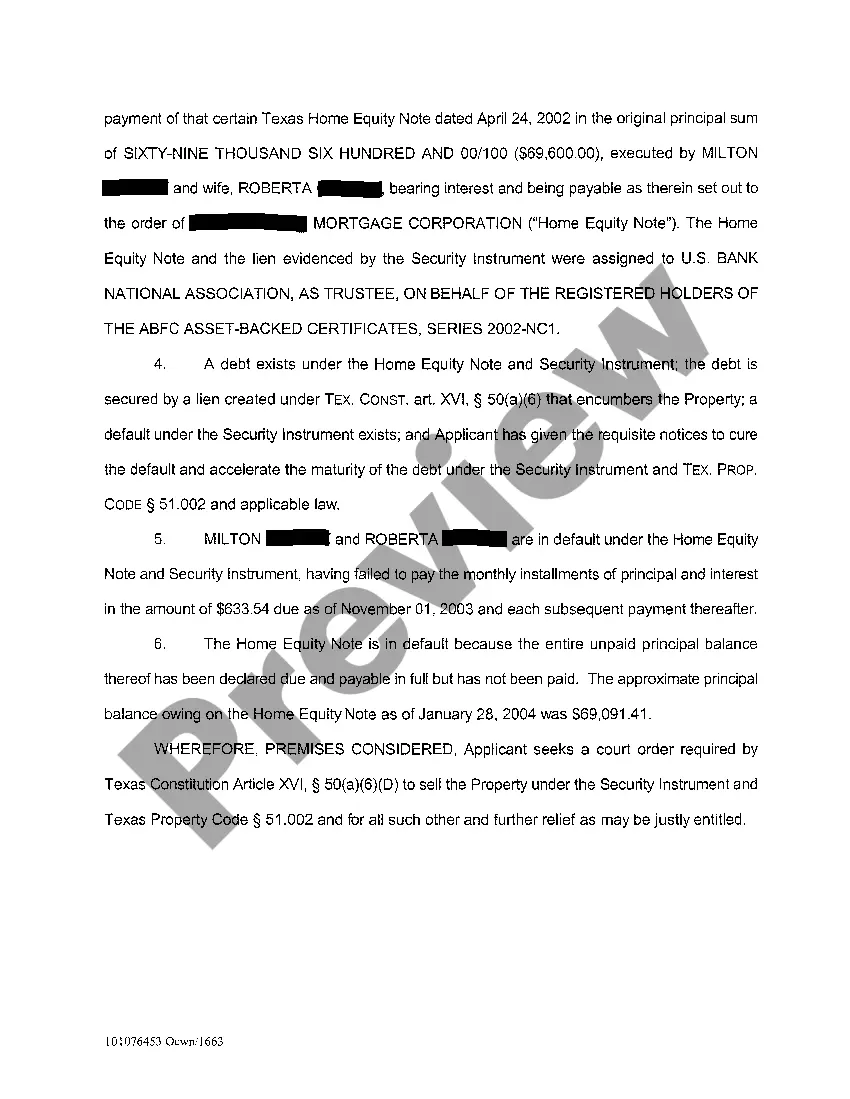

A01 Application For Expedited Foreclosure

Title: Understanding Tarrant Texas Application for Expedited Foreclosure Introduction: Tarrant County, located in Texas, offers an Application for Expedited Foreclosure process to assist lenders in swiftly recovering their collateral in cases of loan default. This application involves a simplified and accelerated foreclosure process, aiming to expedite the resolution for lenders. This article will provide a detailed overview of the Tarrant Texas Application for Expedited Foreclosure, its purpose, eligibility criteria, and the possible types of expedited foreclosure available. Keywords: Tarrant Texas, Application for Expedited Foreclosure, foreclosure process, loan default, collateral, expedite resolution, lenders, eligibility criteria, types of expedited foreclosure. 1. Purpose of Tarrant Texas Application for Expedited Foreclosure: The Tarrant Texas Application for Expedited Foreclosure is designed to facilitate lenders in swiftly reclaiming their collateral when borrowers default on their loans. It offers an efficient process to minimize delays and associated costs, helping lenders regain possession of the pledged property promptly. 2. Eligibility Criteria for Application for Expedited Foreclosure: To avail the benefits of the Tarrant Texas Application for Expedited Foreclosure, lenders must ensure that certain requirements are met, including: — The borrower must have been in default on their loan payments. — The lender must possess a valid and perfected security interest or mortgage. — The lender must provide adequate evidence of the borrower's default. 3. Types of Tarrant Texas Application for Expedited Foreclosure: There are two common types of expedited foreclosure methods available in Tarrant County, Texas: 3.1. Expedited Nonjudicial Foreclosure: Also known as a power of sale foreclosure, this method allows the lender to sell the pledged property without court intervention. It usually requires a power of sale clause in the loan agreement, granting the lender the authority to initiate the foreclosure process independently. 3.2. Expedited Judicial Foreclosure: In cases where the loan agreement lacks a power of sale clause, lenders can resort to expedited judicial foreclosure. This entails filing a lawsuit against the borrower, seeking a court order to foreclose on the property, and subsequently initiating the sale. Conclusion: Tarrant County, Texas, streamlines the foreclosure process for lenders through the Application for Expedited Foreclosure. By following the specified eligibility criteria, lenders can choose between expedited nonjudicial or judicial foreclosure methods to efficiently recover their collateral. This streamlined process helps minimize delays and costs usually associated with traditional foreclosure proceedings, benefiting both lenders and borrowers. Keywords: Tarrant Texas, Application for Expedited Foreclosure, foreclosure process, loan default, collateral, expedite resolution, lenders, eligibility criteria, types of expedited foreclosure, power of sale foreclosure, expedited nonjudicial foreclosure, expedited judicial foreclosure.

Free preview

How to fill out Tarrant Texas Application For Expedited Foreclosure?

If you’ve already utilized our service before, log in to your account and download the Tarrant Texas Application For Expedited Foreclosure on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Tarrant Texas Application For Expedited Foreclosure. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!