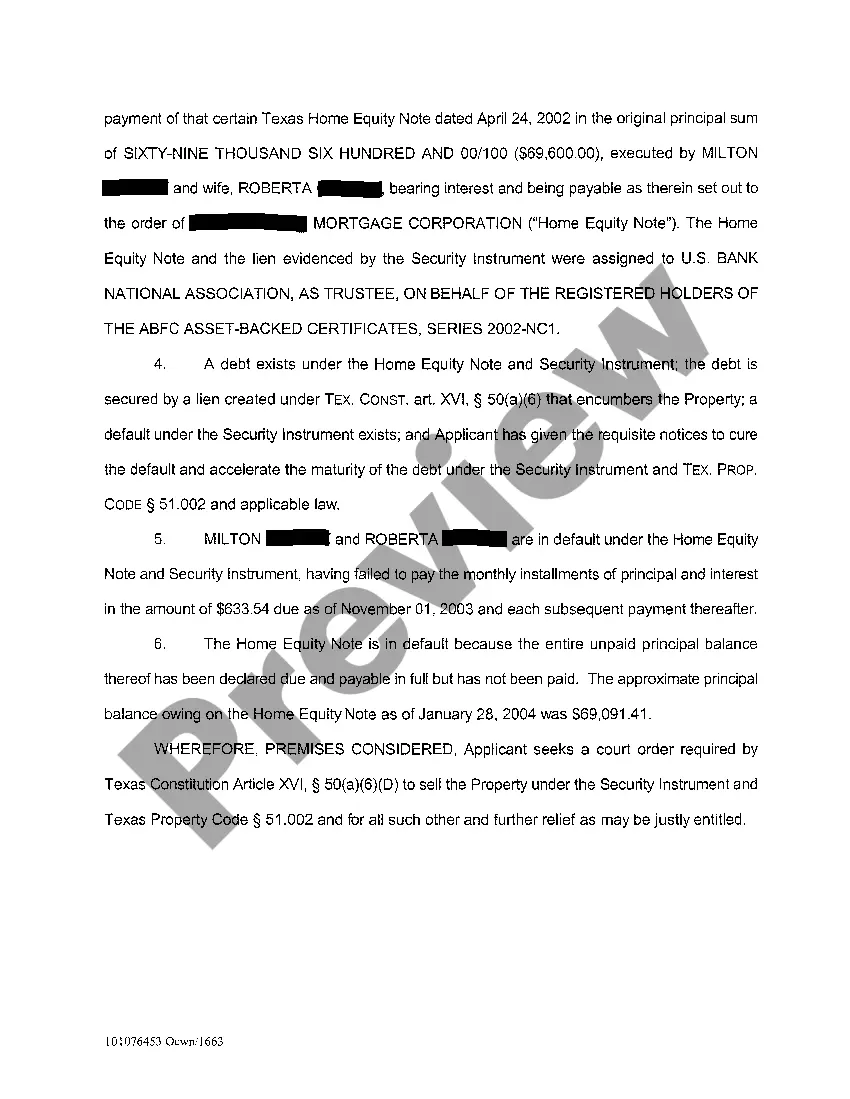

Title: Understanding the Waco Texas Application For Expedited Foreclosure: A Comprehensive Overview Introduction: The Waco Texas Application for Expedited Foreclosure is a legal process employed by lenders to accelerate the foreclosure procedure in cases where the borrower defaults on their mortgage payments or breaches certain terms of the loan agreement. This detailed description aims to clarify the various aspects of this application, encompassing its purpose, key features, and possible alternative solutions, if applicable. Keywords: Waco Texas, Application For Expedited Foreclosure, foreclosure process, default, mortgage payments, loan agreement, alternative solutions. 1. Purpose of the Waco Texas Application For Expedited Foreclosure: The Waco Texas Application for Expedited Foreclosure serves as a mechanism through which lenders can seek an efficient and timely resolution to foreclosure cases. It allows them to petition the court for an expedited foreclosure process, enabling the recovery of the outstanding debt secured by the property at a quicker pace. 2. Key Features and Procedure: — Documentation: The lender must prepare and submit the necessary documentation to support their application for expedited foreclosure. This typically includes evidence of default, breach of loan agreement, and relevant notice given to the borrower. — Court Petition: Once the application is ready, the lender must file it with the appropriate court in Waco, Texas, along with the required filing fees. The court will then evaluate the application based on the evidence provided. — Judicial Review: The court reviews the application and assesses the circumstances of the default or breach, ensuring that due process was followed and the application meets necessary legal requirements. — Foreclosure Sale: If the court approves the application, it grants the lender permission to proceed with the foreclosure sale in a reduced timeframe. The property may then be sold through a public auction, typically supervised by the court or a designated trustee. 3. Types of Waco Texas Application For Expedited Foreclosure: While there is no specific categorization of different types of Waco Texas Application for Expedited Foreclosure, variations may arise based on the specific circumstances of each foreclosure case. These could include: — Residential Foreclosure Application: Pertaining to foreclosure cases involving residential properties, such as single-family homes or residential rental properties. — Commercial Foreclosure Application: Applicable to foreclosure cases involving commercial properties, such as office buildings, retail spaces, or industrial facilities. — Judicial Foreclosure Application: Involving foreclosure proceedings guided and supervised by the court system, as opposed to non-judicial foreclosure methods. 4. Alternative Solutions: While the Waco Texas Application for Expedited Foreclosure provides an efficient means of resolving foreclosure cases, it is worth exploring alternative options that could potentially prevent foreclosure altogether or offer different resolutions. Some potential alternatives may include loan modifications, repayment plans, short sales, or seeking assistance from housing counseling agencies. It is essential for borrowers facing foreclosure to consult with legal professionals or housing experts to explore these alternatives and determine the most suitable solution. Conclusion: The Waco Texas Application for Expedited Foreclosure offers lenders an expedited process to recover debts secured by properties in cases of borrower default or breach. Understanding this application's purpose, features, and potential alternatives empowers borrowers and lenders to make informed decisions during foreclosure proceedings. Consulting with legal professionals and housing experts is crucial to navigate this process and explore the various alternatives available in Waco, Texas.

Waco Texas Application For Expedited Foreclosure

Description

How to fill out Waco Texas Application For Expedited Foreclosure?

We consistently aim to lessen or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we enroll in legal options that are typically very costly.

Nonetheless, not all legal concerns are of the same degree of complexity.

Most can be handled independently.

Benefit from US Legal Forms whenever you need to retrieve and download the Waco Texas Application For Expedited Foreclosure or any other document with ease and security. Just Log In to your account and select the Get button next to it. If you misplace the document, you can always retrieve it again from the My documents section. The procedure is equally simple if you're new to the platform! You can create your account in just a few minutes. Ensure to verify if the Waco Texas Application For Expedited Foreclosure conforms to the statutes and rules of your state and region. Additionally, it's essential to review the form's outline (if available), and if you find any inconsistencies with your initial needs, look for an alternative form. Once you’ve confirmed that the Waco Texas Application For Expedited Foreclosure fits your situation, you can choose a subscription plan and make a payment. Afterward, you can download the document in any appropriate file format. For over 24 years, we've been in the market serving millions by providing customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is a digital directory of current DIY legal documents encompassing a range of items from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection enables you to manage your matters autonomously without the need for an attorney.

- We provide access to legal document templates that are not always readily available to the public.

- Our templates are specific to states and regions, which significantly eases the process of searching.

Form popularity

FAQ

In Texas, the time it takes to get foreclosed on can vary but generally ranges from 30 days to several months, depending on whether the process is judicial or non-judicial. Factors such as the lender's actions and the borrower's responses also influence the timeline. For those looking to understand the specifics of their situation, the US Legal platform can provide valuable insights and assistance with your Waco Texas application for expedited foreclosure.

The most expedient method of foreclosure is non-judicial foreclosure, which allows lenders to proceed without court intervention, significantly speeding up the process. This method is prevalent in states that permit it, including Texas. If you're facing foreclosure, consider filing a Waco Texas application for expedited foreclosure through resources available on the US Legal platform to explore your options.

In Arizona, the foreclosure process can vary but typically takes between 90 to 120 days once the default is filed. This timeline depends on various factors, including the lender's policies and the court's schedule. While this timeframe differs from Texas, understanding these differences can inform your decisions if you're considering a Waco Texas application for expedited foreclosure.

Yes, you can speed up a foreclosure process by applying for expedited foreclosure, which allows for a more rapid resolution of the legal proceedings. By presenting valid reasons to the court for a quicker resolution, you may be able to shorten the timeframe. Platforms like US Legal can assist you in preparing your Waco Texas application for expedited foreclosure, ensuring you meet all necessary criteria.

To expedite closing on a house, both buyers and sellers should prepare all necessary documents in advance and communicate effectively. Ensuring that inspections, appraisals, and financing are in place can significantly speed up the process. Utilizing services like those offered by US Legal will provide guidance, helping you navigate the complexities of property transactions smoothly.

An expedited foreclosure in Texas is a faster legal process that allows lenders to obtain a judgment and foreclose on a property more quickly than standard procedures. This option is beneficial for lenders who need to minimize their losses and act promptly. If you are considering this route, the US Legal platform offers resources to help you submit your Waco Texas application for expedited foreclosure effectively.

The 120 day rule for foreclosure refers to the timeframe in which a lender must wait after a borrower defaults before filing for foreclosure. In Texas, this rule helps ensure that the borrower has ample opportunity to resolve the delinquency before facing foreclosure. By understanding the implications of the 120 day rule, you can make informed decisions regarding your Waco Texas application for expedited foreclosure.

To expedite a foreclosure in Waco, Texas, you may begin by filing an application for expedited foreclosure with the court. This process often involves providing the necessary documentation and demonstrating a valid reason for the expedited request. Utilizing the US Legal platform can help you navigate these requirements seamlessly, ensuring you follow the correct legal procedures.

In Texas, it is essential to file a response to a counterclaim if you wish to defend against the allegations. Failing to respond can result in a default judgment against you. For individuals facing mortgage issues, understanding how this works is crucial, especially when considering a Waco Texas Application For Expedited Foreclosure, where timely responses can significantly impact the outcome.

Rule 736 in Texas is a legal guideline that enables lenders to obtain a court order for expedited foreclosure without a traditional lawsuit. It focuses on cases where the borrower's right to redeem the property may be impaired. By utilizing a Waco Texas Application For Expedited Foreclosure, those in the lending industry can navigate this process more easily and effectively.