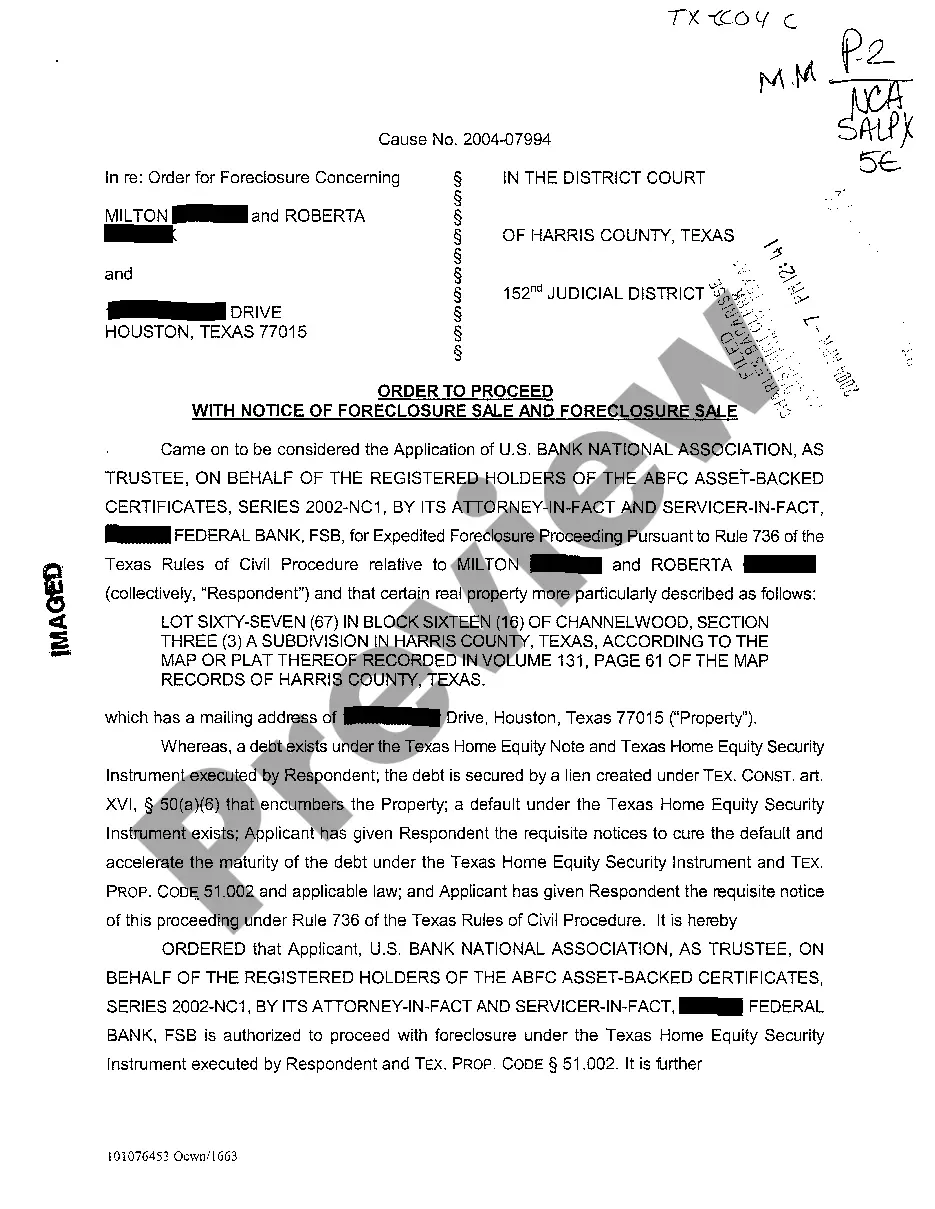

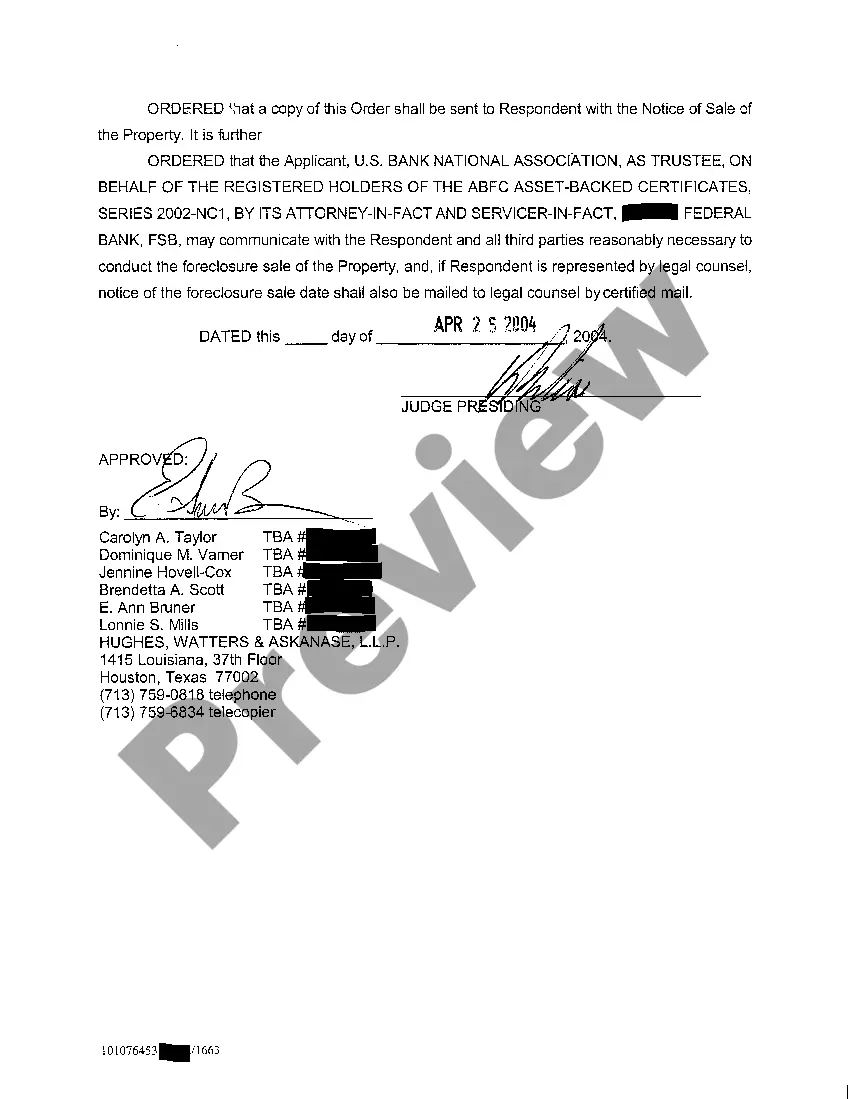

Corpus Christi Texas Order To Proceed With Notice of Foreclosure is a legal document issued by a court or lender to initiate the foreclosure process on a property in Corpus Christi, Texas. This order is typically obtained after the borrower has defaulted on their mortgage or loan payments. It is important to understand the different types of Corpus Christi Texas Orders Proceeding With Notice of Foreclosure and their implications: 1. Judicial Foreclosure: In this type of foreclosure, the lender must file a lawsuit in court and obtain a Corpus Christi Texas Order To Proceed With Notice of Foreclosure from the judiciary. The borrower will receive a formal notice informing them of the court action against them and warning them of the potential loss of their property. 2. Non-Judicial Foreclosure: In some cases, the lender may choose to forego the court process and initiate a non-judicial foreclosure. This type of foreclosure is governed by specific statutes and typically requires the lender to follow a specific set of procedures outlined in the loan agreement or state laws. In Corpus Christi, Texas, the lender must still obtain a Corpus Christi Texas Order To Proceed With Notice of Foreclosure, which allows them to proceed with the foreclosure process outside of court. 3. Notice of Default: Before obtaining an Order To Proceed With Notice of Foreclosure, the lender must first serve the borrower with a Notice of Default. This notice informs the borrower that they have failed to make their mortgage or loan payments as agreed and gives them a specific period, typically 30 days, to bring the account current. If the borrower does not respond or rectify the default within the specified time, the lender may proceed to request the Corpus Christi Texas Order To Proceed With Notice of Foreclosure. 4. Redemption Period: Once the Corpus Christi Texas Order To Proceed With Notice of Foreclosure is obtained and the foreclosure process begins, there may be a redemption period in which the borrower has an opportunity to reclaim the property. This period allows the borrower to pay off the outstanding debt and any associated costs before the foreclosure is finalized. 5. Sale of Foreclosed Property: After the foreclosure process is complete, the property is typically sold at a foreclosure auction. The proceeds from the sale are used to pay off the outstanding debt, including the mortgage balance and any associated fees. Any remaining funds may be returned to the borrower or used to cover the lender's costs. It is essential for borrowers facing foreclosure in Corpus Christi, Texas, to seek legal advice and explore their options to prevent or delay the foreclosure process. Understanding the Corpus Christi Texas Order To Proceed With Notice of Foreclosure and its implications can help borrowers navigate through this challenging situation.

Foreclosure Relief Corpus Christi

Description

How to fill out Corpus Christi Texas Order To Proceed With Notice Of Foreclosure?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Corpus Christi Texas Order To Proceed With Notice of Foreclosure or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Corpus Christi Texas Order To Proceed With Notice of Foreclosure complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Corpus Christi Texas Order To Proceed With Notice of Foreclosure is proper for your case, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!