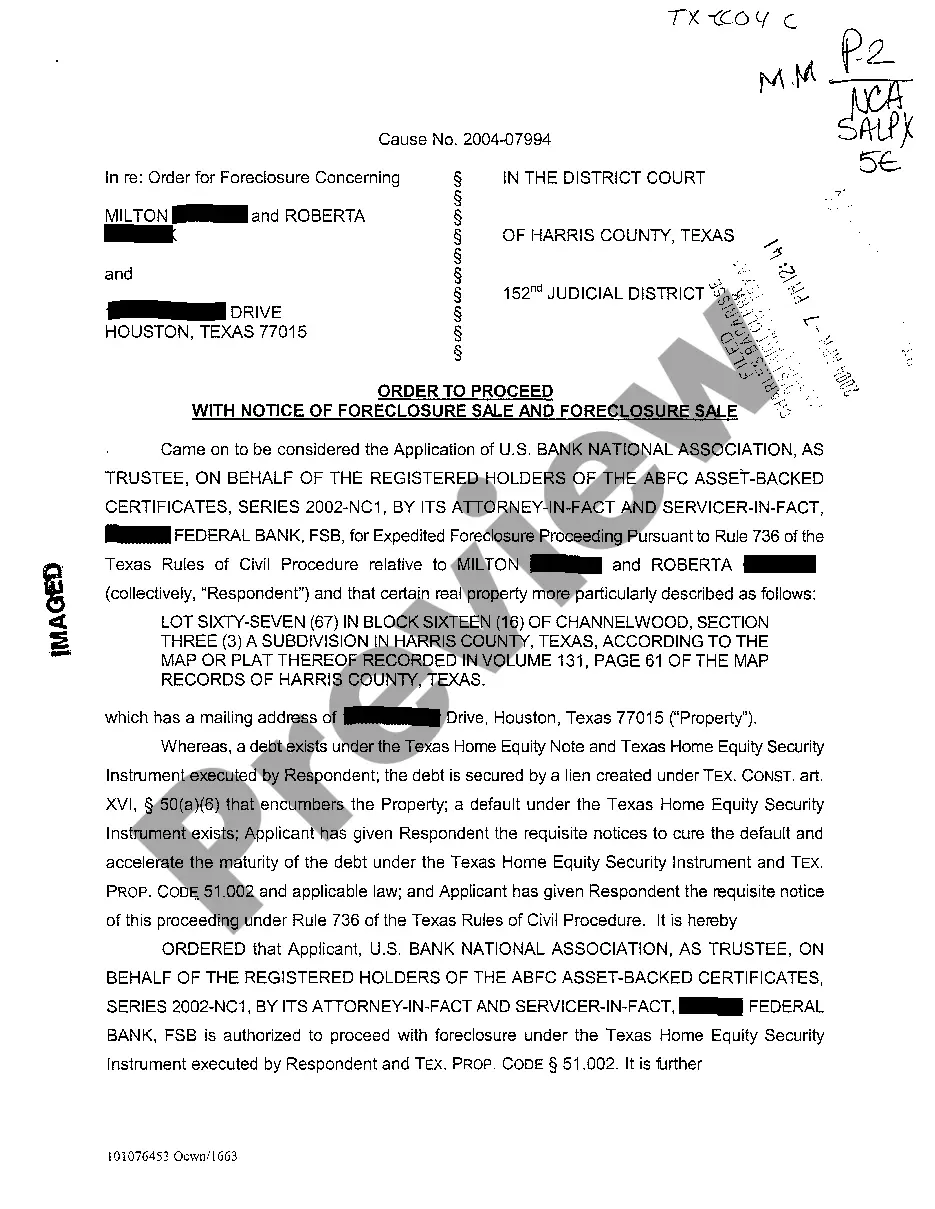

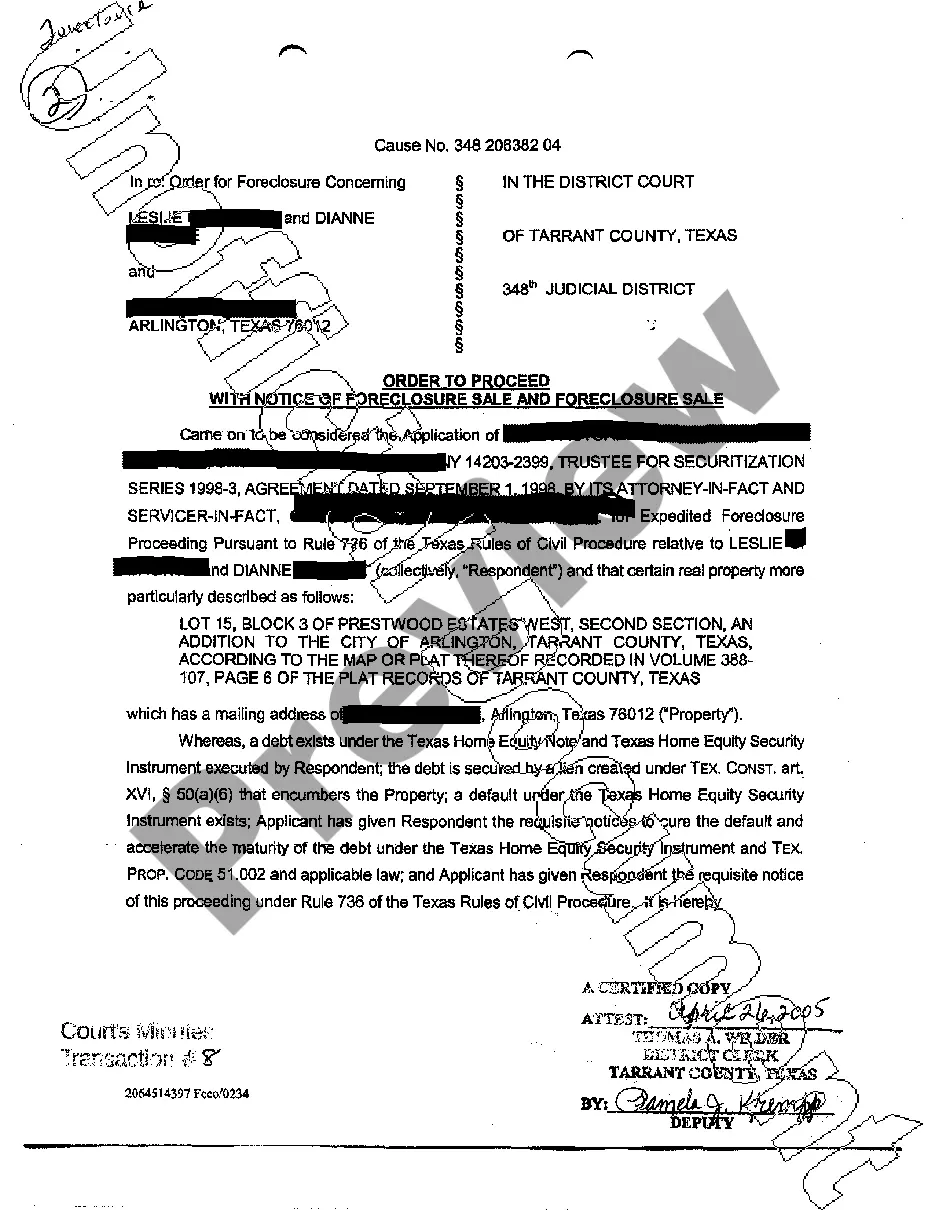

Frisco Texas Order To Proceed With Notice of Foreclosure

Description

How to fill out Texas Order To Proceed With Notice Of Foreclosure?

Utilize the US Legal Forms and gain instant access to any form sample you require.

Our advantageous website featuring thousands of document templates simplifies the process of locating and acquiring virtually any document sample you need.

You can save, complete, and validate the Frisco Texas Order To Proceed With Notice of Foreclosure in merely a few minutes rather than spending hours online trying to find a suitable template.

Using our collection is an excellent approach to enhancing the security of your form submission.

If you haven't created an account yet, follow these steps.

Locate the form you need. Make sure it is the document you were looking for: check its title and description, and use the Preview option if it is accessible. If not, leverage the Search box to find the correct one.

- Our expert attorneys routinely examine all documents to ensure that the forms are applicable for a certain state and adhere to recent laws and regulations.

- How do you secure the Frisco Texas Order To Proceed With Notice of Foreclosure.

- If you have an account, just Log In to your profile.

- The Download button will be activated on all the documents you review.

- Additionally, you can locate all previously saved files in the My documents section.

Form popularity

FAQ

The deed given after a foreclosure sale in Texas is known as a trustee’s deed. This document transfers ownership of the property from the original borrower to the new owner after the successful bid. The trustee’s deed is a vital part of the Frisco Texas Order To Proceed With Notice of Foreclosure, as it legally finalizes the change in property ownership. Buyers should ensure they receive this important document when purchasing at a foreclosure auction.

A notice of default foreclosure in Texas is a formal notice sent to homeowners after several missed payments. It signifies that the lender intends to initiate the Frisco Texas Order To Proceed With Notice of Foreclosure if the debt remains unpaid. This notice provides critical information about the amount owed and the steps the homeowner can take to resolve the situation. Responding promptly can improve your chances of keeping your home.

A foreclosure sale in Texas occurs after the lender has followed the necessary legal steps, including giving a notice and filing the Frisco Texas Order To Proceed With Notice of Foreclosure. The property is sold at a public auction, typically to the highest bidder. After the sale, the buyer receives a trustee’s deed, which transfers ownership. Understanding this process can help homeowners and bidders alike navigate the complexities of foreclosure.

Foreclosure sales in Texas are conducted by a trustee or an auctioneer appointed by the lender. The sale usually takes place on the first Tuesday of each month at the county courthouse, but this can vary. During these sales, properties in the Frisco Texas Order To Proceed With Notice of Foreclosure will be available to the highest bidder. It’s important for bidders to understand the process and legal implications involved.

In Texas, you can typically miss two to three mortgage payments before the lender initiates foreclosure. The exact timeframe can vary depending on the lender's policies. After the third missed payment, you may receive a notice regarding the Frisco Texas Order To Proceed With Notice of Foreclosure. It's crucial to communicate with your lender immediately to explore options and avoid losing your home.

In Texas, the foreclosure process typically takes 60 to 90 days from the time the notice is sent. The timeline can vary depending on factors such as lender actions and any potential legal challenges. Once the Frisco Texas Order To Proceed With Notice of Foreclosure is issued, homeowners often have a brief window to respond. Being proactive is crucial, as it can significantly impact the timeline.

Texas law does not provide a redemption period for properties sold at foreclosure auctions. This means that once the property is sold, the previous owner generally cannot reclaim it by paying off the debt. If you are considering a Frisco Texas Order To Proceed With Notice of Foreclosure, it’s vital to be aware of this legal aspect to make informed decisions.

In Texas, the mortgage holder must provide notice of the foreclosure sale at least 21 days before the scheduled auction date. This notice must be sent to the borrower by certified mail and posted at the county courthouse. Understanding these requirements is essential when dealing with a Frisco Texas Order To Proceed With Notice of Foreclosure, as proper notice protects your rights.

While many assume the foreclosure process in Texas takes 120 days, this can vary depending on multiple factors. Sometimes the process can take less time, especially if no objections are made. For anyone navigating a Frisco Texas Order To Proceed With Notice of Foreclosure, it’s crucial to stay informed about the timeline and possible variations.

The most common foreclosure process in Texas is the non-judicial foreclosure. This process involves a series of notices and an auction of the property without court intervention, which leads to a more expedited process. Whether you're facing a non-judicial route or considering a Frisco Texas Order To Proceed With Notice of Foreclosure, understanding this common practice can guide your next steps.