Austin Texas Home Equity Foreclosure Application is a process by which individuals in Austin, Texas, who are facing foreclosure on their homes due to a default in their home equity loans, can apply for assistance or explore potential solutions. This application allows homeowners to seek alternatives to foreclosure and potentially save their homes from being repossessed by the lender. The Austin Texas Home Equity Foreclosure Application caters specifically to residents of Austin, Texas, who have taken out home equity loans and are struggling to meet their repayment obligations. It is important to note that this application is distinct from other foreclosure applications in that it focuses solely on home equity foreclosures in Austin, Texas. The purpose of the Austin Texas Home Equity Foreclosure Application is to provide homeowners with an avenue to explore options such as loan modifications, repayment plans, refinancing, or even government-assisted programs. These options aim to make the loan repayment process more manageable for homeowners, potentially preventing foreclosure proceedings. Applying for this program requires homeowners to submit certain documentation, such as proof of income, financial statements, and details about the loan agreement. Different types of Austin Texas Home Equity Foreclosure Applications may exist depending on the specific circumstances and programs available to homeowners in Austin, Texas. Some of these may include: 1. Loan Modification Application: This type of application allows homeowners to request changes to the original loan terms, such as interest rate adjustments, extended loan duration, or principal reduction. 2. Repayment Plan Application: Homeowners may apply for a repayment plan that outlines a structured schedule to catch up on missed payments or arrears over a specific period. 3. Refinancing Application: This application involves exploring the possibility of refinancing the original home equity loan to secure more favorable terms or lower monthly payments. 4. Government-Assisted Program Application: Certain government programs, such as the Home Affordable Modification Program (CAMP) or the Home Affordable Refinance Program (HARP), may have their own application processes specifically designed to assist homeowners in financial distress. 5. Non-Profit Assistance Application: Non-profit organizations working to help homeowners facing foreclosure may offer their own application process to evaluate eligibility for their assistance programs. It is important for homeowners facing home equity foreclosure in Austin, Texas, to explore the specific application options available to them, and to seek professional advice from housing counselors or legal professionals specializing in foreclosure prevention. These experts can guide homeowners through the application process and provide tailored assistance based on their unique circumstances.

Austin Texas Home Equity Foreclosure Application

Description

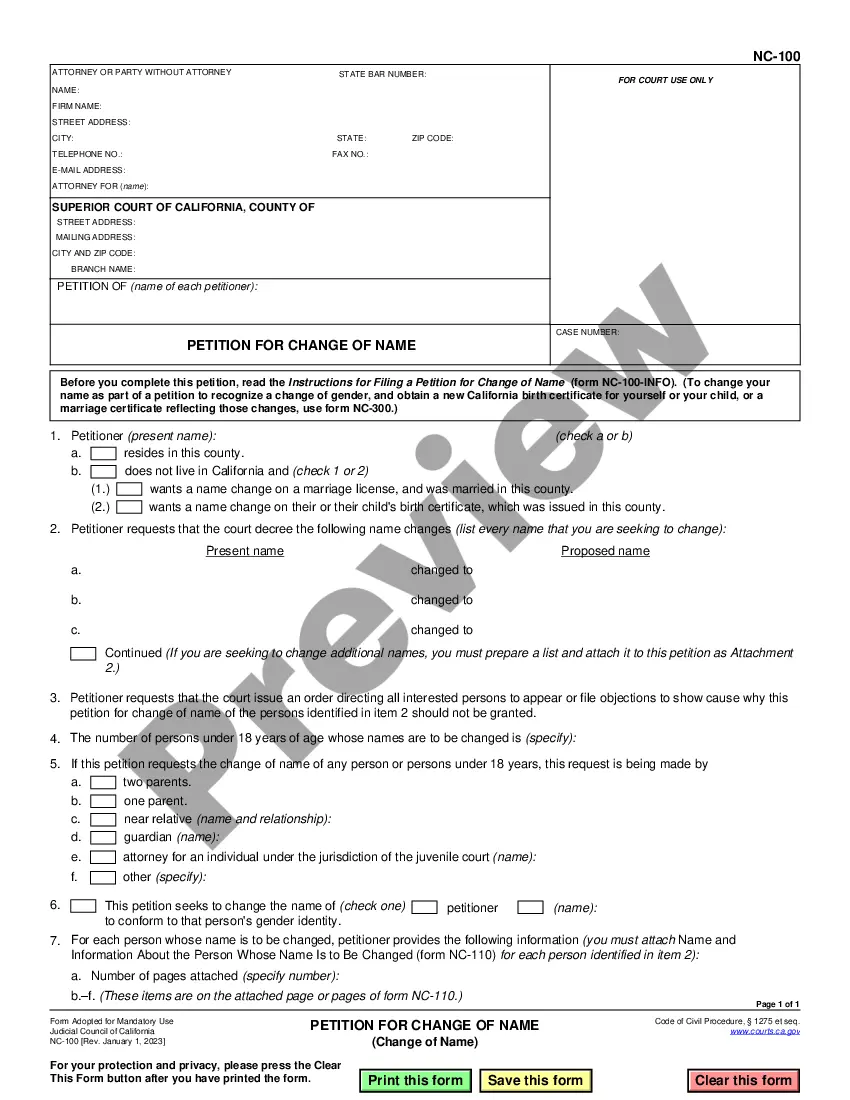

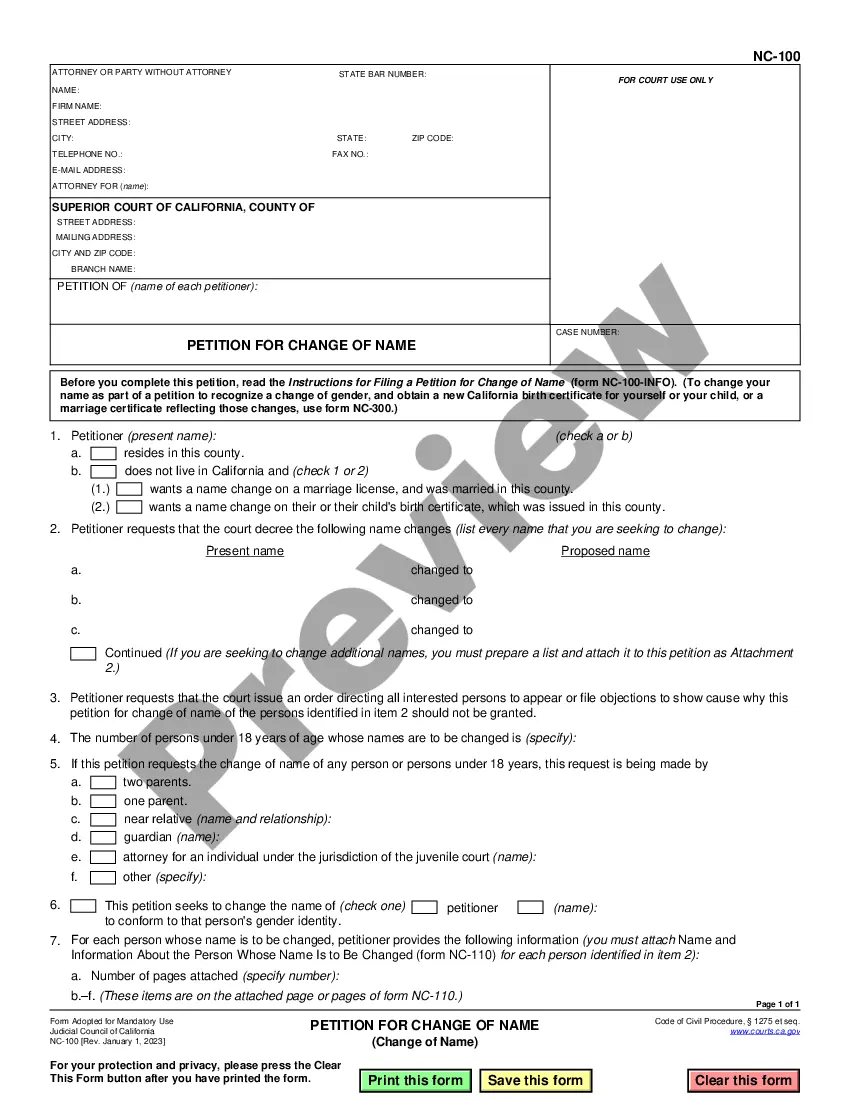

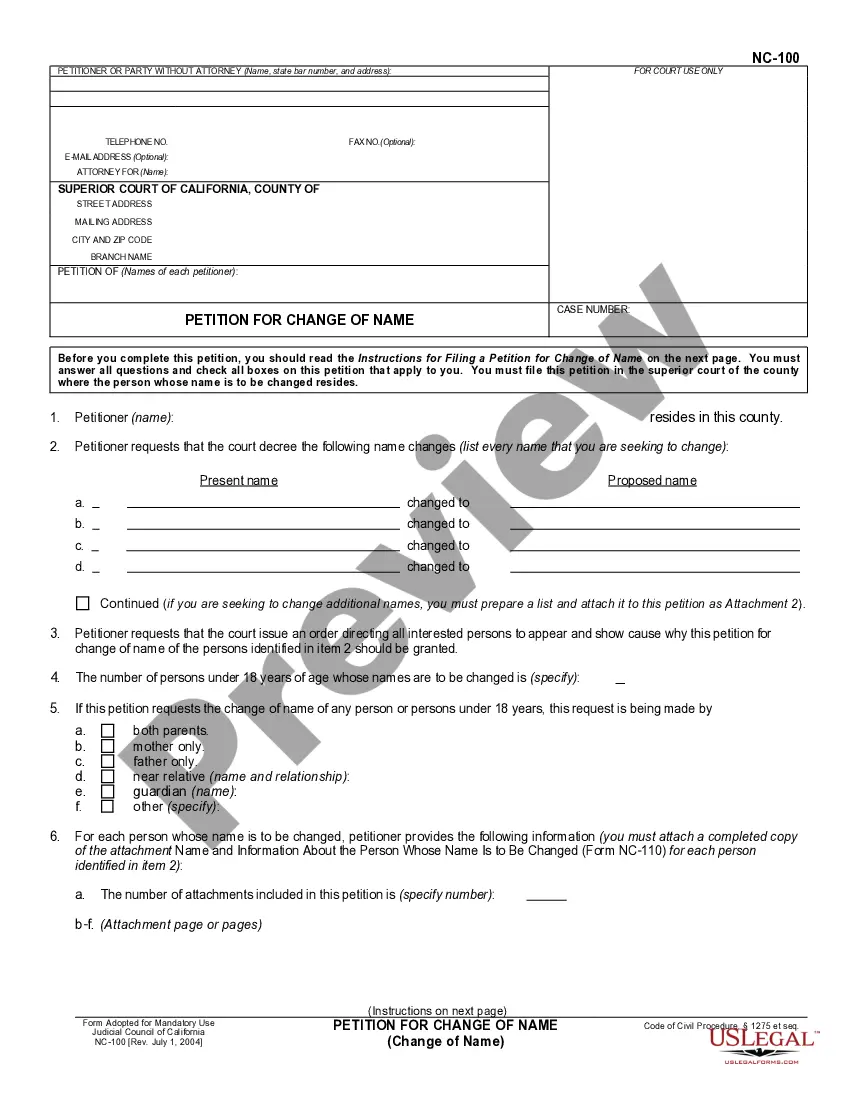

How to fill out Austin Texas Home Equity Foreclosure Application?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no legal background to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Austin Texas Home Equity Foreclosure Application or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Austin Texas Home Equity Foreclosure Application in minutes employing our reliable service. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to obtaining the Austin Texas Home Equity Foreclosure Application:

- Be sure the form you have found is suitable for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the form and read a short description (if provided) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and look for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Austin Texas Home Equity Foreclosure Application once the payment is completed.

You’re all set! Now you can proceed to print the form or complete it online. In case you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.