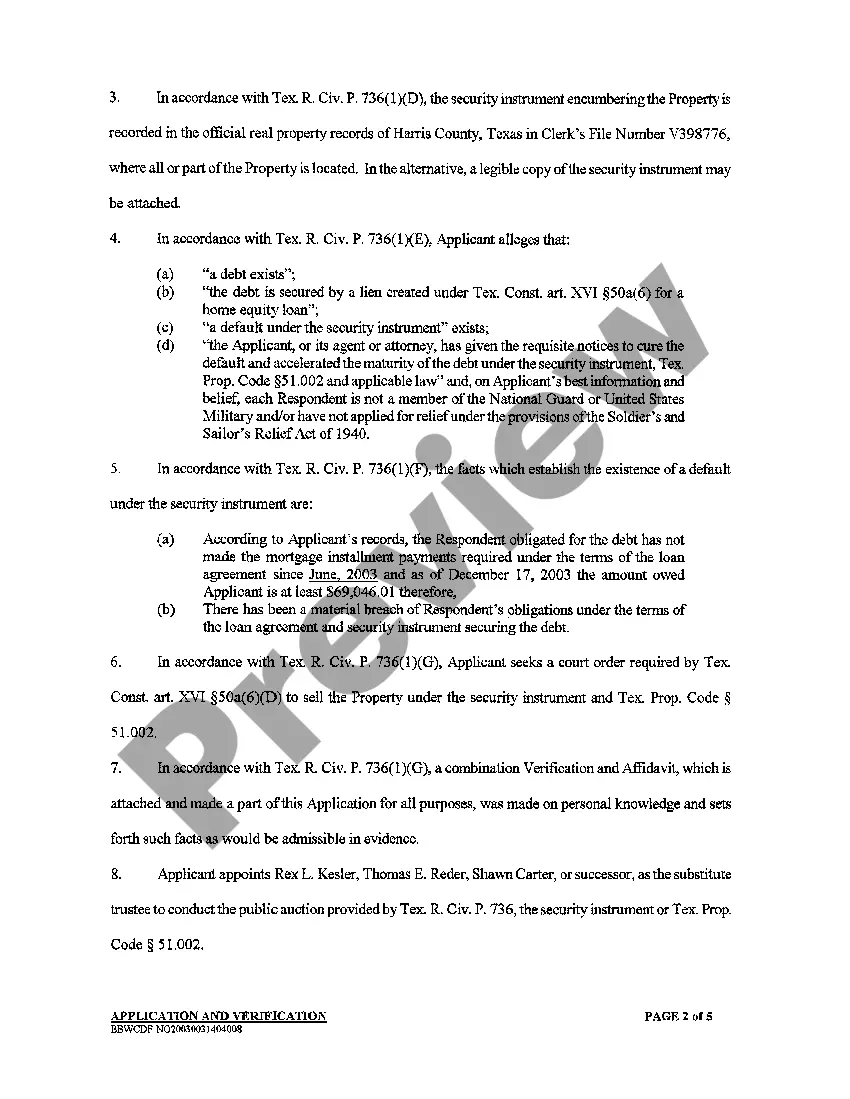

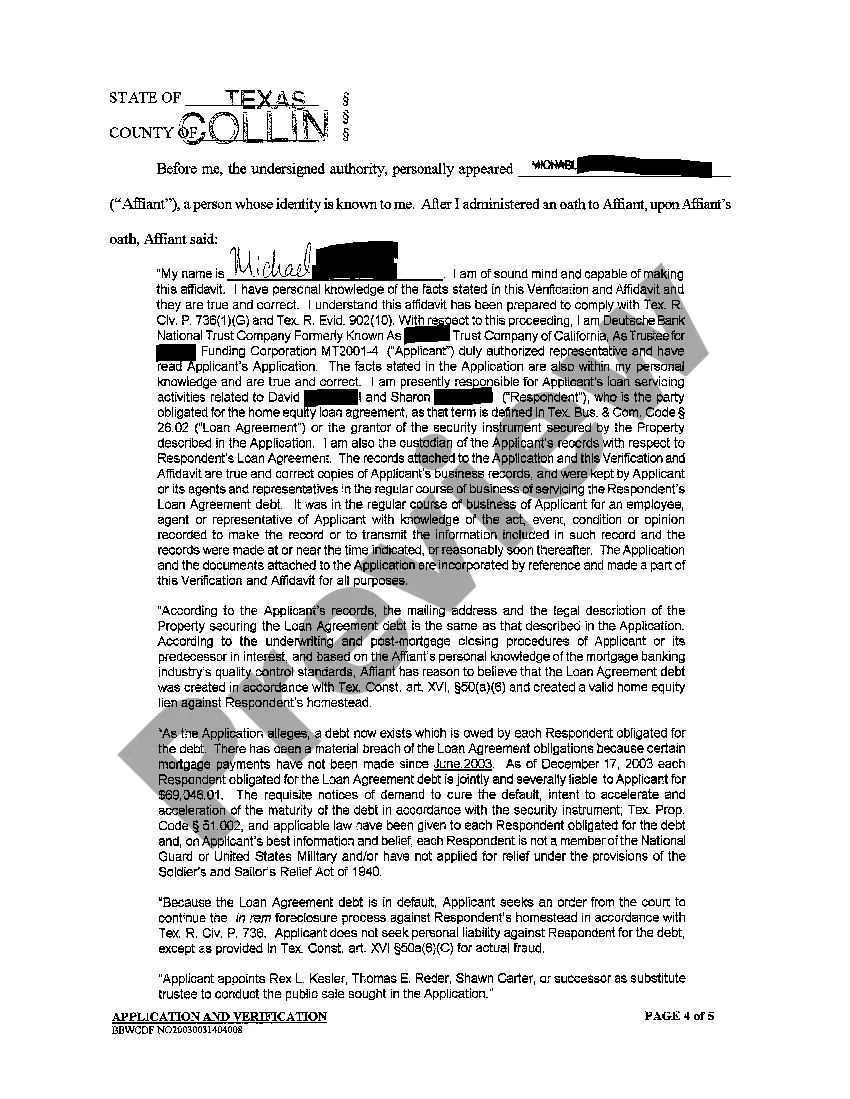

Brownsville Texas Home Equity Foreclosure Application is a legal process by which a lender can take possession of a property in cases where the homeowner fails to repay their home equity loan or mortgage. This application allows the lender to initiate foreclosure proceedings in order to recover the outstanding debt. Brownsville, Texas offers various types of Home Equity Foreclosure Applications, each serving different purposes and catering to specific circumstances. Some of these application types include: 1. Traditional Home Equity Foreclosure Application: This is the standard process initiated by a lender when a borrower defaults on their home equity loan or mortgage payments. It involves filing a formal application with the appropriate court to begin the legal foreclosure proceedings. 2. Judicial Home Equity Foreclosure Application: In this type of application, the lender files a lawsuit against the borrower seeking foreclosure relief. The court then reviews the case and determines the validity of the lender's claims before proceeding with the foreclosure process. 3. Non-Judicial Home Equity Foreclosure Application: Unlike the judicial process, this application does not involve court intervention. Instead, the lender follows a specific set of procedures outlined by Texas law to foreclose on the property without court involvement. 4. Home Equity Refinance Foreclosure Application: This type of application pertains to the foreclosure of a property resulting from a refinanced home equity loan. When the borrower fails to make timely repayments on the refinanced loan, the lender can initiate the foreclosure process. 5. Home Equity Reverse Mortgage Foreclosure Application: Reverse mortgages, typically available to senior homeowners, allow them to convert their home equity into cash. If the borrower does not meet the reverse mortgage requirements or fails to comply with the loan terms, the lender may initiate a foreclosure application to take possession of the property. 6. Home Equity Foreclosure Application Due to Bankruptcy: If a homeowner files for bankruptcy and has a home equity loan or mortgage, the lender can file a specific type of foreclosure application to recover the outstanding debt. It is essential for homeowners in Brownsville, Texas to understand the implications and potential consequences of a Home Equity Foreclosure Application. Seeking legal advice or consulting with a foreclosure expert is recommended if homeowners find themselves facing financial difficulties that may lead to foreclosure.

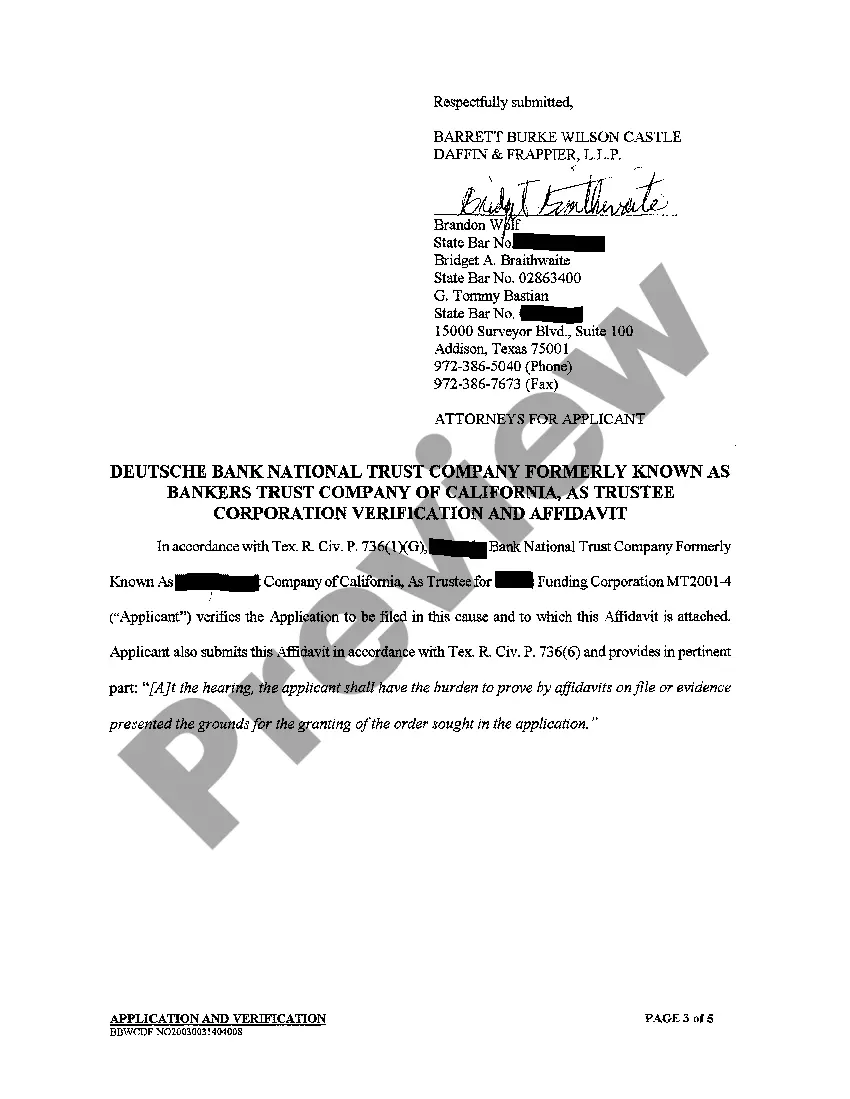

Texas Home Equity Security Instrument

Description

How to fill out Brownsville Texas Home Equity Foreclosure Application?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Brownsville Texas Home Equity Foreclosure Application? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Brownsville Texas Home Equity Foreclosure Application conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Brownsville Texas Home Equity Foreclosure Application in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal papers online once and for all.