Edinburg Texas Home Equity Foreclosure Application: A Comprehensive Guide Homeowners in Edinburg, Texas, who are facing financial difficulties and unable to make their mortgage payments may find themselves in a situation where a foreclosure looms over their heads. In such cases, understanding the Edinburg Texas Home Equity Foreclosure Application process becomes crucial. This detailed description aims to shed light on this topic, providing relevant information and keywords to guide homeowners through the process. 1. What is Home Equity Foreclosure? Home equity foreclosure occurs when a homeowner defaults on their home equity loan, resulting in the lender initiating legal proceedings to repossess the property and sell it to recover the outstanding loan amount. 2. Edinburg, Texas Home Equity Foreclosure Application: In Edinburg, Texas, homeowners facing the risk of foreclosure have the option to submit a Home Equity Foreclosure Application. This application is designed to help homeowners request alternative foreclosure prevention options from their lender or mortgage service. 3. Key Steps in the Home Equity Foreclosure Application Process: a. Gather necessary documentation: To initiate the process, homeowners should compile essential documents such as loan statements, income verification, bank statements, and any correspondence with the lender. b. Contact the lender: Homeowners should reach out to their lender or mortgage service to inform them of the financial hardship they are facing and express their intention to apply for foreclosure prevention options. c. Submit a completed Home Equity Foreclosure Application: The application form requires homeowners to provide details about their financial situation, reasons for the hardship, and any additional supporting documents specifying the loss of income, medical expenses, or other factors contributing to the inability to make mortgage payments. d. Wait for lender response: After submitting the application, homeowners must be patient while the lender reviews their request. It is crucial to stay in communication with the lender during this period to follow up and provide any additional documentation if required. e. Explore available alternatives: Depending on the homeowner's specific circumstances and the lender's guidelines, potential alternatives may include loan modification, repayment plans, forbearance, refinancing, or short sale options. Each option can help alleviate the risk of home equity foreclosure in different ways. f. Seek professional assistance if needed: Homeowners may find it beneficial to consult with foreclosure prevention counselors or real estate attorneys who can provide expert advice and guidance throughout the application process. 4. Types of Home Equity Foreclosure Applications: Though specific types of Home Equity Foreclosure Applications in Edinburg, Texas, are not explicitly named, homeowners can still request mortgage assistance or explore foreclosure prevention options using various application forms provided by their lenders or mortgage services. These applications may differ based on the lender's internal guidelines and programs. In conclusion, the Edinburg Texas Home Equity Foreclosure Application process is a critical step for homeowners facing the risk of foreclosure due to financial hardship. By understanding the process, gathering the necessary documents, and contacting their lender, homeowners can initiate the application process and explore alternative foreclosure prevention options. Seeking professional advice can further enhance the chances of finding a viable solution. Remember, each homeowner's situation is unique, and communication with the lender is crucial to navigate through this challenging time.

Edinburg Texas Home Equity Foreclosure Application

State:

Texas

City:

Edinburg

Control #:

TX-CC-07-01

Format:

PDF

Instant download

This form is available by subscription

Description

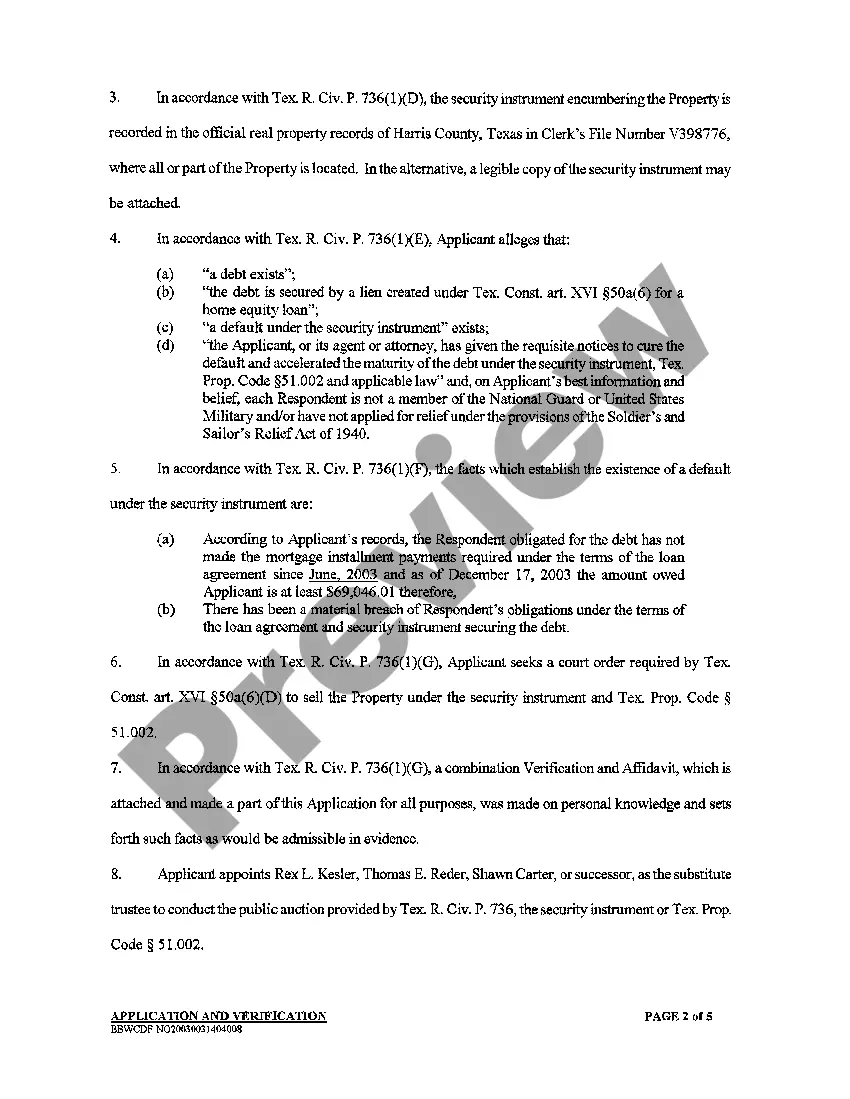

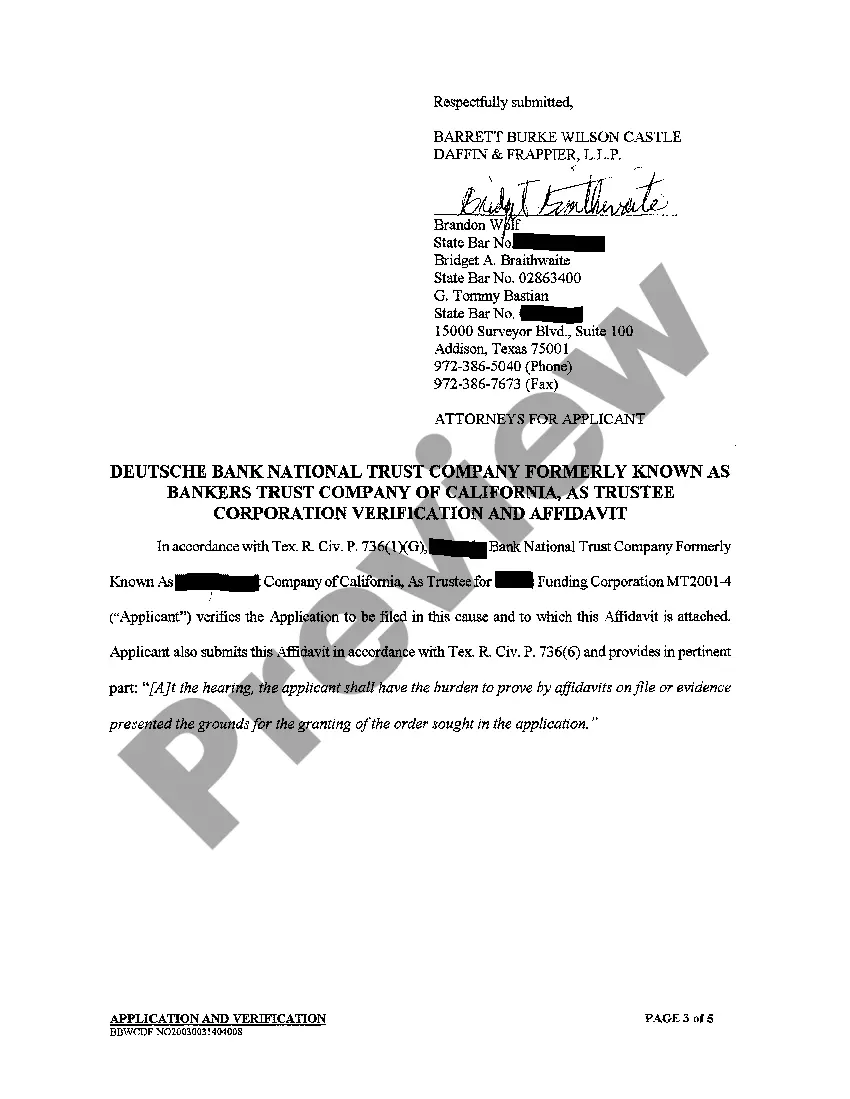

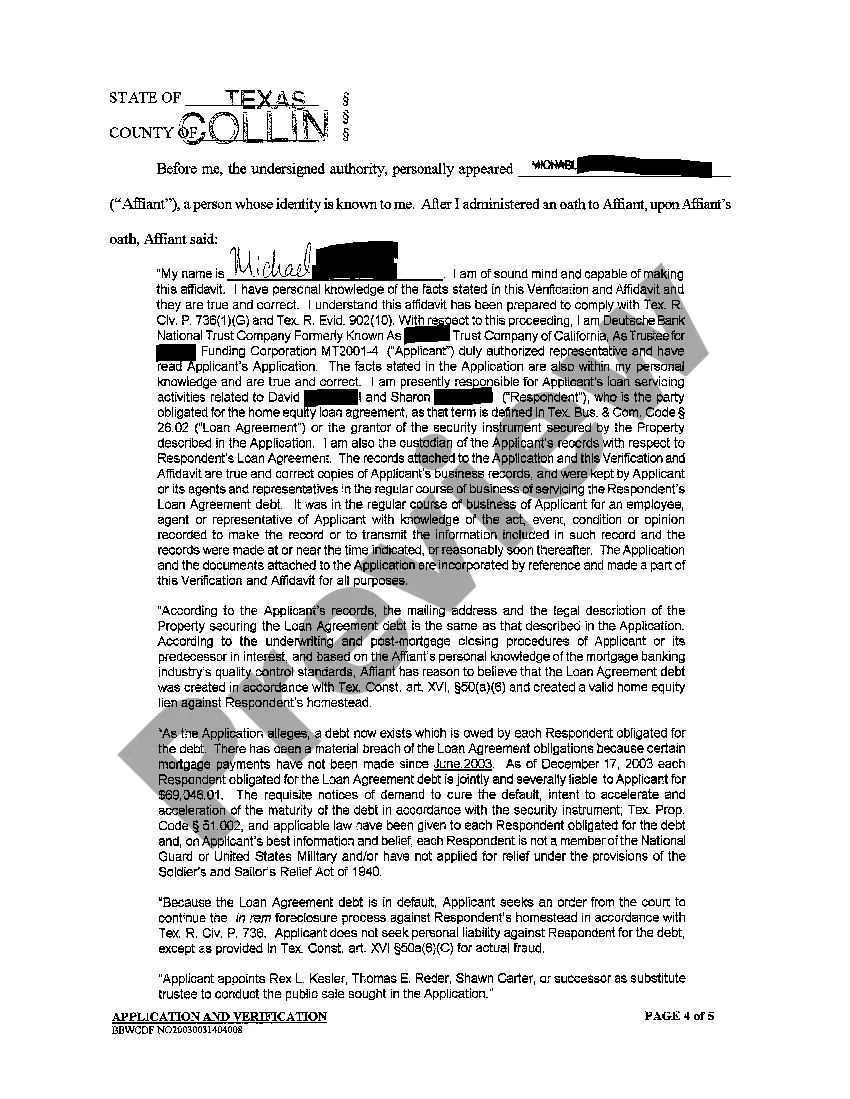

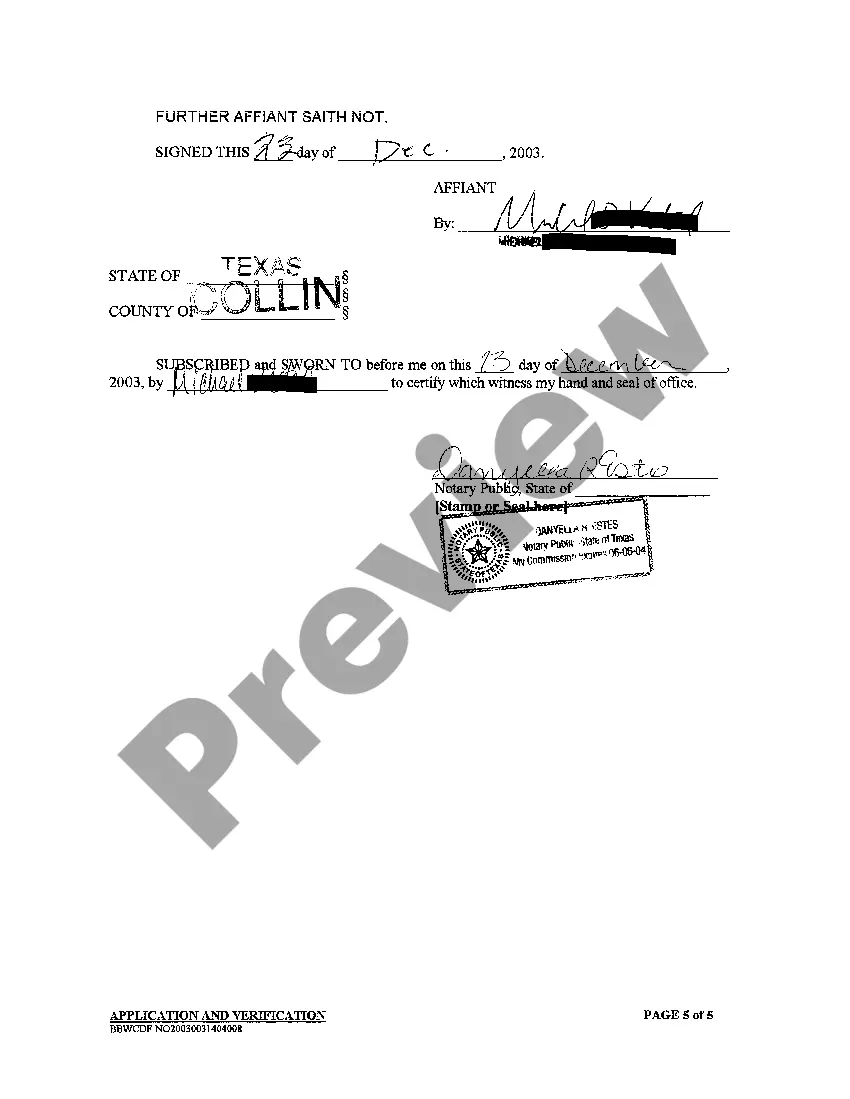

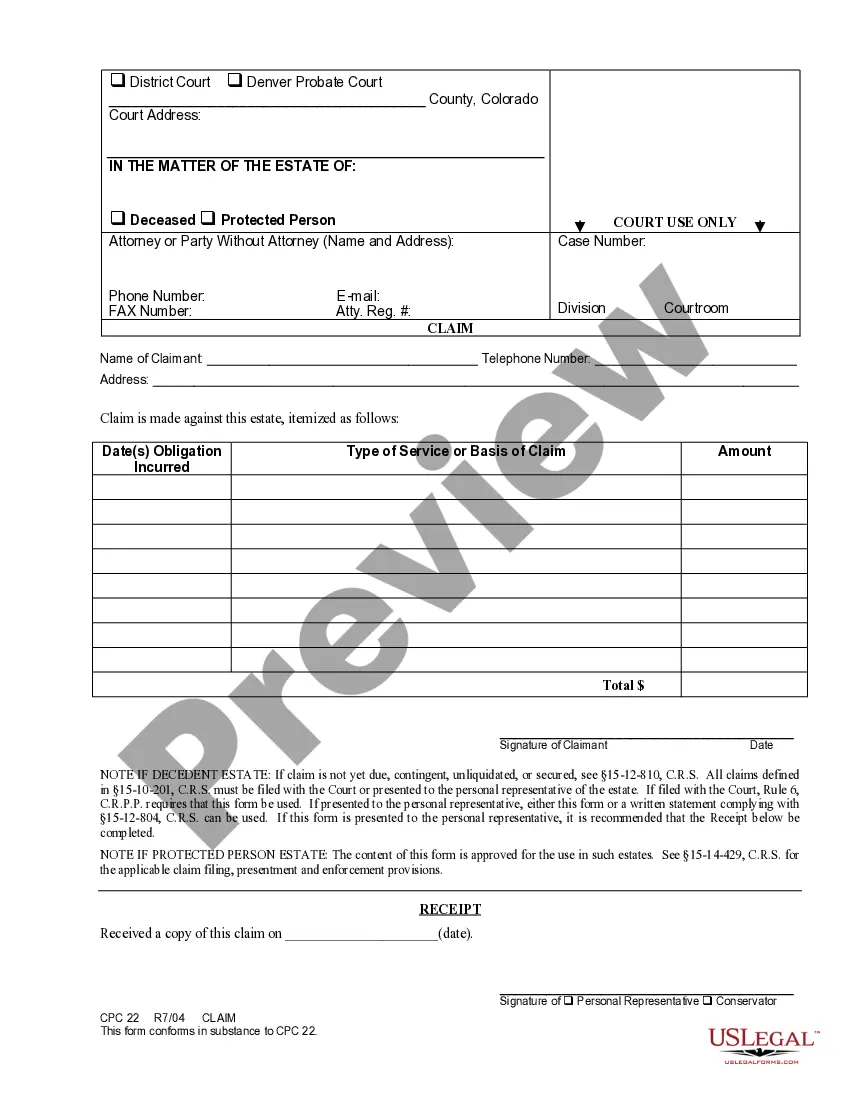

A01 Home Equity Foreclosure Application

Edinburg Texas Home Equity Foreclosure Application: A Comprehensive Guide Homeowners in Edinburg, Texas, who are facing financial difficulties and unable to make their mortgage payments may find themselves in a situation where a foreclosure looms over their heads. In such cases, understanding the Edinburg Texas Home Equity Foreclosure Application process becomes crucial. This detailed description aims to shed light on this topic, providing relevant information and keywords to guide homeowners through the process. 1. What is Home Equity Foreclosure? Home equity foreclosure occurs when a homeowner defaults on their home equity loan, resulting in the lender initiating legal proceedings to repossess the property and sell it to recover the outstanding loan amount. 2. Edinburg, Texas Home Equity Foreclosure Application: In Edinburg, Texas, homeowners facing the risk of foreclosure have the option to submit a Home Equity Foreclosure Application. This application is designed to help homeowners request alternative foreclosure prevention options from their lender or mortgage service. 3. Key Steps in the Home Equity Foreclosure Application Process: a. Gather necessary documentation: To initiate the process, homeowners should compile essential documents such as loan statements, income verification, bank statements, and any correspondence with the lender. b. Contact the lender: Homeowners should reach out to their lender or mortgage service to inform them of the financial hardship they are facing and express their intention to apply for foreclosure prevention options. c. Submit a completed Home Equity Foreclosure Application: The application form requires homeowners to provide details about their financial situation, reasons for the hardship, and any additional supporting documents specifying the loss of income, medical expenses, or other factors contributing to the inability to make mortgage payments. d. Wait for lender response: After submitting the application, homeowners must be patient while the lender reviews their request. It is crucial to stay in communication with the lender during this period to follow up and provide any additional documentation if required. e. Explore available alternatives: Depending on the homeowner's specific circumstances and the lender's guidelines, potential alternatives may include loan modification, repayment plans, forbearance, refinancing, or short sale options. Each option can help alleviate the risk of home equity foreclosure in different ways. f. Seek professional assistance if needed: Homeowners may find it beneficial to consult with foreclosure prevention counselors or real estate attorneys who can provide expert advice and guidance throughout the application process. 4. Types of Home Equity Foreclosure Applications: Though specific types of Home Equity Foreclosure Applications in Edinburg, Texas, are not explicitly named, homeowners can still request mortgage assistance or explore foreclosure prevention options using various application forms provided by their lenders or mortgage services. These applications may differ based on the lender's internal guidelines and programs. In conclusion, the Edinburg Texas Home Equity Foreclosure Application process is a critical step for homeowners facing the risk of foreclosure due to financial hardship. By understanding the process, gathering the necessary documents, and contacting their lender, homeowners can initiate the application process and explore alternative foreclosure prevention options. Seeking professional advice can further enhance the chances of finding a viable solution. Remember, each homeowner's situation is unique, and communication with the lender is crucial to navigate through this challenging time.

Free preview

How to fill out Edinburg Texas Home Equity Foreclosure Application?

If you’ve already utilized our service before, log in to your account and save the Edinburg Texas Home Equity Foreclosure Application on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Edinburg Texas Home Equity Foreclosure Application. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!