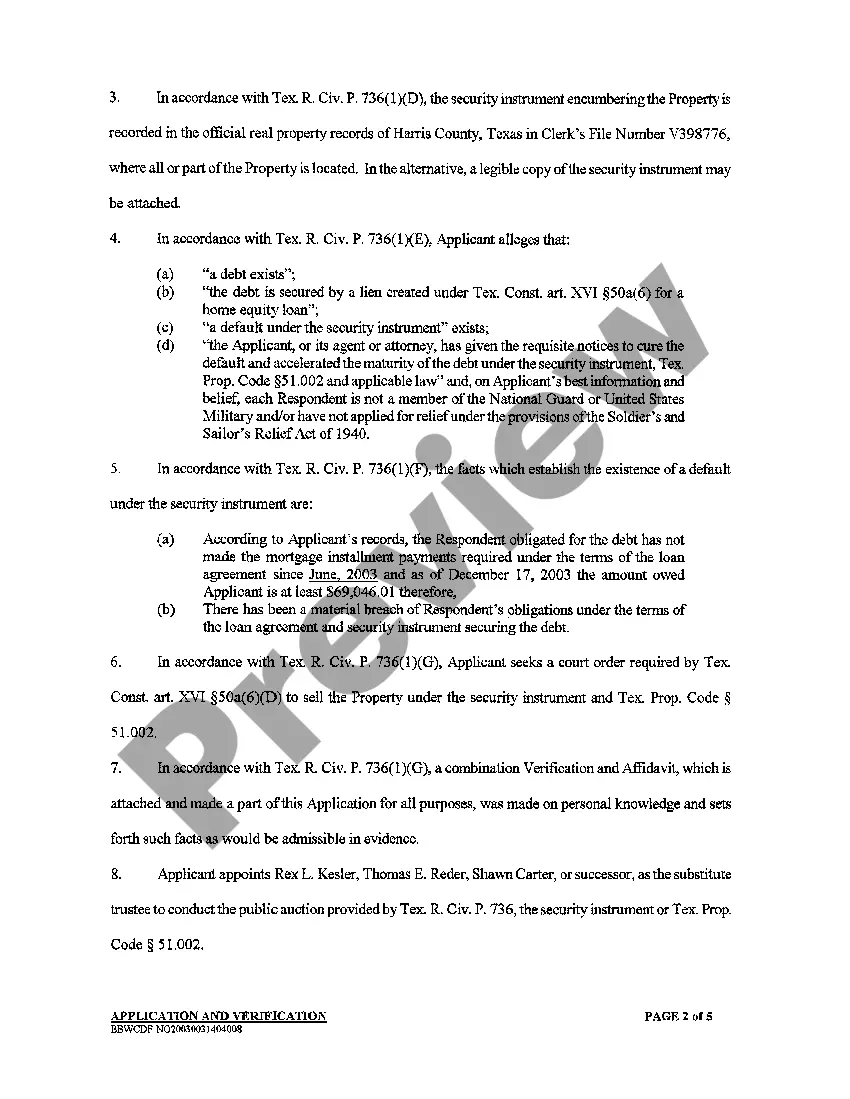

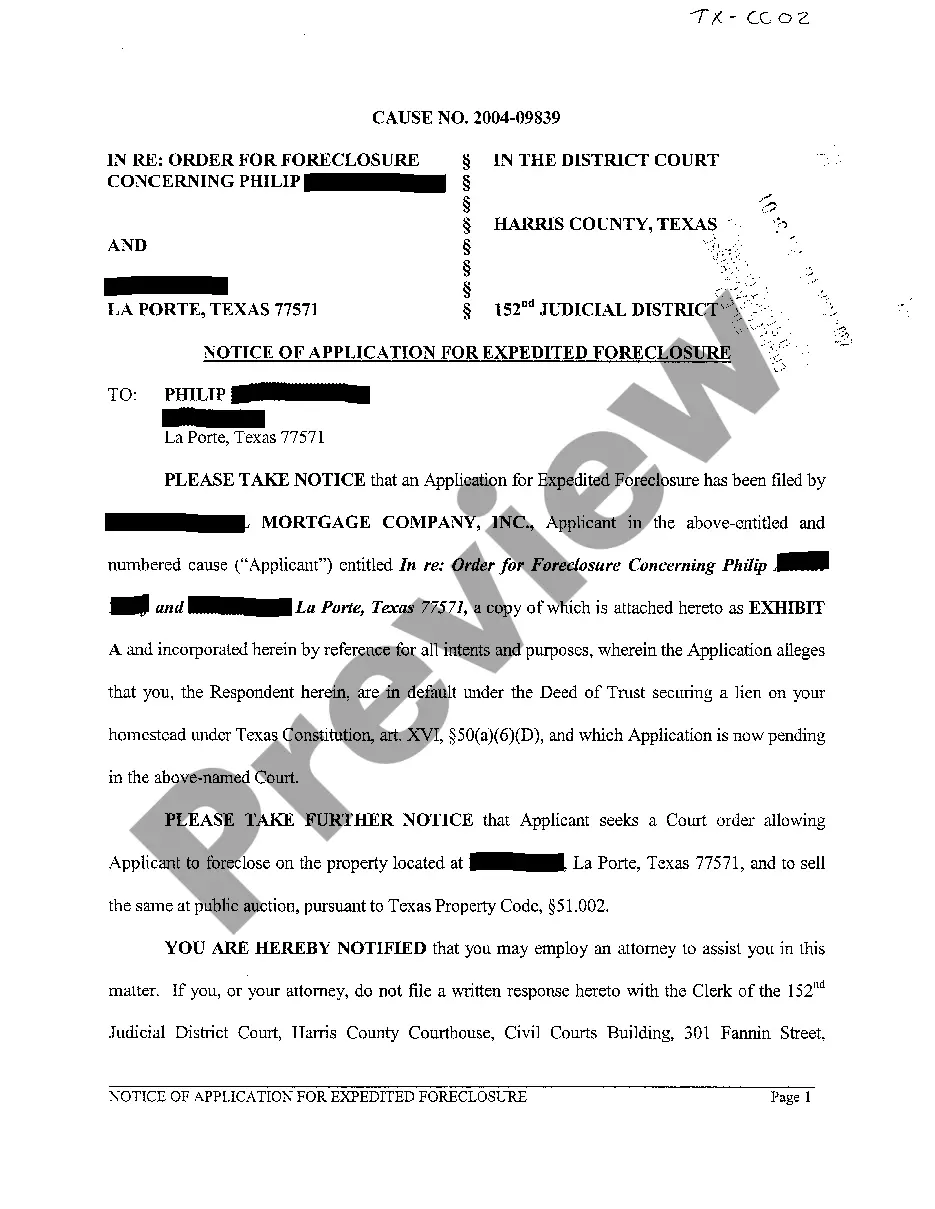

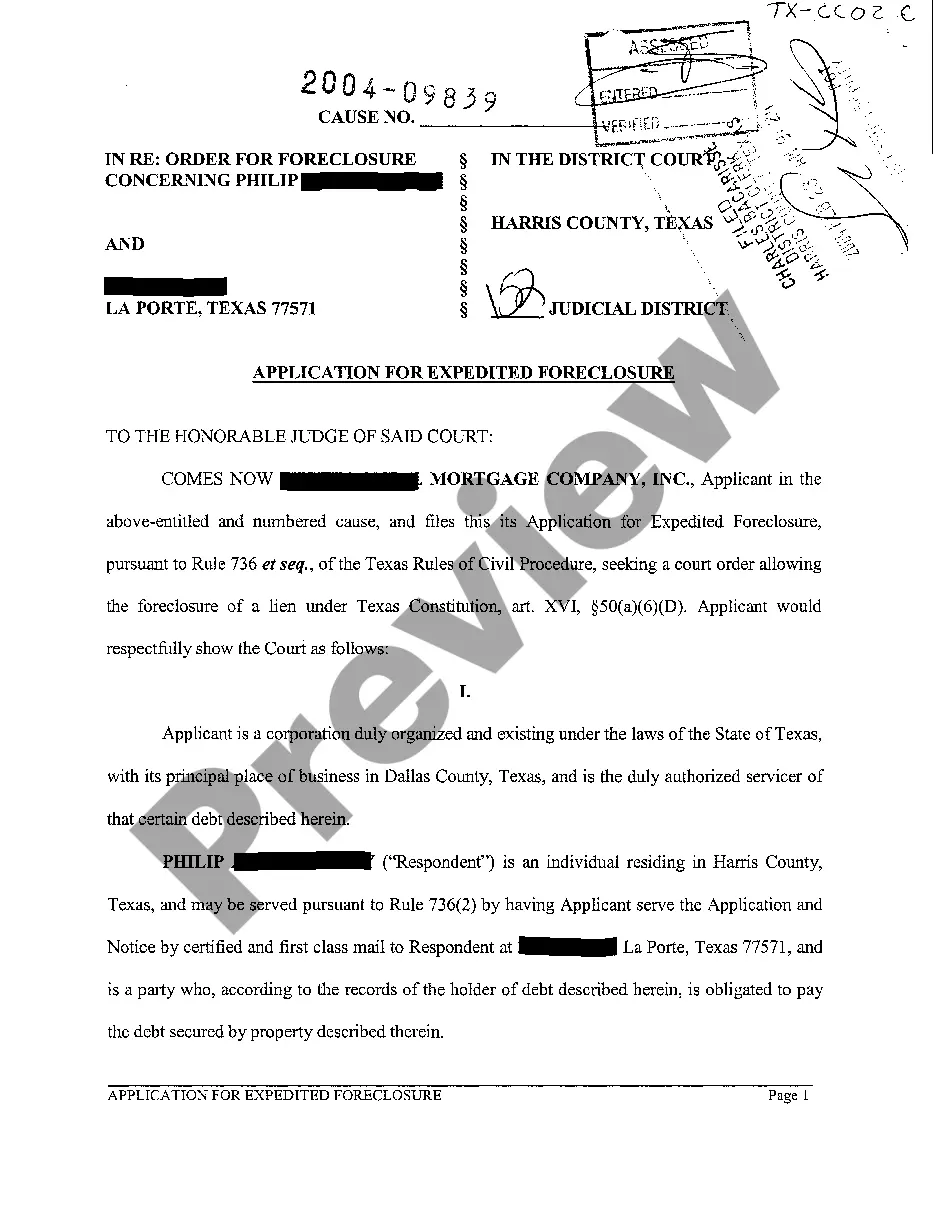

Houston Texas Home Equity Foreclosure Application

Description

How to fill out Texas Home Equity Foreclosure Application?

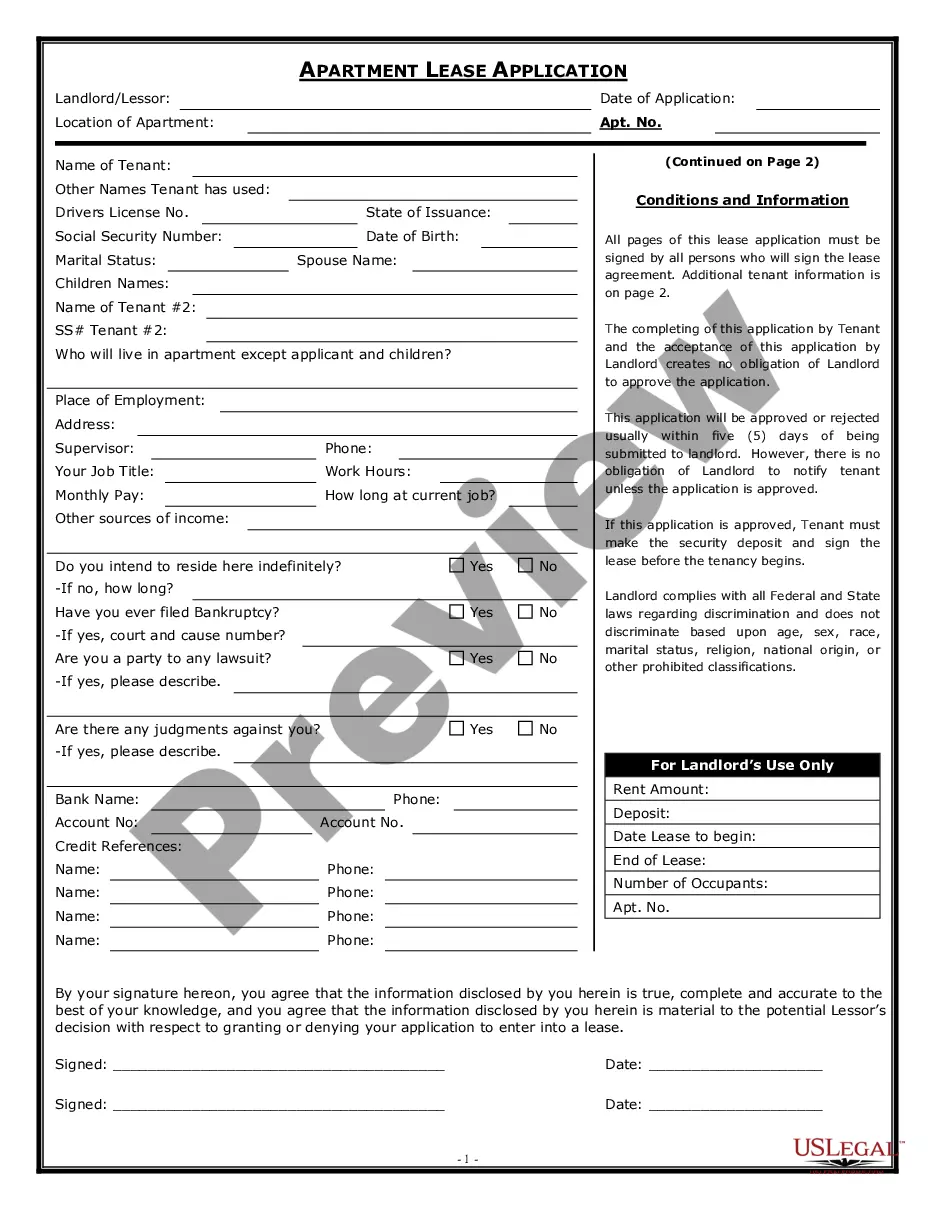

Obtaining validated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to personal and professional needs across various real-world situations.

All the documents are appropriately categorized by usage area and jurisdiction, making it as effortless as ABC to find the Houston Texas Home Equity Foreclosure Application.

Keeping documentation organized and in compliance with legal standards is critically important. Leverage the US Legal Forms library to consistently have essential document templates for any requirements right at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that fits your requirements and fully aligns with your local legal criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. Foreclosure and COVD-19 Relief. The Bottom Line.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.

In Texas, there are three ways in which a lienholder can foreclose on a property: Judicial Foreclosure. A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner.Non-Judicial Foreclosure.Expedited Foreclosure.

How Long Does Foreclosure Take? In Georgia, the foreclosure process can vary depending on your circumstances. However, on average, it takes about one to three weeks to complete. If your property was sold at a foreclosure auction, the eviction process takes about 14 to 30 days.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can. You miss your second payment. When your lender calls, it is important to pick up the phone and speak to your lender.

How does foreclosure work in Georgia? Georgia is a ?non-judicial foreclosure? state. That means the lender can foreclose on your home without filing suit or appearing in court before a judge. The procedures for foreclosure are spelled out in the Official Code of Georgia, Sections 44-14-162 through 44-14-162.4.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.

The Most Commonly Used Foreclosure Procedure In the State A foreclosure can be either: judicial (the foreclosing party files a lawsuit, and the case goes through the court system) or. nonjudicial (the foreclosing party follows a set of state-specific, out-of-court procedural steps to foreclose).

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.