McAllen Texas Home Equity Foreclosure Application is a process by which homeowners in McAllen, Texas, apply for foreclosure on their home equity loans. Home equity foreclosure occurs when borrowers default on their home equity loans, leading to legal action by the lender to repossess the property and recover the outstanding balance. The foreclosure application is a crucial step in initiating the foreclosure process, and it involves thorough documentation and submission of relevant paperwork to the appropriate authorities. This application typically includes important personal and financial information, supporting documents, and a comprehensive explanation of the borrower's financial difficulties. There are several types of McAllen Texas Home Equity Foreclosure Application that homeowners may encounter depending on their specific circumstances: 1. Judicial foreclosure application: This type of application involves filing a lawsuit against the homeowner in order to obtain a court order for foreclosure. The judicial process typically requires the lender to demonstrate that the borrower has defaulted on their loan and has not taken appropriate measures to resolve the issue. 2. Non-judicial foreclosure application: In contrast to the judicial process, non-judicial foreclosure applications allow the lender to foreclose without involving the court system. This process is usually quicker and more streamlined, as it follows a specific timeline established by state laws. 3. Deed in lieu of foreclosure application: Sometimes, homeowners facing imminent foreclosure may choose to voluntarily transfer the property's title to the lender instead of going through a lengthy foreclosure process. This is known as a deed in lieu of foreclosure application, and it can be an option for borrowers who cannot afford to repay their loan. 4. Short sale application: In certain situations, homeowners may be permitted to sell their property for less than the outstanding loan balance, with the lender's approval. A short sale application is submitted to the lender, outlining the borrower's financial hardship and providing details of the proposed sale, including the listing price and expected proceeds. It is important for homeowners facing foreclosure to understand the specific type of application that applies to their situation. Seeking professional assistance from foreclosure attorneys or housing counselors can provide invaluable guidance throughout the application process. Remember, it is crucial to act promptly and explore available options to avoid or mitigate the consequences of a home equity foreclosure.

McAllen Texas Home Equity Foreclosure Application

State:

Texas

City:

McAllen

Control #:

TX-CC-07-01

Format:

PDF

Instant download

This form is available by subscription

Description

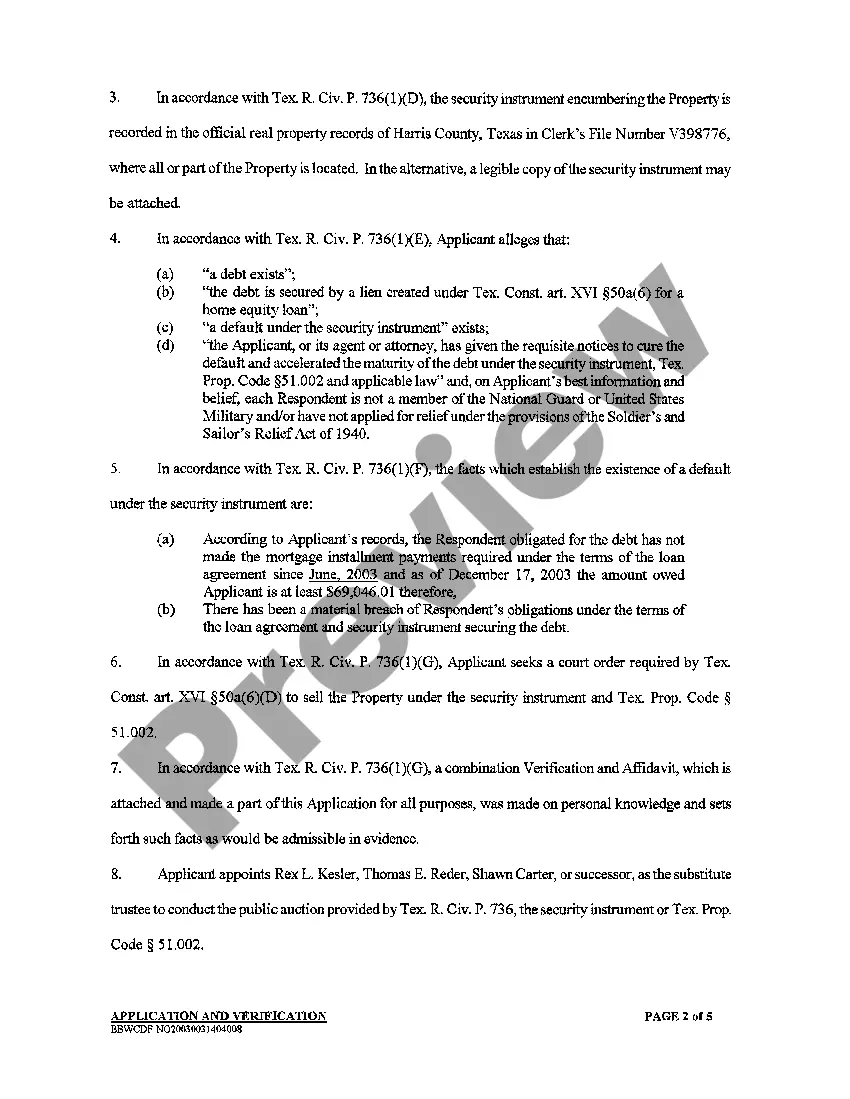

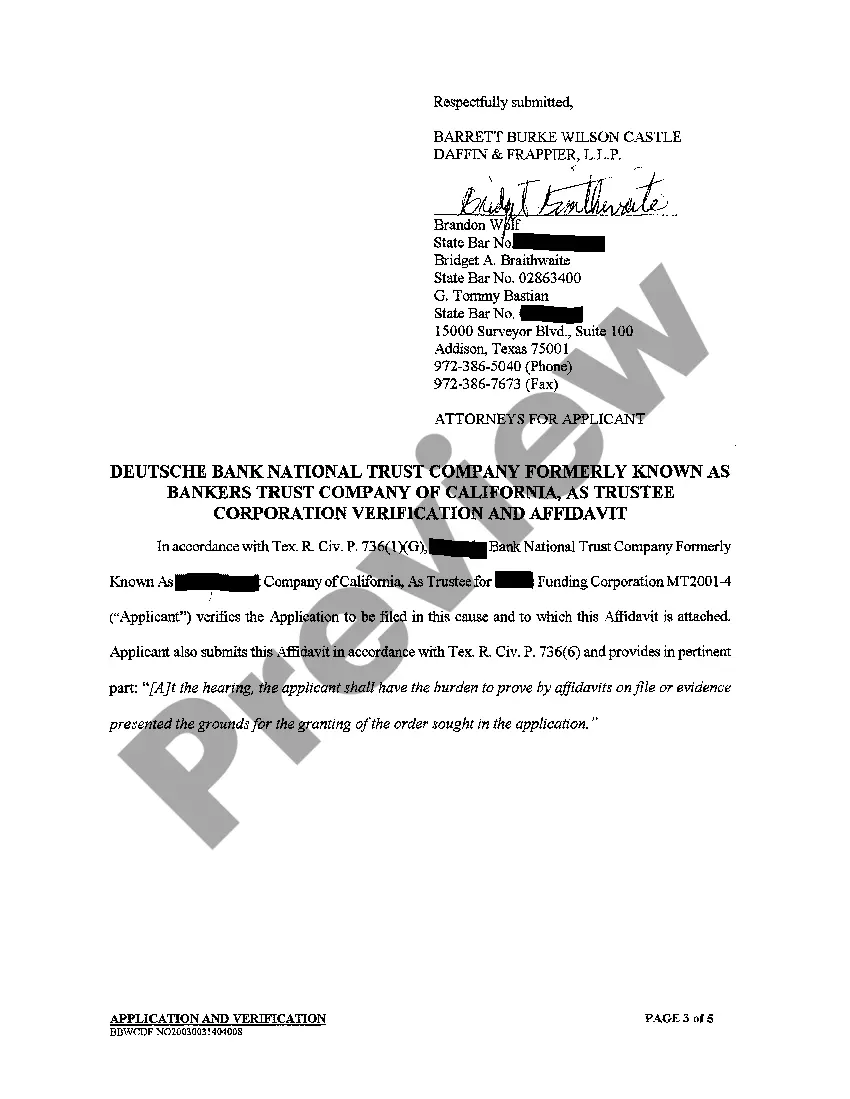

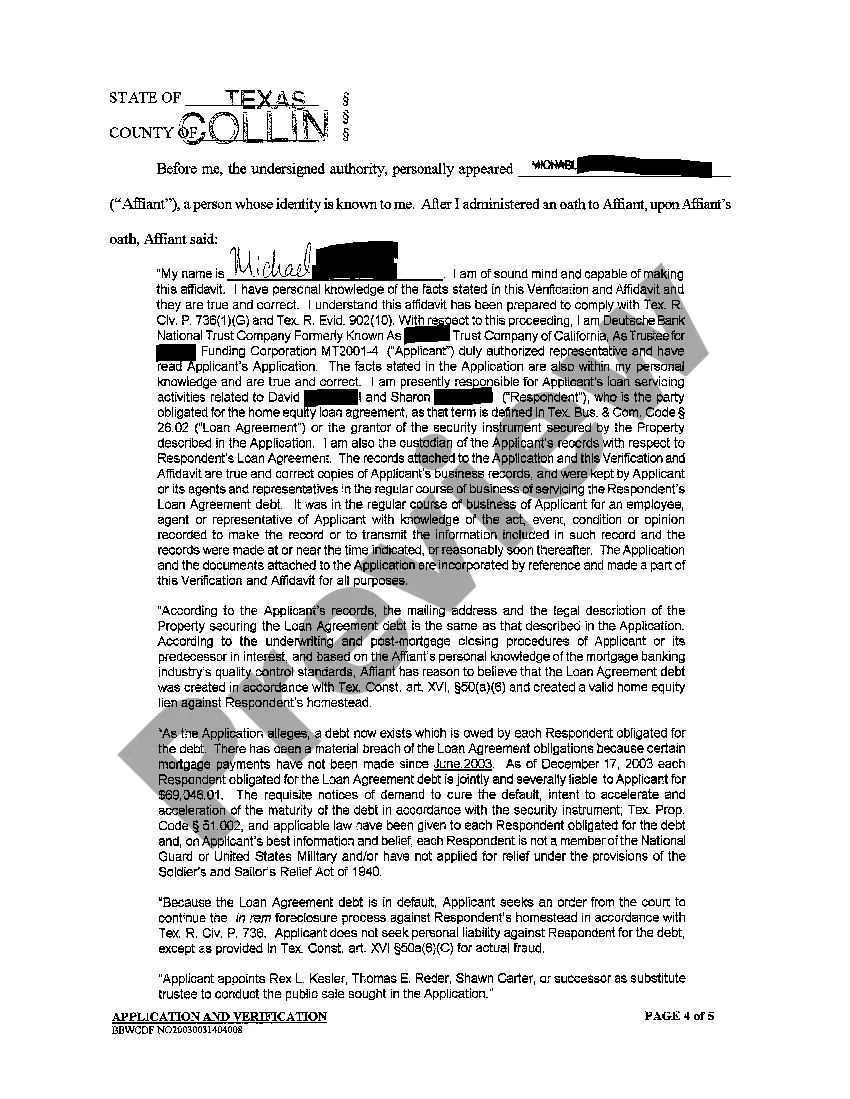

A01 Home Equity Foreclosure Application

McAllen Texas Home Equity Foreclosure Application is a process by which homeowners in McAllen, Texas, apply for foreclosure on their home equity loans. Home equity foreclosure occurs when borrowers default on their home equity loans, leading to legal action by the lender to repossess the property and recover the outstanding balance. The foreclosure application is a crucial step in initiating the foreclosure process, and it involves thorough documentation and submission of relevant paperwork to the appropriate authorities. This application typically includes important personal and financial information, supporting documents, and a comprehensive explanation of the borrower's financial difficulties. There are several types of McAllen Texas Home Equity Foreclosure Application that homeowners may encounter depending on their specific circumstances: 1. Judicial foreclosure application: This type of application involves filing a lawsuit against the homeowner in order to obtain a court order for foreclosure. The judicial process typically requires the lender to demonstrate that the borrower has defaulted on their loan and has not taken appropriate measures to resolve the issue. 2. Non-judicial foreclosure application: In contrast to the judicial process, non-judicial foreclosure applications allow the lender to foreclose without involving the court system. This process is usually quicker and more streamlined, as it follows a specific timeline established by state laws. 3. Deed in lieu of foreclosure application: Sometimes, homeowners facing imminent foreclosure may choose to voluntarily transfer the property's title to the lender instead of going through a lengthy foreclosure process. This is known as a deed in lieu of foreclosure application, and it can be an option for borrowers who cannot afford to repay their loan. 4. Short sale application: In certain situations, homeowners may be permitted to sell their property for less than the outstanding loan balance, with the lender's approval. A short sale application is submitted to the lender, outlining the borrower's financial hardship and providing details of the proposed sale, including the listing price and expected proceeds. It is important for homeowners facing foreclosure to understand the specific type of application that applies to their situation. Seeking professional assistance from foreclosure attorneys or housing counselors can provide invaluable guidance throughout the application process. Remember, it is crucial to act promptly and explore available options to avoid or mitigate the consequences of a home equity foreclosure.

Free preview

How to fill out McAllen Texas Home Equity Foreclosure Application?

If you’ve already utilized our service before, log in to your account and download the McAllen Texas Home Equity Foreclosure Application on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your McAllen Texas Home Equity Foreclosure Application. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!