Pasadena Texas Home Equity Foreclosure Application is a legal process through which a lender can pursue the foreclosure of a home in Pasadena, Texas, in order to recover unpaid debts on a home equity loan. This application is typically filed by the lender when a borrower defaults on their home equity loan payments, resulting in the potential loss of their property. In Pasadena, Texas, several types of Home Equity Foreclosure Applications may exist, depending on the specific circumstances. These may include: 1. Judicial Foreclosure Application: In this type of foreclosure process, the lender files a lawsuit against the borrower in the court to obtain a judgment of foreclosure. The court oversees the entire procedure and ultimately orders the sale of the property to satisfy the outstanding debt. 2. Non-Judicial Foreclosure Application: This type of foreclosure does not involve court intervention and is often more streamlined. It occurs when the borrower signed a deed of trust or mortgage that includes a "power of sale" clause, allowing the lender to sell the property outside of court proceedings. 3. Home Equity Loan Modification Application: Instead of pursuing foreclosure, lenders may offer borrowers the opportunity to modify the terms of their home equity loan. This could involve lowering the interest rate, extending the repayment period, or adjusting the loan amount, making it more affordable for the borrower. 4. Home Equity Refinance Application: Borrowers facing foreclosure may consider applying for a home equity loan refinance to pay off the existing loan and potentially lower their monthly payments. Refinancing allows homeowners to obtain a new loan with different terms, effectively replacing the previous loan. It is important for borrowers facing potential foreclosure in Pasadena, Texas, to understand their rights, seek legal advice, and explore available options. Each situation may require specific actions, and individuals should consult with professionals familiar with the local laws and regulations regarding home equity foreclosure applications.

Pasadena Texas Home Equity Foreclosure Application

State:

Texas

City:

Pasadena

Control #:

TX-CC-07-01

Format:

PDF

Instant download

This form is available by subscription

Description

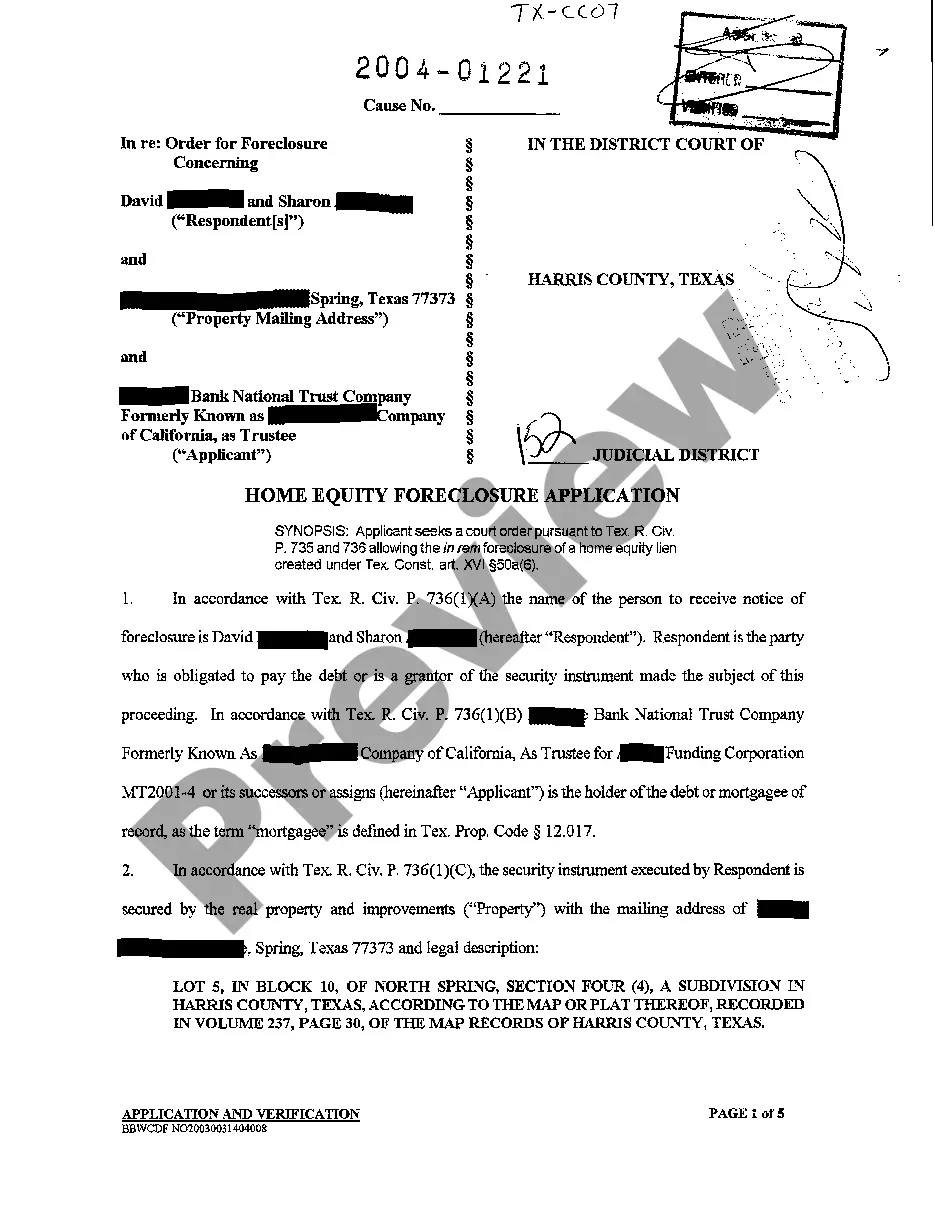

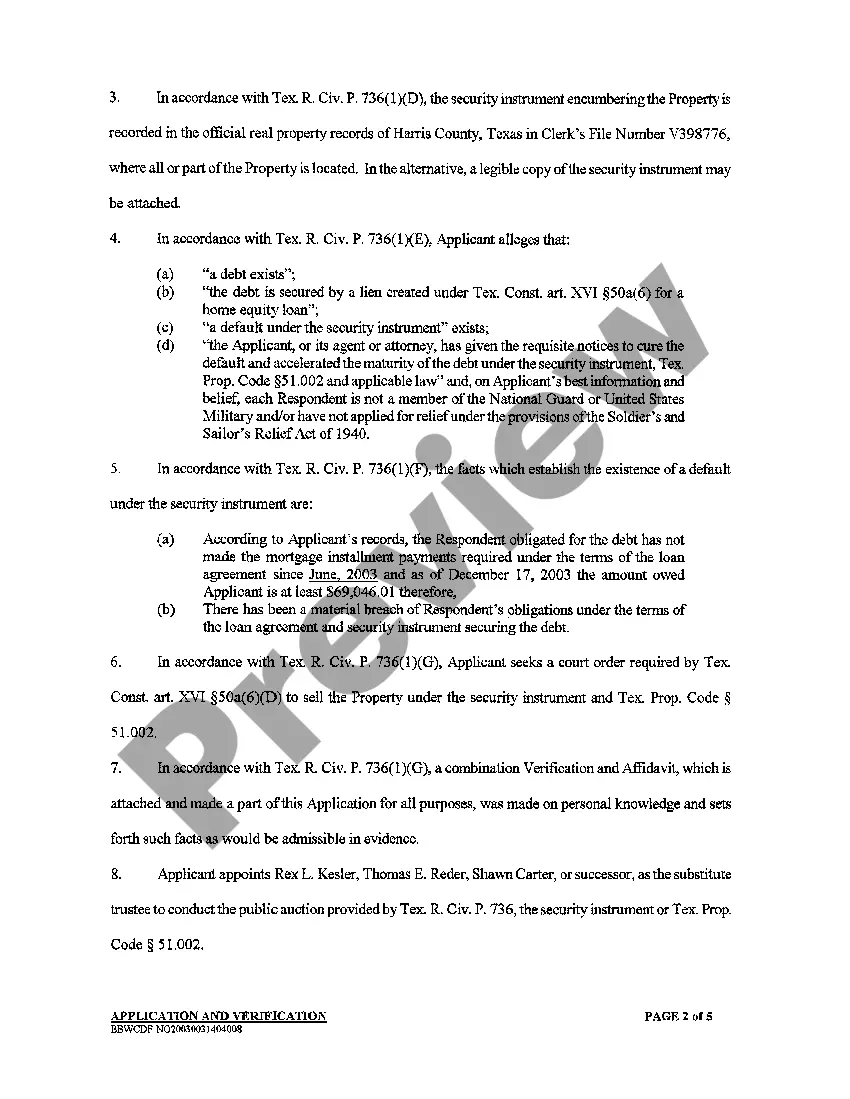

A01 Home Equity Foreclosure Application

Pasadena Texas Home Equity Foreclosure Application is a legal process through which a lender can pursue the foreclosure of a home in Pasadena, Texas, in order to recover unpaid debts on a home equity loan. This application is typically filed by the lender when a borrower defaults on their home equity loan payments, resulting in the potential loss of their property. In Pasadena, Texas, several types of Home Equity Foreclosure Applications may exist, depending on the specific circumstances. These may include: 1. Judicial Foreclosure Application: In this type of foreclosure process, the lender files a lawsuit against the borrower in the court to obtain a judgment of foreclosure. The court oversees the entire procedure and ultimately orders the sale of the property to satisfy the outstanding debt. 2. Non-Judicial Foreclosure Application: This type of foreclosure does not involve court intervention and is often more streamlined. It occurs when the borrower signed a deed of trust or mortgage that includes a "power of sale" clause, allowing the lender to sell the property outside of court proceedings. 3. Home Equity Loan Modification Application: Instead of pursuing foreclosure, lenders may offer borrowers the opportunity to modify the terms of their home equity loan. This could involve lowering the interest rate, extending the repayment period, or adjusting the loan amount, making it more affordable for the borrower. 4. Home Equity Refinance Application: Borrowers facing foreclosure may consider applying for a home equity loan refinance to pay off the existing loan and potentially lower their monthly payments. Refinancing allows homeowners to obtain a new loan with different terms, effectively replacing the previous loan. It is important for borrowers facing potential foreclosure in Pasadena, Texas, to understand their rights, seek legal advice, and explore available options. Each situation may require specific actions, and individuals should consult with professionals familiar with the local laws and regulations regarding home equity foreclosure applications.

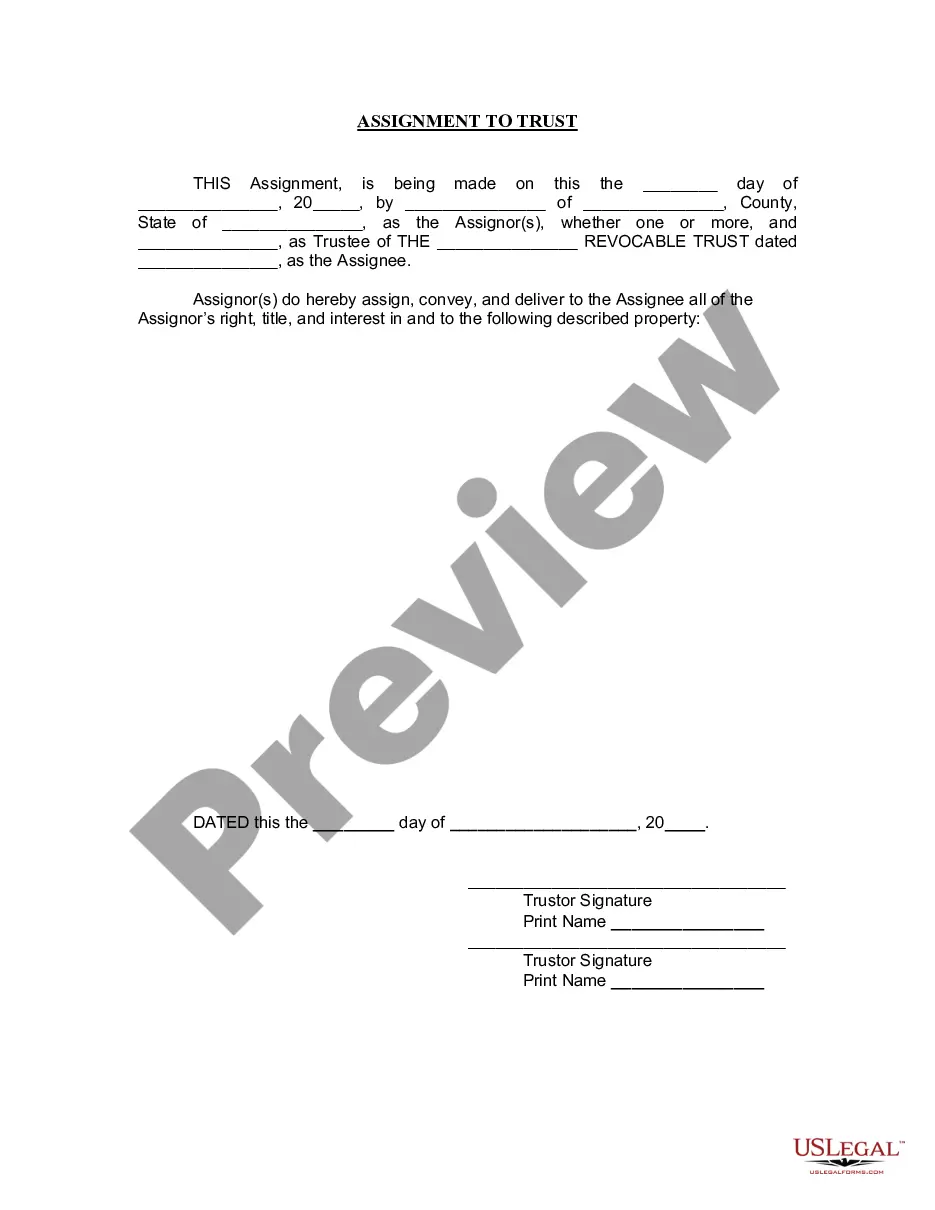

Free preview

How to fill out Pasadena Texas Home Equity Foreclosure Application?

If you’ve already utilized our service before, log in to your account and download the Pasadena Texas Home Equity Foreclosure Application on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Pasadena Texas Home Equity Foreclosure Application. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!