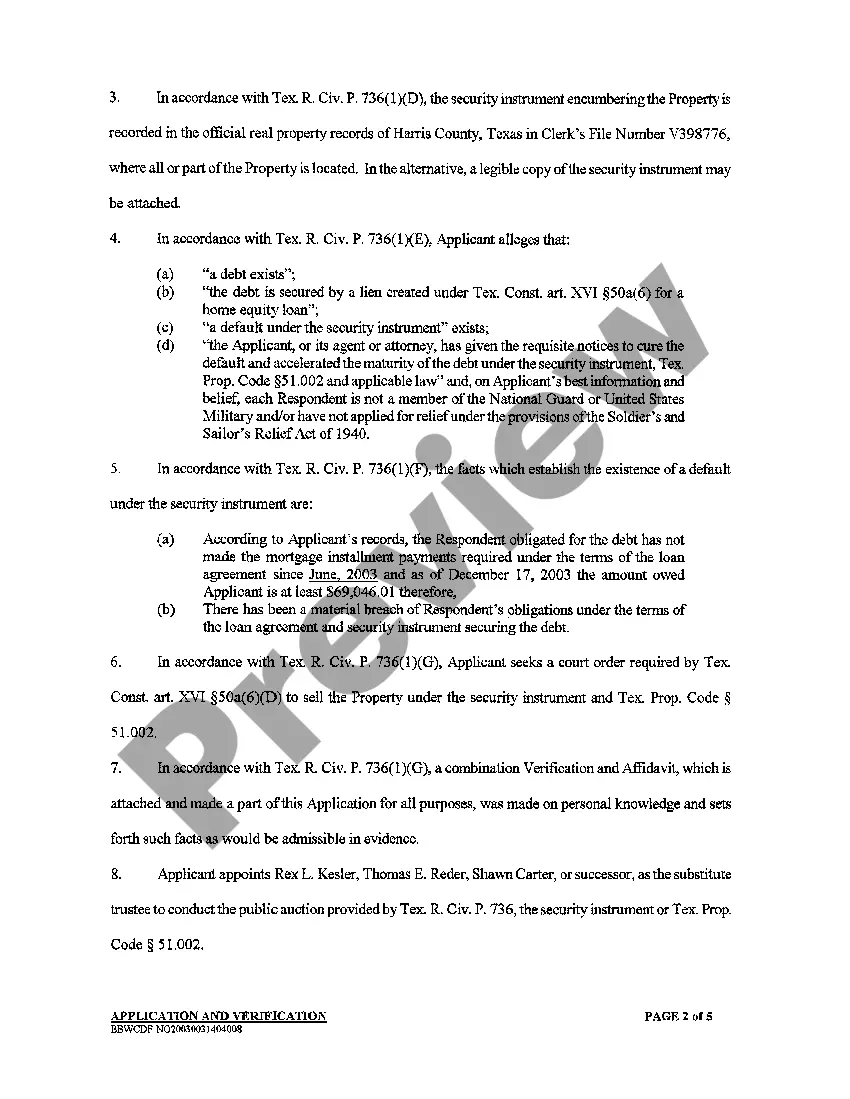

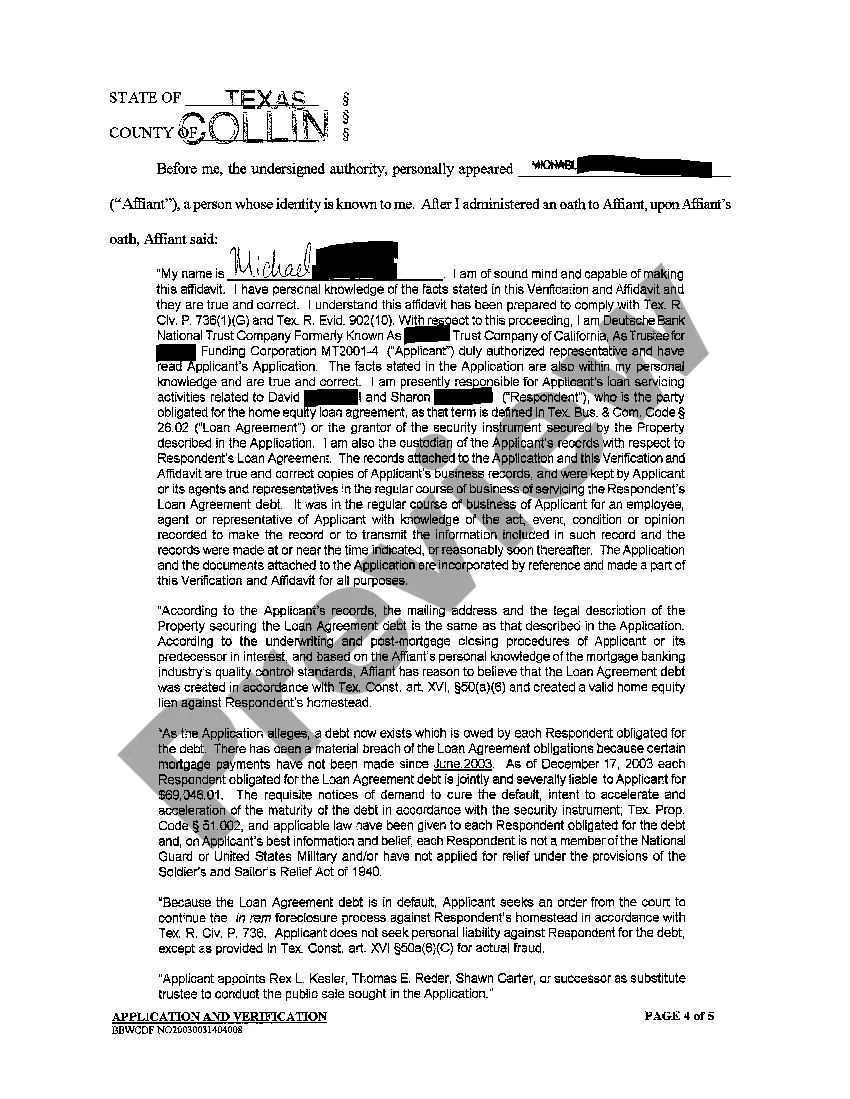

Plano Texas Home Equity Foreclosure Application is a specific process and application form that homeowners in Plano, Texas, need to go through when facing foreclosure on their home due to home equity loans. Home equity foreclosure occurs when homeowners are unable to meet their financial obligations resulting from a home equity loan secured on their property. Applying for a Plano Texas Home Equity Foreclosure Application is a necessary step for homeowners looking to explore their options and potentially avoid losing their homes. This application requires detailed information about the homeowner, their property, and the specific circumstances leading to the foreclosure. Homeowners must provide their personal details such as name, contact information, and social security number. They also need to include information about their property, including the address, legal description, and details about the mortgage and home equity loan. Additionally, the Plano Texas Home Equity Foreclosure Application will likely ask for financial information, such as income, expenses, assets, and liabilities. This information helps assess the homeowner's financial situation and evaluate potential alternatives to foreclosure, such as loan modifications, repayment plans, or refinancing. While there might not be different types of Plano Texas Home Equity Foreclosure Applications, it is important to note that homeowners may have different circumstances or loan agreements, which may affect how their application is assessed and the options available to them. Each homeowner's situation is unique, and therefore the Plano Texas Home Equity Foreclosure Application is tailored to meet individual needs based on their specific circumstances. Keywords: Plano Texas, home equity, foreclosure, application, Plano Texas Home Equity Foreclosure Application, homeowner, property, financial obligations, foreclosure options, home equity loan, mortgage, personal details, financial information, loan modification, repayment plan, refinancing.

Plano Texas Home Equity Foreclosure Application

Description

How to fill out Plano Texas Home Equity Foreclosure Application?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no law education to create such papers from scratch, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Plano Texas Home Equity Foreclosure Application or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Plano Texas Home Equity Foreclosure Application quickly employing our reliable platform. In case you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Plano Texas Home Equity Foreclosure Application:

- Ensure the template you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a quick description (if available) of scenarios the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Choose the payment method and proceed to download the Plano Texas Home Equity Foreclosure Application once the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.