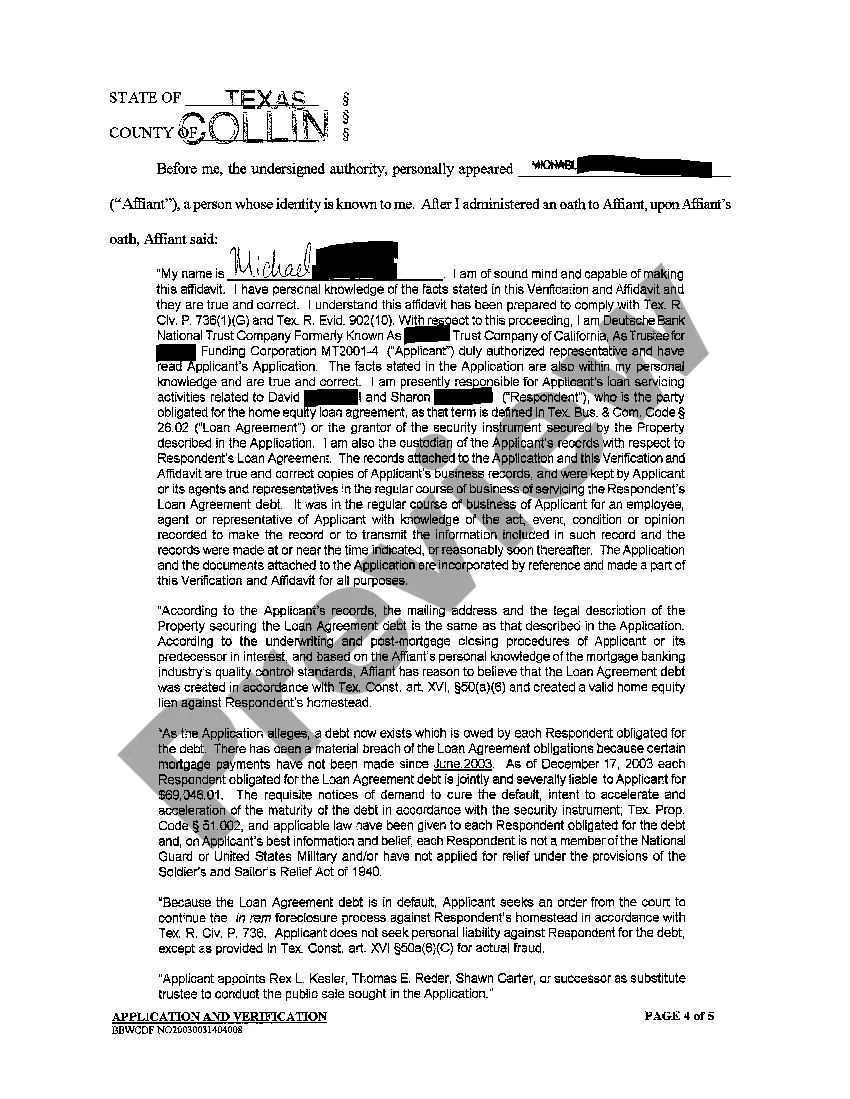

Sugar Land, Texas Home Equity Foreclosure Application: A Comprehensive Overview In Sugar Land, Texas, home equity foreclosure applications refer to the process homeowners go through when facing the possibility of foreclosure on a property with an existing home equity loan or line of credit. This procedure allows financial institutions to reclaim the property and settle the remaining debt by selling it at an auction to recoup their losses. Keywords: Sugar Land, Texas, home equity, foreclosure application, process, homeowners, property, existing loan, line of credit, financial institutions, reclaim, settle, debt, auction, losses. Types of Sugar Land, Texas Home Equity Foreclosure Applications: 1. Pre-foreclosure Counseling: Before filing a foreclosure application, lenders may offer pre-foreclosure counseling to homeowners in Sugar Land, Texas, facing financial difficulties. During this phase, homeowners can discuss options like loan modification, refinancing, or repayment plans to avoid foreclosure. 2. Foreclosure Notice: Once a homeowner falls behind on their home equity loan or line of credit payments, the lender issues a foreclosure notice, officially starting the foreclosure process. This notice will outline the amount owed, the steps needed to resolve the issue, and the timeframe to prevent further action. 3. Foreclosure Application Filing: If the homeowner fails to take corrective measures within the specified timeframe, the lender proceeds with filing the foreclosure application to start the legal process. This application includes details of the loan, property, and any additional relevant information. 4. Notice of Sale: After the foreclosure application is approved by the court, the lender issues a notice of sale to inform the homeowner and potential buyers that the property will be sold at a public auction. This notice provides information about the auction date, location, and terms. 5. Auction: The property is then sold at public auction to the highest bidder. The winning bidder becomes the new owner of the property and assumes responsibility for any outstanding debts or liens on the property. 6. Post-Foreclosure Proceedings: If the property does not sell at auction or the sale does not cover the outstanding debts, the lender may begin post-foreclosure proceedings, such as initiating eviction or pursuing a deficiency judgment to recover the remaining balance. It is crucial for homeowners in Sugar Land, Texas, facing home equity foreclosure applications to seek professional advice from foreclosure prevention counselors or attorneys who can guide them through the process and explore available alternatives to foreclosure. Acting promptly and engaging in proactive communication with the lender can increase the chances of finding a favorable resolution and potentially keeping the property.

Sugar Land Texas Home Equity Foreclosure Application

Description

How to fill out Sugar Land Texas Home Equity Foreclosure Application?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our user-friendly site, featuring a vast array of document samples, enables you to locate and acquire nearly any document you require.

You can download, complete, and validate the Sugar Land Texas Home Equity Foreclosure Application within minutes, avoiding hours of online searching for the correct template.

Employing our catalog is an excellent method to enhance the security of your form submissions.

If you haven't created a profile yet, follow the instructions below.

Locate the template you need. Ensure that it is the correct template you were searching for: check its title and description, and use the Preview option when available. Otherwise, utilize the Search field to find the required one. Initiate the downloading process. Click Buy Now and choose the pricing plan that fits you best. Then, set up an account and pay for your order with a credit card or PayPal. Download the document. Specify the format to receive the Sugar Land Texas Home Equity Foreclosure Application and edit, complete, or sign it according to your requirements. US Legal Forms is among the largest and most trustworthy document libraries available online. We are always prepared to assist you with any legal process, even if it's simply downloading the Sugar Land Texas Home Equity Foreclosure Application. Take full advantage of our form catalog and simplify your document experience!

- Our skilled attorneys consistently assess all documents to ensure that the templates are suitable for a specific area and adhere to updated laws and regulations.

- How can you obtain the Sugar Land Texas Home Equity Foreclosure Application.

- If you hold a profile, simply Log In to your account. The Download option will be visible on all the samples you examine. Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

In Texas, missing a single mortgage payment can trigger the foreclosure process, but actual foreclosure usually happens after several months of default. Once you begin missing payments, lenders will typically reach out to discuss alternatives. If you find yourself in this situation and are looking into a Sugar Land Texas Home Equity Foreclosure Application, it is wise to act quickly. Services like uslegalforms are available to help you understand your options moving forward.

Foreclosure in Texas typically begins with a default on the mortgage. The lender must issue a notice and wait at least 20 days before proceeding further. After that, a foreclosure sale can occur, usually on the first Tuesday of the month. If you are navigating a Sugar Land Texas Home Equity Foreclosure Application, understanding these steps is essential in managing the process effectively, and platforms like uslegalforms can provide helpful resources.

Foreclosure in Texas usually takes between 60 and 180 days, depending on various factors like the lender's actions and any potential legal issues. Once the process starts, understanding your position and options is essential. The Sugar Land Texas Home Equity Foreclosure Application can assist you in managing this process and exploring alternatives to foreclosure.

Yes, there is a 120-day timeline related to the foreclosure process in Texas. After you miss a payment, your lender must wait at least 120 days before initiating foreclosure. For homeowners seeking to avoid foreclosure, utilizing resources like the Sugar Land Texas Home Equity Foreclosure Application can provide essential information and guidance.

In Texas, you can miss up to three consecutive mortgage payments before your lender can initiate foreclosure proceedings. It's crucial to communicate with your lender if you face financial difficulties. Using the Sugar Land Texas Home Equity Foreclosure Application can help you understand your options and navigate this complex situation.

During a foreclosure, your home equity typically decreases as the lender takes possession of the property. If you have positive equity, you may still have the opportunity to receive some funds from the sale of the home after debts are settled. Filing a Sugar Land Texas Home Equity Foreclosure Application can help you understand your rights and determine what options you may have to claim that equity. Utilizing USLegalForms can also assist you in navigating the necessary steps effectively.

Three types of foreclosures may be initiated at this time: judicial, power of sale and strict foreclosure. All types of foreclosure require public notices to be issued and all parties to be notified regarding the proceedings.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

The home equity loan lender can only collect from a foreclosure once the first mortgage has been paid off. In other words, the home must be worth more than what is owed on the first mortgage to make foreclosure worthwhile to the second mortgage holder.

Simply put, the equity remains yours, but it will likely shrink during the foreclosure process. If you've defaulted on your loan, and your home is in foreclosure, there are a few things that could happen. If you are unable to get new financing or sell your home, the lender could attempt to sell your home in auction.