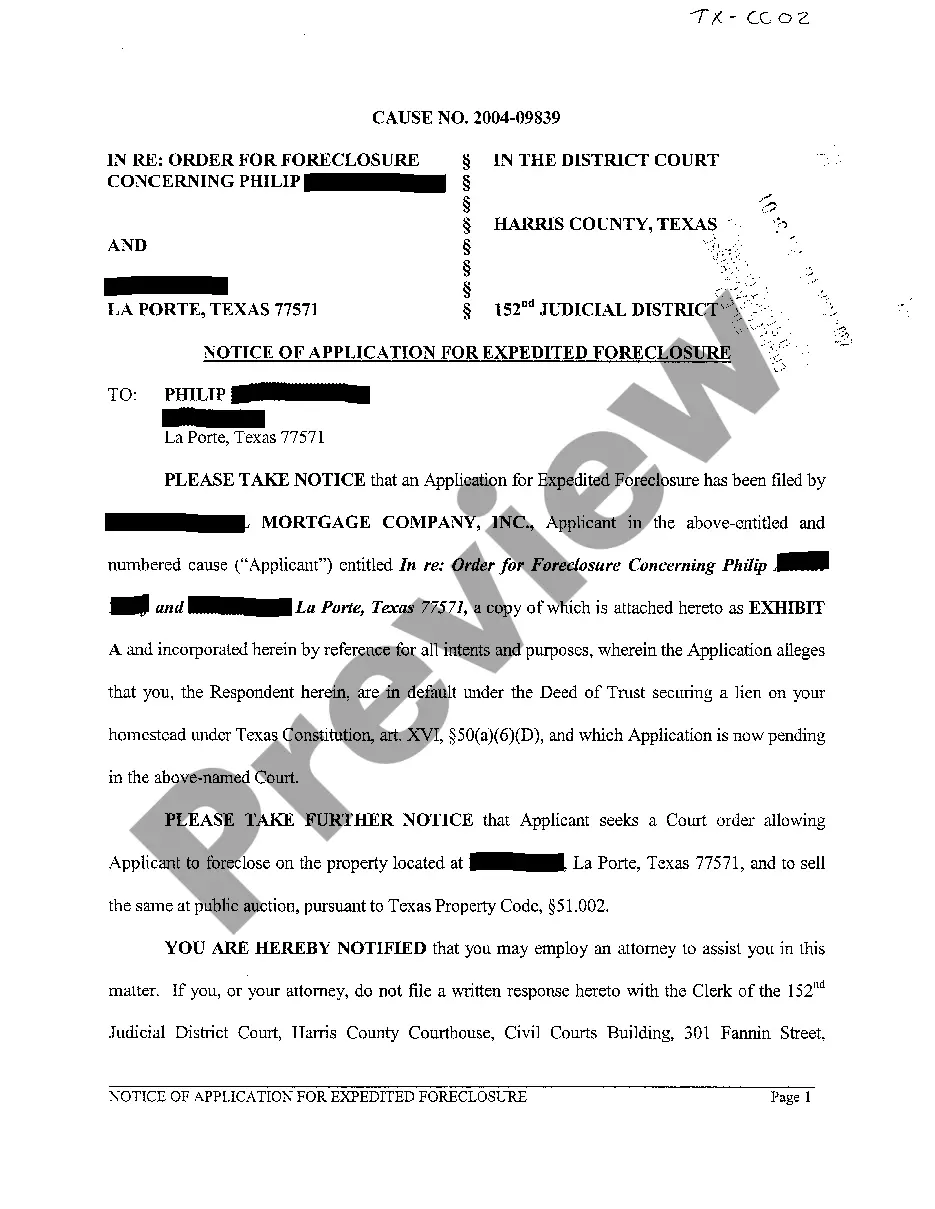

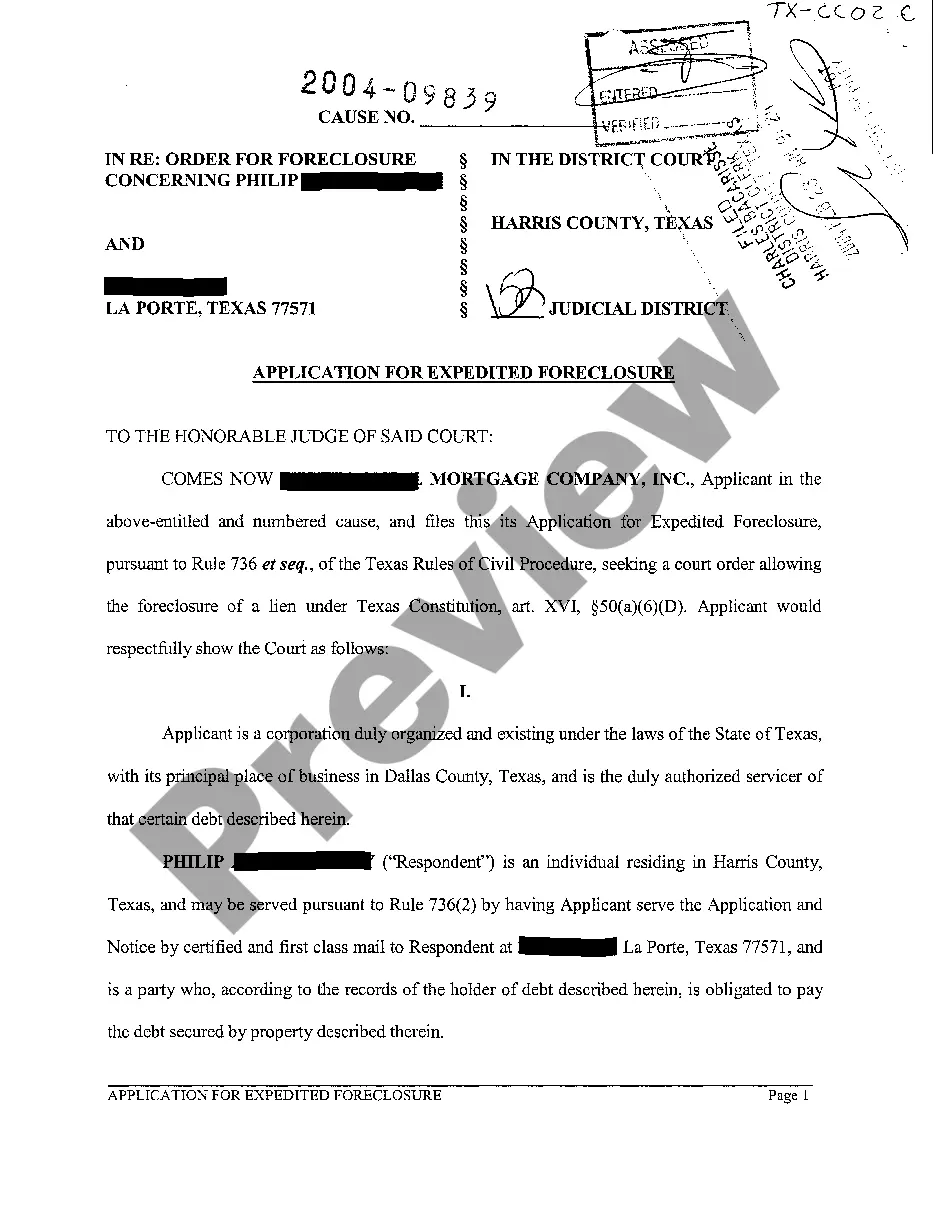

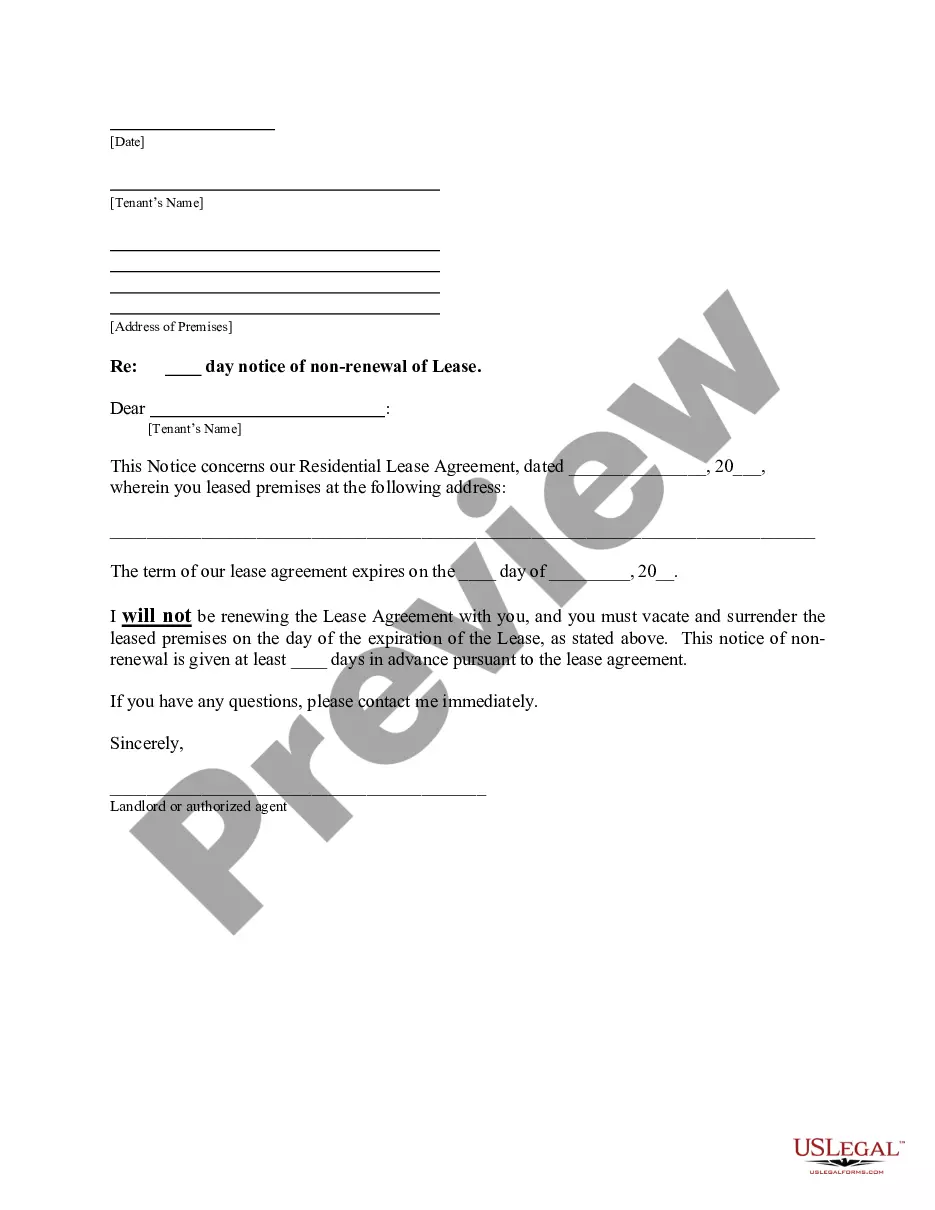

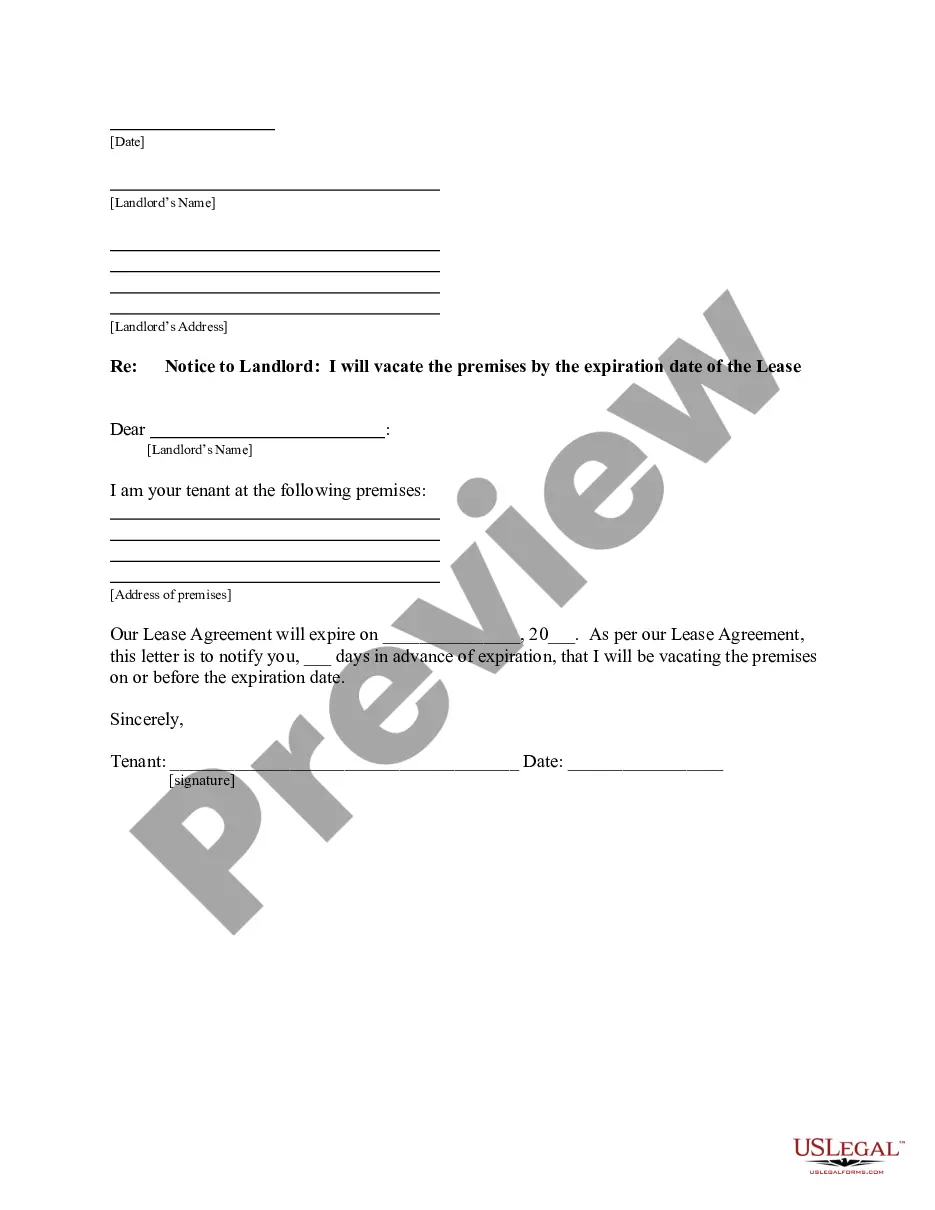

Tarrant Texas Home Equity Foreclosure Application

Description

How to fill out Texas Home Equity Foreclosure Application?

If you are looking for an appropriate form template, it’s incredibly challenging to discover a superior service than the US Legal Forms website – likely the most extensive collections on the internet.

Here you can locate a vast array of document samples for business and personal uses categorized by types and regions or keywords.

With the excellent search capability, finding the most current Tarrant Texas Home Equity Foreclosure Application is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Choose the format and download it to your device. Make edits. Fill in, alter, print, and sign the received Tarrant Texas Home Equity Foreclosure Application.

- Additionally, the accuracy of each document is confirmed by a group of experienced attorneys who periodically evaluate the templates on our platform and update them according to the latest state and county regulations.

- If you are already acquainted with our system and possess a registered account, all you need to do to obtain the Tarrant Texas Home Equity Foreclosure Application is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the form you desire. Review its description and utilize the Preview option to inspect its content. If it does not satisfy your needs, use the Search feature at the top of the page to find the appropriate document.

- Validate your choice. Click the Buy now button. Afterwards, select the desired subscription plan and provide details to create an account.

Form popularity

FAQ

In Texas, the foreclosure process typically takes around 60 to 90 days after the initial default notice. However, various factors, such as court delays and borrower responses, can extend this timeline. Knowing the specifics can help when filing a Tarrant Texas Home Equity Foreclosure Application, so you understand your situation better.

Foreclosure affects equity by allowing the lender to repossess the home and claim any remaining equity after debts are cleared. It is essential to know the equity amount in your home to determine what you may lose during the process. A proper understanding of the Tarrant Texas Home Equity Foreclosure Application can provide clarity on how equity interacts with foreclosure.

To foreclose on an owner-financed property in Texas, you must follow specific steps detailed in the Texas Property Code. This process includes notifying the borrower and adhering to timelines before proceeding with the foreclosure. If you need guidance, the Tarrant Texas Home Equity Foreclosure Application can help you navigate this complex situation effectively.

During foreclosure, the lender often claims the equity in your home, which can diminish your financial return. If the house sells for more than what you owe, you may receive the excess equity back. This aspect of foreclosure is significant for anyone considering the Tarrant Texas Home Equity Foreclosure Application.

The 120-day rule for foreclosure mandates that lenders must wait at least 120 days after a borrower defaults on a mortgage before initiating foreclosure proceedings. This rule provides homeowners the opportunity to catch up on missed payments and explore alternatives. Understanding this timeframe is crucial when navigating the Tarrant Texas Home Equity Foreclosure Application.

To claim your home equity after foreclosure, you need to file a notice of claim in the appropriate court. This process allows you to recover any remaining equity that may exist after the sale. It’s important to document all your financial details and communicate with the lender as part of the Tarrant Texas Home Equity Foreclosure Application process.

The equity of redemption is the homeowner's ability to reclaim their property after foreclosure, typically by paying off the outstanding mortgage balance. In Texas, you usually have a limited time frame to exercise this right before the property ownership transfers to the lender. Understanding this concept is crucial to protecting your investments. The Tarrant Texas Home Equity Foreclosure Application can provide guidance on how to approach the equity of redemption effectively.

To claim equity after foreclosure in Tarrant Texas, you first need to determine your equity amount. This involves calculating the difference between your home's market value and your mortgage balance at the time of foreclosure. If your home sells for more than what you owe, you may be eligible to receive the excess funds. Utilizing the Tarrant Texas Home Equity Foreclosure Application can help streamline the process of reclaiming your equity.

If the buyer defaults on owner financing, the seller has the legal right to initiate foreclosure. This means the seller can reclaim ownership of the property and resell it. In Texas, the seller may need to file a Tarrant Texas Home Equity Foreclosure Application to officially start this process. It’s essential for both parties to understand their rights and obligations in these situations to avoid potential disputes.

To foreclose on an owner financed property in Texas, the seller must follow specific procedures outlined by state law. Typically, they must provide notice to the buyer about the default and offer a chance to remedy the situation. If the buyer does not respond, the seller can file a Tarrant Texas Home Equity Foreclosure Application to pursue foreclosure. This pathway ensures compliance with legal standards while protecting the seller's interests.