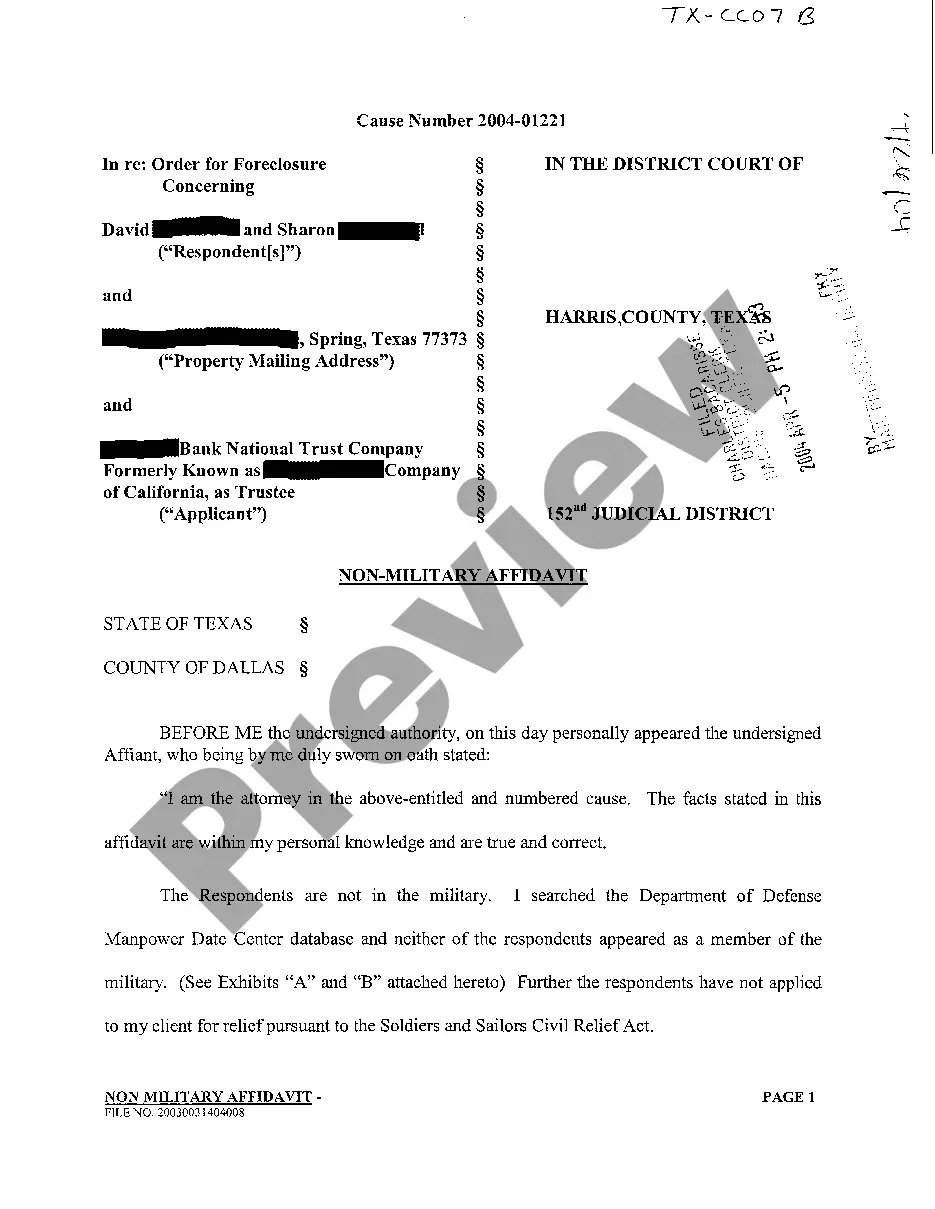

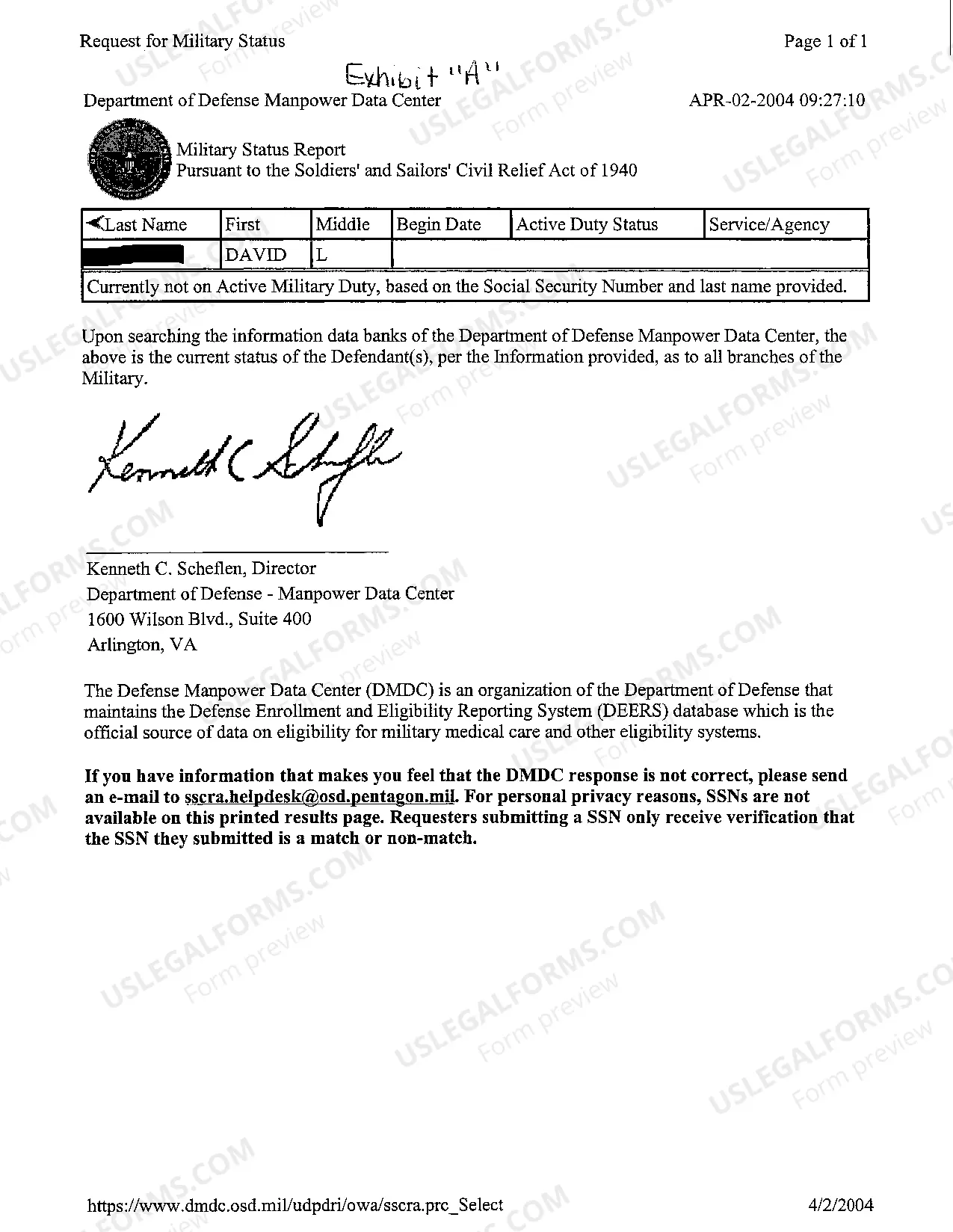

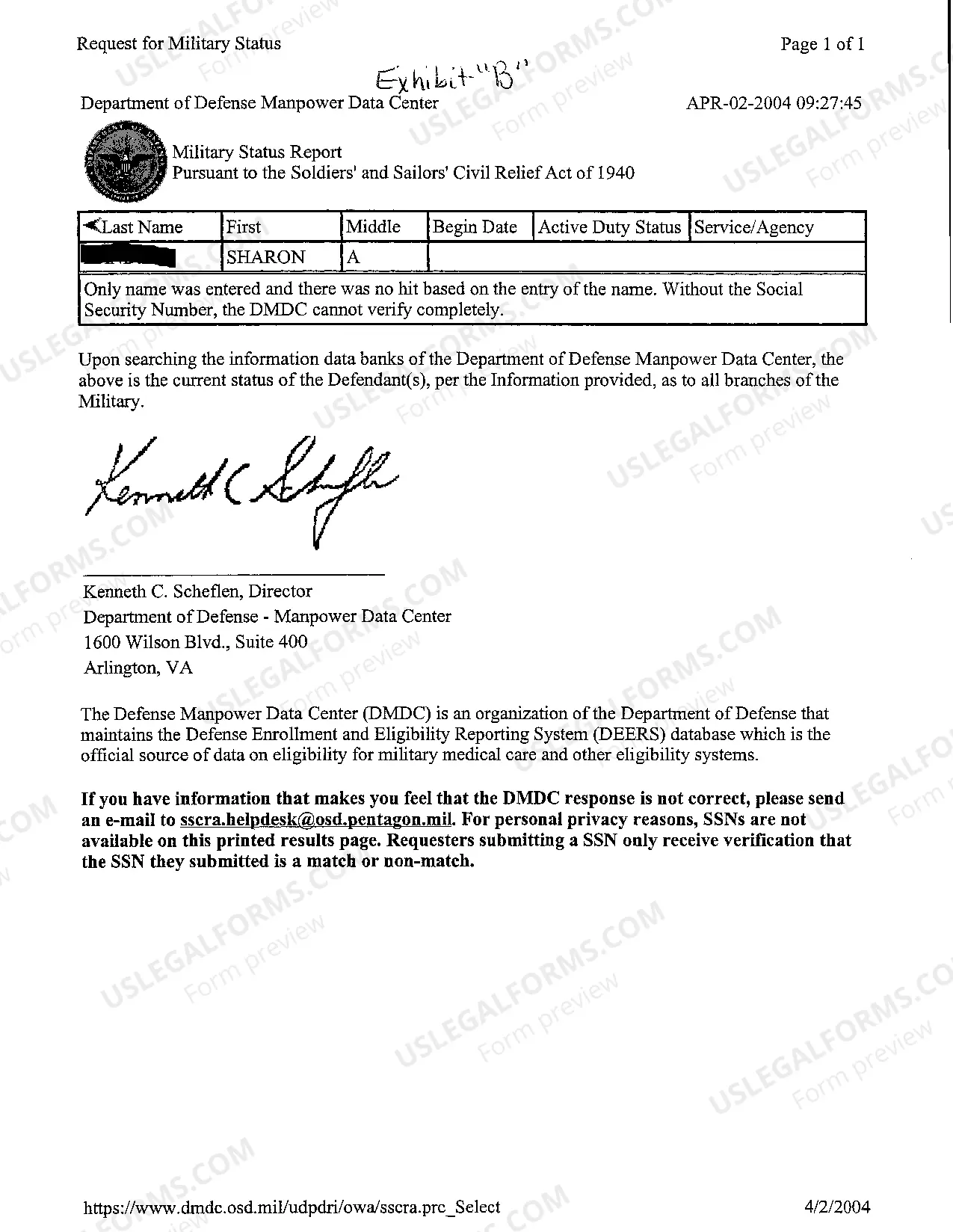

The Tarrant Texas Non-Military Affidavit is a legal document used to declare the non-military status of an individual residing in Tarrant County, Texas. This affidavit certifies that the person named in the document is not an active duty military member, thus making them eligible for certain benefits and exemptions provided by the state. The Tarrant Texas Non-Military Affidavit is often required for various purposes, including but not limited to: 1. Property Tax Exemptions: Homeowners who are not in active military service may be eligible for property tax exemptions. The affidavit helps verify their non-military status, allowing them to claim tax benefits. 2. Jury Duty Exemption: Individuals who are not active military members can use the affidavit to request exemption from serving on a jury. The document serves as proof that the person is not subject to military duties that may hinder their ability to participate. 3. Vehicle Registration: Certain vehicle registration exemptions or discounts may be available to non-military residents. The affidavit clarifies the individual's non-military status, enabling them to benefit from such exemptions. 4. College Tuition and Fees: Non-military students residing in Tarrant County may be eligible for in-state tuition rates at Texas colleges or universities. The affidavit can support their application for reduced tuition fees. It's important to note that there may be different types of Tarrant Texas Non-Military Affidavits, depending on the specific purpose for which it is needed. For instance, a separate affidavit may be required for property tax exemptions, while another may be needed for jury duty exemption. It's advisable to consult the relevant government entities to determine which specific type of affidavit is required for a particular case. In summary, the Tarrant Texas Non-Military Affidavit is a crucial legal document that verifies an individual's non-military status in Tarrant County. Its purpose is to facilitate the appropriate benefits and exemptions available to non-military residents in areas such as property taxes, jury duty, vehicle registration, and college tuition.

Tarrant Texas Non-Military Affidavit

Description

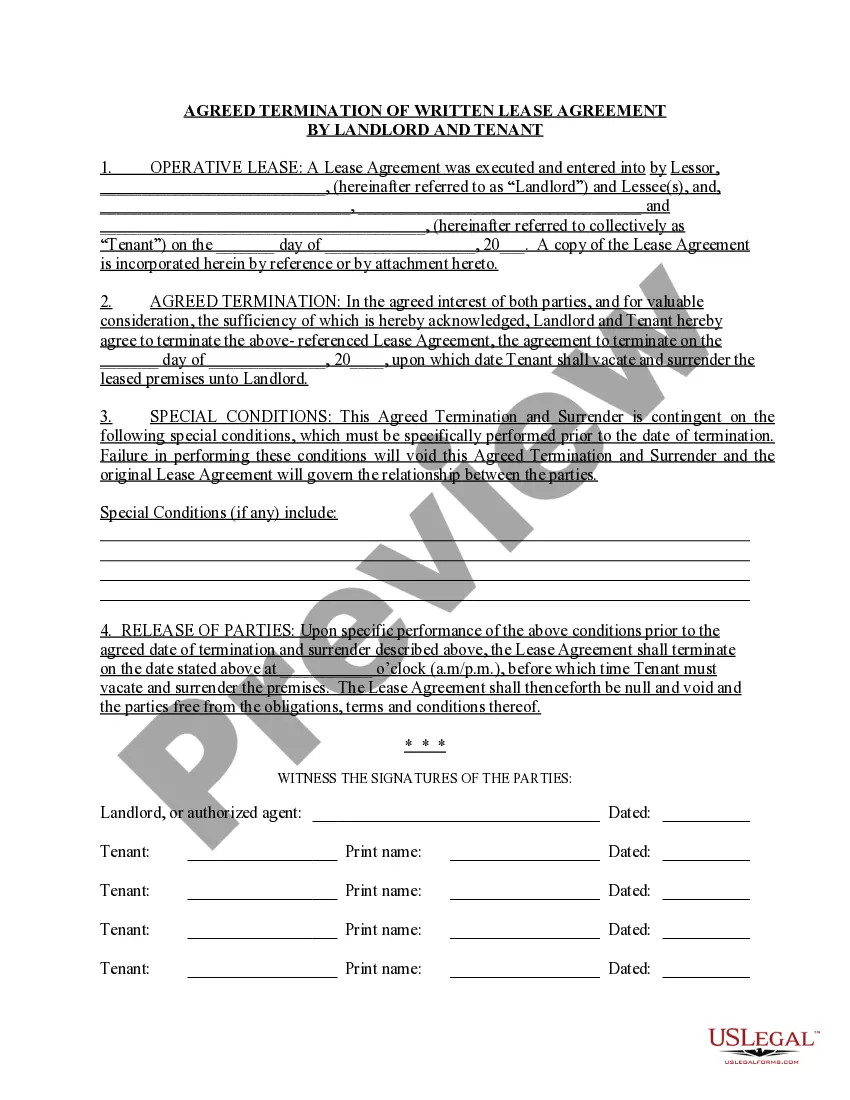

How to fill out Tarrant Texas Non-Military Affidavit?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are extremely expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Tarrant Texas Non-Military Affidavit or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Tarrant Texas Non-Military Affidavit complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Tarrant Texas Non-Military Affidavit is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!