A Brownsville Texas Home Equity Foreclosure Order is a legal decision issued by a court to initiate the foreclosure process on a home that was purchased using a home equity loan in Brownsville, Texas. This foreclosure order is specific to homeowners in Brownsville who have utilized their home equity as collateral for a loan and failed to meet their mortgage repayment obligations. Home equity is the current market value of a homeowner's property minus any outstanding mortgage balance. When individuals cannot meet their mortgage payments, they could face foreclosure, which is the legal process through which a lender seizes and sells the property to recover the unpaid loan amount. There are several types of Brownsville Texas Home Equity Foreclosure Orders that can be issued based on the specific circumstances of the foreclosure case. These may include: 1. Judicial Foreclosure Order: This type of order requires the lender to file a lawsuit against the homeowner, seeking permission from the court to foreclose on the property. The court will then issue a foreclosure order if it concludes that the homeowner has defaulted on the mortgage and all necessary steps for foreclosure have been taken. 2. Non-Judicial Foreclosure Order: In certain cases, the mortgage contract may include a power of sale clause, allowing the lender to foreclose on the property without court involvement. A non-judicial foreclosure order will follow the procedures outlined in the mortgage contract, typically involving notice of default, a trustee's sale, and the transfer of ownership to the lender if the homeowner fails to cure the default. 3. Strict Foreclosure Order: While less common, strict foreclosure orders can occur in some circumstances. In this type of order, the court awards the property directly to the lender without holding a foreclosure sale. The homeowner loses all rights to the property immediately. It is crucial for homeowners facing foreclosure in Brownsville, Texas, to seek legal advice promptly. They should understand the specifics of their foreclosure order, including the nature of the order, any deadlines or opportunities for redemption, and potential consequences. Acting swiftly and exploring various options such as loan modification, repayment plans, or negotiating with the lender can help homeowners protect their rights and potentially avoid losing their homes.

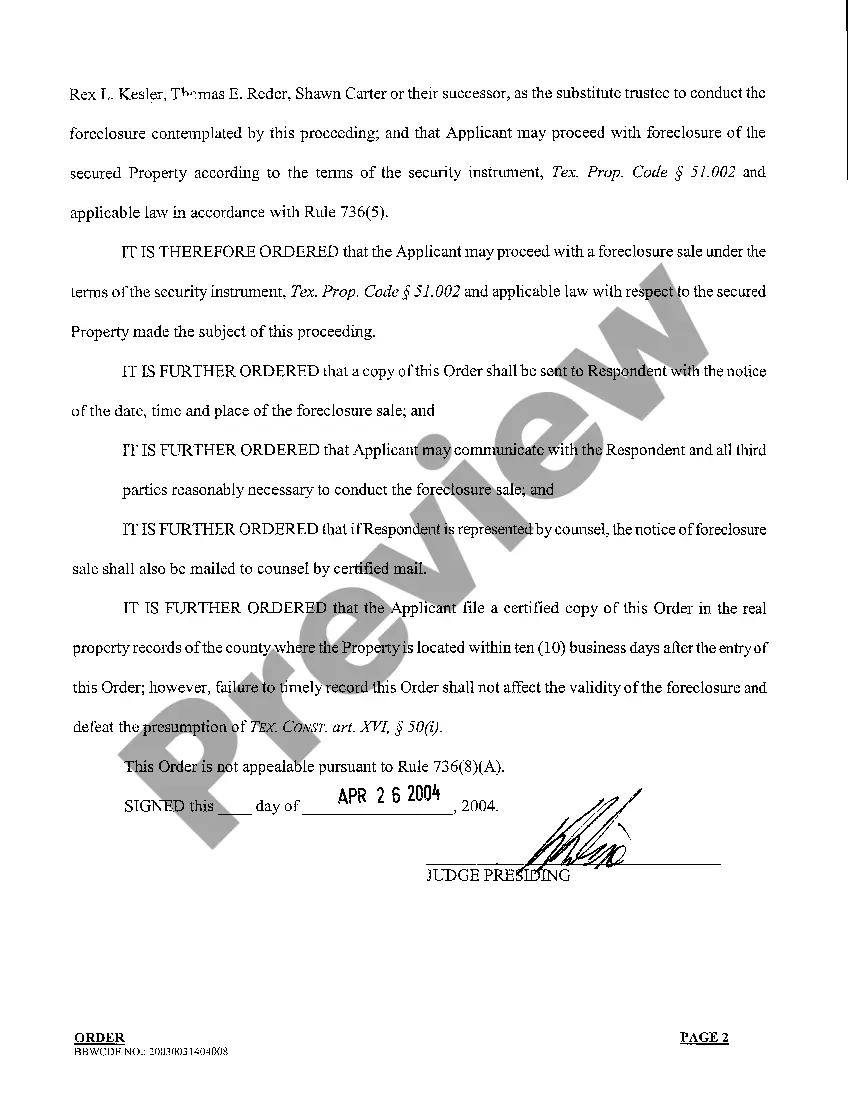

Brownsville Texas Home Equity Foreclosure Order

Description

How to fill out Brownsville Texas Home Equity Foreclosure Order?

If you are looking for a valid form template, it’s extremely hard to find a more convenient platform than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can find a large number of document samples for company and personal purposes by categories and states, or keywords. Using our advanced search function, getting the latest Brownsville Texas Home Equity Foreclosure Order is as easy as 1-2-3. In addition, the relevance of each document is proved by a group of skilled lawyers that on a regular basis review the templates on our website and update them according to the most recent state and county demands.

If you already know about our platform and have an account, all you need to receive the Brownsville Texas Home Equity Foreclosure Order is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the form you want. Check its description and make use of the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to get the needed record.

- Affirm your choice. Select the Buy now option. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Brownsville Texas Home Equity Foreclosure Order.

Every single form you save in your account has no expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to receive an extra copy for editing or printing, you can return and export it once more at any moment.

Make use of the US Legal Forms professional collection to get access to the Brownsville Texas Home Equity Foreclosure Order you were looking for and a large number of other professional and state-specific samples on one website!