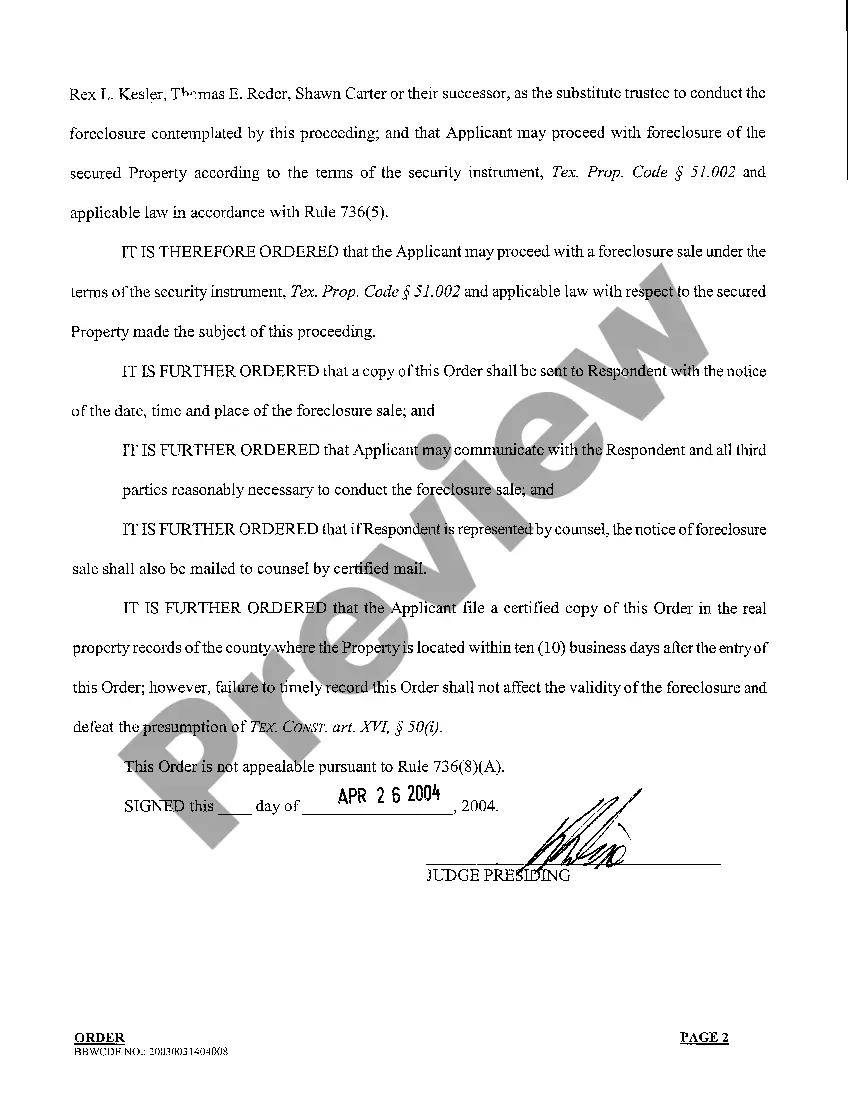

Carrollton Texas Home Equity Foreclosure Order is a legal process initiated by a mortgage lender to recover outstanding debts from a borrower who has defaulted on their home equity loan in Carrollton, Texas. This procedure allows the lender to foreclose on the property and sell it off through a public auction to recover the loan amount. In Carrollton, Texas, there are two common types of Home Equity Foreclosure Orders: 1. Judicial Foreclosure: In this type of foreclosure, the lender files a lawsuit against the borrower in a court of law. The court assesses whether the lender has the legal right to foreclose on the property and determines the amount owed by the borrower. If the court grants the foreclosure order, the property is put up for sale in a public auction. 2. Non-Judicial Foreclosure: This type of foreclosure does not involve a court process. Instead, the borrower's loan agreement typically includes a "power of sale" clause, which grants the lender the authority to sell the property in the event of default. The lender must follow specific procedures outlined in the Texas Property Code to provide notice to the borrower and conduct a public auction to sell the property. Key concepts related to Carrollton Texas Home Equity Foreclosure Order include: — Home Equity Loan: A loan that allows homeowners to borrow against the equity in their property, often used for expenses such as home improvements or college tuition. — Default: When a borrower fails to make timely payments or violates other terms of the loan agreement, it is considered a default. — Foreclosure Auction: A public sale where the foreclosed property is sold to the highest bidder to recover the outstanding loan amount. — Loan Modification: An alternative to foreclosure, where the lender and borrower negotiate new terms to make the loan more affordable for the borrower. — Redemption Period: A specific timeframe during which the borrower has the opportunity to pay off the outstanding debt and reclaim their property before it is sold at auction. — Deficiency Judgment: If the sale of the foreclosed property does not fully cover the outstanding debt, the lender may seek a deficiency judgment against the borrower for the remaining balance. Carrollton Texas Home Equity Foreclosure Order can have significant legal and financial implications for borrowers. It is crucial for homeowners facing foreclosure to seek legal advice and explore all available options to protect their rights and interests.

Carrollton Texas Home Equity Foreclosure Order

Description

How to fill out Carrollton Texas Home Equity Foreclosure Order?

Do you need a trustworthy and affordable legal forms provider to get the Carrollton Texas Home Equity Foreclosure Order? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of specific state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Carrollton Texas Home Equity Foreclosure Order conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search if the template isn’t good for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Carrollton Texas Home Equity Foreclosure Order in any provided file format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.