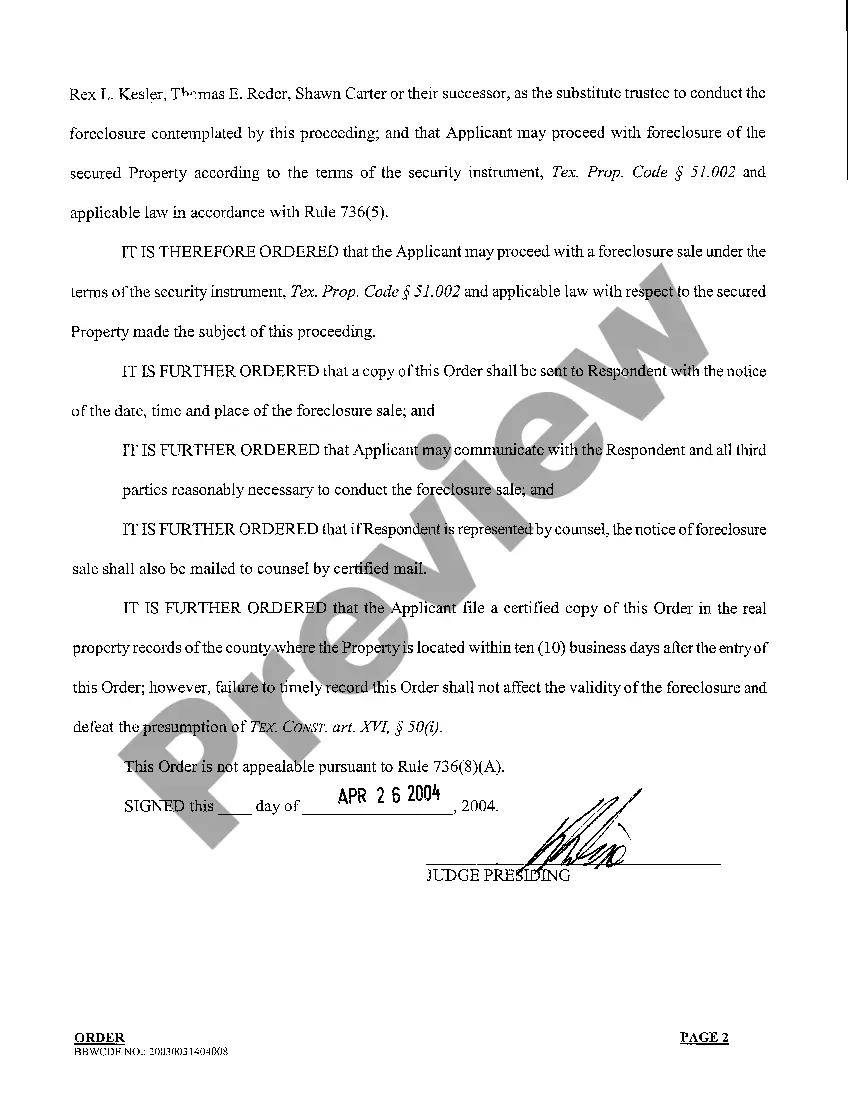

College Station, Texas is a city located in Brazos County and is known for its vibrant community and thriving real estate market. Home equity foreclosure orders in College Station can occur when homeowners default on their home equity loans, resulting in legal actions to recover the amount owed by selling the property. A home equity foreclosure order is a legal process initiated by the lender when a homeowner fails to make timely payments on their home equity loan. This order allows the lender to take possession of the property and sell it to recover the outstanding debt. Homeowners facing financial difficulties or extreme circumstances may find themselves in a situation where a home equity foreclosure order is issued. There are different types of College Station Texas Home Equity Foreclosure Orders, including: 1. Judicial Foreclosure: In this type of foreclosure, the lender files a lawsuit against the homeowner in court. The court then determines if the homeowner is in default and grants a foreclosure order if appropriate. The property is then sold at a public auction, and the proceeds are used to pay off the outstanding debt. 2. Non-judicial Foreclosure: This type of foreclosure does not involve the court system and is typically faster. The lender follows a specified process outlined in the loan agreement, involving sending notices of default and sale to the homeowner. If the homeowner fails to cure the default within the specified timeframe, the property is sold at a public auction. 3. Short Sale: In some cases, homeowners facing financial hardships may opt for a short sale instead of going through foreclosure. A short sale involves selling the property for less than the outstanding loan amount with the agreement of the lender. The lender accepts the sale proceeds as a full settlement of the debt, allowing the homeowner to avoid foreclosure. 4. Deed in Lieu of Foreclosure: Another option to avoid foreclosure is a deed in lieu of foreclosure. This involves the homeowner voluntarily transferring the property to the lender in exchange for the cancellation of the debt. This option is typically considered when the property's value has significantly decreased, and selling it through foreclosure would not yield sufficient proceeds to cover the debt. Facing a home equity foreclosure order can be a daunting and distressing situation for homeowners. However, it is essential to understand the options available and seek professional guidance from foreclosure prevention experts or housing counselors. They can provide advice on foreclosure alternatives or help negotiate with lenders to find a suitable solution for both parties.

College Station Texas Home Equity Foreclosure Order

Description

How to fill out College Station Texas Home Equity Foreclosure Order?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person without any law background to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our service provides a huge library with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the College Station Texas Home Equity Foreclosure Order or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the College Station Texas Home Equity Foreclosure Order quickly using our reliable service. If you are already an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are new to our library, make sure to follow these steps prior to obtaining the College Station Texas Home Equity Foreclosure Order:

- Be sure the form you have chosen is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and go through a quick outline (if provided) of cases the document can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment gateway and proceed to download the College Station Texas Home Equity Foreclosure Order as soon as the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

Typically, you can fall behind by a couple of mortgage payments before facing serious consequences, including a College Station Texas Home Equity Foreclosure Order. However, every lender has its own policy regarding how long they will wait before initiating foreclosure. Being proactive and communicating with your lender can help you prevent reaching a point where foreclosure becomes inevitable.

In Texas, a lienholder can initiate foreclosure proceedings on a lien within four years after the debt becomes due. This timeframe is crucial for lienholders considering a College Station Texas Home Equity Foreclosure Order. It helps ensure that they act promptly to secure the property in question.

In Texas, the timeline for foreclosure can unfold relatively quickly after a missed payment. Following a default, lenders typically send a notice after 21 days, and foreclosure can occur 21 days later. For anyone facing a College Station Texas Home Equity Foreclosure Order, understanding this timeline is essential to protect your interests and explore possible resolutions.

No, the process of foreclosure in Texas typically does not take 120 days as a blanket rule. Instead, once a homeowner defaults, the lender must provide a minimum of 21 days' notice before proceeding with foreclosure. Thus, for homeowners facing a College Station Texas Home Equity Foreclosure Order, understanding the specific timeline is crucial to avoiding complications.

Yes, Texas does provide a redemption period after the foreclosure sale. Homeowners can reclaim their property within two years if they redeem the property in full. This opportunity allows individuals to recover from a College Station Texas Home Equity Foreclosure Order, giving them time to secure funds and regain ownership.

The 120 day rule in Texas provides homeowners a grace period before foreclosure proceedings can begin, ensuring that lenders must wait 120 days after the first missed payment. This rule aims to give homeowners time to address their financial issues and seek solutions before facing a College Station Texas Home Equity Foreclosure Order. Understanding this timeline helps homeowners make informed decisions about seeking help or negotiating with their lenders.

In Texas, missing just one mortgage payment can start the path toward foreclosure, although lenders typically wait until a borrower is significantly behind. Most lenders will begin the foreclosure process after three to six missed payments. It's important to catch up on payments as soon as possible to avoid a College Station Texas Home Equity Foreclosure Order. Seeking assistance through services like uslegalforms can help you understand your options.

In Texas, certain exceptions to the 120 day foreclosure rule exist, especially in cases related to bankruptcy or military service. If you have filed for bankruptcy, the foreclosure process may be halted temporarily. Additionally, if you are active in the military, you may have protections under the Servicemembers Civil Relief Act. It is essential to understand these exceptions to navigate your situation effectively regarding a College Station Texas Home Equity Foreclosure Order.

The process of foreclosure in Texas can vary, but it generally takes about 60 to 90 days from the time of the notice of default until the foreclosure sale occurs. If you're facing a College Station Texas Home Equity Foreclosure Order, it's essential to understand this timeline so you can take action. Keep in mind that the exact duration can depend on factors such as the lender’s policies and any potential legal disputes. To navigate this process effectively, consider utilizing resources from USLegalForms for guidance and documentation.

Claiming equity after foreclosure can be complex, but it's not impossible. You may need to file a claim to recover surplus funds if your property sells for more than what you owe. Engaging with professionals who understand the College Station Texas Home Equity Foreclosure Order can provide clarity and guidance on the steps you need to take. Utilizing platforms like uslegalforms can help streamline the process of reclaiming your equity.