Collin Texas Home Equity Foreclosure Order is a legal proceeding triggered when a homeowner in Collin County, Texas fails to make mortgage payments on their property. This order allows the lender to reclaim the property and sell it to recover the remaining loan amount. Home equity foreclosure orders may be pursued by various financial institutions or mortgage lenders operating in Collin County. Some common types of Collin Texas Home Equity Foreclosure Orders include: 1. Judicial Foreclosure: This order involves a lawsuit filed by the lender against the homeowner. The court oversees the foreclosure process, ensuring the property is sold at a fair market value, and proceeds are used to settle the outstanding loan balance. 2. Non-Judicial Foreclosure: In this type of order, the lender follows a streamlined foreclosure process without involving the court. Non-judicial foreclosure is possible when the mortgage contract includes a power of sale clause, allowing the lender to sell the property without court intervention. 3. Foreclosure by Advertisement: This is a specific type of non-judicial foreclosure where the lender places public advertisements, typically in local newspapers, to inform the homeowner about the impending foreclosure sale. The property is then sold at a public auction to the highest bidder. When facing a Collin Texas Home Equity Foreclosure Order, homeowners have certain rights and opportunities to prevent the loss of their property. They may have the option to reinstate the loan by paying the outstanding amount plus associated fees within a specific period. Another possibility is to negotiate a loan modification or apply for government assistance programs to halt the foreclosure process temporarily. To protect their interests during a Collin Texas Home Equity Foreclosure Order, homeowners are advised to seek legal counsel from foreclosure defense attorneys who specialize in Texas real estate law. These attorneys can navigate the complexities of the foreclosure process, explore potential alternatives, and represent the homeowner's best interests in court if necessary. Understanding the Collin Texas Home Equity Foreclosure Order and its various types is crucial for homeowners in Collin County who find themselves in financial distress. By knowing their rights and exploring available options, homeowners can make informed decisions to potentially avoid foreclosure or mitigate its consequences.

Collin Texas Home Equity Foreclosure Order

State:

Texas

County:

Collin

Control #:

TX-CC-07-04

Format:

PDF

Instant download

This form is available by subscription

Description

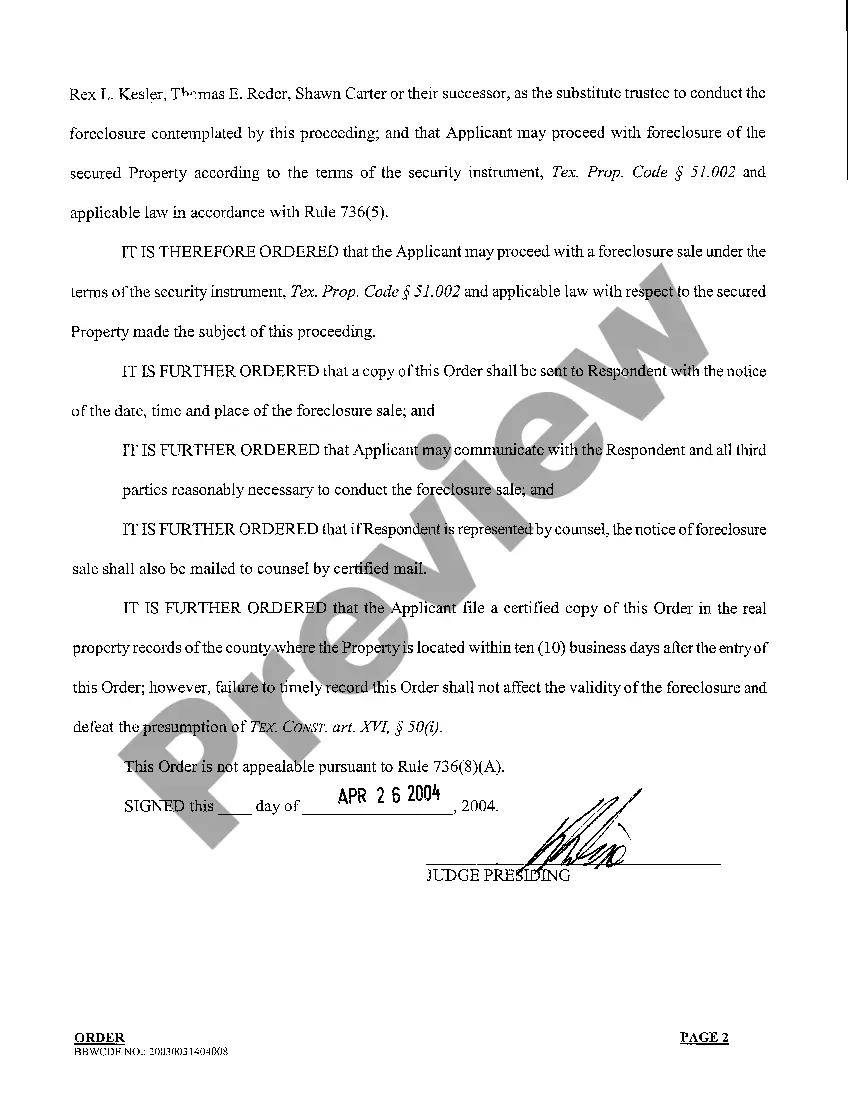

A04 Home Equity Foreclosure Order

Collin Texas Home Equity Foreclosure Order is a legal proceeding triggered when a homeowner in Collin County, Texas fails to make mortgage payments on their property. This order allows the lender to reclaim the property and sell it to recover the remaining loan amount. Home equity foreclosure orders may be pursued by various financial institutions or mortgage lenders operating in Collin County. Some common types of Collin Texas Home Equity Foreclosure Orders include: 1. Judicial Foreclosure: This order involves a lawsuit filed by the lender against the homeowner. The court oversees the foreclosure process, ensuring the property is sold at a fair market value, and proceeds are used to settle the outstanding loan balance. 2. Non-Judicial Foreclosure: In this type of order, the lender follows a streamlined foreclosure process without involving the court. Non-judicial foreclosure is possible when the mortgage contract includes a power of sale clause, allowing the lender to sell the property without court intervention. 3. Foreclosure by Advertisement: This is a specific type of non-judicial foreclosure where the lender places public advertisements, typically in local newspapers, to inform the homeowner about the impending foreclosure sale. The property is then sold at a public auction to the highest bidder. When facing a Collin Texas Home Equity Foreclosure Order, homeowners have certain rights and opportunities to prevent the loss of their property. They may have the option to reinstate the loan by paying the outstanding amount plus associated fees within a specific period. Another possibility is to negotiate a loan modification or apply for government assistance programs to halt the foreclosure process temporarily. To protect their interests during a Collin Texas Home Equity Foreclosure Order, homeowners are advised to seek legal counsel from foreclosure defense attorneys who specialize in Texas real estate law. These attorneys can navigate the complexities of the foreclosure process, explore potential alternatives, and represent the homeowner's best interests in court if necessary. Understanding the Collin Texas Home Equity Foreclosure Order and its various types is crucial for homeowners in Collin County who find themselves in financial distress. By knowing their rights and exploring available options, homeowners can make informed decisions to potentially avoid foreclosure or mitigate its consequences.

Free preview

How to fill out Collin Texas Home Equity Foreclosure Order?

If you’ve already utilized our service before, log in to your account and download the Collin Texas Home Equity Foreclosure Order on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Collin Texas Home Equity Foreclosure Order. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!