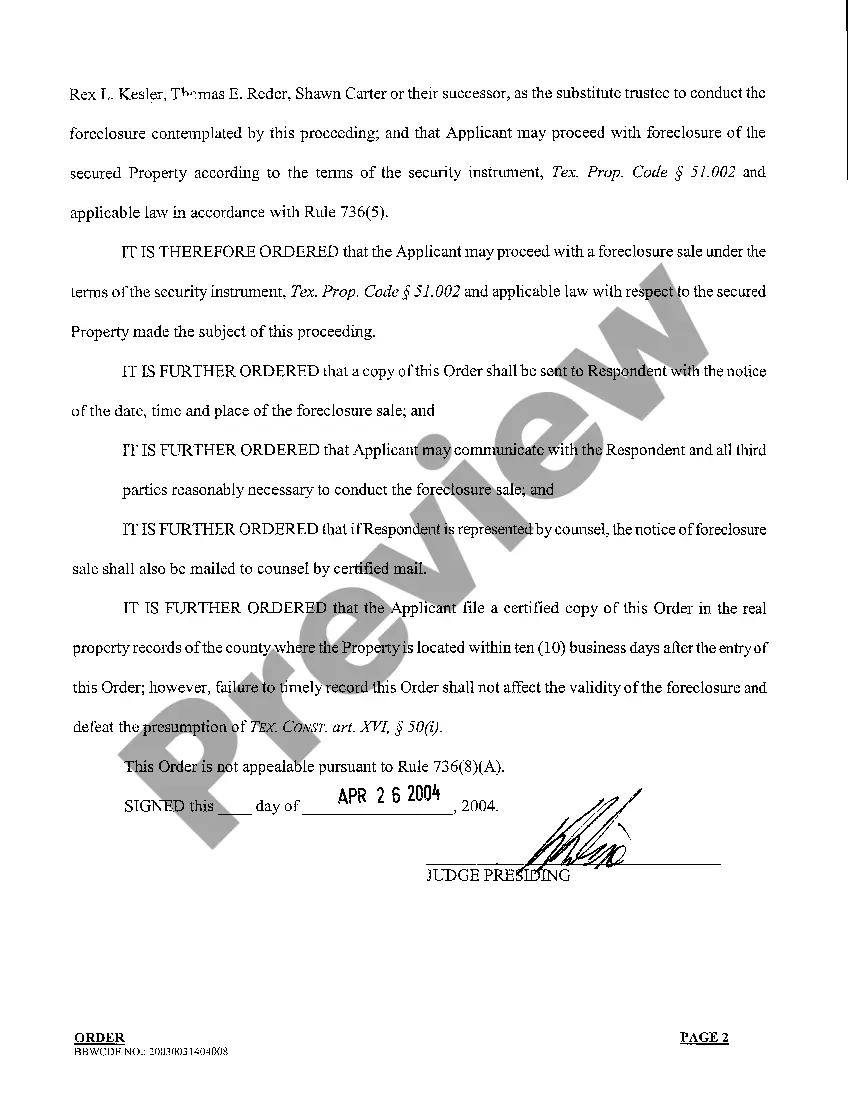

Edinburg Texas Home Equity Foreclosure Order is a legal process that allows lenders to repossess a property when the homeowner fails to repay their home equity loan in Edinburg, Texas. This type of foreclosure order specifically targets properties that are used as collateral for a home equity loan, which means the lender has the right to seize and sell the property to recover the outstanding debt. Home equity foreclosure orders in Edinburg, Texas are typically initiated by lenders when the borrower has become delinquent in their loan payments, violating the terms agreed upon in the home equity loan agreement. The lender must follow a specific legal process in order to proceed with the foreclosure and take possession of the property. There are two main types of Edinburg Texas Home Equity Foreclosure Orders: judicial foreclosure and non-judicial foreclosure. 1. Judicial Foreclosure: In this type of foreclosure, the lender files a lawsuit against the borrower in court. The court then reviews all relevant documents, including the loan agreement, and if the lender is proven to have a valid claim, a foreclosure order is issued. The property is then sold at a public auction to recover the outstanding debt. The borrower may have the opportunity to cure the default before the auction takes place. 2. Non-Judicial Foreclosure: In this type of foreclosure, also known as a power of sale foreclosure, the loan agreement typically includes a provision allowing the lender to sell the property without court involvement. The lender must follow the procedures outlined in the loan agreement and comply with relevant Texas foreclosure laws. This process typically involves giving notice to the borrower and publishing the foreclosure sale in a local newspaper. The property is then sold at a public auction, where the highest bidder becomes the new owner. It's important for homeowners in Edinburg, Texas, to understand the implications of a home equity foreclosure order. Losing a property due to foreclosure can have long-lasting financial and emotional consequences. Seeking legal advice and exploring alternatives, such as loan modifications or refinancing, may help homeowners facing foreclosure to save their properties and avoid the adverse effects of foreclosure.

Edinburg Texas Home Equity Foreclosure Order

Description

How to fill out Edinburg Texas Home Equity Foreclosure Order?

Do you need a reliable and inexpensive legal forms supplier to buy the Edinburg Texas Home Equity Foreclosure Order? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Edinburg Texas Home Equity Foreclosure Order conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is good for.

- Restart the search in case the template isn’t good for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Edinburg Texas Home Equity Foreclosure Order in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online for good.