Title: Understanding Frisco Texas Home Equity Foreclosure Order: Types and Procedures Introduction: In Frisco, Texas, home equity foreclosure orders play a crucial role in the real estate market. This detailed description aims to explore what exactly a Frisco Texas Home Equity Foreclosure Order entails and shed light on its various types. This comprehensive guide will provide key information, procedures, and relevant keywords associated with these orders. Keywords: Frisco Texas, home equity, foreclosure order, real estate market I. What is a Frisco Texas Home Equity Foreclosure Order? A Frisco Texas Home Equity Foreclosure Order is a legal process initiated by a lender to recover any unpaid debts secured by a home's equity. This typically occurs when homeowners fail to meet their mortgage obligations, leading to the foreclosure of their property. The order allows lenders to recoup their investment, often through a public auction of the foreclosed property. Keywords: legal process, lender, unpaid debts, secured, mortgage obligations, foreclosure, property, recoup, public auction II. Types of Frisco Texas Home Equity Foreclosure Orders: 1. Judicial Foreclosure Order: Under this type of foreclosure order, the lender files a lawsuit against the homeowner in a court of law. It typically involves extensive legal procedures, giving the homeowner an opportunity to contest the foreclosure. If the court rules in favor of the lender, the property will be sold at a public auction to settle the debt. Keywords: judicial foreclosure, lawsuit, court, legal procedures, contest, public auction 2. Non-Judicial Foreclosure Order: Also known as a power of sale foreclosure, this type of order allows lenders to sell the property without involving the court system. Non-judicial foreclosure orders are applicable when the mortgage contains a "power of sale" clause, granting the lender the right to sell the property in case of default. The lender must adhere to specific state laws and provide proper notice to the homeowner before proceeding with the sale. Keywords: non-judicial foreclosure, power of sale, default, state laws, notice, sale III. Procedures for a Frisco Texas Home Equity Foreclosure Order: 1. Notice of Default: When a homeowner fails to make mortgage payments as agreed, the lender issues a Notice of Default, officially informing the homeowner of their default status. This notice typically includes the total amount owed and a deadline for payment. Keywords: notice of default, mortgage payments, default status, total amount owed 2. Notice of Foreclosure Sale: If the homeowner fails to cure the default within the specified deadline, the lender issues a Notice of Foreclosure Sale. This notice provides details about the date, time, and location of the foreclosure auction. It is crucial for homeowners to review this notice carefully and consider their options. Keywords: notice of foreclosure sale, cure, foreclosure auction, options 3. Foreclosure Auction: At the foreclosure auction, the lender sells the foreclosed property to the highest bidder. The property is typically sold "as-is," meaning the buyer accepts any existing liens, repairs, or encumbrances. The proceeds from the auction are used to repay the outstanding debt. Keywords: foreclosure auction, foreclosed property, the highest bidder, as-is sale, liens, encumbrances, outstanding debt Conclusion: Frisco Texas Home Equity Foreclosure Orders are legal processes used to recover unpaid debts secured by a home's equity. This detailed description covered the different types of foreclosure orders, namely judicial and non-judicial, along with the associated procedures and relevant keywords. Understanding these orders is essential for homeowners to make informed decisions and navigate the complexities of the real estate market.

Frisco Texas Home Equity Foreclosure Order

State:

Texas

City:

Frisco

Control #:

TX-CC-07-04

Format:

PDF

Instant download

This form is available by subscription

Description

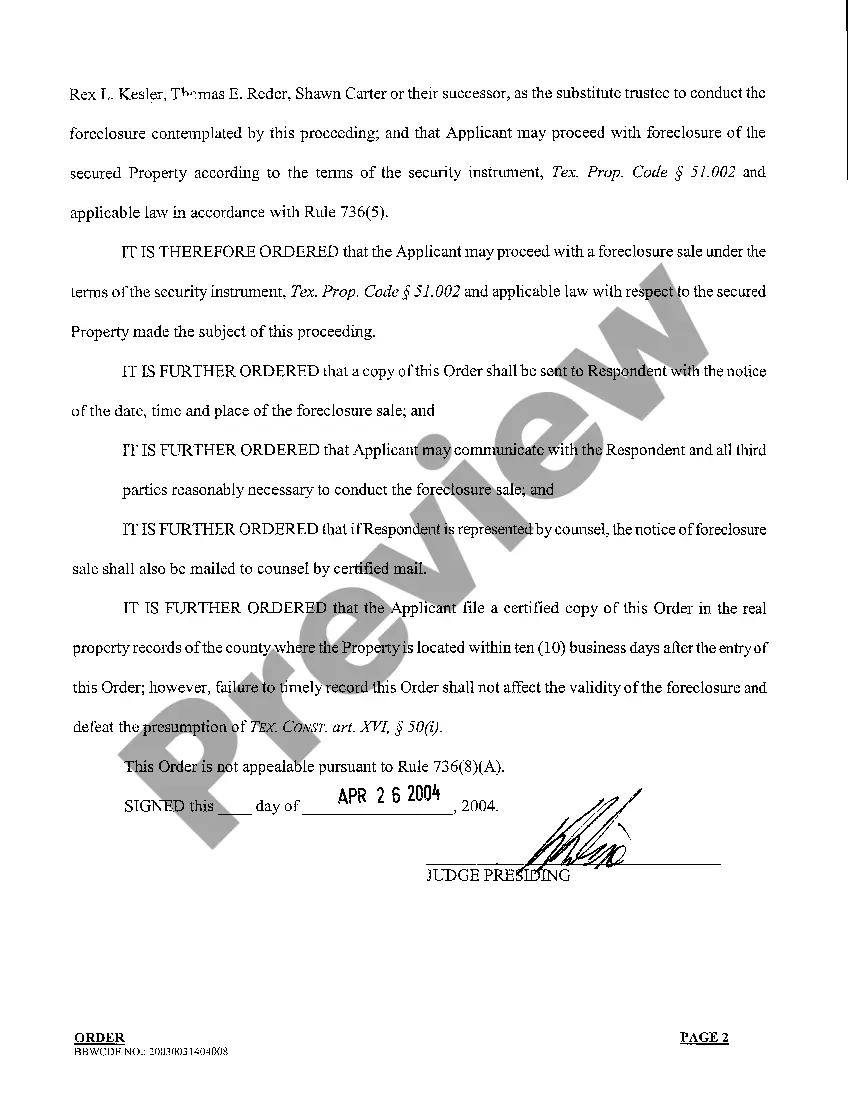

A04 Home Equity Foreclosure Order

Title: Understanding Frisco Texas Home Equity Foreclosure Order: Types and Procedures Introduction: In Frisco, Texas, home equity foreclosure orders play a crucial role in the real estate market. This detailed description aims to explore what exactly a Frisco Texas Home Equity Foreclosure Order entails and shed light on its various types. This comprehensive guide will provide key information, procedures, and relevant keywords associated with these orders. Keywords: Frisco Texas, home equity, foreclosure order, real estate market I. What is a Frisco Texas Home Equity Foreclosure Order? A Frisco Texas Home Equity Foreclosure Order is a legal process initiated by a lender to recover any unpaid debts secured by a home's equity. This typically occurs when homeowners fail to meet their mortgage obligations, leading to the foreclosure of their property. The order allows lenders to recoup their investment, often through a public auction of the foreclosed property. Keywords: legal process, lender, unpaid debts, secured, mortgage obligations, foreclosure, property, recoup, public auction II. Types of Frisco Texas Home Equity Foreclosure Orders: 1. Judicial Foreclosure Order: Under this type of foreclosure order, the lender files a lawsuit against the homeowner in a court of law. It typically involves extensive legal procedures, giving the homeowner an opportunity to contest the foreclosure. If the court rules in favor of the lender, the property will be sold at a public auction to settle the debt. Keywords: judicial foreclosure, lawsuit, court, legal procedures, contest, public auction 2. Non-Judicial Foreclosure Order: Also known as a power of sale foreclosure, this type of order allows lenders to sell the property without involving the court system. Non-judicial foreclosure orders are applicable when the mortgage contains a "power of sale" clause, granting the lender the right to sell the property in case of default. The lender must adhere to specific state laws and provide proper notice to the homeowner before proceeding with the sale. Keywords: non-judicial foreclosure, power of sale, default, state laws, notice, sale III. Procedures for a Frisco Texas Home Equity Foreclosure Order: 1. Notice of Default: When a homeowner fails to make mortgage payments as agreed, the lender issues a Notice of Default, officially informing the homeowner of their default status. This notice typically includes the total amount owed and a deadline for payment. Keywords: notice of default, mortgage payments, default status, total amount owed 2. Notice of Foreclosure Sale: If the homeowner fails to cure the default within the specified deadline, the lender issues a Notice of Foreclosure Sale. This notice provides details about the date, time, and location of the foreclosure auction. It is crucial for homeowners to review this notice carefully and consider their options. Keywords: notice of foreclosure sale, cure, foreclosure auction, options 3. Foreclosure Auction: At the foreclosure auction, the lender sells the foreclosed property to the highest bidder. The property is typically sold "as-is," meaning the buyer accepts any existing liens, repairs, or encumbrances. The proceeds from the auction are used to repay the outstanding debt. Keywords: foreclosure auction, foreclosed property, the highest bidder, as-is sale, liens, encumbrances, outstanding debt Conclusion: Frisco Texas Home Equity Foreclosure Orders are legal processes used to recover unpaid debts secured by a home's equity. This detailed description covered the different types of foreclosure orders, namely judicial and non-judicial, along with the associated procedures and relevant keywords. Understanding these orders is essential for homeowners to make informed decisions and navigate the complexities of the real estate market.

Free preview

How to fill out Frisco Texas Home Equity Foreclosure Order?

If you’ve already used our service before, log in to your account and download the Frisco Texas Home Equity Foreclosure Order on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Frisco Texas Home Equity Foreclosure Order. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!