Grand Prairie Texas Home Equity Foreclosure Order refers to a legal process initiated by a lender in Grand Prairie, Texas, to foreclose on a home due to the homeowner's failure to repay a home equity loan. This type of foreclosure order typically occurs when the borrower defaults on their loan and fails to meet the required mortgage payments. A Grand Prairie Texas Home Equity Foreclosure Order can occur in different scenarios, such as: 1. Non-Judicial Foreclosure: In this type of foreclosure, commonly known as a "power of sale," the lender can initiate the foreclosure process without court intervention. Non-judicial foreclosure is allowed when the mortgage contract contains a power of sale clause, enabling the lender to sell the property to recover the outstanding debt. 2. Judicial Foreclosure: In this process, the lender files a lawsuit against the borrower, seeking permission from the court to foreclose on the property. The court oversees the foreclosure procedure, ensuring it complies with all legal requirements. Judicial foreclosures are utilized when the mortgage contract does not include a power of sale clause, requiring court intervention. During a Grand Prairie Texas Home Equity Foreclosure Order, the borrower's home becomes subject to foreclosure auction. The lender aims to sell the property to recoup the outstanding debt. It is crucial for homeowners facing foreclosure to understand their rights and options. Seeking legal advice is highly recommended exploring available alternatives, such as loan modifications or negotiating with the lender to avoid foreclosure. When dealing with a Grand Prairie Texas Home Equity Foreclosure Order, homeowners may have the opportunity to redeem their property by paying off the entire debt or potentially bidding and repurchasing the home during the foreclosure auction. However, it is essential to act swiftly and effectively to prevent any further complications and potential losses. In conclusion, a Grand Prairie Texas Home Equity Foreclosure Order is a legal process initiated by a lender to foreclose on a home due to the borrower's failure to repay a home equity loan. This situation can arise in the form of non-judicial foreclosure or judicial foreclosure, depending on the terms of the mortgage contract. If facing foreclosure, homeowners should seek professional guidance and explore available options to potentially avoid losing their property.

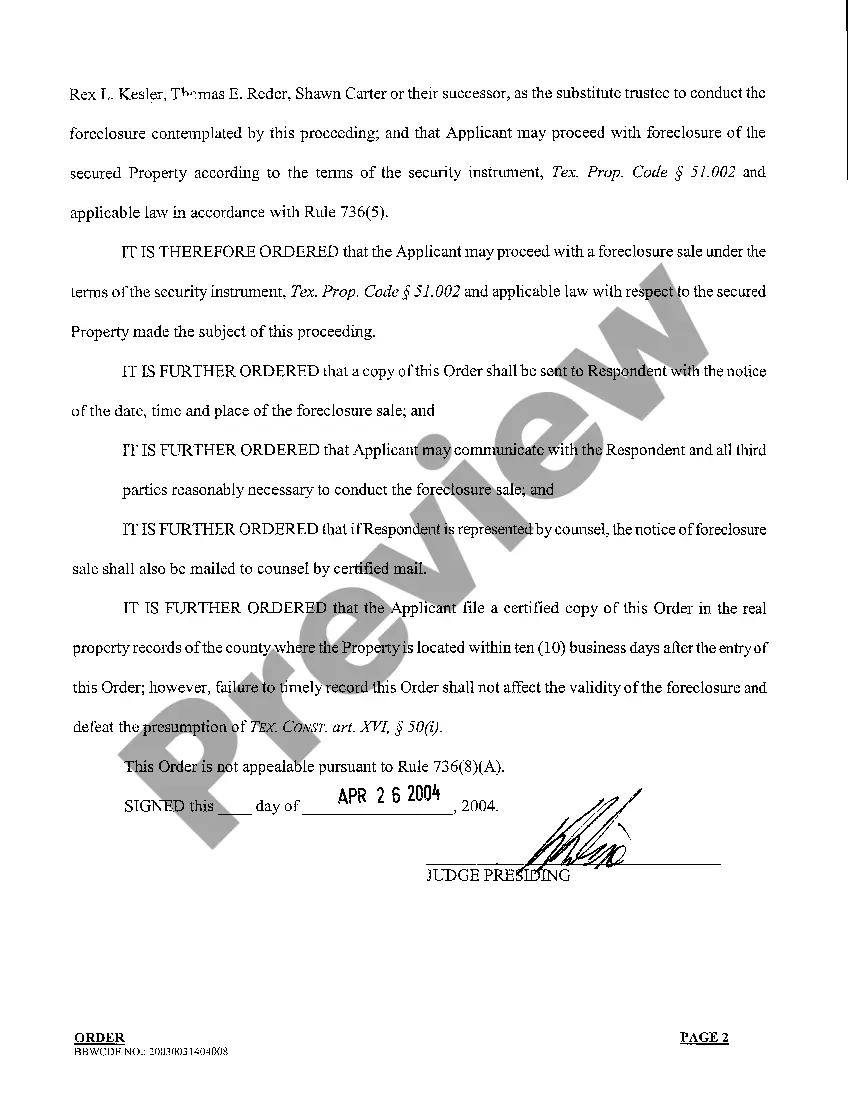

Grand Prairie Texas Home Equity Foreclosure Order

Description

How to fill out Grand Prairie Texas Home Equity Foreclosure Order?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Grand Prairie Texas Home Equity Foreclosure Order or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Grand Prairie Texas Home Equity Foreclosure Order adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Grand Prairie Texas Home Equity Foreclosure Order is suitable for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!