In Irving, Texas, a Home Equity Foreclosure Order refers to a legal process that allows a lender to seize and sell a property to recover the unpaid balance on a home equity loan or line of credit. This order comes into effect when a homeowner defaults on their loan payments or violates the terms of the agreement. A Home Equity Foreclosure Order in Irving, Texas can have several types, including: 1. Judicial Foreclosure: This is the most common type of foreclosure process where the lender initiates a lawsuit against the homeowner in order to obtain a court order to foreclose on the property. The court oversees the process and ensures that all parties involved follow the proper legal procedures. 2. Non-Judicial Foreclosure: In some cases, if the mortgage or deed of trust contains a "power of sale" clause, the lender can opt for a non-judicial foreclosure process. This type of foreclosure does not involve the court system and instead follows a specific set of procedures outlined in the mortgage contract or state laws. 3. Order of Sale: Once a foreclosure is initiated, the court may issue an Order of Sale, which authorizes the foreclosure sale to take place. This order sets a specific date, time, and location for the auction of the property, allowing potential buyers to bid on it. 4. Redemption Period: In certain instances, there may be a redemption period attached to the Home Equity Foreclosure Order, providing the homeowner with an opportunity to reclaim the property by paying the outstanding debt, interest, and associated costs within a specified timeframe. It is crucial for homeowners facing a Home Equity Foreclosure Order in Irving, Texas to seek legal advice and explore available options to prevent the loss of their home. This may include negotiating with the lender, refinancing the loan, or pursuing loan modification programs to make the payments more manageable.

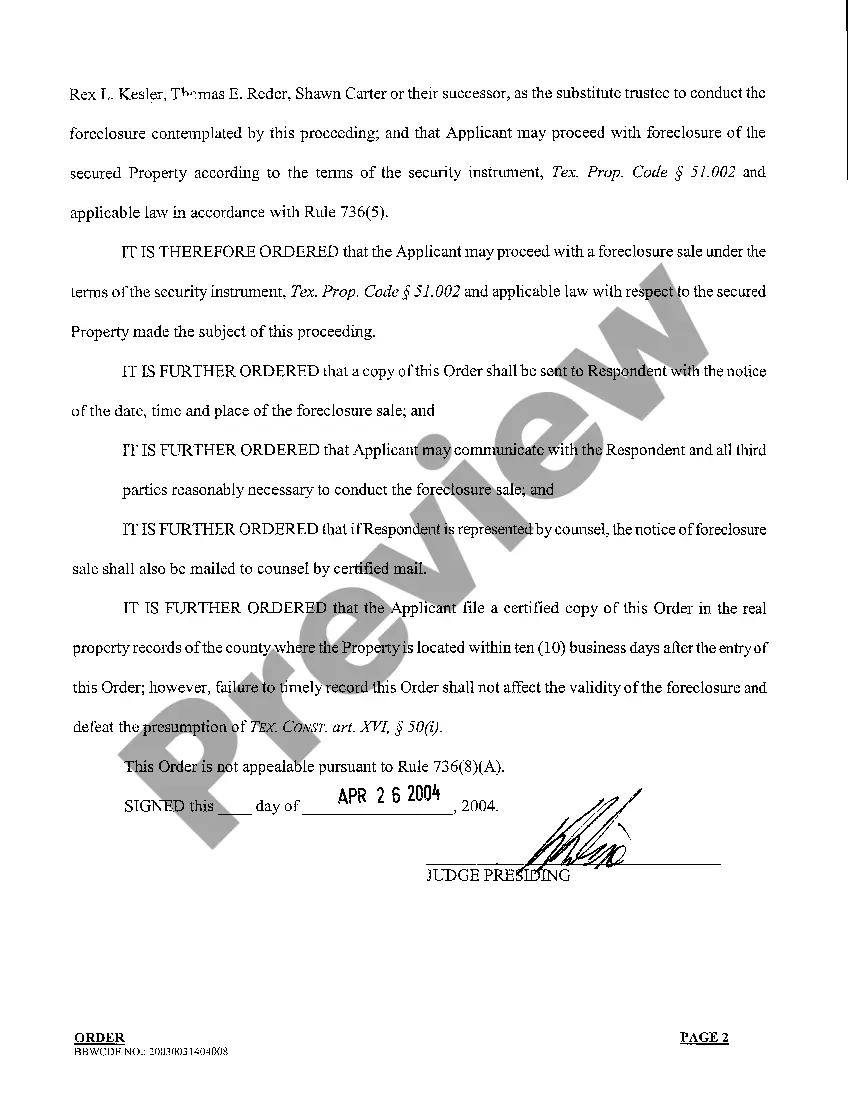

Irving Texas Home Equity Foreclosure Order

Description

How to fill out Irving Texas Home Equity Foreclosure Order?

Take advantage of the US Legal Forms and get immediate access to any form template you require. Our useful platform with a large number of templates allows you to find and obtain almost any document sample you want. You can export, fill, and sign the Irving Texas Home Equity Foreclosure Order in a matter of minutes instead of surfing the Net for hours seeking a proper template.

Utilizing our collection is an excellent strategy to improve the safety of your form filing. Our professional attorneys regularly review all the documents to ensure that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Irving Texas Home Equity Foreclosure Order? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the template you need. Make certain that it is the form you were hoping to find: verify its title and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the document. Indicate the format to get the Irving Texas Home Equity Foreclosure Order and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the internet. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Irving Texas Home Equity Foreclosure Order.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!