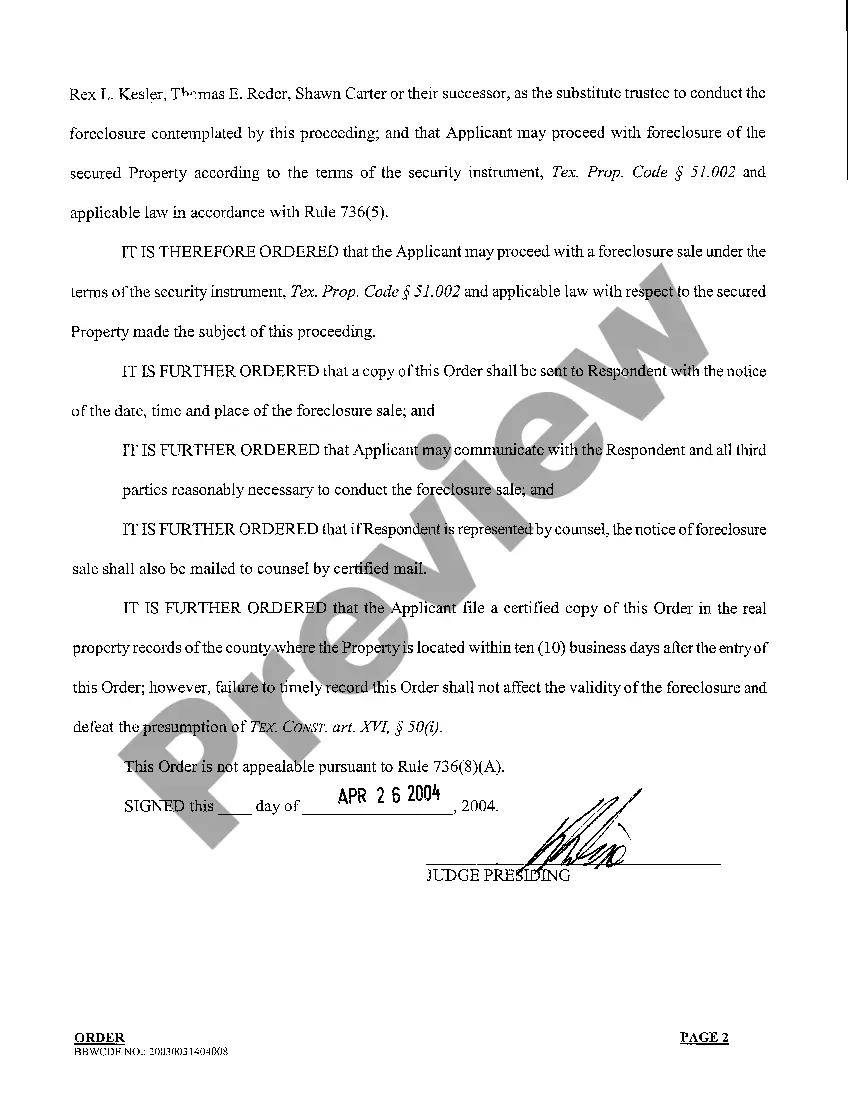

Lewisville Texas Home Equity Foreclosure Order is a legal process that allows lenders to recoup the unpaid balance on a home loan by selling the property. This order is specifically related to home equity loans obtained by homeowners in Lewisville, Texas. When borrowers fail to make regular mortgage payments on their home equity loans, lenders may initiate a foreclosure proceeding to recover their investment. During the Lewisville Texas Home Equity Foreclosure Order process, the lender files a lawsuit against the borrower to obtain a court order authorizing the sale of the property. This court order is commonly referred to as a foreclosure order. It provides the necessary legal authority for the lender to reclaim the home and sell it to recover the outstanding debt. There are different types of Lewisville Texas Home Equity Foreclosure Orders, including judicial foreclosure and non-judicial foreclosure. Judicial foreclosure requires the lender to file a lawsuit in court and obtain a judgment before proceeding with the foreclosure sale. On the other hand, non-judicial foreclosure allows the lender to follow a specific set of procedures outlined in the loan contract or state laws to proceed with the foreclosure sale without court involvement. It is important for homeowners in Lewisville, Texas, to understand the implications of a Home Equity Foreclosure Order. Foreclosure can have significant consequences, including the loss of the property, damage to credit scores, and potential legal consequences. Therefore, it is crucial for homeowners facing financial difficulties to explore alternatives such as loan modifications, refinancing, or negotiating repayment plans with the lender. If a Lewisville Texas Home Equity Foreclosure Order has been issued, homeowners should seek legal advice promptly to understand their rights and explore potential options for avoiding foreclosure. Homeowners may also consider consulting with housing counseling agencies or reaching out to local resources to understand available foreclosure prevention programs. In summary, Lewisville Texas Home Equity Foreclosure Order is a legal process that allows lenders to reclaim and sell a property when borrowers default on their home equity loans in Lewisville, Texas. This process can be either judicial or non-judicial, and it is important for homeowners to understand the potential consequences and seek professional advice when facing foreclosure.

Lewisville Texas Home Equity Foreclosure Order is a legal process that allows lenders to recoup the unpaid balance on a home loan by selling the property. This order is specifically related to home equity loans obtained by homeowners in Lewisville, Texas. When borrowers fail to make regular mortgage payments on their home equity loans, lenders may initiate a foreclosure proceeding to recover their investment. During the Lewisville Texas Home Equity Foreclosure Order process, the lender files a lawsuit against the borrower to obtain a court order authorizing the sale of the property. This court order is commonly referred to as a foreclosure order. It provides the necessary legal authority for the lender to reclaim the home and sell it to recover the outstanding debt. There are different types of Lewisville Texas Home Equity Foreclosure Orders, including judicial foreclosure and non-judicial foreclosure. Judicial foreclosure requires the lender to file a lawsuit in court and obtain a judgment before proceeding with the foreclosure sale. On the other hand, non-judicial foreclosure allows the lender to follow a specific set of procedures outlined in the loan contract or state laws to proceed with the foreclosure sale without court involvement. It is important for homeowners in Lewisville, Texas, to understand the implications of a Home Equity Foreclosure Order. Foreclosure can have significant consequences, including the loss of the property, damage to credit scores, and potential legal consequences. Therefore, it is crucial for homeowners facing financial difficulties to explore alternatives such as loan modifications, refinancing, or negotiating repayment plans with the lender. If a Lewisville Texas Home Equity Foreclosure Order has been issued, homeowners should seek legal advice promptly to understand their rights and explore potential options for avoiding foreclosure. Homeowners may also consider consulting with housing counseling agencies or reaching out to local resources to understand available foreclosure prevention programs. In summary, Lewisville Texas Home Equity Foreclosure Order is a legal process that allows lenders to reclaim and sell a property when borrowers default on their home equity loans in Lewisville, Texas. This process can be either judicial or non-judicial, and it is important for homeowners to understand the potential consequences and seek professional advice when facing foreclosure.