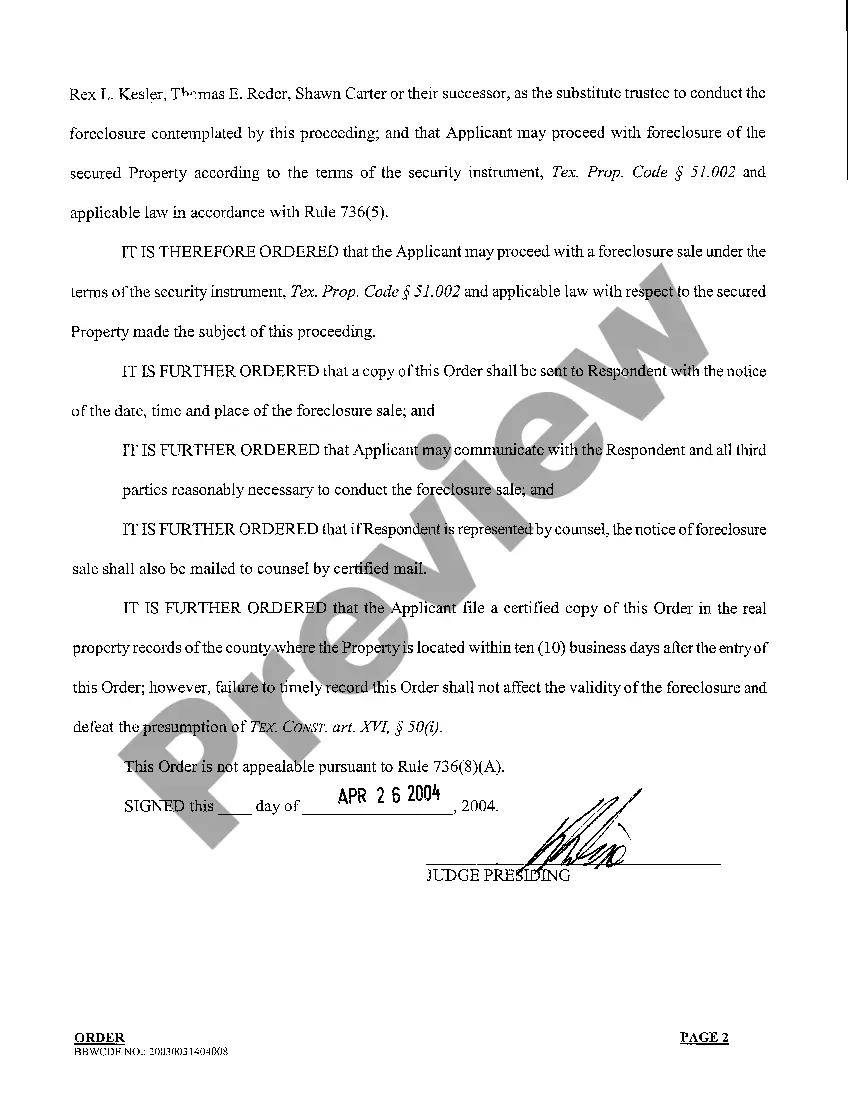

McAllen, Texas Home Equity Foreclosure Order is a legal process initiated by the lender to reclaim a property when the homeowner defaults on their home equity loan or line of credit. This foreclosure order allows the lender to sell the property in order to recover the outstanding debt. The McAllen, Texas Home Equity Foreclosure Order can occur in two main forms: judicial foreclosure and non-judicial foreclosure. 1. Judicial Foreclosure: In this type of foreclosure, the lender files a lawsuit against the homeowner in a court of law. The court examines the evidence and, if it determines that the borrower has defaulted on their home equity loan, issues a McAllen, Texas Home Equity Foreclosure Order. The property is then sold through a public auction to recoup the debt. 2. Non-Judicial Foreclosure: This type of foreclosure occurs when the mortgage or deed of trust includes a "power of sale" clause, which authorizes the lender to sell the property without going through the court system. In a non-judicial foreclosure, the lender is required to follow a specific procedure outlined in the deed of trust or mortgage. They must provide proper notice to the homeowner and hold a public auction to sell the property and recover the debt. The McAllen, Texas Home Equity Foreclosure Order is a serious matter that can have long-lasting consequences for homeowners. Losing a property to foreclosure can damage credit scores, hinder future borrowing opportunities, and lead to financial instability. It is important for homeowners facing foreclosure to seek legal advice and explore all possible options to avoid losing their home. If a homeowner in McAllen, Texas receives a foreclosure notice or believes they might be at risk of foreclosure, they should immediately seek assistance from a foreclosure defense attorney or a housing counselor. These professionals can provide guidance on possible alternatives, such as loan modifications, repayment plans, or refinancing options, to prevent the foreclosure process and protect the homeowner's interests. Dealing with a McAllen, Texas Home Equity Foreclosure Order requires careful attention and understanding of the legal procedures involved. Homeowners should educate themselves on their rights and responsibilities, and take proactive measures to resolve their financial struggles before it leads to a foreclosure situation.

McAllen Texas Home Equity Foreclosure Order

Description

How to fill out McAllen Texas Home Equity Foreclosure Order?

If you have previously utilized our service, Log In to your account and store the McAllen Texas Home Equity Foreclosure Order on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it as per your payment schedule.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have acquired: you can find it in your profile within the My documents section whenever you want to reuse it. Utilize the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Ensure you’ve located the correct document. Browse through the description and use the Preview option, if available, to verify if it satisfies your requirements. If it doesn't fit your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and opt for a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your McAllen Texas Home Equity Foreclosure Order. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it and sign it digitally.

Form popularity

FAQ

If the housing market crashes, the value of your home may decrease, potentially impacting your Home Equity Line of Credit (HELOC). A drop in home value might reduce the amount you can draw from your HELOC or even result in the lender freezing your line of credit. As your McAllen Texas Home Equity Foreclosure Order develops, it's crucial to stay informed about these changes to safeguard your financial position. Seeking guidance through platforms like uslegalforms can provide valuable information on protecting your equity.

In Texas, the foreclosure process can take anywhere from a few months to several months, primarily depending on various factors. Typically, a lender must provide a notice of default and allow you at least 20 days to rectify your payment before proceeding. After this notice, they can schedule a foreclosure sale, which usually occurs at least 21 days after the notice is published. Understanding the timeline can help you effectively navigate your McAllen Texas Home Equity Foreclosure Order.

In Texas, lenders usually initiate foreclosure proceedings after a homeowner is at least 90 days behind on their mortgage payments. This period allows homeowners to catch up on their payments or negotiate a solution before a McAllen Texas Home Equity Foreclosure Order is issued. However, it is essential for homeowners to act quickly once they fall behind, as each situation can vary based on lender policies. Engaging with a trusted platform like uslegalforms can provide valuable assistance in navigating these challenges and exploring potential solutions.

In Texas, a notice of default is a formal statement provided to homeowners when they fail to make their mortgage payments on time. This notice informs the homeowner that they are in default and outlines the necessary steps to rectify the situation to avoid a McAllen Texas Home Equity Foreclosure Order. Receiving a notice of default is a crucial step in the foreclosure process, signaling that the lender is prepared to take further action if the issue is not resolved promptly. Homeowners should take this notice seriously and seek guidance on their options to avoid foreclosure.

The timeframe for foreclosure in Texas generally ranges from a few months to over 120 days, depending on various factors, including the lender's actions and the type of foreclosure process. A McAllen Texas Home Equity Foreclosure Order can influence this timeline, so understanding the entire process is key. If you're navigating through these waters, consider using platforms like uslegalforms to find the necessary documentation and guidance.

The 120-day rule for foreclosure in Texas means that lenders must wait 120 days after a missed payment before completing a foreclosure sale. This waiting period is designed to give homeowners some time to remedy their financial situation. If you find yourself facing a McAllen Texas Home Equity Foreclosure Order, knowing this rule can help you take the necessary steps to potentially avoid foreclosure.

In Texas, foreclosure can occur through either a judicial process or a non-judicial process. Non-judicial foreclosure tends to be the more common route, where the lender can initiate foreclosure without going through the court system. If you're dealing with a McAllen Texas Home Equity Foreclosure Order, it is vital to explore these options and consult with a professional to determine the best course of action.

In Texas, you can miss one payment before facing potential foreclosure, but the situation may escalate quickly after that. Most lenders consider foreclosure options seriously after just one missed payment when it comes to a McAllen Texas Home Equity Foreclosure Order. Staying proactive is essential. If you are struggling, reach out to your lender or seek advice to avoid foreclosure.