Odessa Texas Home Equity Foreclosure Order refers to a legal proceeding that involves the forced sale of a property due to the homeowner's inability to pay their home equity loan. It is important to note that foreclosure laws and processes may differ from state to state, and the following information specifically relates to Odessa, Texas. When an individual takes out a home equity loan in Odessa, Texas, they are essentially borrowing against the equity they have built in their property. This type of loan is secured by a lien on the home and, in the event of default, the lender has the right to initiate foreclosure proceedings to recover the owed debt. There are different types of foreclosure orders relating to home equity in Odessa, Texas. The specifics may vary slightly depending on the circumstances, but two common types include: 1. Judicial Foreclosure: In this type of foreclosure order, the lender files a lawsuit against the homeowner to obtain a court order to sell the property. The process typically involves several steps, such as filing a complaint, serving the homeowner with a notice, and conducting a foreclosure auction. Once the property is sold, the proceeds are used to repay the outstanding loan balance. 2. Non-Judicial Foreclosure: Odessa, Texas also allows for non-judicial foreclosure, which typically follows a more streamlined process compared to judicial foreclosure. Non-judicial foreclosures do not require court involvement and are authorized by a power of sale clause in the loan agreement. In this case, the lender must follow a specific procedure outlined by Texas law, which includes providing the homeowner with a notice of intent to sell, publishing foreclosure notices, and conducting a public auction to sell the property. Homeowners facing home equity foreclosure order in Odessa, Texas should be aware of their legal rights and options. They may have the opportunity to cure the default by paying the outstanding balance or negotiate alternative solutions, such as loan modification or refinancing. Seeking professional guidance from foreclosure attorneys or housing counseling agencies can help borrowers navigate the complex process and explore potential alternatives to foreclosure. It is crucial to consult the relevant laws and regulations governing foreclosure in Odessa, Texas, as this information can evolve or change over time. Homeowners should also reach out to their lenders and legal professionals for specific advice and guidance tailored to their individual circumstances.

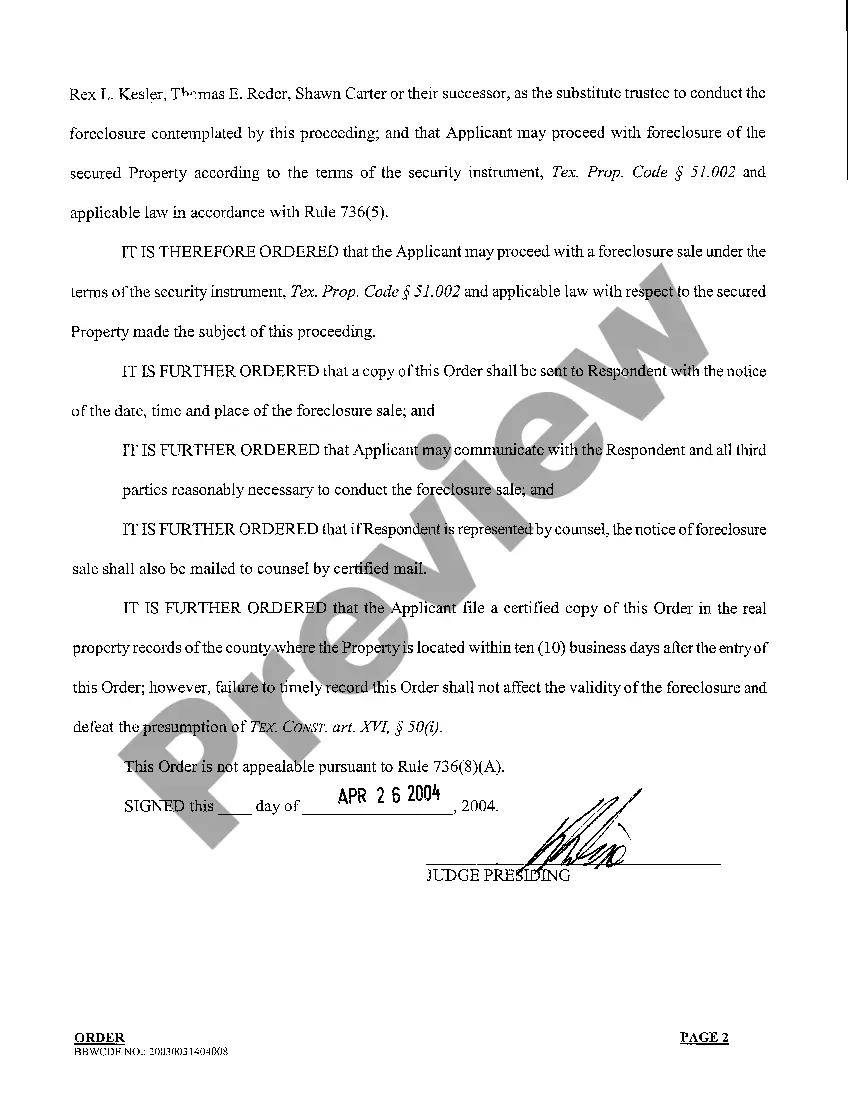

Odessa Texas Home Equity Foreclosure Order

Description

How to fill out Odessa Texas Home Equity Foreclosure Order?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Odessa Texas Home Equity Foreclosure Order or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Odessa Texas Home Equity Foreclosure Order complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Odessa Texas Home Equity Foreclosure Order would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!