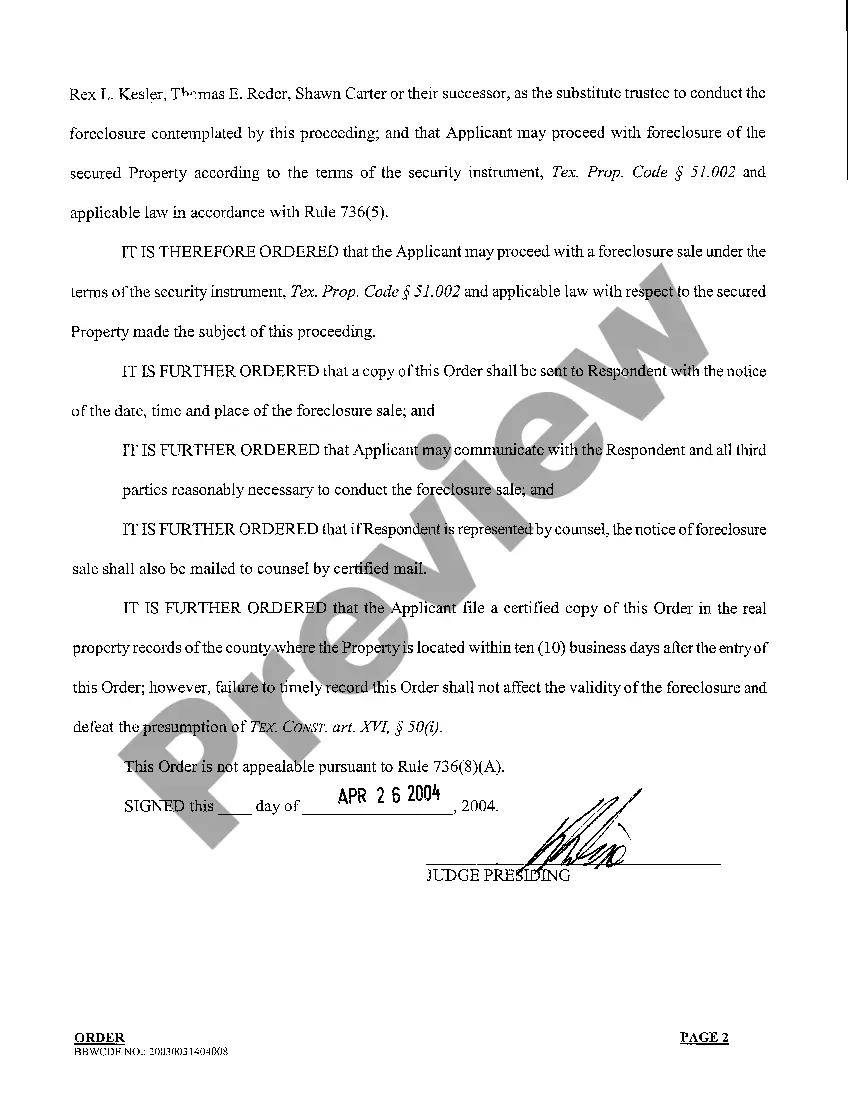

Plano Texas Home Equity Foreclosure Order refers to a legal process undertaken by lenders in the state of Texas to seize and sell a property in order to recover mortgage debts when homeowners default on their home equity loans. Home equity foreclosure orders are issued as a means to protect the rights of lenders and facilitate the retrieval of their financial investments. In Plano, Texas, several types of home equity foreclosure orders exist, each catering to specific circumstances and legal requirements. Some notable types include: 1. Judicial foreclosure: This type of foreclosure order involves a lawsuit initiated by the lender to obtain a court order for the foreclosure. A judge then reviews the case, and if the homeowner is found to be in default, a foreclosure sale is authorized. 2. Non-judicial foreclosure: Unlike judicial foreclosure, non-judicial foreclosure orders do not require court involvement. They are typically utilized when mortgage agreements contain a power of sale clause, allowing lenders to proceed with a foreclosure sale without court intervention. This type of foreclosure is often swifter and less expensive for lenders. 3. Homeowner's Association (HOA) foreclosure: In cases where homeowners fail to pay their HOA dues in Plano, Texas, Has may initiate a foreclosure process to recover unpaid fees. These foreclosure orders, specific to Has, authorize the sale of the property to satisfy the outstanding amounts owed to the association. In each of these Plano Texas Home Equity Foreclosure Order types, lenders follow a legal framework governed by Texas state laws. They must adhere to specific notification and publication requirements, allowing homeowners a chance to rectify the default before the foreclosure sale takes place. Plano homeowners facing the possibility of a home equity foreclosure order should seek legal advice and explore options to prevent or mitigate the consequences of foreclosure. These options may include loan modifications, repayment plans, or negotiating alternative solutions with their lenders.

Plano Texas Home Equity Foreclosure Order

Description

How to fill out Plano Texas Home Equity Foreclosure Order?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Plano Texas Home Equity Foreclosure Order gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Plano Texas Home Equity Foreclosure Order takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Plano Texas Home Equity Foreclosure Order. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!