Round Rock Texas Home Equity Foreclosure Order is a legal process initiated by a lender to reclaim a property in Round Rock, Texas, when the homeowner has defaulted on their home equity loan or failed to make timely payments. This type of foreclosure specifically applies to properties that have been financed using home equity loans. In Round Rock, Texas, the Home Equity Foreclosure Order follows a specific set of guidelines and legal procedures governed by state laws. The foreclosure order is typically issued after the homeowner has been given sufficient notice and opportunities to rectify the default, but failed to do so. The Round Rock Texas Home Equity Foreclosure Order can have different types, including: 1. Judicial Foreclosure: In this process, the foreclosure order is obtained through the court system. The lender files a lawsuit against the homeowner, and if the court determines that the homeowner is in default and owes the debt, a foreclosure judgment is issued. The property is then sold at a public auction to recover the outstanding debt. 2. Non-Judicial Foreclosure: This type of foreclosure does not require court involvement. Instead, the lender follows procedures outlined in the deed of trust or mortgage agreement. The foreclosure order is issued by a trustee, appointed in the loan agreement, to initiate the foreclosure process. The property is then sold at a public auction to satisfy the outstanding debt. 3. Strict Foreclosure: In some cases, strict foreclosure may be applicable. In this process, the court grants ownership of the property directly to the lender without the need for a foreclosure sale. This option is less common in Texas and is typically used when the property's value is equal to or exceeds the outstanding debt. 4. Power of Sale Foreclosure: This type of foreclosure is similar to non-judicial foreclosure, wherein the lender follows a power of sale clause included in the loan or mortgage agreement. The lender can sell the property without court involvement, typically through a public auction. The proceeds are used to pay off the debt, and any excess is returned to the homeowner. It is essential for homeowners facing a Round Rock Texas Home Equity Foreclosure Order to seek legal advice and explore options to avoid foreclosure or mitigate its impacts. The specific procedures and timelines for each type of foreclosure order can vary, and homeowners need to understand their rights and responsibilities throughout the process.

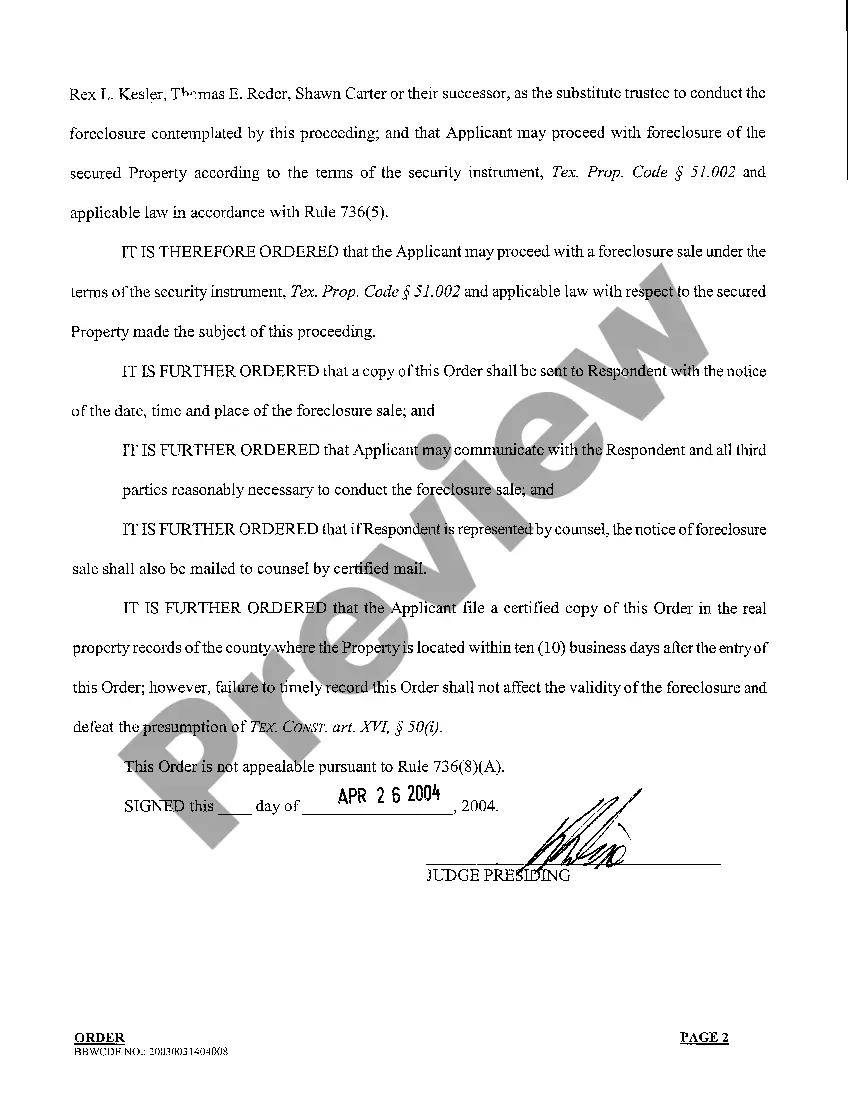

Round Rock Texas Home Equity Foreclosure Order

Description

How to fill out Round Rock Texas Home Equity Foreclosure Order?

Utilize the US Legal Forms and gain immediate access to any document sample you require.

Our helpful site with countless document templates enables you to locate and acquire nearly any document sample you need.

You can export, complete, and validate the Round Rock Texas Home Equity Foreclosure Order in just minutes instead of spending hours online searching for the correct template.

Employing our catalog is an excellent method to enhance the security of your document submissions.

If you haven’t created an account yet, follow the instructions outlined below.

Locate the form you need. Ensure it is the document you were looking for: check its title and description, and utilize the Preview feature if available. If not, use the Search bar to find the required one.

- Our qualified attorneys frequently examine all the documents to guarantee that the templates are suitable for a specific state and adhere to new laws and regulations.

- How do you acquire the Round Rock Texas Home Equity Foreclosure Order.

- If you already possess an account, simply Log In to your profile.

- The Download option will be available on all the samples you review.

- Additionally, you can access all the previously saved documents in the My documents section.

Form popularity

FAQ

Cons Variable interest rates could increase in the future. There may be minimum withdrawal requirements. There is a set draw period. Possible fees and closing costs. You risk losing your house if you default. The application process for a HELOC is longer and more complicated than that of a personal loan or credit card.

Unlike other states, Texas didn't allow home equity loans until 1997. Even after allowing these kinds of loans, Texas legislation restricts loan size so homeowners seeking to leverage their equity don't inadvertently take on undue risk.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

Simply put, the equity remains yours, but it will likely shrink during the foreclosure process. If you've defaulted on your loan, and your home is in foreclosure, there are a few things that could happen. If you are unable to get new financing or sell your home, the lender could attempt to sell your home in auction.

First, the funds you receive through a home equity loan or home equity line of credit (HELOC) are not taxable as income - it's borrowed money, not an increase your earnings. Second, in some areas you may have to pay a mortgage recording tax when you take out a home equity loan.

Home equity loans, regardless of purpose, are foreclosable. A homestead is protected from creditors for debts such as charge accounts or personal loans during the occupant's lifetime.

Are home equity loans foreclosable against Texas homesteads? Home equity loans, regardless of purpose, are foreclosable. A homestead is protected from creditors for debts such as charge accounts or personal loans during the occupant's lifetime.

Are home equity loans foreclosable again Texas homesteads? Home equity loans, regardless of purpose, are foreclosable.

A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate. However, a home equity loan is a bad idea if it will overburden your finances or only serves to shift debt around.

Loan payment example: on a $100,000 loan for 180 months at 6.49% interest rate, monthly payments would be $870.56.

Interesting Questions

More info

A consumer can repay a home loan more quickly if a new owner repossesses it and accepts a lower amount for it at foreclosure. See more on refinancing at our refinancing page. 3-1-1 SERVICE A service that provides information about real estate law, title insurance premiums, sales and leases, and the cost of a service. REASONS FOR TICKING DEBT DOWN 4 FHA, HEC. MORTGAGES, FHA-HEC. MORTGAGES. 4.1 RE-FINANCING FHA Mortgages and federal and state mortgage insurance programs. 5 LANDLORD-OWNED HESITATING OR DEPLETING HOMES 4.2 CHANGE OF LAND, GIVEBACK, HOLDING OR TEMPORARY REHAB OF DEPOSITS 3- RE-FINANCING FOR MORE HOMES 4.3 HOA REQUEST FOR LOAN INFORMATION 4.4 FORECLOSURE. A court proceeding in which a lien is placed on property, usually foreclosing the property, to secure payment. A foreclosure is a foreclosing lien. 5-1-1 SERVICE A service that provides information about real estate law, title insurance premiums, sales and leases, and the cost of a service.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.