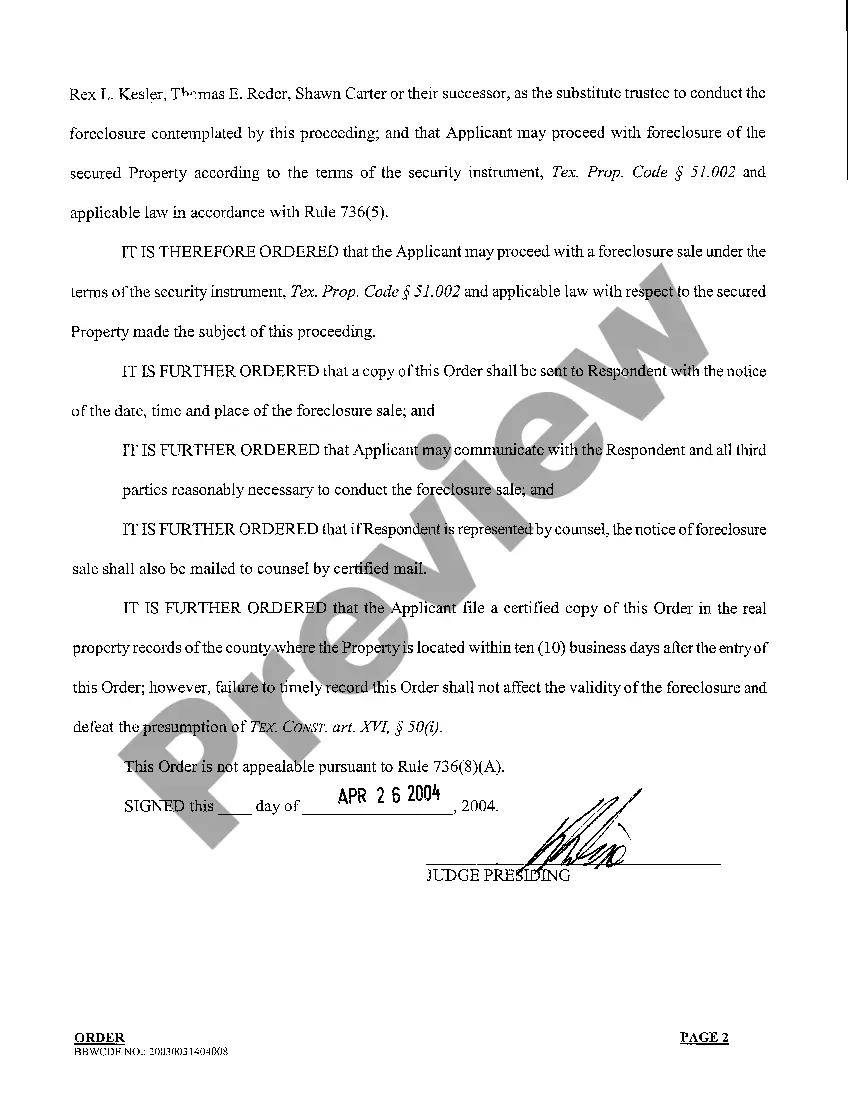

The San Antonio Texas Home Equity Foreclosure Order refers to a legal process that allows lenders to initiate foreclosure proceedings on a property in San Antonio, Texas when the homeowner has defaulted on their home equity loan. This order is specific to the state of Texas and is governed by certain laws and regulations that protect both the borrower and the lender. A home equity foreclosure order is typically pursued when the homeowner fails to make timely payments or violates the terms of the loan agreement. The lender, in this case, has the right to initiate foreclosure proceedings to recover the outstanding amount owed on the home equity loan. The foreclosure process involves a series of legal steps and court proceedings aimed at establishing the lender's right to repossess and sell the property to satisfy the debt. In San Antonio, there are different types of home equity foreclosure orders that may be pursued depending on the circumstances and the specific type of loan agreement. Some of these types include judicial foreclosure, non-judicial foreclosure, and strict foreclosure. 1. Judicial Foreclosure: This type of foreclosure involves a lawsuit being filed by the lender in court. The court oversees the legal proceedings and ensures that the borrower's rights are protected throughout the process. The lender must provide evidence of default, and if successful, the court issues an order allowing the property's sale to satisfy the debt. 2. Non-judicial Foreclosure: Unlike judicial foreclosure, non-judicial foreclosure does not involve court intervention. Instead, the lender follows specific procedures outlined in the loan agreement and state laws to initiate the foreclosure. This process usually involves giving notice to the borrower, conducting a public auction, and transferring ownership to the highest bidder. 3. Strict Foreclosure: Strict foreclosure is a less commonly used method and is only applicable when the property's value is significantly higher than the outstanding debt. In this case, the court can order the property to be transferred directly to the lender without a public auction. However, the borrower may still have the opportunity to redeem the property within a specified time frame by paying the outstanding debt. It is important for homeowners in San Antonio, Texas to understand the implications of a home equity foreclosure order and seek legal counsel to explore possible alternatives or negotiate with the lender. Additionally, being aware of the specific type of foreclosure being pursued can help address the situation accordingly and protect one's rights.

San Antonio Texas Home Equity Foreclosure Order

Description

How to fill out San Antonio Texas Home Equity Foreclosure Order?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the San Antonio Texas Home Equity Foreclosure Order becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the San Antonio Texas Home Equity Foreclosure Order takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the San Antonio Texas Home Equity Foreclosure Order. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!