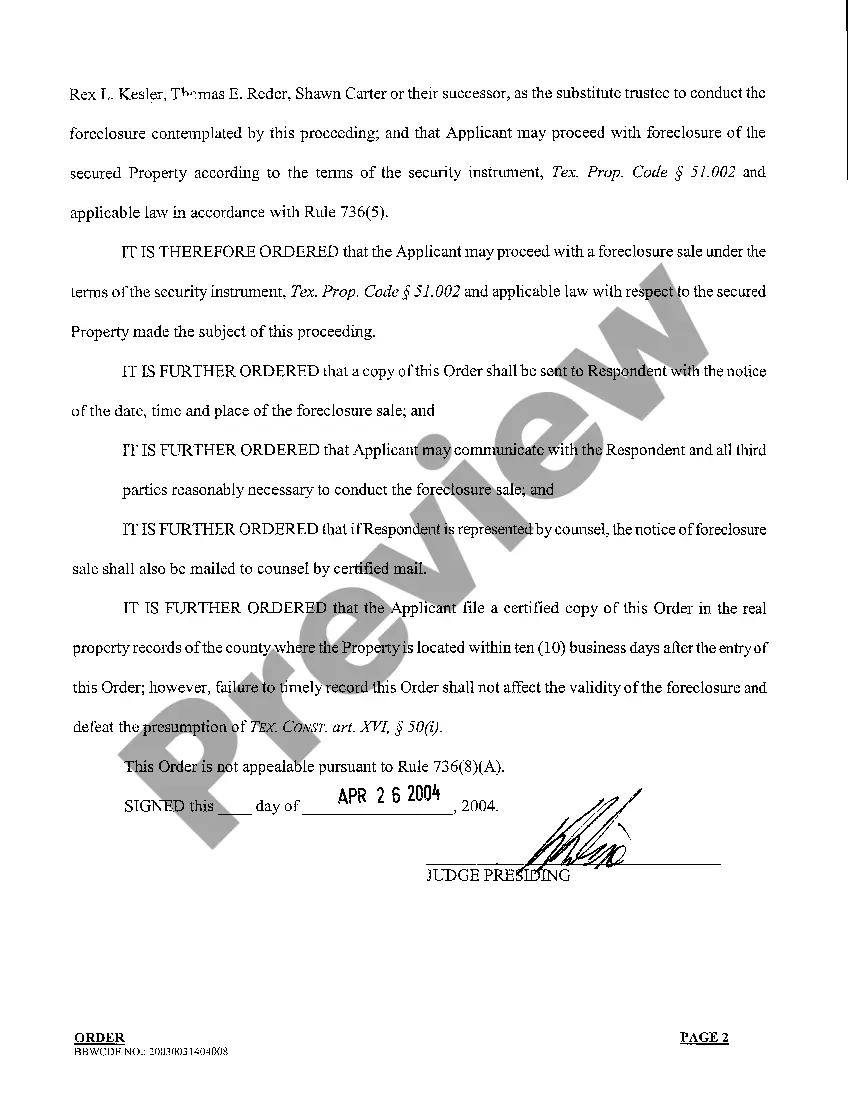

A Waco Texas Home Equity Foreclosure Order refers to a legal process through which a lender attempts to recover their outstanding debt by forcing the sale of a property on which a homeowner has defaulted on their home equity loan. This order allows the lender to foreclose on the property and sell it at auction to recoup their losses. The Waco Texas Home Equity Foreclosure Order follows a specific set of procedures outlined by the state laws. These laws protect both the lender's interests and the rights of the homeowner. It is crucial for homeowners to understand the foreclosure process to navigate it effectively. Different types of Waco Texas Home Equity Foreclosure Orders include: 1. Judicial Foreclosure: This is the most common type of foreclosure process. It involves the lender filing a lawsuit against the homeowner to obtain a court order authorizing the foreclosure. The court oversees the entire process, ensuring that both parties receive fair treatment. 2. Non-Judicial Foreclosure: In some cases, home equity foreclosure may proceed without involving the court system. Non-judicial foreclosures usually occur when the mortgage or deed of trust includes a "power of sale" clause, giving the lender the right to auction the property if the homeowner defaults. However, specific legal requirements must still be met. 3. Notice of Default: Before a foreclosure order is sought, the lender typically sends the homeowner a notice of default. This document alerts the homeowner of their delinquency and gives them the opportunity to cure the default within a specified timeframe. If the homeowner fails to remedy the default, the foreclosure process can proceed. 4. Notice of Sale: If the foreclosure process moves forward, the lender must issue a notice of sale. This notice informs the homeowner and the public of the scheduled auction date and location. The sale is typically set for public auction, where interested parties can bid on the property. Homeowners facing a Waco Texas Home Equity Foreclosure Order should act promptly to assess their options. They can seek legal advice, explore loan modification programs, negotiate repayment plans, or consider selling the property to satisfy the debt and prevent foreclosure. Understanding the foreclosure process and potential alternatives is crucial for homeowners in Waco, Texas, to protect their interests and find the most favorable resolution.

Waco Texas Home Equity Foreclosure Order

Description

How to fill out Waco Texas Home Equity Foreclosure Order?

If you are looking for a valid form, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most comprehensive online libraries. With this library, you can get a large number of form samples for company and individual purposes by categories and regions, or keywords. With the advanced search feature, finding the latest Waco Texas Home Equity Foreclosure Order is as easy as 1-2-3. In addition, the relevance of each and every file is confirmed by a team of professional lawyers that on a regular basis check the templates on our website and revise them based on the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Waco Texas Home Equity Foreclosure Order is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the sample you want. Look at its explanation and utilize the Preview feature to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the needed record.

- Affirm your choice. Choose the Buy now button. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Waco Texas Home Equity Foreclosure Order.

Each template you save in your user profile has no expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to get an extra duplicate for modifying or printing, feel free to come back and save it once again at any moment.

Make use of the US Legal Forms extensive catalogue to gain access to the Waco Texas Home Equity Foreclosure Order you were looking for and a large number of other professional and state-specific templates on one website!