A Home Equity Foreclosure Order is a legal action initiated by a lender in Wichita Falls, Texas to secure payment of a debt owed by a borrower. This order is typically pursued when a homeowner fails to make the required payments on a home equity loan or line of credit secured by their property. Wichita Falls, Texas, like all of Texas, has specific laws governing home equity foreclosures. Article 16, Section 50 of the Texas Constitution outlines certain provisions to protect homeowners from predatory lending practices and ensure fair treatment during the foreclosure process. Wichita Falls Texas Home Equity Foreclosure Order may involve various types, including: 1. Judicial Home Equity Foreclosure Order: In this type of foreclosure, the lender files a lawsuit against the homeowner in court. A judge reviews the evidence, confirms the default on the home equity loan, and issues a Home Equity Foreclosure Order. This order grants legal authority to the lender to proceed with the foreclosure process. 2. Non-Judicial Home Equity Foreclosure Order: This type of foreclosure does not involve court intervention. Instead, it follows a specific process outlined in the home equity loan agreement and Texas law. The lender sends a Notice of Default and Intent to Accelerate to the borrower, which provides a certain period for the borrower to cure the default. If the borrower fails to do so, the lender may proceed with sending a Notice of Sale and eventually obtain a Home Equity Foreclosure Order to initiate the sale of the property. 3. Home Equity Foreclosure Auction: Once a Home Equity Foreclosure Order is obtained, either through judicial or non-judicial means, the lender can proceed with an auction of the foreclosed property. The property is typically sold to the highest bidder at a public auction, with the proceeds being used to pay off the outstanding debt. 4. Home Equity Foreclosure Redemption: In some cases, Texas law allows homeowners to redeem their foreclosed property even after a Home Equity Foreclosure Order has been issued. This means the homeowner can reclaim the property by paying the outstanding debt, interest, and associated fees in full within a specified period after the foreclosure sale. Facing a Home Equity Foreclosure Order in Wichita Falls, Texas can be a distressing experience for homeowners. It is essential for borrowers to understand their rights and options when dealing with foreclosure proceedings. Seeking legal advice from a qualified attorney who specializes in real estate and foreclosure law can provide individuals with guidance and potential strategies to avoid or mitigate the impact of foreclosure.

Wichita Falls Texas Home Equity Foreclosure Order

State:

Texas

City:

Wichita Falls

Control #:

TX-CC-07-04

Format:

PDF

Instant download

This form is available by subscription

Description

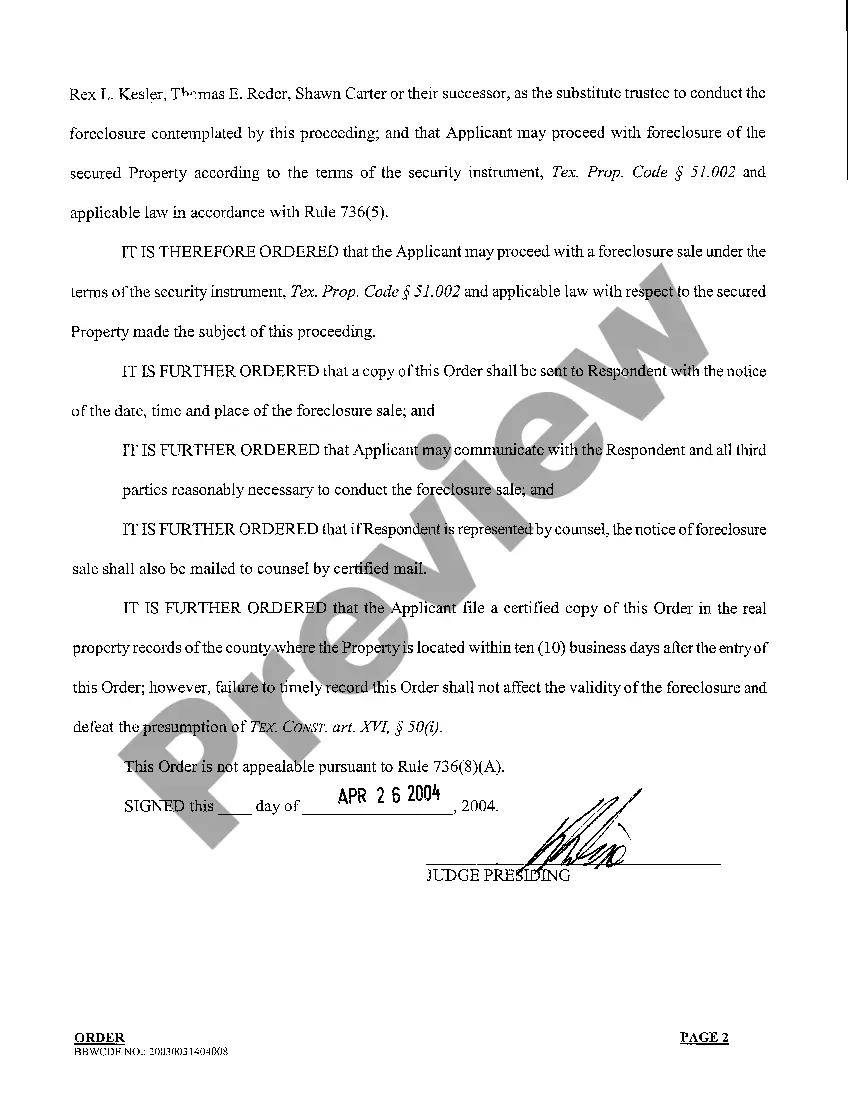

A04 Home Equity Foreclosure Order

A Home Equity Foreclosure Order is a legal action initiated by a lender in Wichita Falls, Texas to secure payment of a debt owed by a borrower. This order is typically pursued when a homeowner fails to make the required payments on a home equity loan or line of credit secured by their property. Wichita Falls, Texas, like all of Texas, has specific laws governing home equity foreclosures. Article 16, Section 50 of the Texas Constitution outlines certain provisions to protect homeowners from predatory lending practices and ensure fair treatment during the foreclosure process. Wichita Falls Texas Home Equity Foreclosure Order may involve various types, including: 1. Judicial Home Equity Foreclosure Order: In this type of foreclosure, the lender files a lawsuit against the homeowner in court. A judge reviews the evidence, confirms the default on the home equity loan, and issues a Home Equity Foreclosure Order. This order grants legal authority to the lender to proceed with the foreclosure process. 2. Non-Judicial Home Equity Foreclosure Order: This type of foreclosure does not involve court intervention. Instead, it follows a specific process outlined in the home equity loan agreement and Texas law. The lender sends a Notice of Default and Intent to Accelerate to the borrower, which provides a certain period for the borrower to cure the default. If the borrower fails to do so, the lender may proceed with sending a Notice of Sale and eventually obtain a Home Equity Foreclosure Order to initiate the sale of the property. 3. Home Equity Foreclosure Auction: Once a Home Equity Foreclosure Order is obtained, either through judicial or non-judicial means, the lender can proceed with an auction of the foreclosed property. The property is typically sold to the highest bidder at a public auction, with the proceeds being used to pay off the outstanding debt. 4. Home Equity Foreclosure Redemption: In some cases, Texas law allows homeowners to redeem their foreclosed property even after a Home Equity Foreclosure Order has been issued. This means the homeowner can reclaim the property by paying the outstanding debt, interest, and associated fees in full within a specified period after the foreclosure sale. Facing a Home Equity Foreclosure Order in Wichita Falls, Texas can be a distressing experience for homeowners. It is essential for borrowers to understand their rights and options when dealing with foreclosure proceedings. Seeking legal advice from a qualified attorney who specializes in real estate and foreclosure law can provide individuals with guidance and potential strategies to avoid or mitigate the impact of foreclosure.

Free preview

How to fill out Wichita Falls Texas Home Equity Foreclosure Order?

If you’ve already utilized our service before, log in to your account and download the Wichita Falls Texas Home Equity Foreclosure Order on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Wichita Falls Texas Home Equity Foreclosure Order. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!