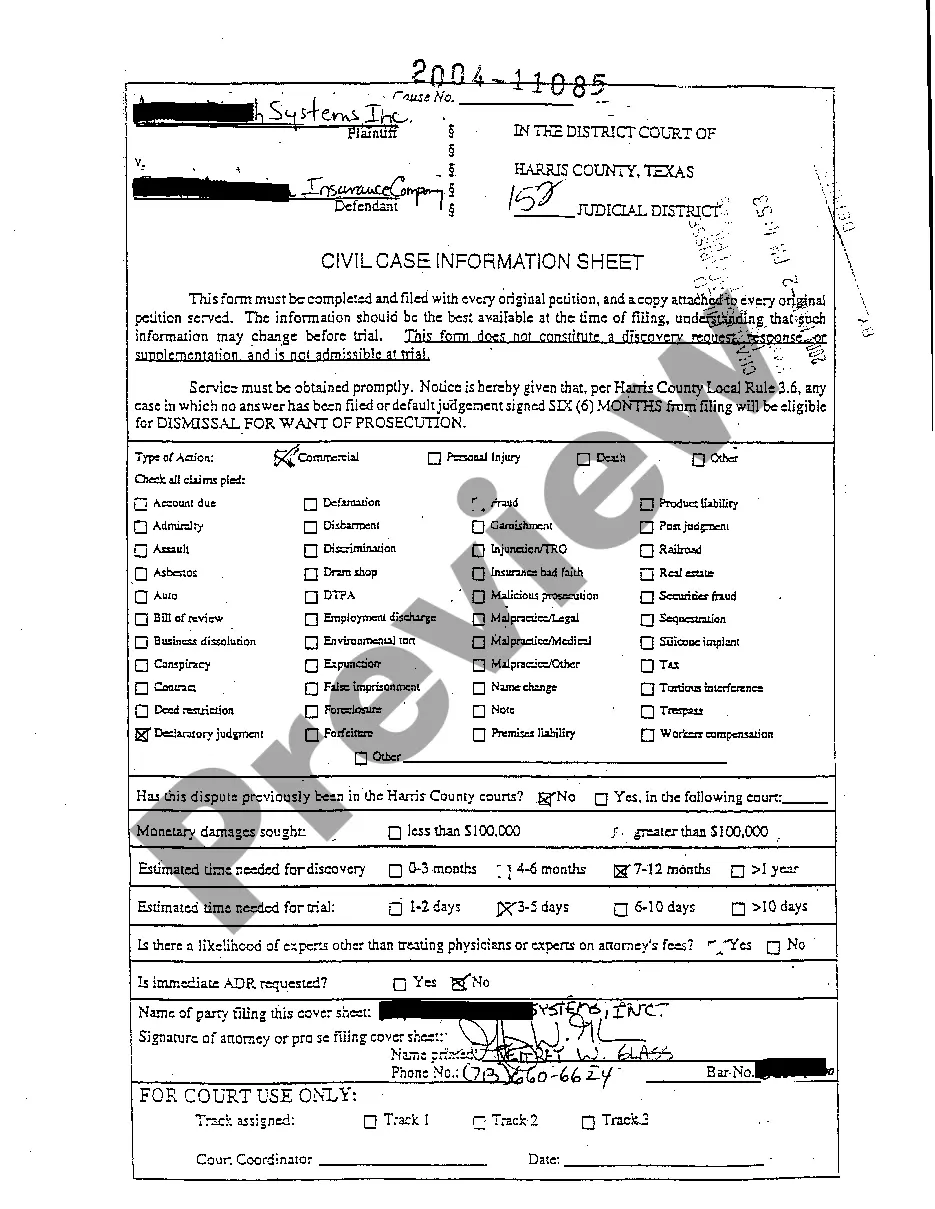

McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage is a legal document that clarifies the rights and obligations of the parties involved in an insurance dispute in McAllen, Texas. This petition is usually filed by a plaintiff seeking a resolution regarding insurance coverage issues or disputes. In this petition, the plaintiff outlines the details of the insurance policy in question, including policy terms, coverage limits, and relevant endorsements. The plaintiff provides a comprehensive account of the events leading to the dispute and explains how they believe the insurance coverage applies to their specific claim. Keywords: McAllen Texas, Plaintiff's Original Petition, Declaratory Judgment, Insurance Coverage, Insurance Dispute, Rights and Obligations, Policy Terms, Coverage Limits, Endorsements, Claim. Different types of McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage may include: 1. Personal Injury Coverage: This type of case involves a plaintiff seeking clarification on the insurance coverage available for personal injury claims caused by an accident or negligence. The plaintiff may be seeking coverage for medical expenses, lost wages, pain and suffering, and other related damages. 2. Property Damage Coverage: Here, a plaintiff files a petition to determine the insurance coverage regarding property damage caused by events such as natural disasters, accidents, or vandalism. This may involve claims for repairs, replacement costs, or reimbursement for damaged property. 3. Professional Liability Coverage: This involves disputes related to insurance coverage for professionals, such as doctors, lawyers, or architects, who may be facing claims of professional negligence. The plaintiff seeks clarification on the coverage available under their professional liability insurance policy for legal defense costs, settlements, or damages awarded. 4. Business Interruption Coverage: In this type of petition, a business owner files a claim seeking coverage for losses suffered due to interruptions in their normal business operations caused by events like fires, natural disasters, or other unforeseen circumstances. The plaintiff may seek compensation for lost revenue, ongoing operating expenses, and potential business interruption damages. 5. Product Liability Coverage: This petition deals with insurance coverage disputes related to claims arising from defective products causing bodily injury or property damage. The plaintiff may seek a declaratory judgment to determine the extent of coverage available for legal costs, settlements, or damages resulting from the product liability claim. Overall, McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage encompasses various types of disputes, each focusing on different aspects of insurance coverage and its application to specific circumstances.

McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage

Description

How to fill out McAllen Texas Plaintiff's Original Petition For Declaratory Judgment Regarding Insurance Coverage?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our useful platform with a large number of document templates simplifies the way to find and get almost any document sample you require. It is possible to save, complete, and sign the McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage in just a couple of minutes instead of surfing the Net for hours attempting to find a proper template.

Using our catalog is a wonderful way to increase the safety of your document submissions. Our experienced lawyers regularly check all the documents to ensure that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Open the page with the form you require. Make sure that it is the form you were hoping to find: verify its title and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Save the file. Indicate the format to get the McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the web. Our company is always ready to help you in any legal case, even if it is just downloading the McAllen Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!