Title: Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage: Explained Introduction: In Round Rock, Texas, a Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage serves as a legal document filed by an individual or entity seeking a resolution regarding an unresolved insurance coverage dispute. This petition aims to obtain a court's declaration on the interpretation of coverage within an insurance policy. Below, we will delve into the elements and potential types of such petitions, employing relevant keywords to enhance the description. Keywords: Round Rock Texas, Plaintiff's Original Petition, Declaratory Judgment, Insurance Coverage, insurance policy, dispute resolution, interpretation. Content: 1. Purpose: Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage is filed with the intent of clarifying disputed matters concerning insurance coverage. This petition is used when parties involved have differing interpretations or disagreements regarding specific policy provisions, coverage limits, exclusions, or other related terms. 2. Parties Involved: The plaintiff, also referred to as the insured party, files the petition against the defendant, typically an insurance company. The defendant holds the insurance policy in question, and the plaintiff seeks the court's intervention to resolve the coverage dispute. 3. Filing the Petition: The plaintiff's attorney prepares the Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment, which includes key details such as the names and addresses of the parties involved, a description of the insurance policy, and a statement outlining the specific coverage issue or dispute. This document is filed in the appropriate Texas court, initiating the legal process. 4. Types of Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage: a) Coverage Disputes: This type of petition typically arises when the insurance company refuses to provide coverage for a claim, asserting that it falls within policy exclusions or limitations. The plaintiff may challenge this denial, seeking a declaration from the court stating the claim should be covered by the policy. b) Policy Interpretation: In cases where the language or interpretation of policy provisions is in contention, the plaintiff may file a petition to ascertain the correct understanding of the insurance policy terms, hoping to determine coverage obligations more definitively. c) Breach of Contract: When the plaintiff believes the insurance company has breached its contractual obligations, such as by failing to pay valid claims or acting in bad faith, they can initiate a declaratory judgment petition to establish the contractual violations and the associated coverage rights under the policy. 5. The Legal Process: Upon filing the petition, the court will review the case to ensure all necessary information is included. The defendant, the insurance company, is served with a copy of the petition and is afforded a specific timeframe to respond, typically within 21 days. Subsequently, both parties engage in a process of discovery, gathering evidence, and sharing relevant information to support their respective positions. The court then reviews the evidence presented and makes a declaratory judgment, providing a binding resolution to the coverage dispute. Conclusion: Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage serves as a vital legal tool for individuals or entities seeking clarity and resolution in insurance coverage disputes. This petition enables the court to review policy terms, interpret coverage, and ultimately provide an authoritative declaration that determines the rights and responsibilities of the parties involved. By filing this petition, plaintiffs aim to secure the coverage they believe is rightfully due under their insurance policies in Round Rock and beyond.

Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage

Description

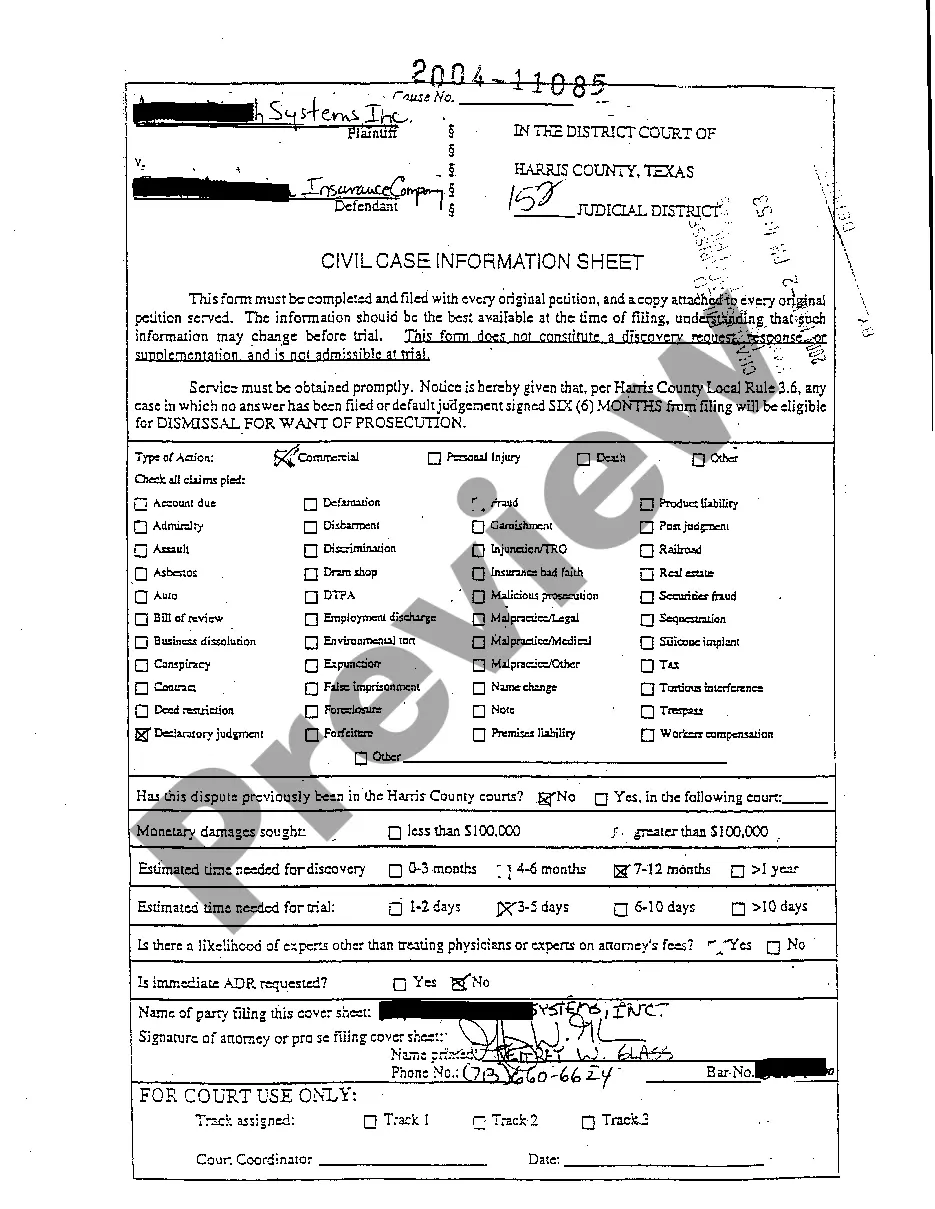

How to fill out Round Rock Texas Plaintiff's Original Petition For Declaratory Judgment Regarding Insurance Coverage?

If you have previously employed our service, sign in to your account and download the Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment concerning Insurance Coverage onto your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have constant access to every document you have acquired: they can be found in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to quickly find and store any template for your personal or corporate requirements!

- Confirm you’ve found an appropriate document. Browse the description and utilize the Preview option, if available, to determine if it satisfies your requirements. If it does not suit you, use the Search tab above to locate the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Receive your Round Rock Texas Plaintiff's Original Petition for Declaratory Judgment regarding Insurance Coverage. Choose the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

The Uniform Declaratory Judgments Act (UDJA) authorizes courts to adjudicate actual controversies concerning legal rights and duties even though traditional remedies for damages or equitable relief are not available.

Whilst an executory judgment is capable of immediate execution, a declaratory judgment gives no such right. It merely declares the rights of the parties. The rights which it confers on the plaintiff can only become enforceable if another and subsequent judgment, albeit relying on the rights it declared, so decrees.

Another common cause of action under Texas law in commercial litigation is declaratory judgment. A declaratory judgment is where one party is asking the court to determine the rights of the parties under the agreements that they had or under the arrangements that they had.

V. Mirowski Family Ventures, LLC, 571 U.S. (2014), ruling unanimously that a patentee defendant bears the burden of proving infringement in a declaratory judgment action.

A judgment from a court that defines the rights of the parties regarding the legal question presented. Declaratory judgments differ from other judgments because they do not order a party to take any action or award any damages for violations of the law.

Under Chapter 37 of the Texas Civil Practice and Remedies Code, a party is entitled to seek a declaratory judgment from a Texas state court to ?settle and afford relief from uncertainty and insecurity with respect to rights, status, and other legal relations.? Tex.

Since there is no limitations period specifically addressed to the declaratory judgment action, it generally falls under the ?catch-all? provision of CPLR 2131 and gets six years as ?an action for which no limitation is specifically prescribed by law.? That being the case, you assume1 your declaratory judgment cause