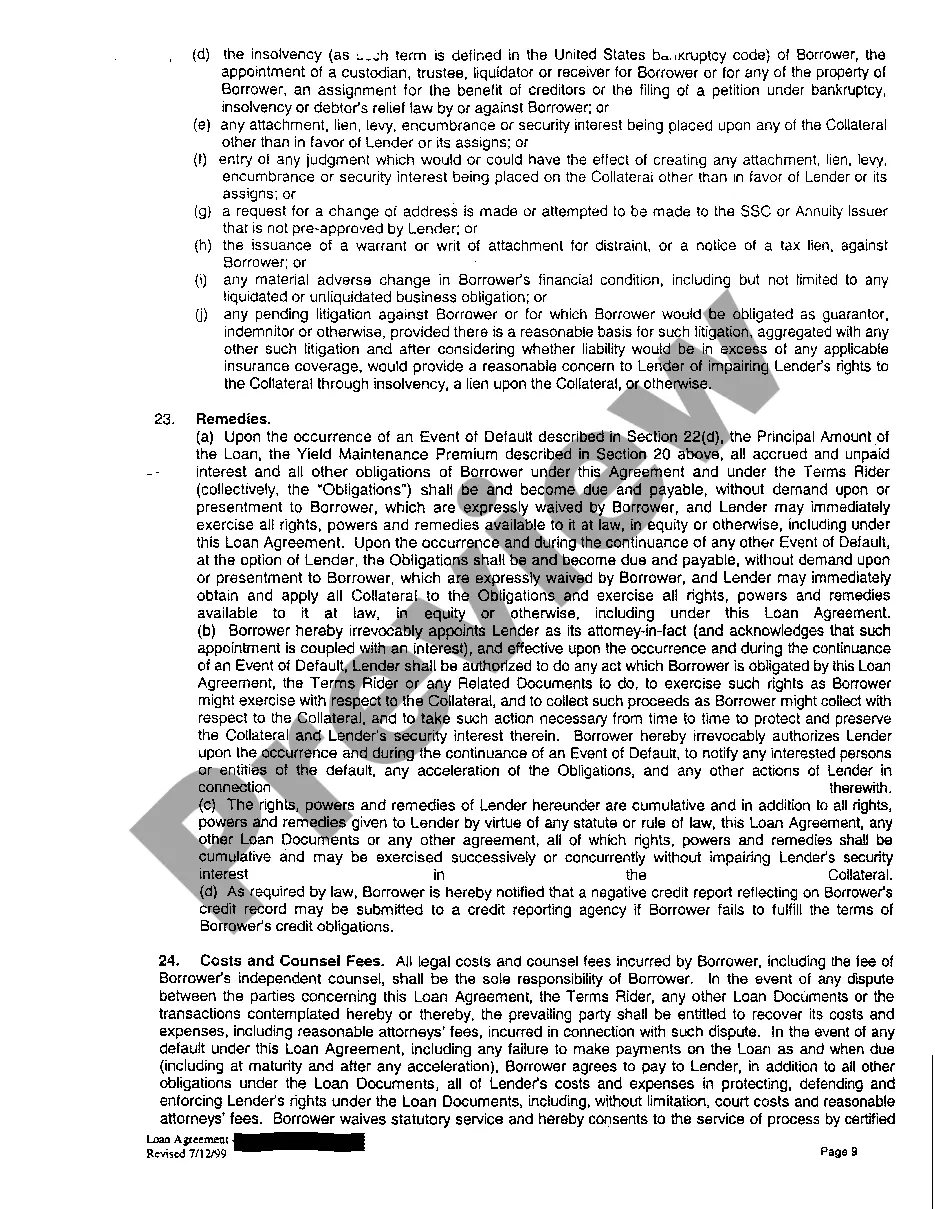

Beaumont Texas Loan Application and Personal Loan Agreement — A Comprehensive Overview Introduction: Beaumont, Texas offers various loan options to individuals who may need financial assistance. The Beaumont Texas Loan Application and Personal Loan Agreement are two crucial documents that help individuals secure loans for various purposes. Understanding the loan application process, different types of loans available, and the components of a personal loan agreement is essential when seeking financial assistance in Beaumont, Texas. Loan Application Process: The Beaumont Texas Loan Application is the first step in obtaining a loan. This application is the starting point for individuals to express their interest in borrowing money from reputable financial institutions or lenders in Beaumont, Texas. The loan application typically requires the applicant to provide personal, financial, and employment details. This information is used by lenders to assess the borrower's creditworthiness, repayment capacity, and overall financial situation. By carefully completing the application, borrowers increase their chances of securing a loan. Types of Beaumont Texas Loans: 1. Personal Loans: Personal loans in Beaumont, Texas are a versatile financial solution that allows borrowers to access a lump sum of money. These loans can be used for various purposes, such as debt consolidation, home improvement projects, medical expenses, or unexpected financial emergencies. Personal loans usually have fixed interest rates and require the borrower to repay the loan in fixed installments over a specific period. 2. Auto Loans: Beaumont, Texas offers auto loans to individuals planning to purchase a new or used vehicle. These loans provide financial assistance to borrowers, allowing them to pay for their desired vehicle and repay the loan in monthly installments. Auto loans typically have different repayment terms, interest rates, and down payment requirements based on the borrower's creditworthiness and the chosen vehicle. 3. Mortgage Loans: Beaumont, Texas also provides mortgage loans to individuals wanting to purchase or refinance a home. Mortgage loans enable borrowers to finance a significant portion of their home's purchase price or remaining mortgage balance. These loans often have long repayment terms, competitive interest rates, and may require a down payment. Mortgage loans in Beaumont, Texas can be obtained from banks, credit unions, or specialized mortgage lenders. Components of a Personal Loan Agreement: Once the loan application is approved, borrowers are usually required to sign a Personal Loan Agreement. This agreement is a legal contract between the borrower and the lender, outlining the terms and conditions of the loan. Key components found in a Personal Loan Agreement include: 1. Loan Amount: The specific amount of money borrowed by the borrower. 2. Interest Rate: The annual interest rate at which the borrower agrees to repay the loan. 3. Repayment Terms: The agreed-upon schedule for repaying the loan, including the duration and frequency of installments. 4. Late Payment Penalties: The additional charges incurred by the borrower in case of late loan repayments. 5. Prepayment Penalties: Any charges or fees imposed on the borrower for paying off the loan early. 6. Collateral: If applicable, details of any asset or property that the borrower pledges as security against the loan. Conclusion: Beaumont, Texas Loan Application and Personal Loan Agreements are crucial elements in the loan acquisition process. By understanding the different types of loans available and the key components of a Personal Loan Agreement, individuals can make informed decisions when seeking financial assistance in Beaumont, Texas. Remember to research thoroughly, compare loan options, and ensure complete comprehension before signing any loan agreement.

Beaumont Texas Loan Application and Personal Loan Agreement

Description

How to fill out Texas Loan Application And Personal Loan Agreement?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our helpful platform with a vast array of documents streamlines the process of locating and acquiring nearly any document template you require.

You can store, complete, and sign the Beaumont Texas Loan Application and Personal Loan Agreement within minutes instead of spending hours on the internet searching for a suitable template.

Using our collection enhances the security of your record filing.

If you have not yet created an account, follow the steps below.

Locate the form you seek. Ensure that it is the form you desire: check its title and description, and utilize the Preview function when available. Otherwise, use the Search bar to find the correct one.

- Our expert attorneys consistently review all records to guarantee that the templates are suitable for a specific state and adhere to up-to-date laws and regulations.

- How can you obtain the Beaumont Texas Loan Application and Personal Loan Agreement.

- If you possess a subscription, simply Log In to your account.

- The Download feature will show for all documents you review.

- Furthermore, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

Does a personal loan agreement need to be notarized? No, a personal loan agreement does not need to be notarized to be legally binding ? it simply needs to be signed by each party to the agreement.

Personal loan documents your lender may require Loan application. Each lender will have an application to initiate the loan process, and this application can look different from lender to lender.Proof of identity.Employer and income verification.Proof of address.Credit score.Loan purpose.Monthly expenses.Learn more:

In the most sensitive cases, you should notarize your promissory note and any amended versions. This gives your document added authenticity and legal protection. If a borrower defaults or fails to pay, and you need to go to court, a notary signature could do you a solid in the long run.

How to sign a loan agreement online Load the loan agreement template.Fill in the lender and borrower information.Specify the loan amount and the date of the loan.Specify the loan delivery method.Fill in the details of the loan repayment schedule and regular payment options.

There are no legal differences between typed and handwritten agreements when it comes to enforceability. When most people think of a contract, a formally typed, the professional contract usually comes to mind. Nonetheless, a handwritten contract can be as valid as one that's typed.

Documents required Identity proof (copy of passport/voter ID card/driving license/Aadhaar) Address proof (copy of passport/voter ID card/driving license/Aadhaar) Bank statement of previous 3 months (Passbook of previous 6 months) Two latest salary slip/current dated salary certificate with the latest Form 16.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

1. Income documentation Tax returns. For starters, most mortgage lenders want to see your last two years' tax returns.W-2s or 1099s.Pay stubs.Other income documentation.Bank statements.Investment account statements.Gift letters.Other assets.

Typical personal loan documentation requirements Proof of your identity. First and foremost, you have to prove to lenders that you are who you say you are.Proof of address.Proof of income.Recurring monthly expenses.Your credit score.Your purpose for the personal loan.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.