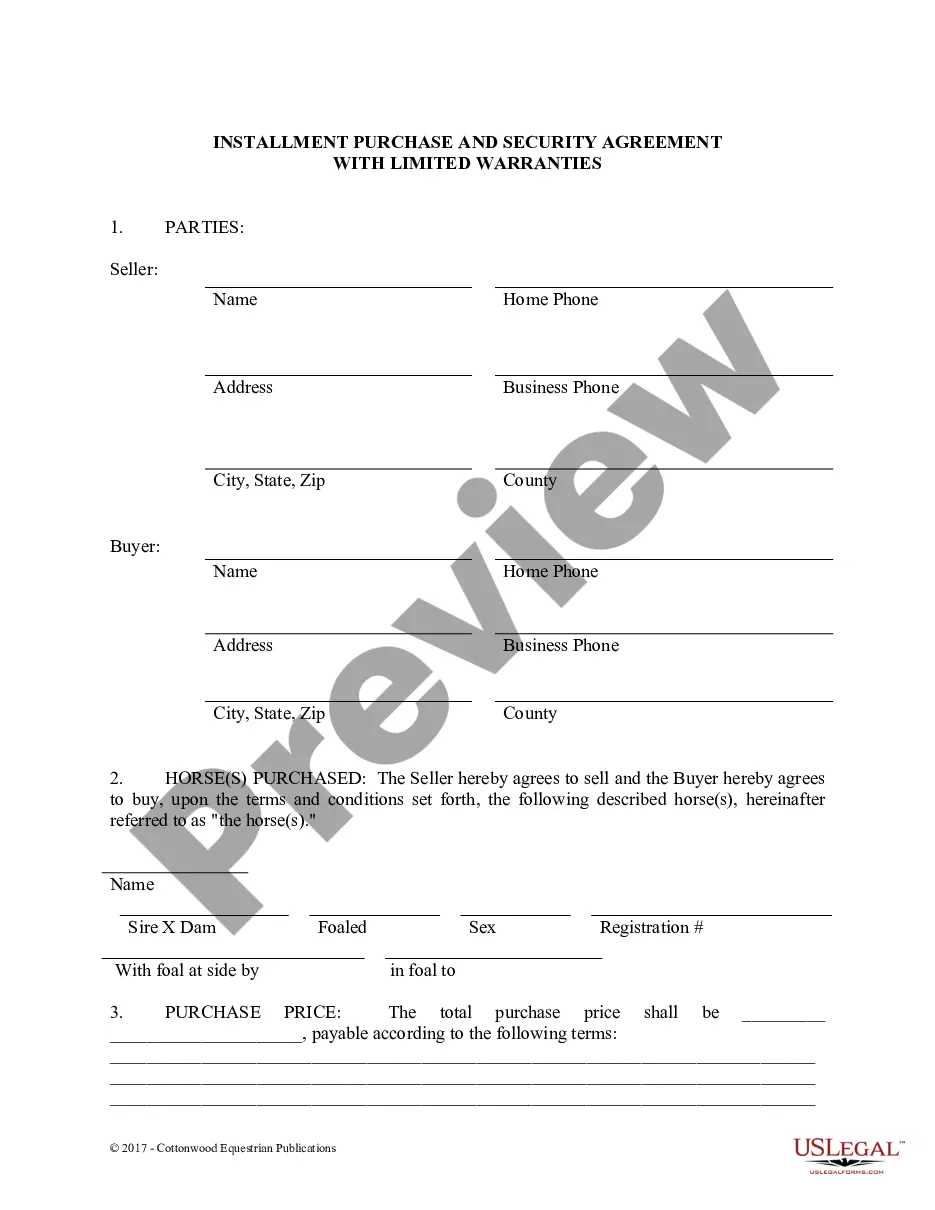

The Fort Worth Texas Loan Application and Personal Loan Agreement refer to the necessary documents and legal agreements involved in applying for a loan in Fort Worth, Texas. These documents outline the terms and conditions of the loan and provide a clear understanding of the rights and obligations of both the borrower and the lender. The Loan Application is the initial step in obtaining a loan and typically requires the borrower to provide personal and financial information. This may include details such as their name, contact information, employment history, income, assets, liabilities, and credit history. The application serves as a comprehensive evaluation tool for the lender to assess the borrower's creditworthiness and determine their eligibility for a loan. On the other hand, the Personal Loan Agreement is a legally binding contract between the borrower and the lender. It sets out the specific terms and conditions governing the loan, including the loan amount, interest rate, repayment schedule, and any associated fees or charges. The agreement establishes the rights and responsibilities of both parties throughout the loan repayment period. In Fort Worth, Texas, there may be different types of Loan Applications and Personal Loan Agreements available, depending on the specific loan products or financial institutions involved. Some common loan types could include personal loans, mortgages, auto loans, student loans, or business loans. Each loan type may have its own set of application requirements and agreement terms, tailored to the specific purpose of the loan. To ensure compliance with local and state regulations, it is essential to carefully review and accurately complete the Fort Worth Texas Loan Application and Personal Loan Agreement, providing honest and up-to-date information. Additionally, borrowers should thoroughly understand the terms outlined in the agreement to make informed decisions and avoid any potential legal or financial consequences.

Fort Worth Texas Loan Application and Personal Loan Agreement

Description

How to fill out Fort Worth Texas Loan Application And Personal Loan Agreement?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no legal education to create such papers from scratch, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform provides a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Fort Worth Texas Loan Application and Personal Loan Agreement or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Fort Worth Texas Loan Application and Personal Loan Agreement quickly employing our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Fort Worth Texas Loan Application and Personal Loan Agreement:

- Ensure the form you have chosen is suitable for your location because the rules of one state or area do not work for another state or area.

- Preview the document and read a brief outline (if available) of scenarios the document can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and look for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Fort Worth Texas Loan Application and Personal Loan Agreement once the payment is completed.

You’re good to go! Now you can proceed to print out the document or complete it online. In case you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.