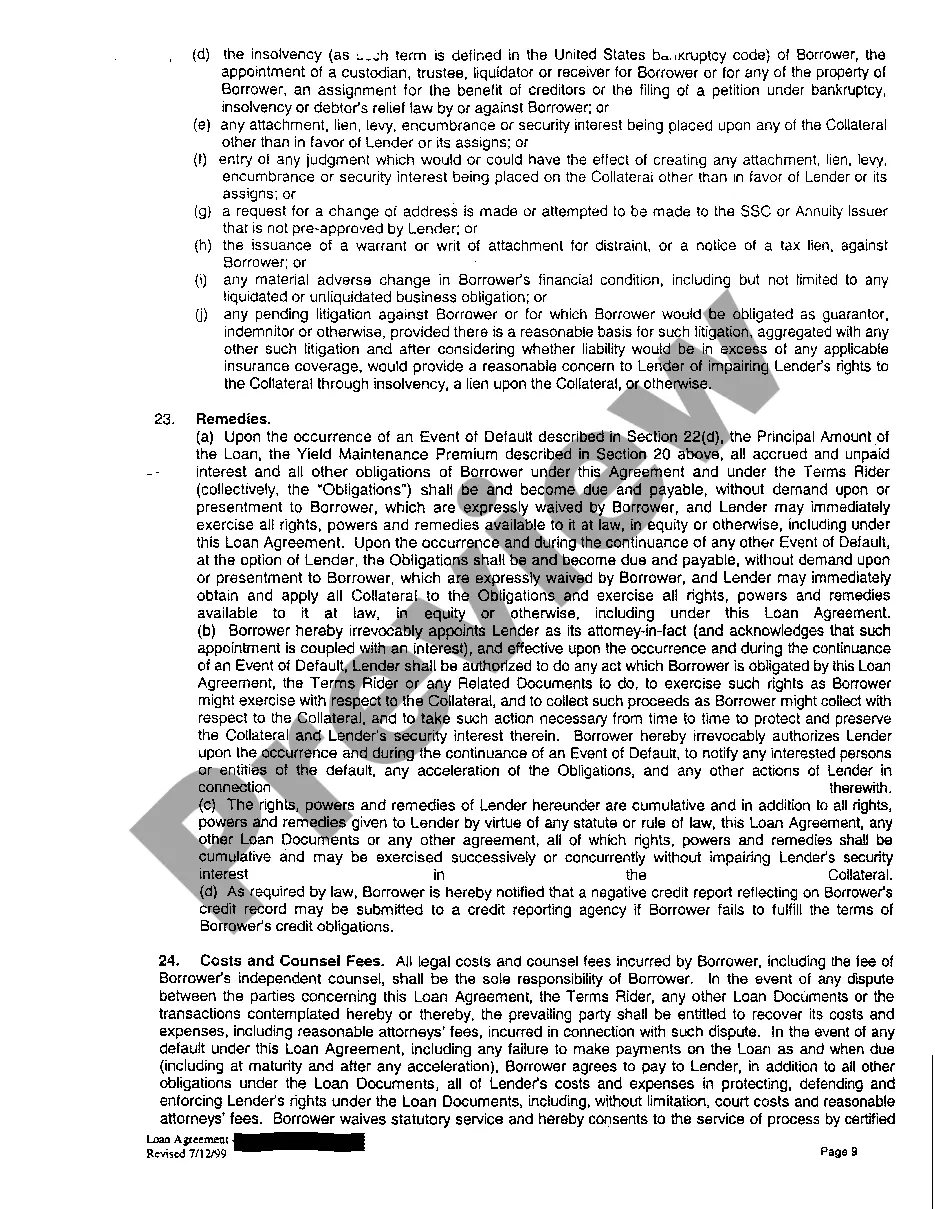

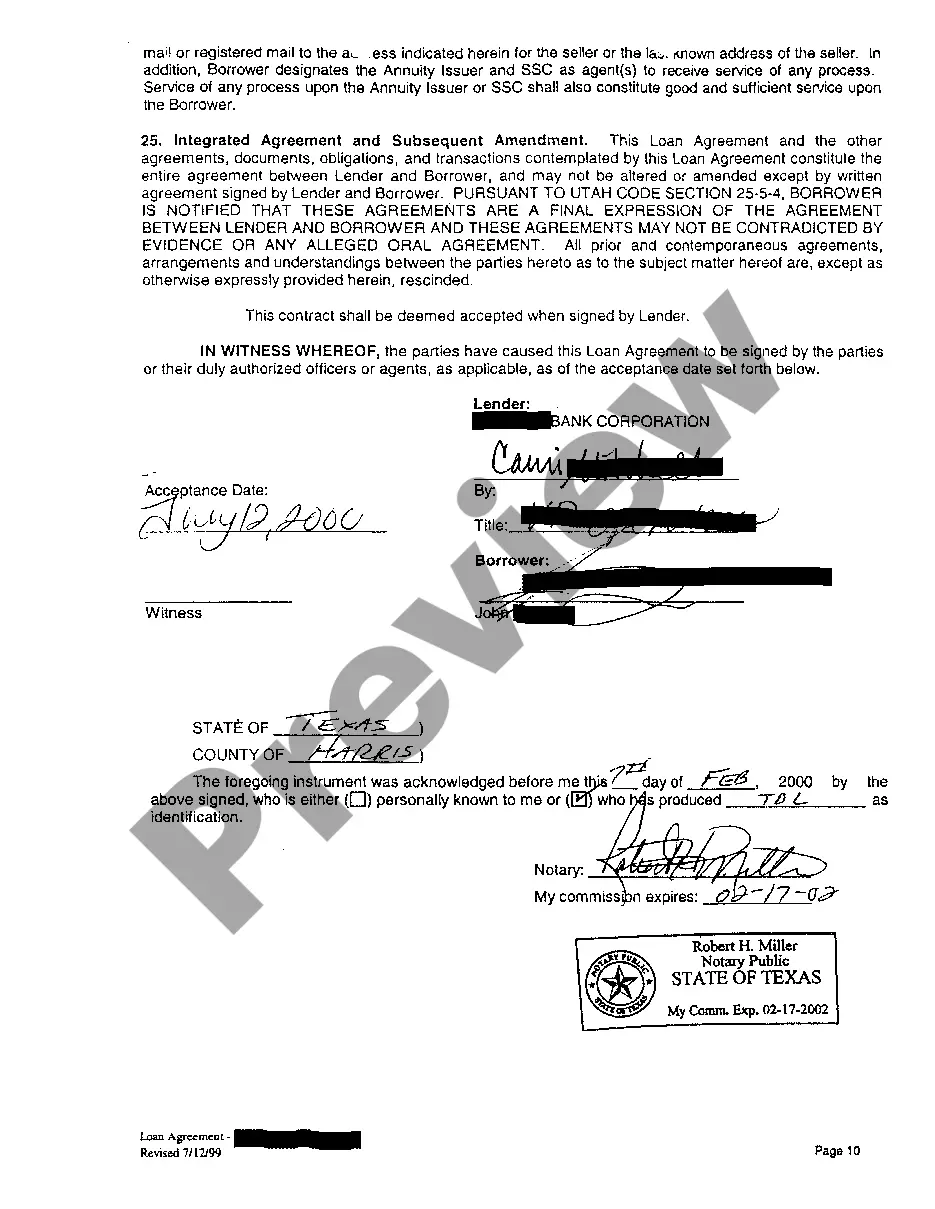

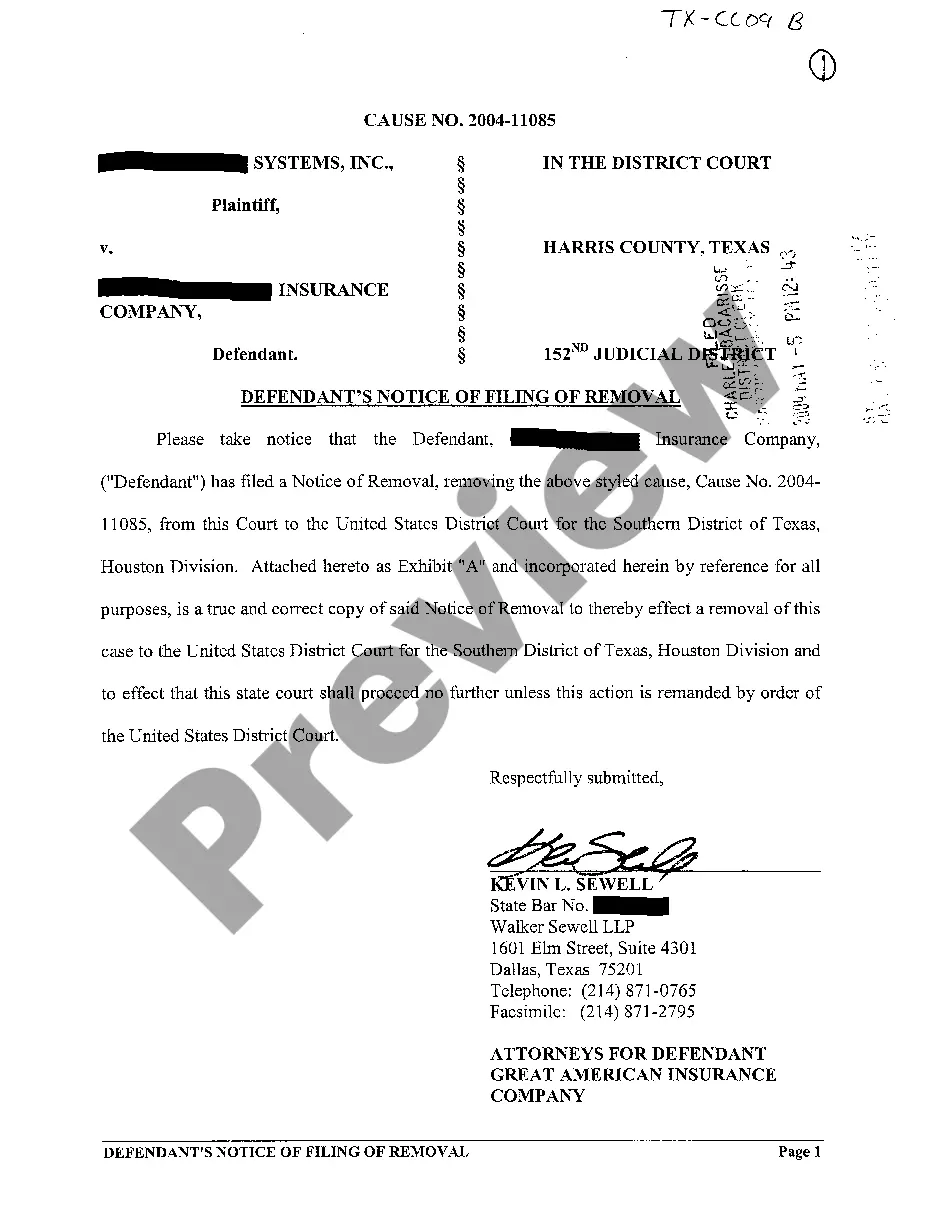

The Houston Texas Loan Application and Personal Loan Agreement is a legal document that outlines the terms and conditions of borrowing money from a lender in Houston, Texas. This agreement is typically used by individuals who are in need of financial assistance for personal reasons such as home improvements, debt consolidation, medical expenses, or other unforeseen circumstances. It is designed to protect both the borrower and the lender by clearly defining the rights and responsibilities of each party. The loan application is the initial step in the borrowing process. It includes information such as the borrower's personal details (name, address, contact information), employment history, income, credit score, and the purpose for which the loan is being requested. It serves as a formal request for a loan and allows the lender to assess the borrower's creditworthiness and capacity to repay the loan. The personal loan agreement is the legally binding contract that governs the terms of the loan. It contains various sections that cover key aspects of the loan, including: 1. Loan amount: This specifies the exact amount of money being borrowed. 2. Interest rate: This indicates the percentage of interest charged on the loan amount, which determines the cost of borrowing for the borrower. 3. Repayment terms: This outlines the repayment schedule, including the frequency of payments (weekly, monthly, etc.) and the duration of the loan (number of months or years). 4. Late fees and penalties: This section defines the consequences for late or missed payments, such as late fees or increased interest rates. 5. Collateral: If the loan is secured, the agreement may detail the collateral being used to secure the loan, such as a property or a vehicle. This protects the lender in case the borrower defaults on the loan. 6. Default and remedies: This outlines the actions that the lender can take in case of default, such as seizing collateral, reporting the default to credit agencies, or pursuing legal action. 7. Governing law: This specifies the jurisdiction under which the agreement is governed, usually the laws of the state of Texas. There can be different types of Houston Texas Loan Application and Personal Loan Agreements, depending on the specific terms and conditions tailored to each borrower's needs. For instance, there may be agreements for short-term personal loans, long-term personal loans, secured personal loans, unsecured personal loans, and so on. Each type of loan may have its own unique requirements and conditions. Overall, the Houston Texas Loan Application and Personal Loan Agreement is a crucial document that ensures transparency and legal compliance between the lender and borrower. It protects the interests of both parties involved, establishes clear expectations, and safeguards against potential disputes or misunderstandings.

Houston Texas Loan Application and Personal Loan Agreement

Description

How to fill out Houston Texas Loan Application And Personal Loan Agreement?

If you are in search of a legitimate form template, it’s unattainable to discover a superior venue than the US Legal Forms website – likely one of the largest collections on the web.

With this collection, you can access an extensive array of document samples for commercial and personal use categorized by types and regions, or keywords.

With the sophisticated search feature, obtaining the latest Houston Texas Loan Application and Personal Loan Agreement is as simple as 1-2-3.

Make the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Specify the file format and download it onto your device.

- Additionally, the accuracy of each document is confirmed by a team of experienced attorneys who consistently review the templates on our site and refresh them according to the most current state and regional requirements.

- If you are already familiar with our platform and have a registered account, all you need to obtain the Houston Texas Loan Application and Personal Loan Agreement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the very first time, just adhere to the guidelines below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview feature to examine its content.

- Confirm your choice. Click the Buy now button.

Form popularity

FAQ

10 Essential Loan Agreement Provisions Identity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

The lender may be a bank, financial institution, or an individual ? the loan agreement will be legally binding in either case.

Does a personal loan agreement need to be notarized? No, a personal loan agreement does not need to be notarized to be legally binding ? it simply needs to be signed by each party to the agreement.

Loan agreements, commonly referred to as 'facility agreements' are a legally binding document between a lender and a borrower. They set out the terms on which the lender is prepared to loan money to the borrower and the mutual obligations of each party.

Loan agreements are an important part of borrowing money; they protect both the borrower and the lender. A loan agreement spells out the details of the transaction, including the loan amount, the interest rate, and the terms.

You must notify your lender in writing that you are cancelling the loan contract and exercising your right to rescind. You may use the form provided to you by your lender or a letter. You can't rescind just by calling or visiting the lender.

A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid.

Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes. Give the duration or tenure of the loan and the termination date.

There are no legal differences between typed and handwritten agreements when it comes to enforceability. When most people think of a contract, a formally typed, the professional contract usually comes to mind. Nonetheless, a handwritten contract can be as valid as one that's typed.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options.