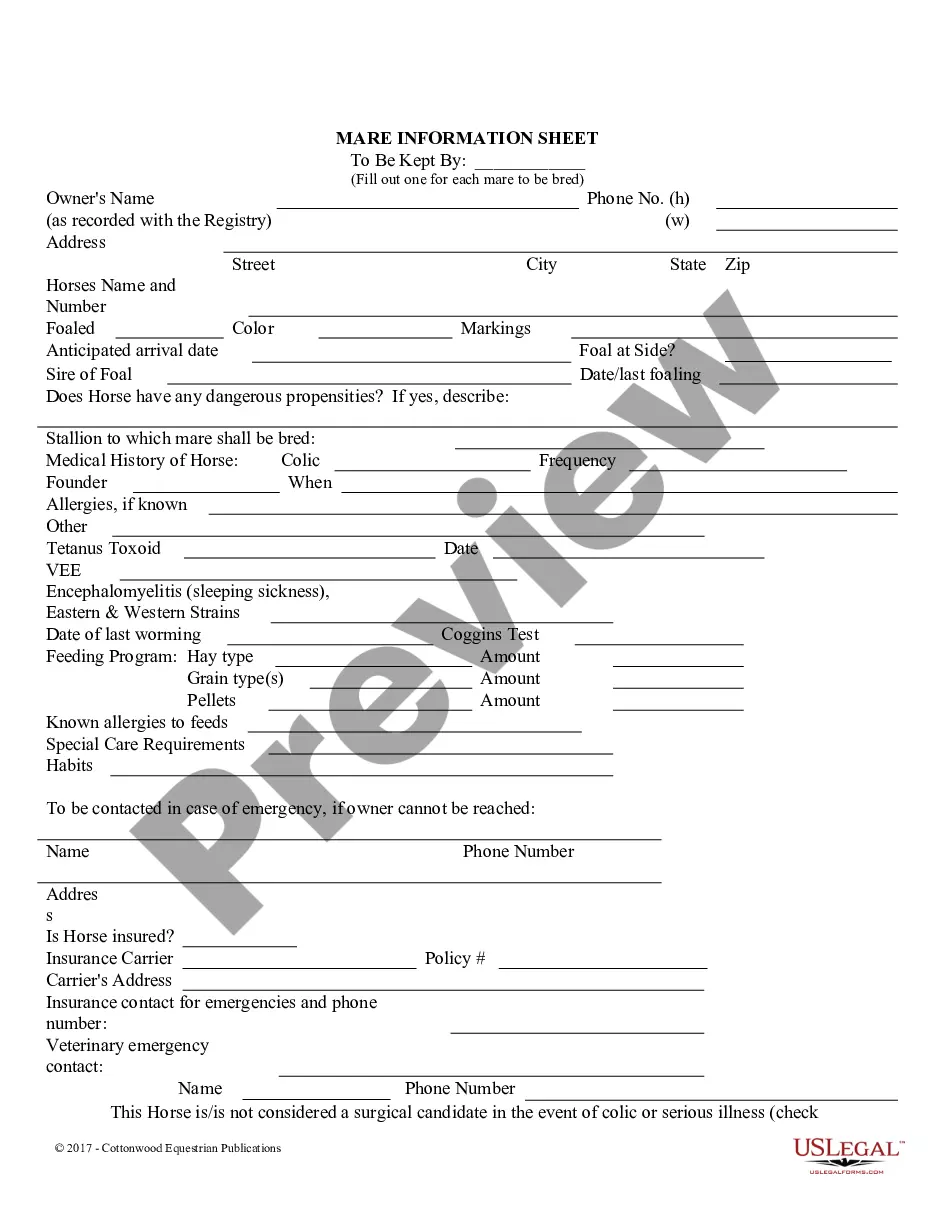

Lewisville, Texas Loan Application and Personal Loan Agreement serve as vital tools when individuals or businesses in Lewisville, Texas seek financial assistance through loans. These documents ensure that the loan application process is streamlined, and both the borrower and lender have a clear understanding of their rights and responsibilities. Let's delve into the key aspects and types of Loan Application and Personal Loan Agreements applicable in Lewisville, Texas. 1. Lewisville, Texas Loan Application: The Lewisville, Texas Loan Application is a comprehensive form that borrowers complete to initiate the loan process. This application collects crucial information about the borrower, such as their personal details, employment history, creditworthiness, desired loan amount, and purpose. The application typically covers various types of loans, including personal loans, auto loans, mortgage loans, business loans, and more. It acts as a reliable tool for financial institutions or lenders in evaluating the borrower's eligibility for the requested loan. 2. Personal Loan Agreement: The Personal Loan Agreement in Lewisville, Texas is a legally binding contract that outlines the terms and conditions between the borrower and lender regarding a personal loan. This agreement ensures transparency and protects the interests of both parties involved. It includes details about the loan amount, interest rate, repayment schedule, late payment penalties, prepayment terms, collateral (if required), and any additional fees. The agreement also specifies the consequences of defaulting on the loan and the actions that the lender can take to recover the debt. Types of Lewisville, Texas Loan Application and Personal Loan Agreement: a) Secured Personal Loan Agreement: This type of loan agreement requires the borrower to provide collateral, such as real estate, vehicles, or other assets, to secure the loan. It assures the lender that they can recover their funds by selling the collateral in case of borrower default. b) Unsecured Personal Loan Agreement: Unlike secured loans, unsecured personal loans do not require collateral. These loans are typically based on the borrower's creditworthiness, income, and financial history. Due to the higher risk for lenders, unsecured personal loans usually have higher interest rates compared to secured loans. c) Short-Term Personal Loan Agreement: Short-term personal loan agreements have a shorter repayment period, usually less than one year. These loans are commonly used for emergency expenses or to bridge temporary financial gaps. The loan terms and interest rates for short-term loans tend to differ from longer-term loans. d) Installment Personal Loan Agreement: Installment personal loan agreements involve borrowing a specific sum of money and repaying it, including the interest, in regular installments over a predetermined period. These loans offer fixed payment amounts during the repayment period, making budgeting more manageable for borrowers. In conclusion, Lewisville, Texas Loan Application and Personal Loan Agreement are crucial components of the loan process, ensuring transparency, clarity, and legal protection for both borrowers and lenders. The agreement types mentioned above cater to different loan requirements and enable individuals and businesses to secure the financial assistance they need in Lewisville, Texas.

Lewisville Texas Loan Application and Personal Loan Agreement

Description

How to fill out Lewisville Texas Loan Application And Personal Loan Agreement?

If you are looking for a valid form template, it’s difficult to choose a more convenient place than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get thousands of document samples for company and individual purposes by categories and states, or keywords. With our advanced search option, finding the newest Lewisville Texas Loan Application and Personal Loan Agreement is as easy as 1-2-3. In addition, the relevance of every file is verified by a team of professional lawyers that regularly check the templates on our platform and revise them based on the newest state and county demands.

If you already know about our platform and have a registered account, all you need to get the Lewisville Texas Loan Application and Personal Loan Agreement is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have chosen the form you want. Check its explanation and utilize the Preview option to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the proper file.

- Confirm your decision. Select the Buy now option. Following that, pick the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Select the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Lewisville Texas Loan Application and Personal Loan Agreement.

Each and every template you add to your account has no expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you need to have an extra copy for modifying or printing, you can return and save it once more at any time.

Take advantage of the US Legal Forms extensive catalogue to get access to the Lewisville Texas Loan Application and Personal Loan Agreement you were seeking and thousands of other professional and state-specific samples in a single place!