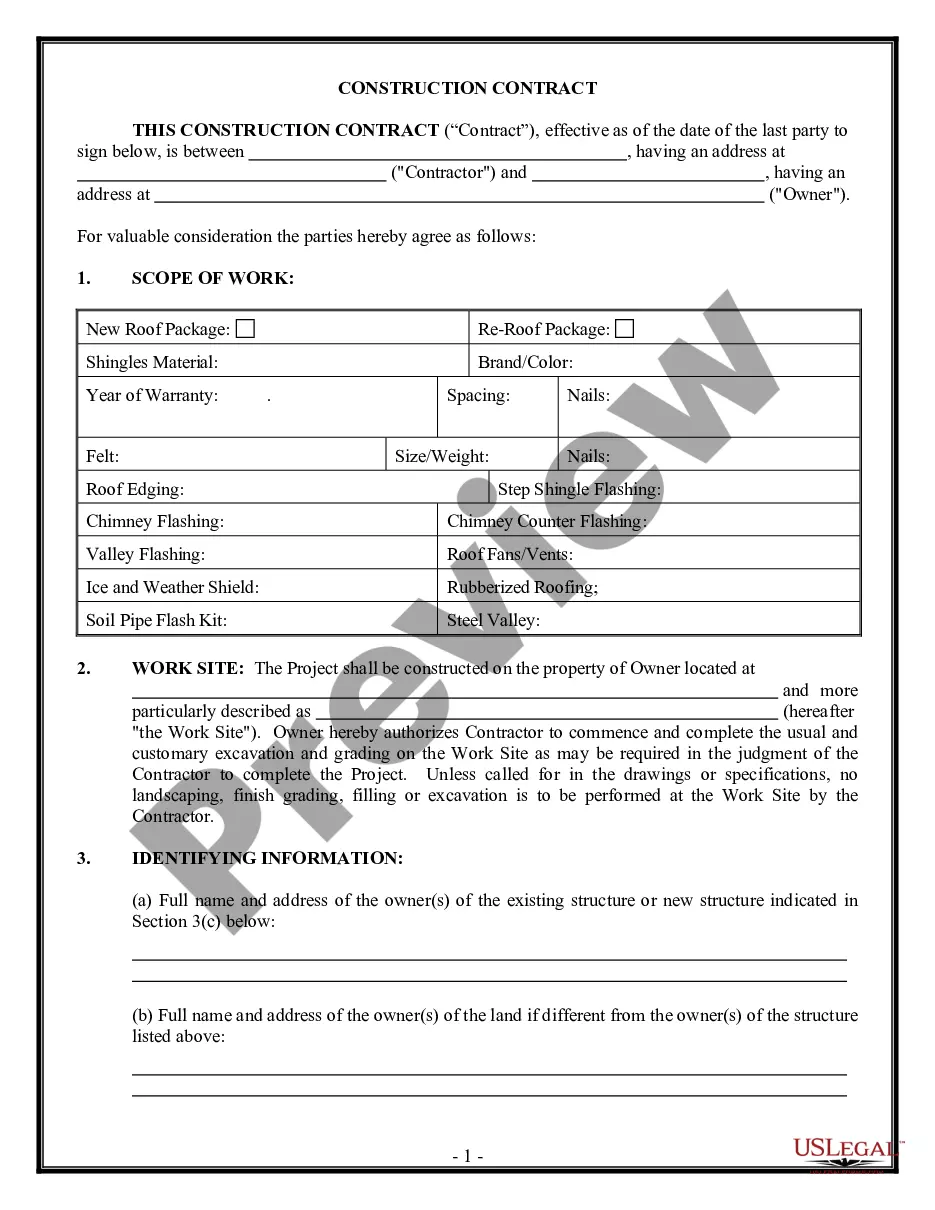

Pearland Texas Loan Application and Personal Loan Agreement — Detailed Description Pearland, Texas, known for its vibrant community and strong economy, offers various loan options to its residents. The Pearland Texas Loan Application and Personal Loan Agreement provide individuals with the means to secure financial assistance for their personal needs. Whether it's for emergency expenses, debt consolidation, home improvements, or education, Pearland residents can explore different loan types based on their unique requirements. 1. Personal Loan: A personal loan is a versatile financial tool that allows residents of Pearland, Texas, to borrow a specific amount of money, typically ranging from a few hundred to several thousands of dollars. This loan is unsecured, meaning borrowers are not required to offer collateral, making it an attractive option for those without significant assets to pledge. The Pearland Texas Loan Application for personal loans assists individuals in expressing their financial needs, providing necessary information such as income, employment, and credit history. 2. Auto Loan: Pearland residents seeking to purchase a vehicle can rely on an auto loan to finance their purchase. An auto loan specifically caters to financing new or used cars, trucks, motorcycles, or other forms of transportation. The Pearland Texas Loan Application for auto loans typically requests details related to the desired vehicle, such as make, model, year, and purchase price. Financial institutions may offer competitive interest rates, flexible repayment terms, and options for individuals with different credit profiles. 3. Home Improvement Loan: For Pearland homeowners looking to upgrade their property or undertake renovations, a home improvement loan provides a suitable solution. This loan allows borrowers to access funds to enhance the aesthetics, energy efficiency, or overall value of their homes. The Pearland Texas Loan Application for home improvement loans may require borrowers to provide details about their property, proposed improvements, and estimated project costs. Lenders often offer attractive interest rates and extended repayment periods to accommodate homeowners' needs. 4. Debt Consolidation Loan: Pearland residents burdened by multiple debts with varying interest rates and repayment terms can benefit from a debt consolidation loan. This loan enables borrowers to combine their outstanding debts into a single manageable loan, simplifying monthly payments and potentially reducing overall interest expenses. The Pearland Texas Loan Application for debt consolidation loans typically requires borrowers to provide details about their existing debts, including outstanding balances and interest rates. Lenders assess applicants' creditworthiness to determine the loan amount and interest rate offered. 5. Student Loan: For individuals pursuing higher education in Pearland or elsewhere, student loans offer a means to finance tuition fees, books, and other educational expenses. The Pearland Texas Loan Application for student loans generally requires applicants to provide information about their chosen educational institution, program of study, and estimated costs. Financial institutions may offer competitive interest rates, flexible repayment options, and grace periods before repayment begins. It is essential for Pearland residents to carefully review and understand the terms and conditions of their loan agreements. Each loan type mentioned above has specific eligibility criteria, interest rates, repayment terms, and disclosure requirements, which are outlined in the Personal Loan Agreement. This agreement describes the responsibilities and obligations of both the borrower and the lender, ensuring transparency and legal compliance throughout the lending process. In conclusion, Pearland Texas Loan Application and Personal Loan Agreement open up various financing avenues for residents to address their individual financial needs. Whether it's a personal loan, auto loan, home improvement loan, debt consolidation loan, or student loan, Pearland residents can rely on these tools to access the necessary funds. By utilizing the appropriate loan application, individuals can express their requirements clearly while complying with the related loan agreement, safeguarding their financial interests.

Pearland Texas Loan Application and Personal Loan Agreement

Description

How to fill out Pearland Texas Loan Application And Personal Loan Agreement?

If you are searching for a relevant form template, it’s difficult to choose a better place than the US Legal Forms website – one of the most considerable online libraries. Here you can find a huge number of document samples for business and individual purposes by categories and regions, or keywords. With our high-quality search function, getting the most recent Pearland Texas Loan Application and Personal Loan Agreement is as easy as 1-2-3. In addition, the relevance of every record is proved by a team of skilled attorneys that regularly check the templates on our platform and revise them based on the newest state and county demands.

If you already know about our system and have an account, all you need to receive the Pearland Texas Loan Application and Personal Loan Agreement is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the sample you require. Look at its explanation and utilize the Preview option (if available) to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the appropriate document.

- Affirm your selection. Choose the Buy now option. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Pearland Texas Loan Application and Personal Loan Agreement.

Every form you add to your account does not have an expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to have an additional copy for modifying or printing, feel free to return and download it once more at any time.

Make use of the US Legal Forms extensive collection to gain access to the Pearland Texas Loan Application and Personal Loan Agreement you were looking for and a huge number of other professional and state-specific samples in one place!