San Angelo Texas Loan Application and Personal Loan Agreement are legal documents used in the process of applying for and securing personal loans in the city of San Angelo, Texas. These documents outline the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and other important information. Keywords: San Angelo Texas, loan application, personal loan agreement, legal document, terms and conditions, loan amount, interest rate, repayment schedule. Types of San Angelo Texas Loan Application and Personal Loan Agreement: 1. Unsecured Personal Loan Agreement: This type of loan agreement does not require collateral and is based solely on the borrower's creditworthiness and ability to repay the loan. 2. Secured Personal Loan Agreement: In this type of loan agreement, the borrower is required to provide collateral, such as a vehicle or property, to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral. 3. Payday Loan Agreement: This type of loan agreement is typically a short-term, high-interest loan that is due on the borrower's next payday. Payday loans are often used for emergencies or unexpected expenses. 4. Installment Loan Agreement: This type of loan agreement allows the borrower to repay the loan in fixed monthly installments over a specified period of time. The terms of the loan, including the interest rate and repayment schedule, are agreed upon by both the borrower and the lender. 5. Personal Line of Credit Agreement: This type of loan agreement grants the borrower access to a predetermined amount of funds, which they can borrow from as needed. The borrower only pays interest on the amount borrowed and has the flexibility to repay and re-borrow within the agreed credit limit. Regardless of the type of personal loan agreement, it is crucial for both the borrower and the lender to carefully review and understand the terms and conditions before signing. It is recommended to seek legal advice or consult a financial professional to ensure all aspects of the loan agreement are clear and fair.

San Angelo Texas Loan Application and Personal Loan Agreement

Description

How to fill out San Angelo Texas Loan Application And Personal Loan Agreement?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law background to draft such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform offers a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the San Angelo Texas Loan Application and Personal Loan Agreement or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the San Angelo Texas Loan Application and Personal Loan Agreement in minutes employing our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

However, if you are new to our platform, make sure to follow these steps prior to obtaining the San Angelo Texas Loan Application and Personal Loan Agreement:

- Ensure the template you have found is good for your area because the rules of one state or area do not work for another state or area.

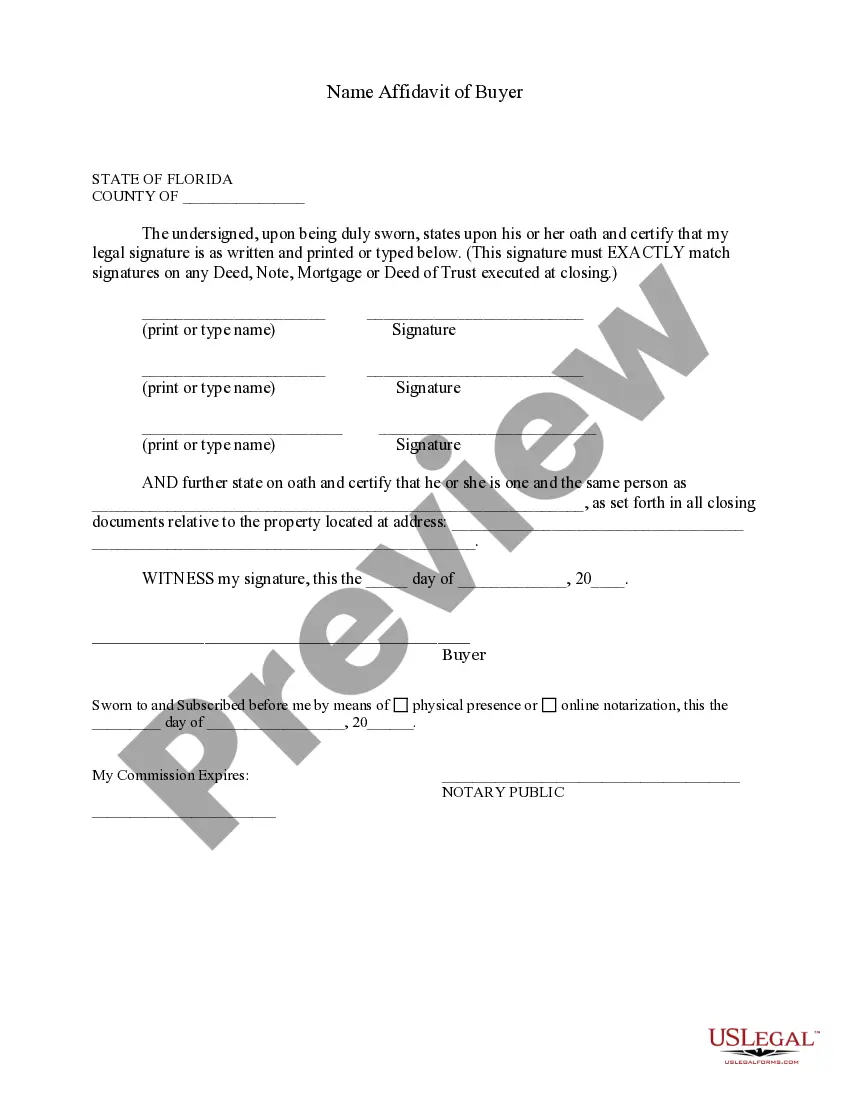

- Preview the document and read a brief outline (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start again and search for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the San Angelo Texas Loan Application and Personal Loan Agreement as soon as the payment is done.

You’re good to go! Now you can proceed to print out the document or complete it online. If you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.