Wichita Falls Texas Loan Application and Personal Loan Agreement When opting for a loan in Wichita Falls, Texas, it is crucial to understand the loan application process and the terms outlined in the personal loan agreement. Whether you are a first-time borrower or an experienced one, being knowledgeable about these aspects ensures a smooth and transparent borrowing experience. The Wichita Falls Texas Loan Application is the initial step in obtaining a loan. It is a formal request submitted by an individual to a financial institution to be considered for a loan. The application typically requires personal information such as name, address, contact details, employment history, income details, and the amount and purpose of the loan. Submitting the loan application accurately and in a timely manner is essential to kick-start the loan approval process. Furthermore, understanding the Personal Loan Agreement is crucial. The agreement is a legally binding document that outlines the terms and conditions of the loan. It specifies important details including the loan amount, interest rate, repayment period, monthly installment amounts, any applicable fees or penalties, and the consequences of defaulting on payments. Keywords: Wichita Falls Texas, loan application, personal loan agreement, borrowing experience, financial institution, personal information, employment history, income details, loan approval process, legally binding document, terms and conditions, interest rate, repayment period, monthly installments, applicable fees, penalties, defaulting on payments. Different Types of Wichita Falls Texas Loan Applications and Personal Loan Agreements: 1. Personal Loans for Emergency Expenses: This type of loan application caters to individuals who require financial assistance for unexpected costs such as medical emergencies or vehicle repairs. The personal loan agreement for this type of loan specifies the loan amount, repayment terms, and any applicable interest rates or fees. 2. Home Loans or Mortgages: Wichita Falls residents who wish to purchase a new home or refinance their existing mortgage can apply for this type of loan. The loan application process requires to be detailed personal and financial information, such as employment history, income, credit score, and property details. The personal loan agreement for a home loan outlines the loan amount, interest rate, repayment schedule, and the consequences of defaulting on payments. 3. Business Loans: Entrepreneurs and small business owners in Wichita Falls may seek business loans to expand their ventures or fund new projects. Business loan application processes typically involve providing business plans, financial statements, and other relevant documents. The personal loan agreement for business loans includes terms related to loan amounts, interest rates, repayment periods, collateral requirements, and potential penalties for late payments. 4. Auto Loans: Individuals in Wichita Falls looking to purchase a vehicle may apply for an auto loan. The loan application for auto loans requires information about the desired vehicle, personal finances, and credit history. The personal loan agreement for auto loans specifies the loan amount, interest rate, repayment schedule, and any potential vehicle repossession consequences due to non-payment. Keywords: personal loans, emergency expenses, home loans, mortgages, business loans, auto loans, Wichita Falls residents, loan application process, employment history, income, credit score, property details, business plans, financial statements, collateral requirements, vehicle repossession.

Wichita Falls Texas Loan Application and Personal Loan Agreement

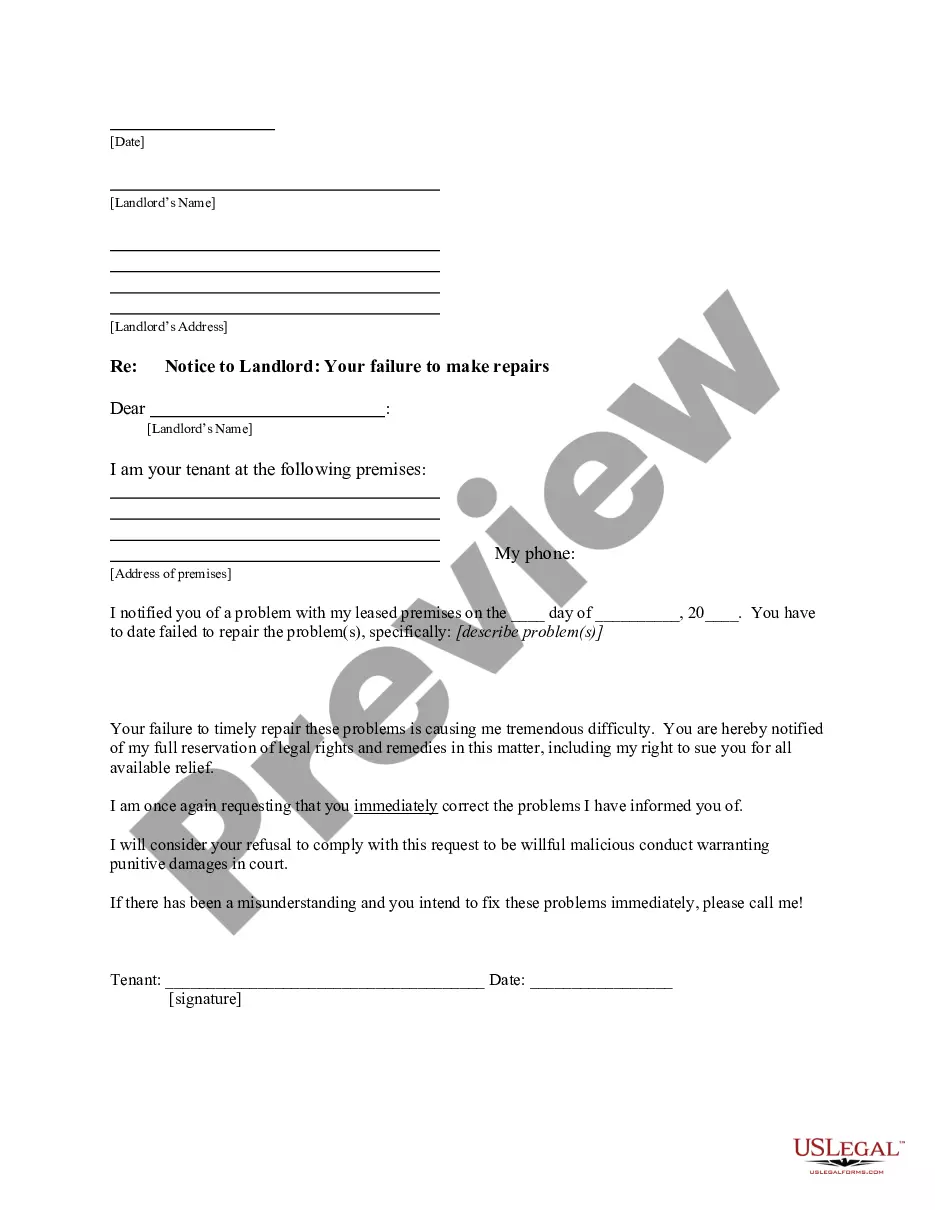

Description

How to fill out Wichita Falls Texas Loan Application And Personal Loan Agreement?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney solutions that, usually, are very costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Wichita Falls Texas Loan Application and Personal Loan Agreement or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Wichita Falls Texas Loan Application and Personal Loan Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Wichita Falls Texas Loan Application and Personal Loan Agreement is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!