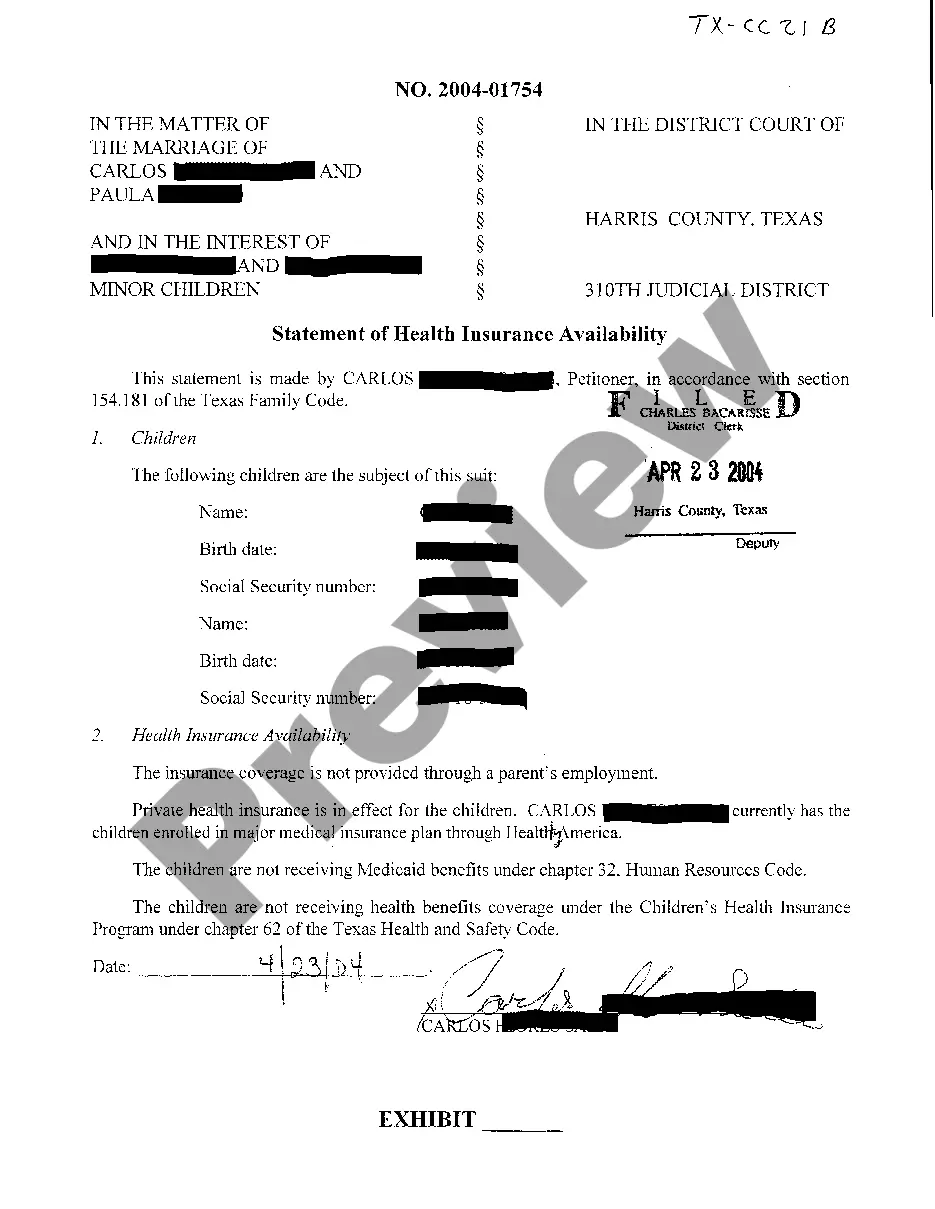

The Wichita Falls Texas Statement of Health Insurance Availability is a crucial document that outlines the various health insurance options and programs available to residents in Wichita Falls, Texas. It serves as a comprehensive guide to understanding the different types of health insurance plans and coverage available in the area. The Statement of Health Insurance Availability provides detailed information on key aspects such as eligibility requirements, enrollment periods, coverage options, premiums, and benefits. It aims to ensure that all individuals and families have access to affordable and comprehensive health insurance options, regardless of their income, employment status, or pre-existing medical conditions. The Wichita Falls Texas Statement of Health Insurance Availability encompasses several types of health insurance programs, each tailored to meet different needs and circumstances. Some notable types include: 1. Individual Health Insurance Plans: These are insurance plans designed for individuals and their families who do not have access to employer-sponsored coverage or government programs. These plans offer a range of coverage options, including preventive care, prescription drugs, hospitalization, and specialist visits. 2. Employer-Sponsored Health Insurance: This type of coverage is offered by employers to their employees as a benefit. It typically includes a variety of coverage options, and the employer may contribute to the premiums, making it more affordable for employees. It can include options such as health maintenance organizations (HMO's), preferred provider organizations (PPO's), or high-deductible health plans (HDPS). 3. Government Programs: The Statement of Health Insurance Availability also provides information on various government programs, such as Medicaid and the Children's Health Insurance Program (CHIP). These programs assist low-income individuals and families in obtaining affordable or no-cost health coverage. Eligibility requirements and coverage options may vary for each program. 4. Medicare: The document also includes information on Medicare, a federal health insurance program primarily for individuals aged 65 and older, as well as some younger individuals with certain disabilities. Medicare consists of different parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage). By providing a detailed overview of different health insurance programs available, the Wichita Falls Texas Statement of Health Insurance Availability aims to empower residents with the knowledge and resources necessary to make informed decisions about their healthcare coverage. It ensures that individuals and families can access affordable and comprehensive health insurance plans that suit their specific needs and circumstances.

Wichita Falls Texas Statement of Health Insurance Availability

Description

How to fill out Wichita Falls Texas Statement Of Health Insurance Availability?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any law education to draft this sort of papers from scratch, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Wichita Falls Texas Statement of Health Insurance Availability or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Wichita Falls Texas Statement of Health Insurance Availability in minutes using our trustworthy platform. If you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps prior to downloading the Wichita Falls Texas Statement of Health Insurance Availability:

- Ensure the template you have chosen is specific to your location considering that the rules of one state or county do not work for another state or county.

- Preview the document and read a quick description (if available) of scenarios the document can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Wichita Falls Texas Statement of Health Insurance Availability as soon as the payment is through.

You’re good to go! Now you can go ahead and print the document or fill it out online. In case you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

Twenty-four states rely fully on the federal government for their marketplaces. They use the HealthCare.gov website and customer service call center.

Texas uses the federally run exchange at HealthCare.gov to enroll Texans in marketplace plans. Fourteen health insurance carriers offer 2022 coverage through the Texas marketplace/exchange.

What is Texas Medicaid? Medicaid is the state and federal cooperative venture that provides medical coverage to eligible needy persons. The purpose of Medicaid in Texas is to improve the health of people in Texas who might otherwise go without medical care for themselves and their children.

In 2022, the MMMNA in TX is $3,435 / month. If a non-applicant spouse has monthly income under this amount, income can be transferred from the applicant spouse to the non-applicant spouse to bring their income up to this level.

Which States Have State-Based Marketplaces? California ? Covered California. Colorado ? Connect for Health Colorado. Connecticut ? Access Health CT. District of Columbia ? DC Health Link. Idaho ? Your Health Idaho. Kentucky ? Kynect (Kentucky Health Benefit Exchange) Maine ? CoverME. Maryland ? Maryland Health Connection.

Texas residents are not required to have health insurance under state law. However, the Affordable Care Act does mandate a health insurance requirement on a federal level that includes Texans. Texas utilizes the federal exchange for health plans and has one of the highest enrollment rates in the country.

Medicaid and Texas Health Steps provide a wide range of health-care services to people who qualify. If you want to find out more about the services they cover or how to qualify and sign up, you can: Download Texas Medicaid's Your Health Care Guide. Visit the Your Texas Benefits website.

Medicaid can provide free or low-cost health care and long-term services and supports to low-income children and adults with disabilities.

The State of Texas offers eligible full-time employees and their dependents coverage that currently meets the ACA's minimum coverage requirement. The State offers this coverage through ERS and the GBP.

Texas Insurance Code requires TDI to: Regulate the business of insurance in Texas. Protect and ensure the fair treatment of consumers. Ensure fair competition in the insurance industry to foster a competitive market.