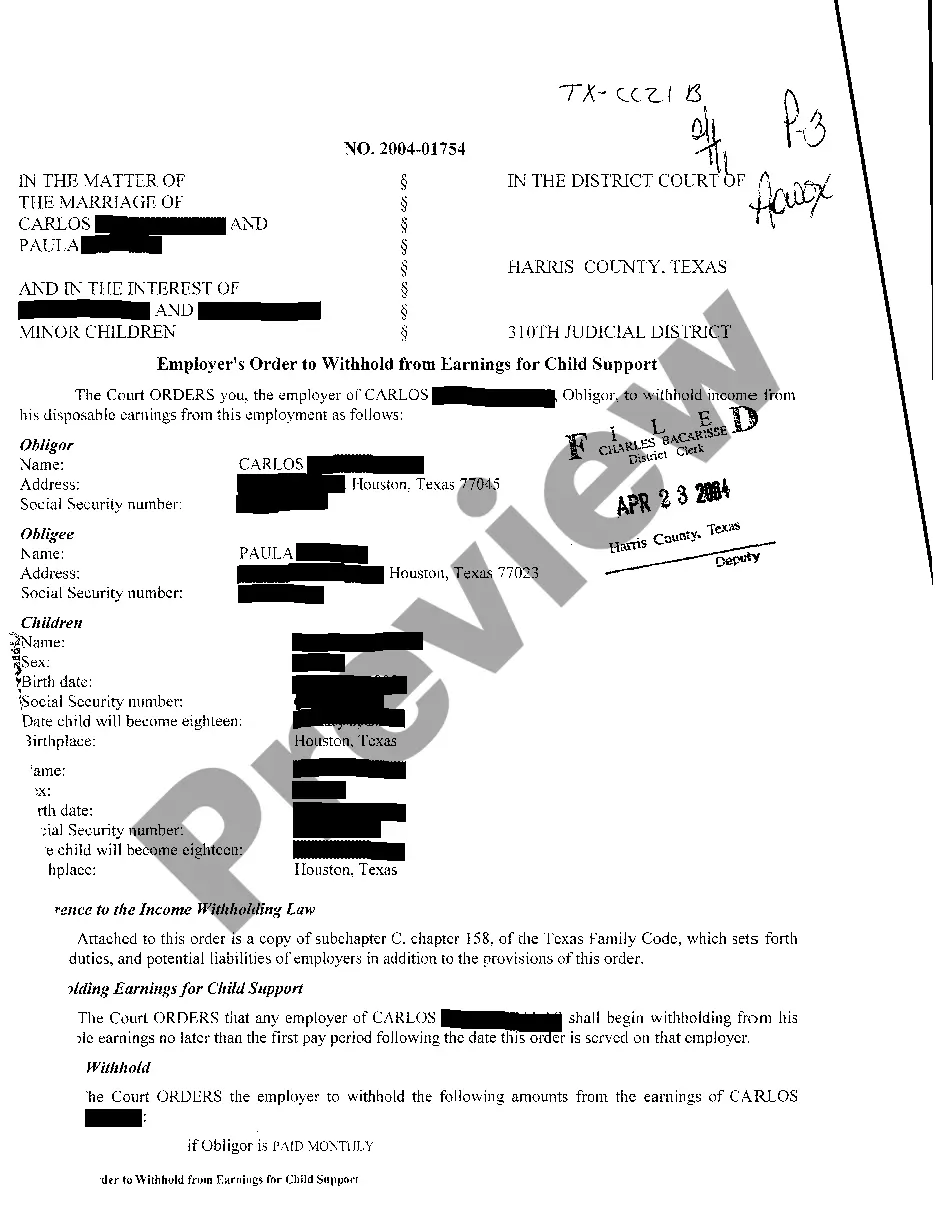

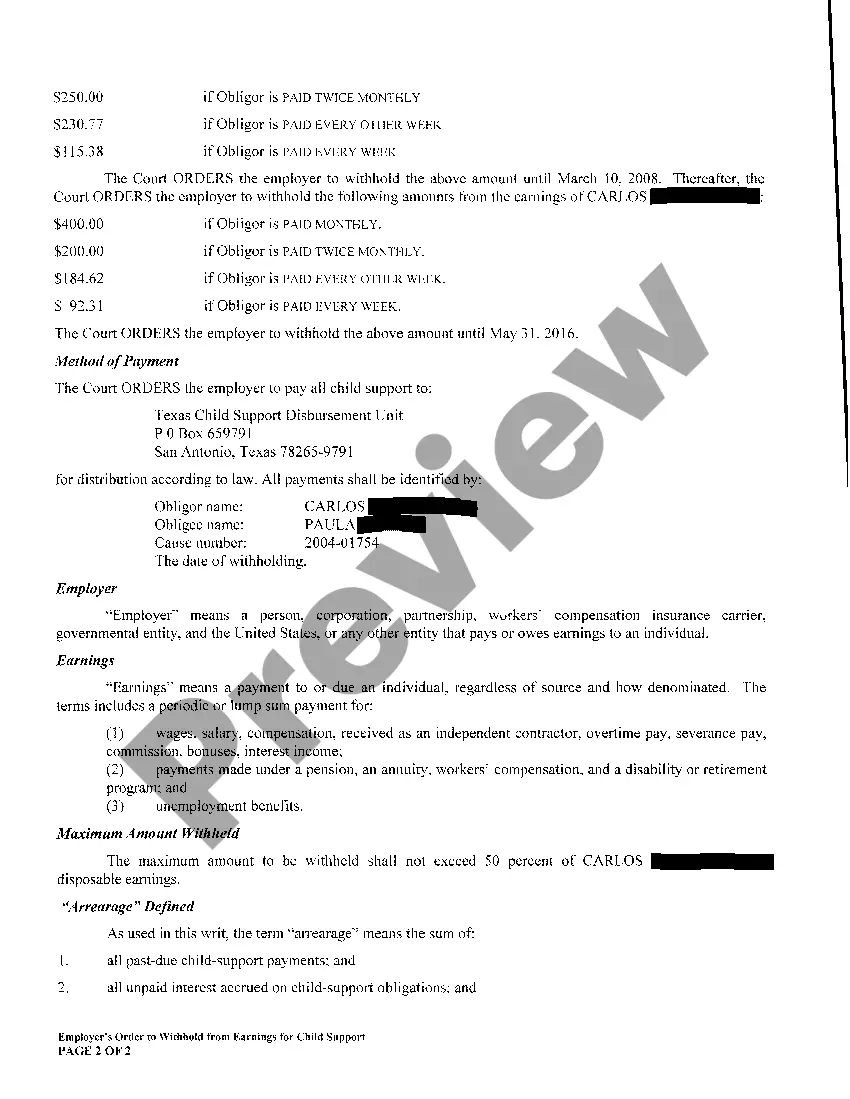

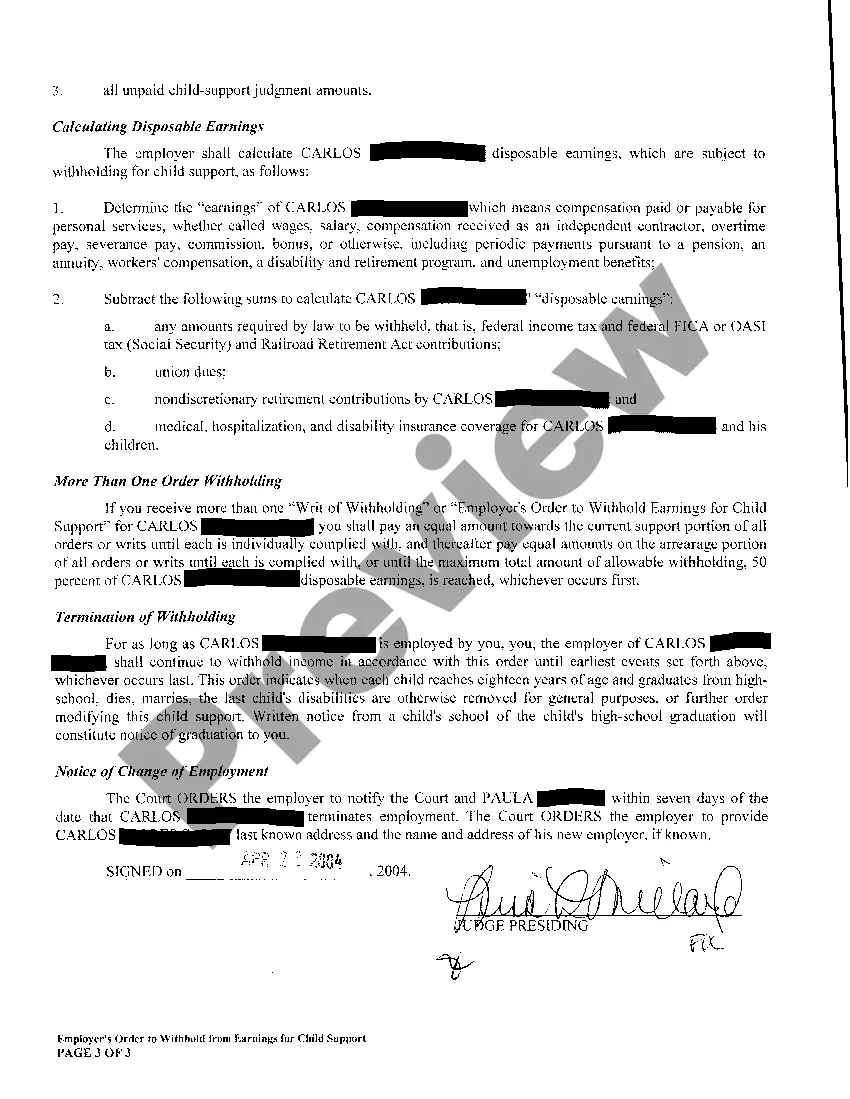

Amarillo Texas Employers Order Withholding From Earnings, often referred to as a wage garnishment, is a legal process where a portion of an employee's wages is withheld by the employer to fulfill a debt or fulfil a court-ordered payment. It is crucial to understand the specifics of this order, its scope, and its implications for both employees and employers in Amarillo, Texas. 1. Definition and Purpose: An Amarillo Texas Employers Order Withholding From Earnings is an official directive issued by a court or government agency, instructing an employer to deduct a specific amount from an employee's wages and remit it to the creditor to satisfy a debt or financial obligation. The goal is to ensure timely collection of outstanding debts while providing a structured process that safeguards the rights of the employee. 2. Types of Amarillo Texas Employers Order Withholding From Earnings: — Child Support Withholding: This type of order is commonly issued by the Texas Office of the Attorney General to enforce child support payments. It requires the employer to deduct a specified amount from the employee's wages to fulfill their child support obligations. — Wage Garnishment for Unpaid Taxes: In cases where an individual owes delinquent state or federal taxes, the Internal Revenue Service (IRS) or Texas Comptroller's Office may obtain an order for wage garnishment. The employer is then obligated to withhold a portion of the employee's earnings and forward it to the respective taxing authority. — Consumer Debt Garnishments: When an individual fails to repay outstanding debts, such as credit card bills, medical bills, or student loans, the creditor may seek an Amarillo Texas Employers Order Withholding From Earnings. This order enables the employer to deduct a specific amount and remit it to the creditor, gradually satisfying the debt. 3. Process and Limitations: Upon receiving an Amarillo Texas Employers Order Withholding From Earnings, the employer must comply with certain regulations and obligations to ensure accurate deductions and proper disbursement. Key aspects of this process include: — Determining the maximum amount allowed to be withheld based on federal and state laws. — Calculating the correct amount for each pay period, considering factors such as employee exemptions, other garnishments, and limits set by law. — Promptly remitting the withheld funds to the appropriate creditor or agency. — Maintaining proper records relating to the garnishment and ensuring employee privacy and confidentiality. It is important to note that certain earnings, such as tips, certain retirement benefits, and federal benefits, may be protected from garnishment or subject to specific limitations. Understanding the Amarillo Texas Employers Order Withholding From Earnings process is critical for both employees and employers to navigate it accurately and ensure compliance with the law. Employees should familiarize themselves with their rights and the specific regulations regarding wage garnishments, while employers must adhere to legal obligations to avoid potential legal consequences. Compliance with these mandates helps to maintain fairness, protect the interests of all parties involved, and support the efficient functioning of the judicial system in Amarillo, Texas.

Amarillo Texas Employers Order To Withhold From Earnings

Description

How to fill out Amarillo Texas Employers Order To Withhold From Earnings?

We consistently endeavor to reduce or evade legal complications when managing intricate legal or financial matters.

To achieve this, we secure legal representation that is often quite expensive.

However, not all legal issues are similarly complicated.

Many of them can be handled independently.

Utilize US Legal Forms whenever you require to locate and download the Amarillo Texas Employers Order To Withhold From Earnings or any other document promptly and safely. Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the document, you can easily re-download it from the My documents section. The procedure is just as simple if you are a newcomer to the site! You can establish your account in just a few minutes. Ensure that you verify if the Amarillo Texas Employers Order To Withhold From Earnings complies with the laws and regulations of your state and locality. Additionally, it’s vital to review the document’s outline (if available), and if you notice any inconsistencies with your initial requirements, search for another template. Once you confirm that the Amarillo Texas Employers Order To Withhold From Earnings is appropriate for your situation, you can choose the subscription plan and proceed to payment. Then you can download the document in any of the available formats. For over 24 years, we have assisted millions by providing ready-to-customize and current legal forms. Make the most of US Legal Forms now to conserve effort and resources!

- US Legal Forms is an online directory of current DIY legal documents covering everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your affairs independently without needing an attorney's services.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Yes, employers in Texas must withhold child support from employees' earnings when they receive an Income Withholding Order. This requirement helps to streamline the payment process for child support obligations. Utilizing resources like USLegalForms can assist employers in managing these orders effectively, ensuring compliance with the law.

Yes, Texas law allows for automatic wage garnishment for child support obligations once an Income Withholding Order is in place. Employers in Amarillo are required to comply with these orders, ensuring that deductions occur without a court hearing. This process helps ensure that children receive the support they need in a timely manner.

Texas does not impose a state income tax, meaning employers generally do not withhold state income taxes from wages. However, employers in Amarillo are still responsible for withholding federal taxes, social security, and Medicare taxes. Understanding these regulations can help ensure your earnings are accurately processed, especially when dealing with orders to withhold from earnings.

IWO stands for Income Withholding Order. This legal document directs an employer, such as those in Amarillo, Texas, to deduct a specific amount from an employee's earnings to cover obligations like child support. Understanding an IWO is crucial, as it helps ensure that necessary payments are made directly from wages, promoting financial responsibility.

In Texas, the maximum amount that can be withheld for child support from an employee's earnings is typically 50% of their disposable income, depending on the number of children supported. It's important to note that this percentage can vary, especially if the employee is currently supporting other dependents. The Amarillo Texas Employers Order To Withhold From Earnings provides the guidelines for employers when handling these deductions. To navigate these processes effectively, you may consider using US Legal Forms, which offers templates to ensure compliance and proper handling of child support orders.

Yes, Texas has provisions for payroll withholding. Employers are required to withhold specific amounts from employees' earnings for various obligations. This includes taxes and other deductions. To ensure compliance, consider using services like USLegalForms to understand your rights regarding Amarillo Texas Employers Order To Withhold From Earnings.

Texas does have certain payroll taxes, such as federal taxes that need to be withheld from employee wages. While there is no state income tax, employers must still manage other tax obligations like federal unemployment tax and Social Security tax. Utilizing solutions like uslegalforms can simplify compliance with Amarillo Texas Employers Order To Withhold From Earnings, ensuring smooth payroll processing.

If an employer in Texas fails to withhold child support, they could face serious penalties, including fines and legal action. The state mandates that employers comply with the Amarillo Texas Employers Order To Withhold From Earnings to ensure that child support payments are collected. It is crucial for employers to have a reliable system in place to avoid complications that arise from non-compliance.

Texas does not hold state income taxes, which differentiates it from many other states. Instead, the tax system relies on sales tax, property tax, and various federal taxes. Employers in Amarillo need to manage their payroll effectively to ensure compliance with federal withholding and any orders like the Amarillo Texas Employers Order To Withhold From Earnings issued in cases of child support or other garnishments.

In Texas, the amount withheld from employees’ paychecks varies depending on federal tax laws. Employers withhold a percentage based on the employee's earnings and filed W-4 form. Since Texas does not have a state income tax, the primary focus should be on federal withholding requirements and any applicable Amarillo Texas Employers Order To Withhold From Earnings for child support payments.