An Austin Texas Employers Order withholding From Earnings, also known as a wage garnishment, is a legal procedure that allows a creditor or government entity to collect a portion of an employee's wages to satisfy a debt or obligation. This court-ordered mandate requires employers located in Austin, Texas, to withhold a specific amount of money from an employee's paycheck and remit it directly to the creditor or agency authorized to collect the debt. There are various types of Austin Texas Employers Orders withholding From Earnings depending on the nature of the debt or obligation. These may include: 1. Child Support Orders: In cases where an employee is obligated to pay child support, the Texas Child Support Division can obtain a court order for withholding income. The employer is required to deduct the specified amount and forward it to the appropriate agency, usually the Office of the Attorney General, to ensure timely child support payments. 2. Tax Levies: The Internal Revenue Service (IRS) or the Texas Comptroller of Public Accounts may issue an order to withhold from earnings to collect unpaid federal or state taxes. Employers must comply with these levies by deducting the designated amount from the employee's wages and remitting it to the respective tax agency. 3. Student Loans: The Texas Guaranteed Student Loan Corporation or other authorized entities can obtain court orders withholding wages for repayment of defaulted student loans. Employers are responsible for deducting a portion of the employee's earnings as stipulated by the court and forwarding it to the appropriate loan service. 4. Bankruptcy Orders: In the case of bankruptcy proceedings, a court may issue an order to withhold earnings as part of a debt repayment plan. The employer must comply with this order by deducting the specified amount and remitting it to the designated trustee or bankruptcy administrator. 5. Judgments and Creditor Garnishments: When a creditor obtains a judgment against an employee, Austin Texas Employers Orders withholding From Earnings can be issued to satisfy the debt. The employer must deduct the court-determined amount from the employee's wages and forward it to the creditor until the debt is satisfied. It is crucial for employers to accurately withhold the specified amount from an employee's earnings, as failure to comply with a court-ordered garnishment can result in legal consequences. Employers must also provide the necessary documentation and communicate the details of the garnishment to the affected employee.

Austin Texas Employers Order To Withhold From Earnings

Description

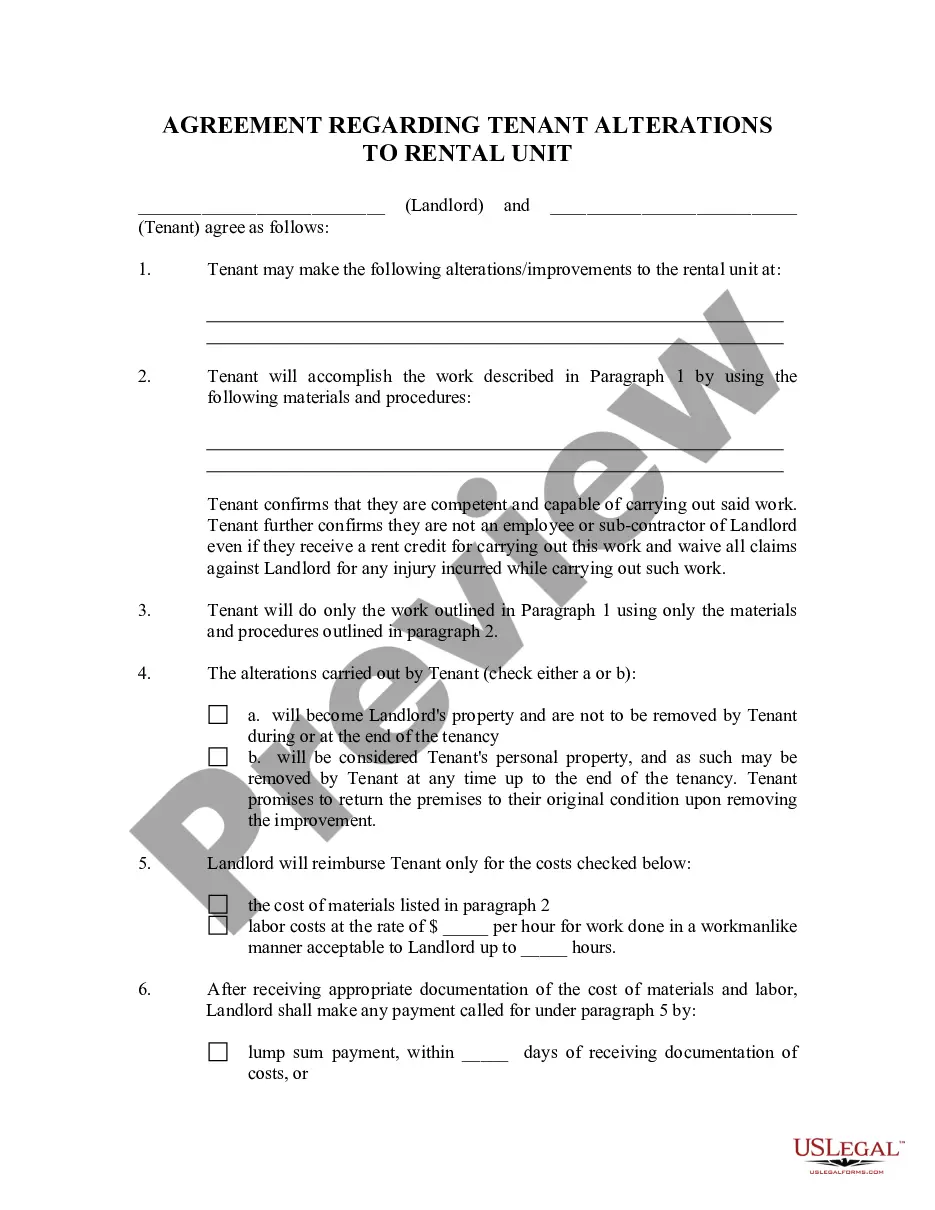

How to fill out Austin Texas Employers Order To Withhold From Earnings?

Make use of the US Legal Forms and get instant access to any form template you want. Our beneficial platform with thousands of documents makes it easy to find and get almost any document sample you want. You are able to download, fill, and certify the Austin Texas Employers Order To Withhold From Earnings in just a couple of minutes instead of browsing the web for hours looking for an appropriate template.

Utilizing our collection is a great strategy to increase the safety of your record filing. Our professional lawyers regularly check all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you get the Austin Texas Employers Order To Withhold From Earnings? If you already have a profile, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can find all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Open the page with the template you require. Ensure that it is the form you were hoping to find: check its headline and description, and use the Preview feature when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Indicate the format to get the Austin Texas Employers Order To Withhold From Earnings and modify and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and trustworthy document libraries on the web. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Austin Texas Employers Order To Withhold From Earnings.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!