Title: Understanding the Beaumont Texas Employers Order Withholding From Earnings: A Comprehensive Overview Introduction: Under Texas law, employers are sometimes required to withhold a portion of their employees' earnings for various reasons. One such legal mechanism is the Beaumont Texas Employers Order Withholding From Earnings. This order typically involves collecting unpaid debts via wage garnishment. In this article, we will delve into the details of this order and explore its purpose, process, and potential types. 1. Explaining Beaumont Texas Employers Order Withholding From Earnings: The Beaumont Texas Employers Order Withholding From Earnings refers to a legal directive issued by a court to an employer to withhold a portion of an employee's wages. The withheld amount is then used to satisfy outstanding debts owed to the creditor named in the order. 2. Purpose of the Order: The primary purpose of the Beaumont Texas Employers Order Withholding From Earnings is to help enforce court-ordered judgments and ensure that individuals fulfill their financial obligations. It allows creditors to collect on unpaid debts by intercepting a portion of an employee's earnings directly from their employer. 3. Types of Beaumont Texas Employers Order Withholding From Earnings: Although not officially categorized into different types, there are common scenarios where this order may be applied: a. Child Support Withholding: If an individual fails to make court-ordered child support payments, the custodial parent or the state child support agency can request an employer to withhold earnings through the Beaumont Texas Employers Order Withholding From Earnings. The deducted amount is then disbursed to the custodial parent or state agency. b. Judgment Liens and Debt Collection: When individuals fail to satisfy their debts as outlined in a court-ordered judgment or other legal proceedings, creditors can seek an employer-issued withholding order. This order allows the creditor to collect a portion of the debtor's earnings until the debt is resolved. 4. Process of Withholding Earnings: To initiate the Beaumont Texas Employers Order Withholding From Earnings, creditors must obtain a court-issued order and provide it to the debtor's employer. The employer, upon receipt of the order, is legally bound to comply and withhold the specified portion from the employee's earnings. The withheld amount is then remitted to the creditor or the appropriate agency responsible for distributing the payments. Conclusion: The Beaumont Texas Employers Order Withholding From Earnings is a legally authorized method to enforce the payment of outstanding debts and child support obligations in Texas. By understanding its purpose, process, and potential scenarios, both employers and employees can navigate this aspect of Texan employment law more effectively. It is essential to consult legal professionals for specific advice tailored to individual circumstances and to ensure compliance with the applicable laws in Beaumont, Texas.

Beaumont Texas Employers Order To Withhold From Earnings

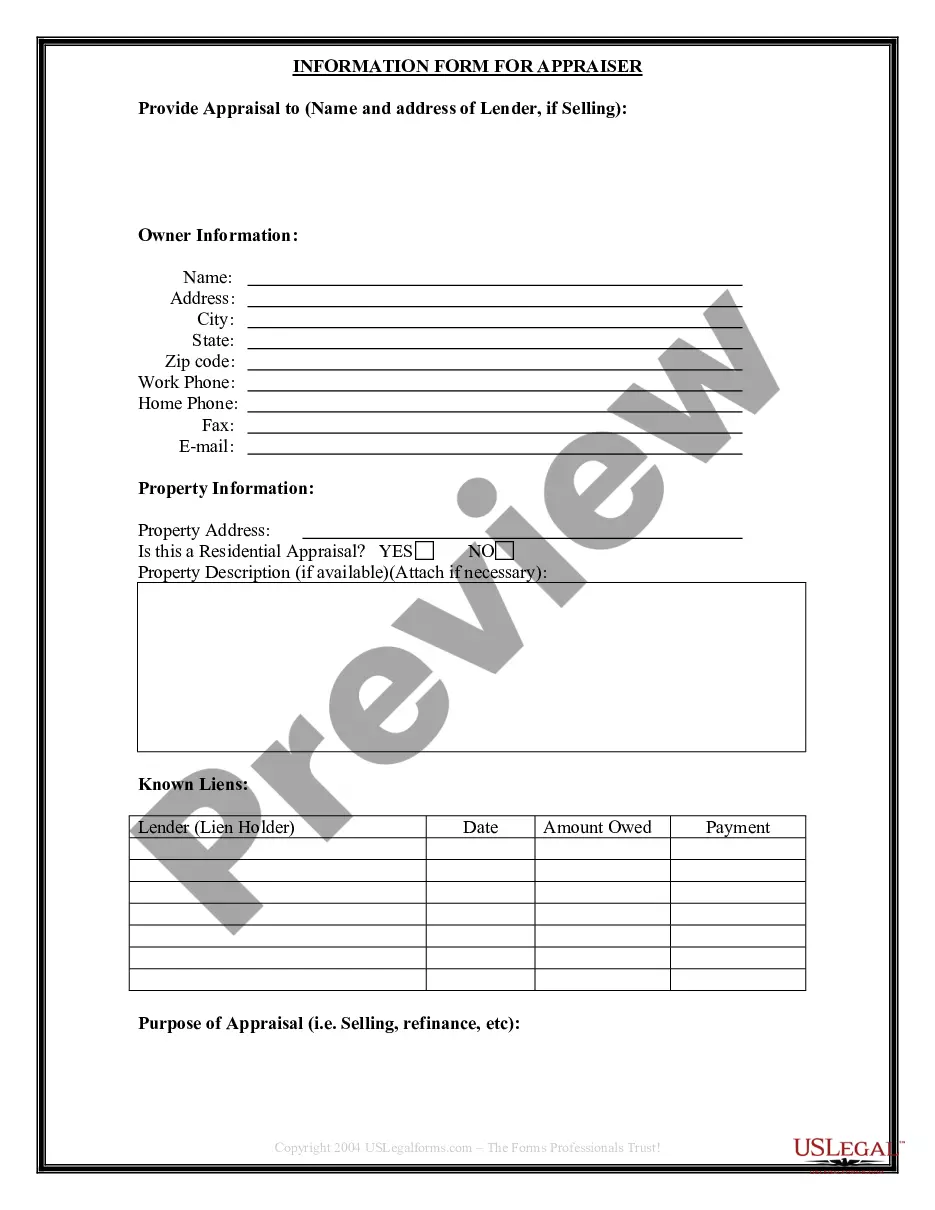

Description

How to fill out Beaumont Texas Employers Order To Withhold From Earnings?

If you are looking for a relevant form template, it’s difficult to find a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can get thousands of templates for business and individual purposes by categories and states, or key phrases. With our high-quality search function, getting the most up-to-date Beaumont Texas Employers Order To Withhold From Earnings is as easy as 1-2-3. In addition, the relevance of every file is confirmed by a group of professional attorneys that regularly review the templates on our website and update them based on the most recent state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Beaumont Texas Employers Order To Withhold From Earnings is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the sample you want. Look at its information and make use of the Preview feature (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the needed document.

- Affirm your choice. Choose the Buy now button. After that, select your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Beaumont Texas Employers Order To Withhold From Earnings.

Every form you add to your user profile does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an extra copy for modifying or creating a hard copy, you can return and save it again anytime.

Make use of the US Legal Forms professional library to get access to the Beaumont Texas Employers Order To Withhold From Earnings you were looking for and thousands of other professional and state-specific templates in a single place!