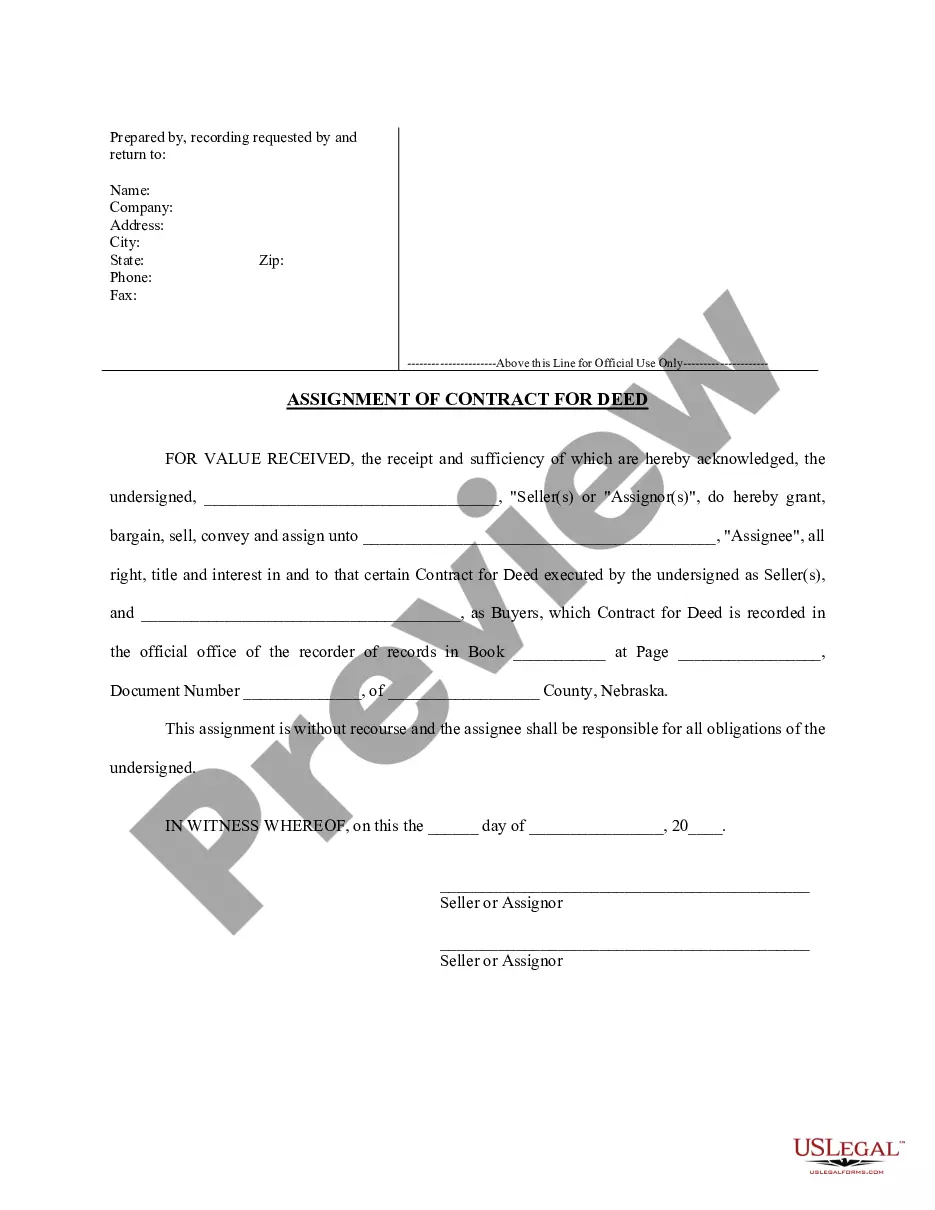

Collin Texas Employers Order Withholding From Earnings, also known as wage garnishment, is a legal process that allows a creditor to collect unpaid debts from an individual's wages. This order is typically issued by a court or government agency, compelling an employer to deduct a specific amount from an employee's earnings and remit it to the creditor until the debt is satisfied. In Collin County, Texas, there are different types of Employers Orders Withholding From Earnings, including: 1. Child Support Orders: When a parent fails to meet their child support obligations, the custodial parent can obtain an order to withhold a specific amount from the noncustodial parent's wages. These funds are then used to provide financial support for the child. 2. Tax Levies: The Internal Revenue Service (IRS) or the Texas Comptroller may issue an employer's order to withhold from earnings to collect unpaid federal or state taxes. This garnishment ensures that the owed taxes are paid directly from the individual's wages. 3. Unpaid Court-Ordered Judgments: In cases where an individual has a court-awarded judgment against them, the creditor can obtain an employer's order to withhold from earnings to satisfy the debt. This type of garnishment is used when the debtor fails to make payments required by the court. To comply with Collin Texas Employers Order Withholding From Earnings, employers must follow specific guidelines. They must calculate the correct amount to withhold based on the employee's disposable income and ensure that the garnished wages are sent to the appropriate creditor within the specified timeframe. It's important to note that there are federal and state limits on the maximum amount of an individual's earnings that can be garnished. These limits aim to protect employees from having too much of their income seized, ensuring they have funds necessary for basic living expenses. In conclusion, Collin Texas Employers Order Withholding From Earnings, or wage garnishment, is a legal process utilized to collect various debts. It encompasses child support orders, tax levies, and unpaid court-ordered judgments. Employers must abide by specific rules when implementing these orders, and there are limits in place to protect employees from excessive wage garnishment.

Collin Texas Employers Order To Withhold From Earnings

Description

How to fill out Collin Texas Employers Order To Withhold From Earnings?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law background to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Collin Texas Employers Order To Withhold From Earnings or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Collin Texas Employers Order To Withhold From Earnings in minutes employing our trustworthy service. If you are already a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps prior to downloading the Collin Texas Employers Order To Withhold From Earnings:

- Ensure the template you have found is good for your area since the rules of one state or area do not work for another state or area.

- Preview the form and read a brief description (if provided) of scenarios the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start again and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Select the payment gateway and proceed to download the Collin Texas Employers Order To Withhold From Earnings as soon as the payment is through.

You’re good to go! Now you can go on and print the form or complete it online. If you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.