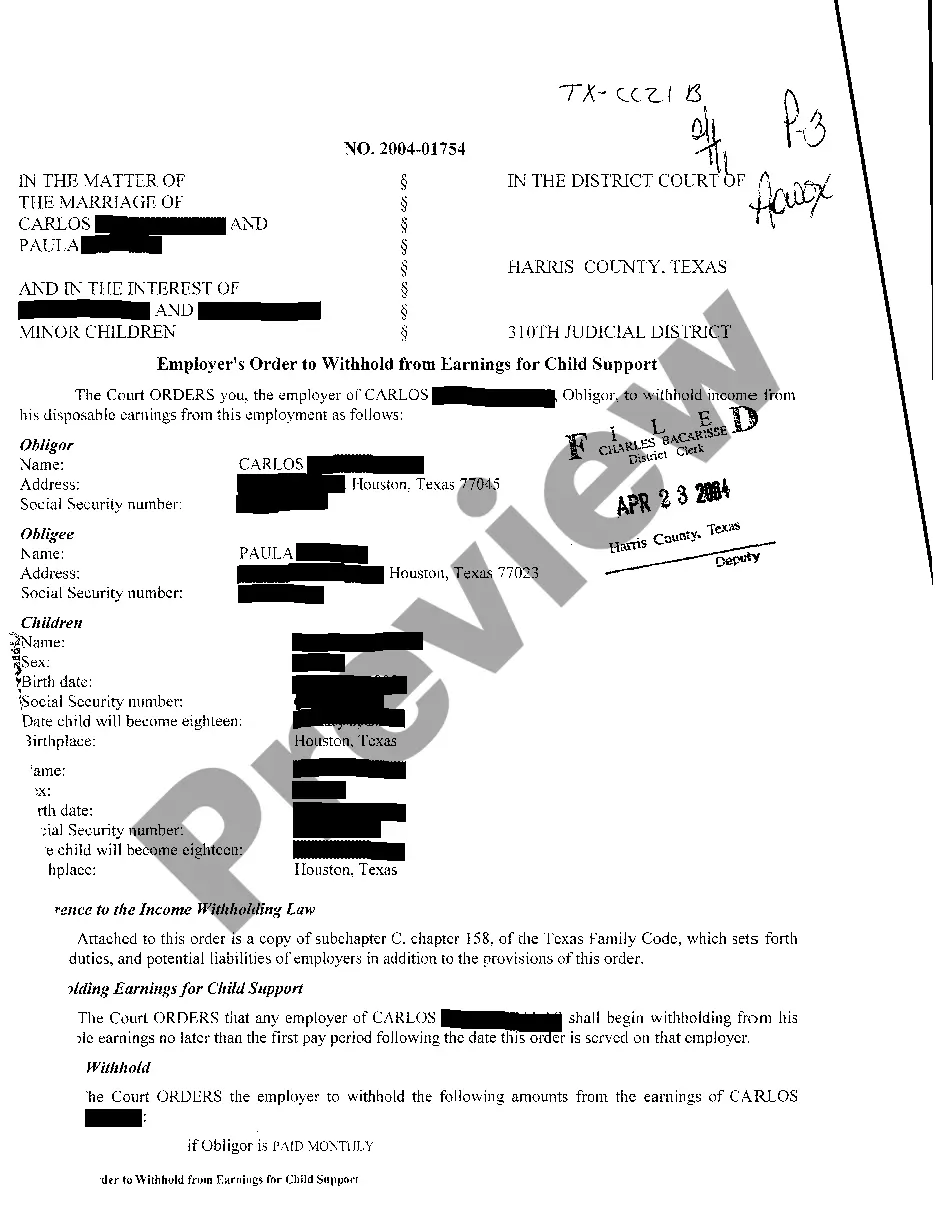

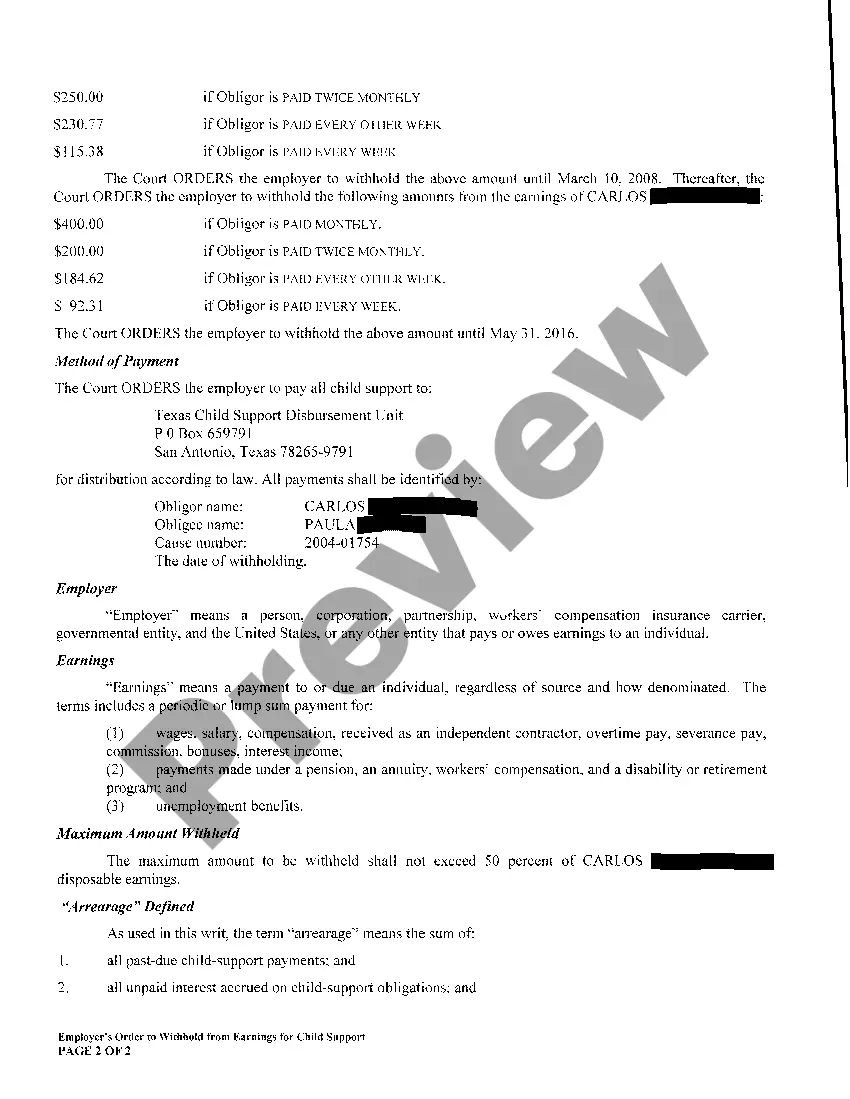

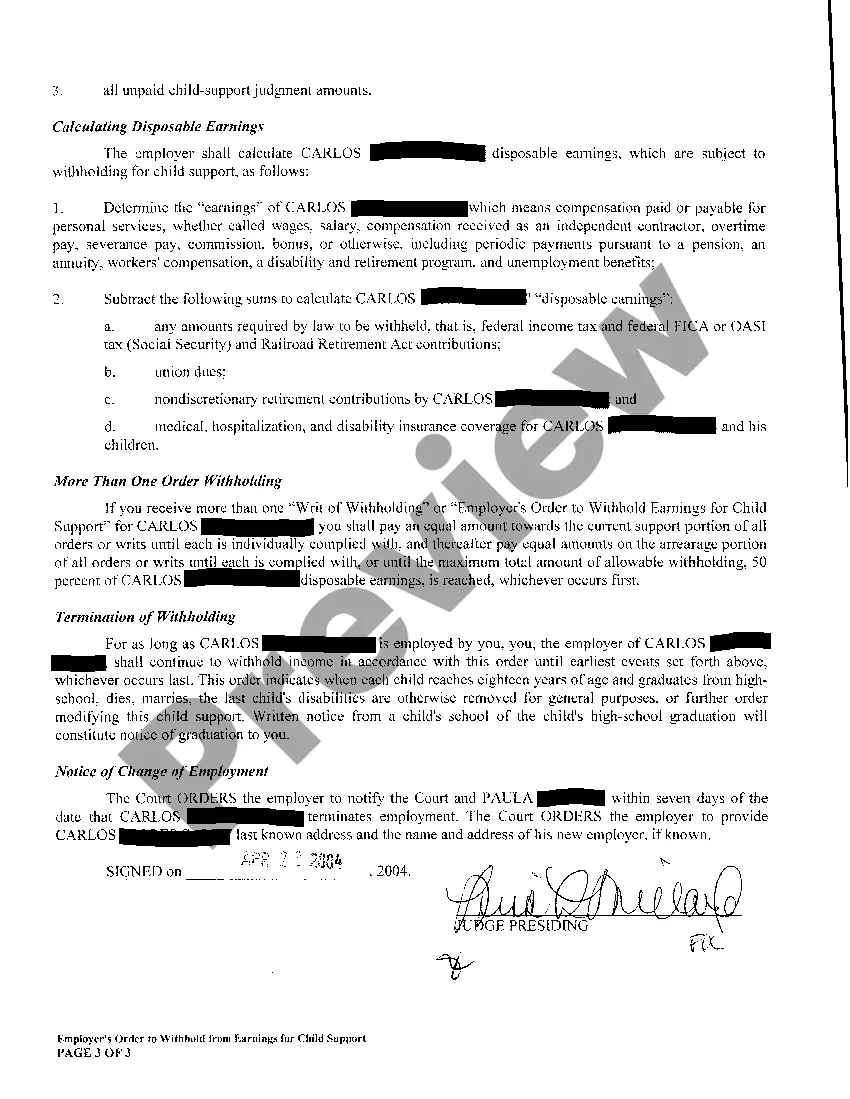

Harris Texas Employers Order Withholding From Earnings is a legal process that allows authorities to collect unpaid debts, child support payments, and taxes from individuals by instructing their employers to withhold a portion of their earnings. This order is primarily executed by the Harris County Domestic Relations Office, Texas Attorney General's Office, and the Internal Revenue Service (IRS). When an individual owes a debt to another party, such as outstanding child support or unpaid taxes, the court or government agency can issue an Employer's Order to Withhold From Earnings. This order is sent directly to the individual's employer, instructing them to deduct a specific amount from their wages before disbursing the remaining balance. The goal is to ensure that the owed amount is directly collected from the debtor's income source, making it easier to fulfill their financial obligations. The Harris Texas Employers Order Withholding From Earnings has different types based on the type of debt or payment being withheld. These include: 1. Child Support Withholding Orders: These orders are issued by the Harris County Domestic Relations Office or the Texas Attorney General's Office to enforce child support payments. If an individual is delinquent in their child support obligations, a withholding order can be issued, specifying the amount to be deducted from their earnings. The order also provides guidance to the employer on how to calculate and remit the withheld amount to the appropriate authorities. 2. Tax Levy Orders: Under the authority of the IRS, a Tax Levy Order can be issued to collect unpaid federal taxes directly from an individual's income. This order enables the IRS to notify the employer about the amount to be withheld, ensuring that a portion of the employee's earnings is directed towards the outstanding tax debt. The employer must comply with the order and transmit the withheld funds to the IRS. 3. Creditor Garnishment Orders: In cases of outstanding debt owed to creditors, such as credit card companies or lenders, a Creditor Garnishment Order can be issued. This order allows a portion of the debtor's wages to be withheld by their employer and paid directly to the creditor until the debt is satisfied. These orders may vary depending on the specific requirements of the creditor and the type of debt owed. It is important to note that Harris Texas Employers Order Withholding From Earnings is a legal process, and failure to comply with the order can lead to severe consequences for the employer, including fines and potential legal action. Individuals who receive such orders should address the underlying debts or obligations promptly to avoid further complications. Overall, Harris Texas Employers Order Withholding From Earnings serves as an effective mechanism to ensure the payment of outstanding debts, child support, and taxes. Implementation of these orders helps enforce financial responsibilities and uphold the obligations of individuals within the Harris County, Texas jurisdiction.

Harris Texas Employers Order To Withhold From Earnings

Description

How to fill out Harris Texas Employers Order To Withhold From Earnings?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no legal background to create this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Harris Texas Employers Order To Withhold From Earnings or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Harris Texas Employers Order To Withhold From Earnings quickly using our trusted platform. If you are presently a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Harris Texas Employers Order To Withhold From Earnings:

- Be sure the template you have chosen is good for your area since the regulations of one state or county do not work for another state or county.

- Review the document and go through a short description (if available) of cases the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Harris Texas Employers Order To Withhold From Earnings once the payment is through.

You’re all set! Now you can go ahead and print the document or complete it online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

We issue orders to withhold to legally take your property to satisfy an outstanding balance due. We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party.

§ 1673). In Texas, up to 50% of your disposable earnings may be garnished to pay domestic support obligations such as child support or alimony. (Tex. Fam.

Turn in your completed Petition to Terminate Withholding for Child Support form at the district clerk's office in the county where your current order was made. Get a copy for both you and the other party. The clerk will ?file-stamp? your forms with the date and time and return the copies to you.

Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. If you aren't supporting a spouse or child, up to 60% of your earnings may be taken. An additional 5% may be taken if you're more than 12 weeks in arrears.

Withholding orders are legal orders we issue to collect past due income taxes or a bill owed to local or state agencies. There are 3 different types of withholding orders we issue: Earnings withholding order (EWOT or EWO) Order to withhold (OTW) Continuous order to withhold (COTW)

Name of SDU (or payee specified in the underlying Tribal support order) to which payments are required to be sent. Federal law requires payments made by IWO to be sent to the SDU except for payments in which the initial child support order was entered before January 1, 1994 or payments in Tribal CSE orders.

The state shall promptly serve on the employer a notice terminating the withholding order for taxes if the state tax liability for which the withholding order for taxes was issued is satisfied before the employer has withheld the full amount specified in the order, and the employer shall discontinue withholding in

What is an Income Withholding Order in Texas? Texas law provides for a court to enter a wage withholding order as a tool to help in collecting spousal maintenance (alimony) payments and child support payments. The order requires the employer of the party obligated to pay to withhold a portion of his paycheck.

The reasons the state will hold funds are: An enforcement action is under review. The payer submits a support check totaling $5,000 or more. The payer's previous checks have bounced.

Interesting Questions

More info

Senate. Committee on Finance. Committee on Ways and Means, United States Senate, 111th Cong., 1st says., Jan. 5, 2009, 4157. Washington, DC.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.