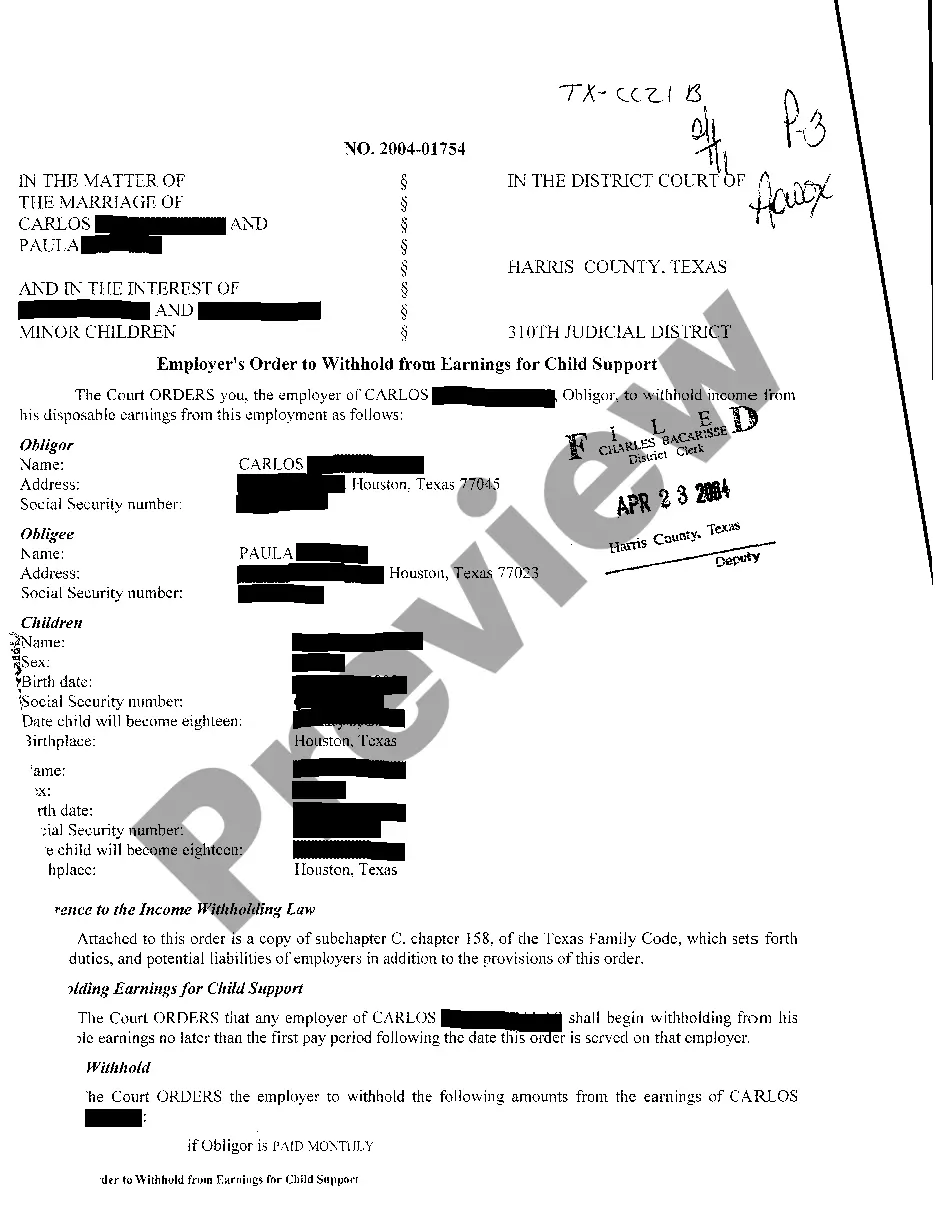

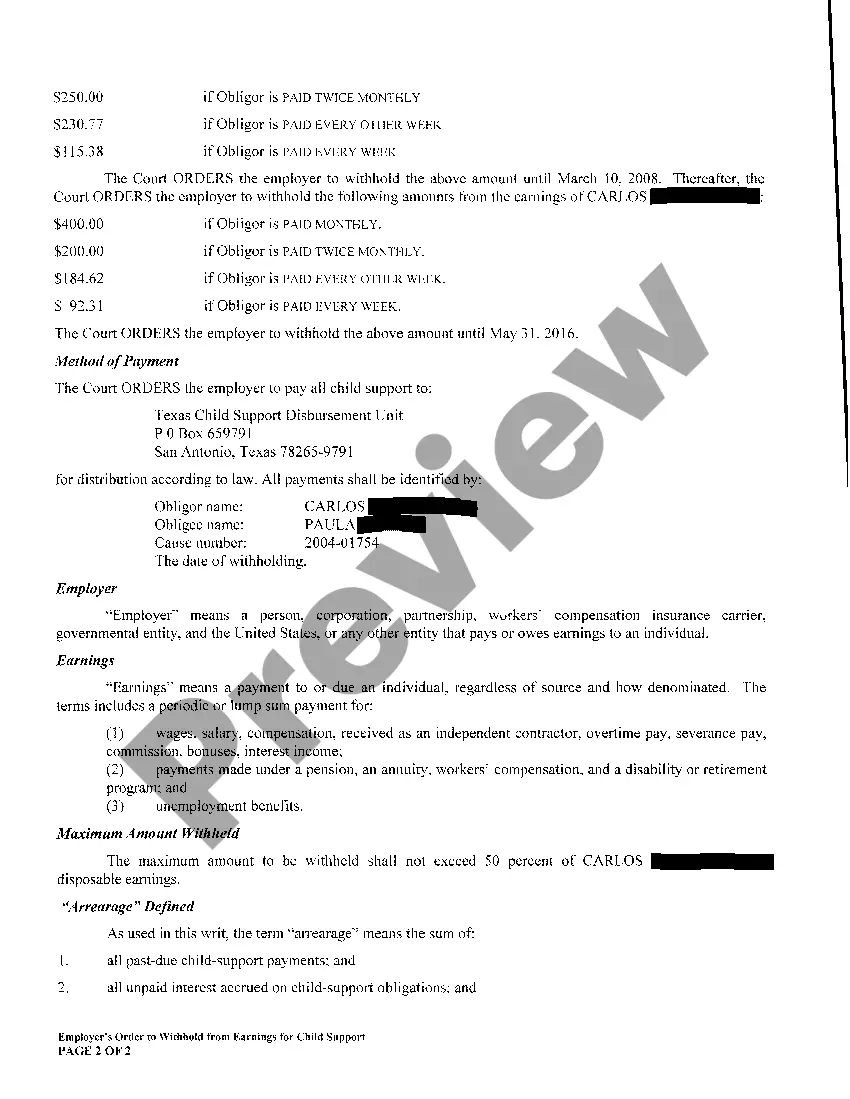

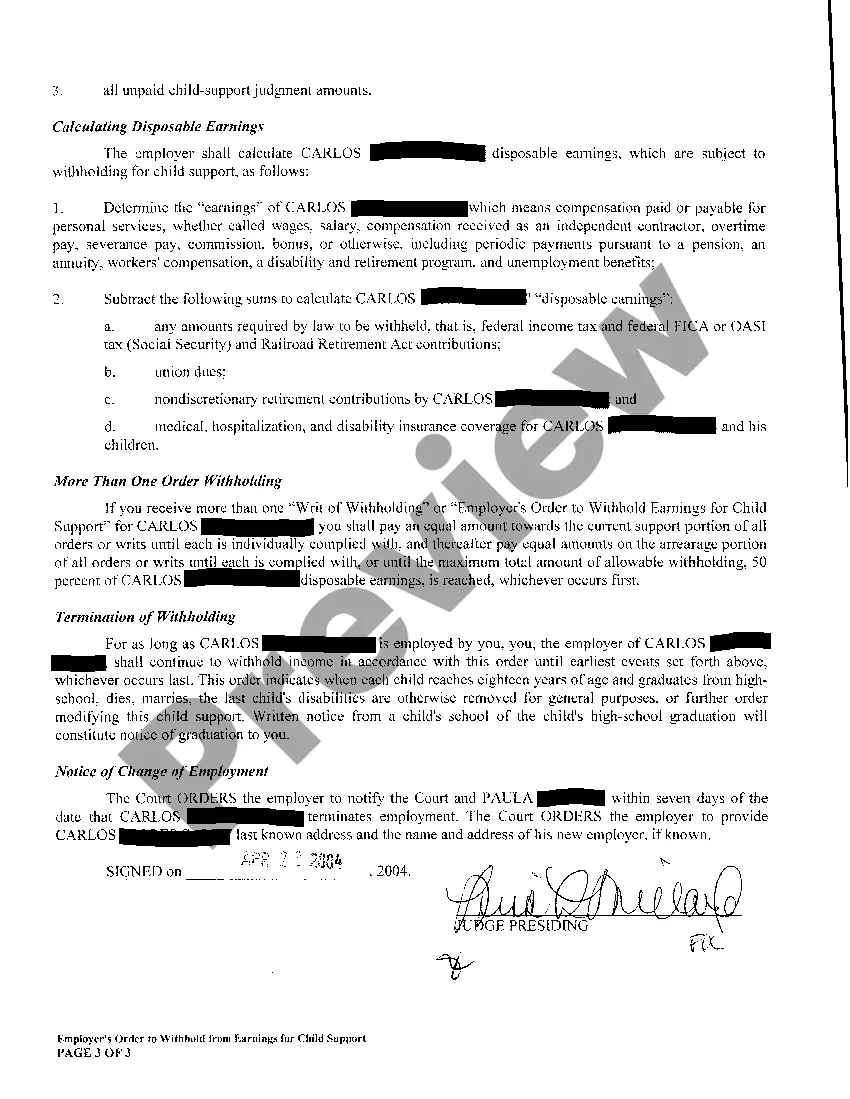

Killeen Texas Employers Order Withholding From Earnings, also known as wage garnishment or wage withholding, is a legal process through which a portion of an employee's wages are withheld by their employer to satisfy a debt or legal obligation. Wage garnishment can be implemented for various reasons, such as child support payments, tax liens, student loan defaults, or unpaid court judgments. In Killeen, Texas, there are different types of Employers Orders Withholding From Earnings that can be issued by relevant authorities or entities. Some notable examples include: 1. Child Support Wage Garnishment: When a parent fails to make court-ordered child support payments, the Texas Attorney General's Office can issue an Employers Order Withholding From Earnings. This allows the employer to deduct a specific amount from the employee's wages and send it directly to the child support agency. 2. Tax Levy Wage Garnishment: The Internal Revenue Service (IRS) can issue an Employers Order Withholding From Earnings to collect unpaid federal taxes. This type of garnishment can result from unpaid income taxes or failure to pay other tax obligations. 3. Student Loan Wage Garnishment: The U.S. Department of Education or a private loan provider can obtain an Employers Order Withholding From Earnings if a borrower defaults on their student loans. In such cases, a percentage of the employee's wages can be withheld to repay the debt. 4. Court-Ordered Wage Garnishment: In situations where an individual owes money as a result of a court judgment, the creditor can obtain an Employers Order Withholding From Earnings. This allows the employer to withhold a portion of the employee's wages until the debt is satisfied. It is important to note that Killeen Texas Employers Order Withholding From Earnings must comply with federal and state laws regarding limits on the amount that can be garnished from an employee's wages. These laws aim to ensure that employees have enough income to cover their basic living expenses. Overall, Killeen Texas Employers Order Withholding From Earnings is a legally mandated process used to collect unpaid debts or obligations. It provides a mechanism for entities such as child support agencies, tax authorities, student loan services, and creditors to recoup funds owed to them while upholding the rights and well-being of employees.

Killeen Texas Employers Order To Withhold From Earnings

Description

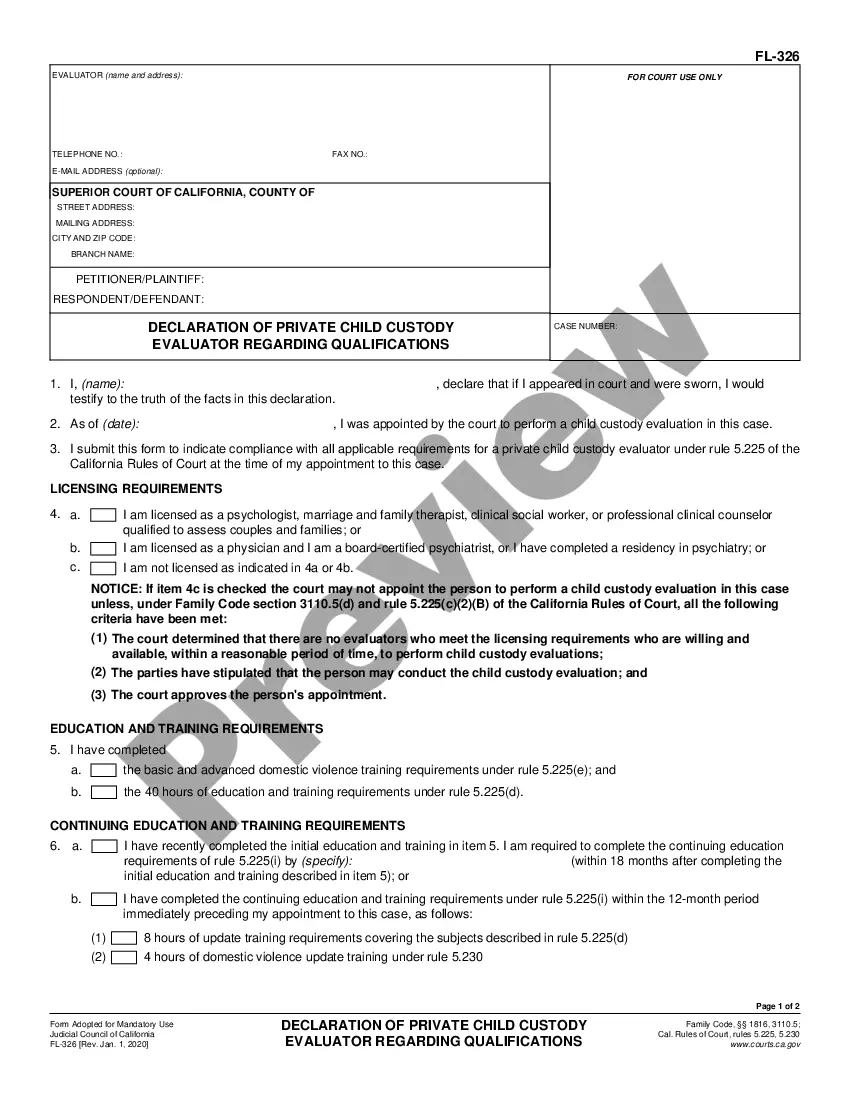

How to fill out Killeen Texas Employers Order To Withhold From Earnings?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any legal education to draft this sort of papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Killeen Texas Employers Order To Withhold From Earnings or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Killeen Texas Employers Order To Withhold From Earnings in minutes using our reliable platform. If you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, if you are new to our platform, ensure that you follow these steps before obtaining the Killeen Texas Employers Order To Withhold From Earnings:

- Be sure the template you have found is specific to your location since the regulations of one state or county do not work for another state or county.

- Review the form and read a quick outline (if provided) of cases the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment method and proceed to download the Killeen Texas Employers Order To Withhold From Earnings as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the form or complete it online. In case you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

Withholdings from earnings refer to amounts deducted from an employee's paycheck for various reasons, including taxes, insurance, and debt repayments. In the context of a Killeen Texas Employers Order To Withhold From Earnings, these deductions ensure compliance with legal obligations. Employers can use specialized resources to manage and track these withholdings, ensuring both accuracy and legal adherence.

An earnings withholding order is a legal order directing employers to withhold a specific amount from an employee's wages to satisfy a debt. In Killeen, Texas, an Employers Order To Withhold From Earnings is issued by the court to facilitate payment of child support, alimony, or other financial obligations. This order ensures that the employee meets their obligations while maintaining a steady income flow.

To calculate an earnings withholding order in Killeen, Texas, start by identifying the employee's disposable earnings, which is the amount left after mandatory deductions like taxes. Generally, the law specifies that certain percentages of disposable earnings can be withheld to meet court-ordered obligations. Utilizing a Killeen Texas Employers Order To Withhold From Earnings template can simplify this calculation process, ensuring compliance with state regulations.

If an employer in Pennsylvania fails to withhold child support, they may face serious legal consequences, including fines or potential lawsuits from the custodial parent. The Killeen Texas Employers Order To Withhold From Earnings serves as a reminder that staying compliant is imperative. Employers should utilize platforms like USLegalForms to ensure they understand their responsibilities and avoid penalties.

Once the Killeen Texas Employers Order To Withhold From Earnings is established, income withholding is usually reflected in the next payroll cycle. However, the initial setup might take longer, especially if the employer needs to verify employee information. It's crucial for employers to streamline their processes to ensure timely withholding periods for maximum compliance.

Withdrawal of a withholding order occurs when payments for child support are no longer necessary. The custodial parent or the court may initiate this process, leading to the Killeen Texas Employers Order To Withhold From Earnings being officially canceled. Employers should ensure they receive proper documentation to avoid continued deductions from their employee's earnings.

An income withholding order can take effect quickly, often within a few days of receipt by the employer. The Killeen Texas Employers Order To Withhold From Earnings mandates that employers comply with the order without delay. However, the speed of processing may vary depending on the employer’s payroll schedule and existing administrative tasks.

The maximum amount that can be withheld for child support under the Killeen Texas Employers Order To Withhold From Earnings typically aligns with federal guidelines. Generally, up to 50% of disposable income may be subject to withholding if the employee supports another spouse or child, and up to 60% if they do not. Employers should be aware of these limits when processing orders to avoid legal complications.

In Texas, employers cannot withhold your paycheck for arbitrary reasons. They are allowed to withhold wages only under specific circumstances, such as lawful deductions for taxes or other agreed-upon reasons. If you believe your employer is unlawfully withholding wages, you should take action to protect your rights. Resources like the USLegalForms platform can guide you in resolving disputes related to the Killeen Texas Employers Order To Withhold From Earnings.

An earnings withholding order is a legal directive that instructs an employer to withhold a portion of an employee's earnings for payment of debts. This can include child support, taxes, or other financial obligations. In Killeen, Texas, such orders are common and must comply with state regulations. Understanding how these orders work can help you manage your finances and obligations more effectively.