The Lewisville Texas Employers Order Withholding From Earnings is a legal process that allows employers in Lewisville, Texas, to deduct a certain portion of an employee's wages for various purposes. This order is typically issued by a court or government agency and is aimed at ensuring compliance with various financial obligations. Employers are obligated to withhold earnings from their employees in specific circumstances, and failure to comply with this order can result in legal consequences. There are several types of orders withholding from earnings that can be issued in Lewisville, Texas, depending on the nature of the financial obligation. Some common types include: 1. Child Support Orders: These orders require employers to deduct a portion of an employee's wages to fulfill their child support obligations. These funds are then sent to the appropriate child support agency for distribution to the custodial parent. 2. Wage Garnishments: Employers may receive orders to withhold from earnings to satisfy debts, such as unpaid taxes, student loans, or court-ordered restitution. These wage garnishments require the employer to deduct a specific amount from the employee's wages until the debt is satisfied. 3. Spousal Support Orders: In certain divorce cases, a court may order an employer to withhold funds from an employee's earnings to fulfill spousal support obligations. These funds are then remitted to the designated recipient, typically the former spouse. 4. Tax Levies: The Internal Revenue Service (IRS) or the Texas Comptroller's Office may issue a levy on an employee's wages if they have outstanding tax liabilities. This order requires the employer to withhold a percentage of the employee's earnings to satisfy the owed tax debt. 5. Student Loan Garnishments: If an individual defaults on their student loan payments, the loan provider or a collection agency may obtain an order to withhold from earnings. This allows the employer to deduct a portion of the employee's wages until the outstanding student loan debt is resolved. It is important to note that the specific requirements and procedures surrounding the Lewisville Texas Employers Order Withholding From Earnings may vary depending on the type of order and the relevant court or agency involved. Employers must familiarize themselves with the applicable laws and regulations to ensure proper compliance and avoidance of any legal complications.

Lewisville Texas Employers Order To Withhold From Earnings

Description

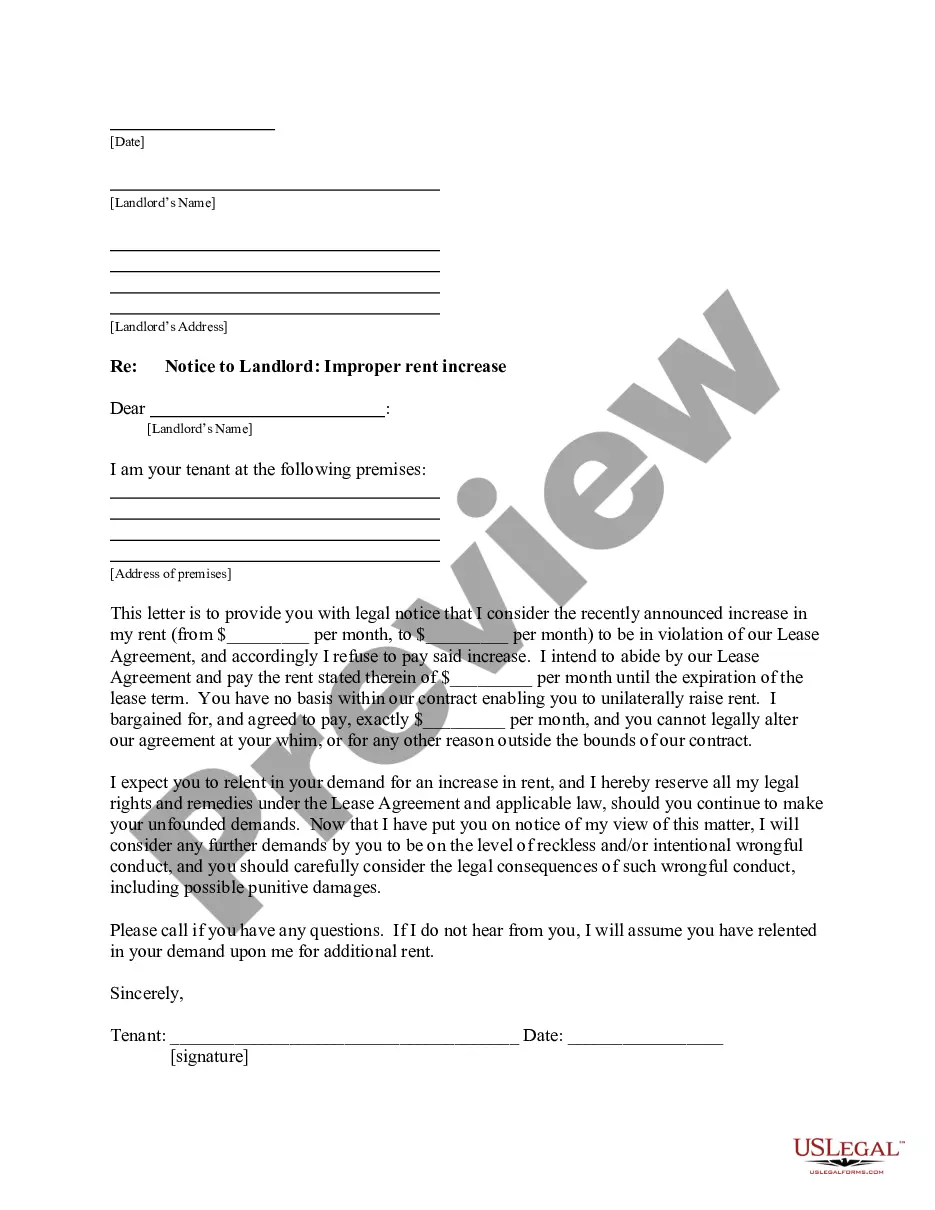

How to fill out Lewisville Texas Employers Order To Withhold From Earnings?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Lewisville Texas Employers Order To Withhold From Earnings gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Lewisville Texas Employers Order To Withhold From Earnings takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Lewisville Texas Employers Order To Withhold From Earnings. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!