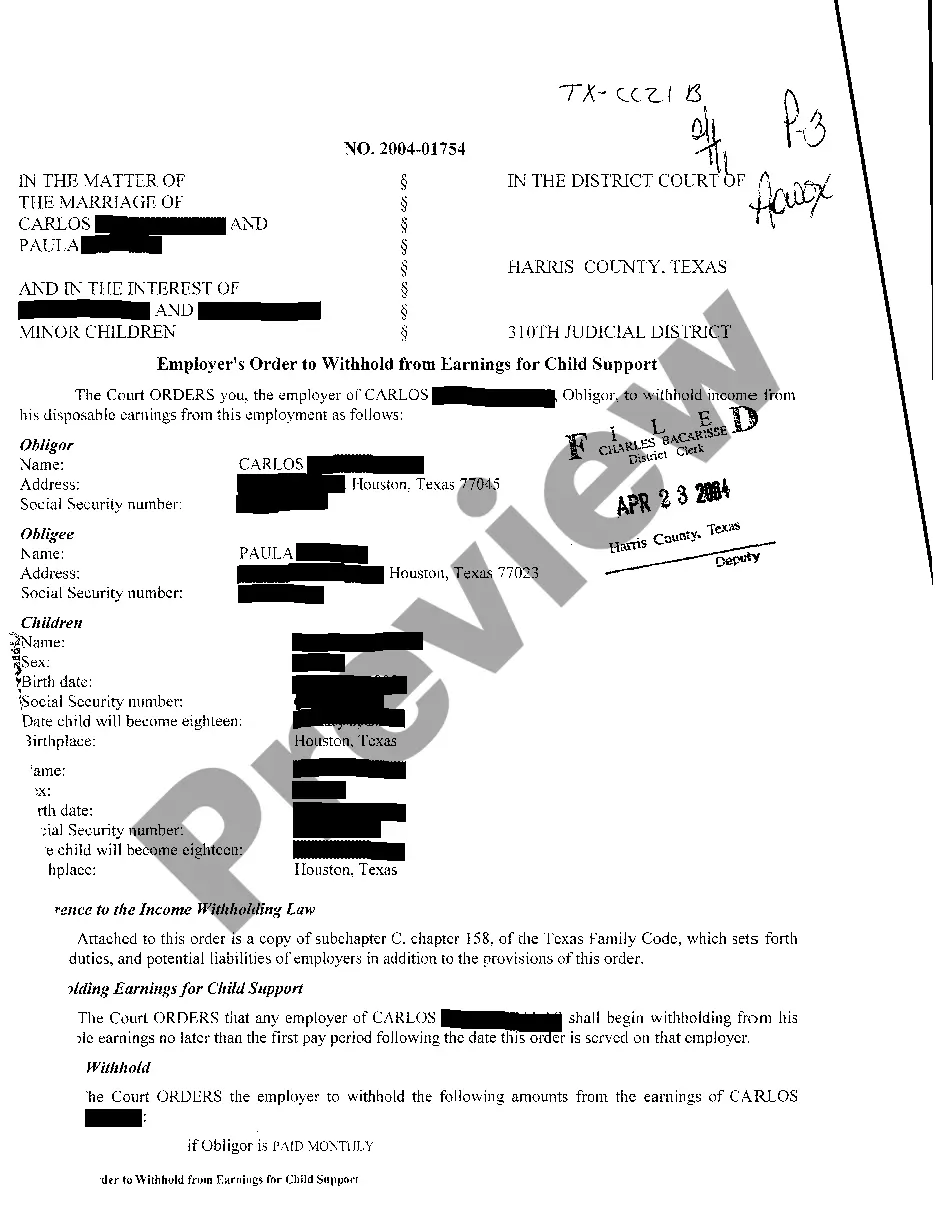

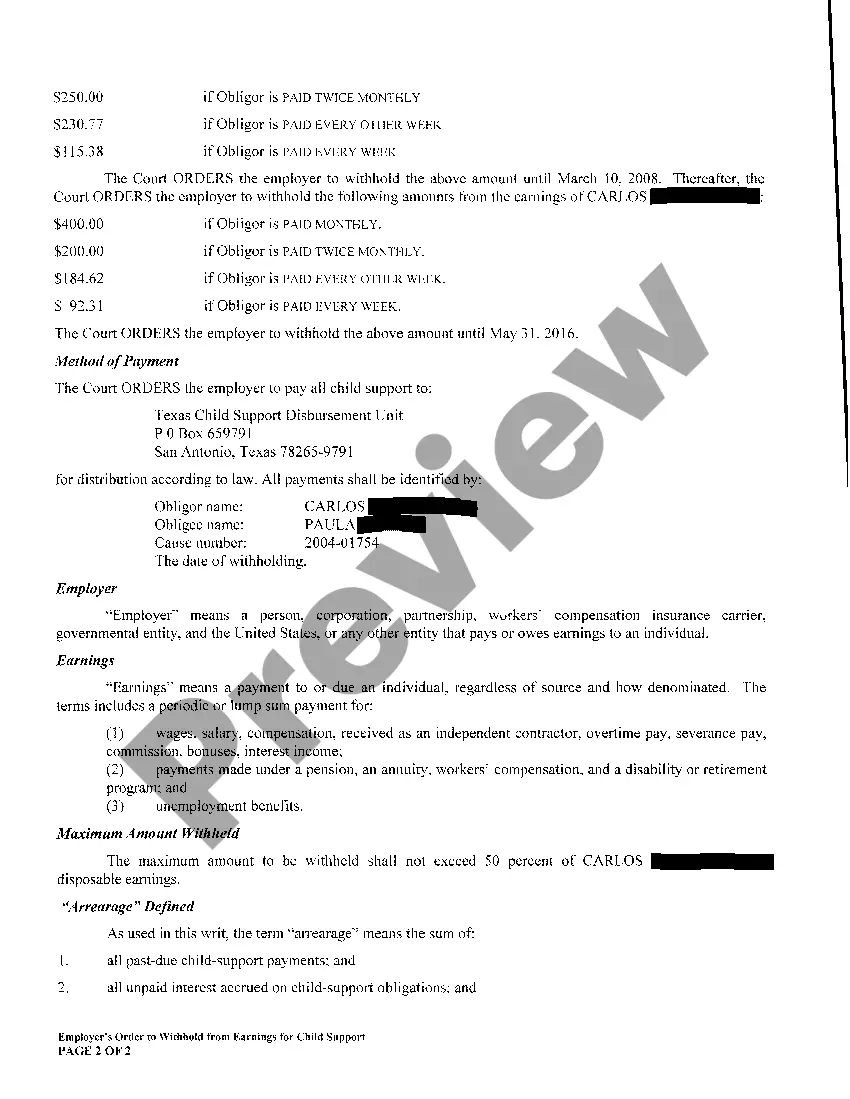

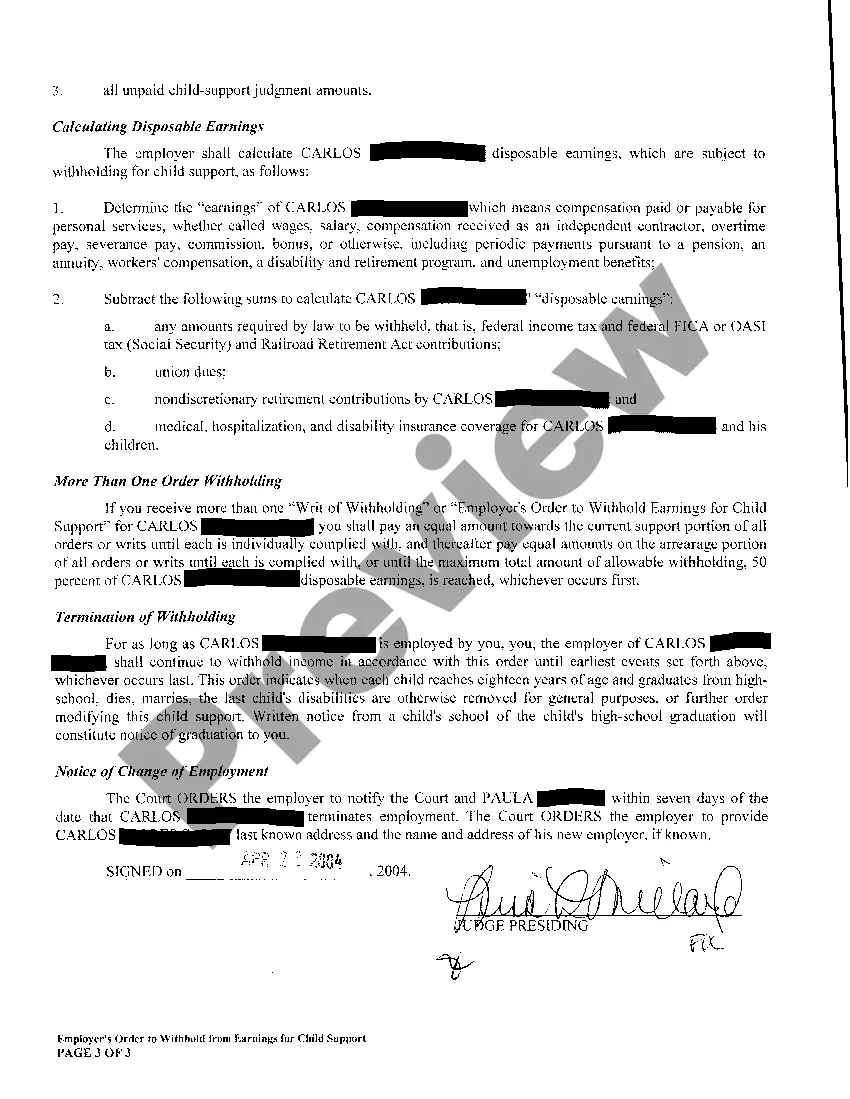

Title: Understanding Round Rock Texas Employers Order Withholding From Earnings: A Comprehensive Explanation Introduction: Round Rock, Texas, like many other jurisdictions, has specific laws in place to ensure that certain financial obligations are met by employees. One such legal mechanism is the Employers Order withholding from Earnings, which allows creditors to collect outstanding debts directly from employees' wages. This detailed description aims to provide an in-depth understanding of the concept, its process, and potential variations in Round Rock, Texas. Keywords: Round Rock Texas, Employers Order withholding, Earnings, creditors, outstanding debts, wages, financial obligations. 1. What is an Employers Order withholding from Earnings? The Employers Order withholding from Earnings is a legal directive issued by a court, allowing creditors to collect outstanding debts owed by employees directly from their wages. This order is typically initiated when employees have failed to meet their financial obligations, such as unpaid loans, child support, or court-ordered restitution. Keywords: Employers Order withholding, outstanding debts, financial obligations, court-ordered restitution, unpaid loans, child support. 2. Process of Implementing an Employers Order withholding from Earnings: i. Obtaining a court order: First, the creditor must initiate legal proceedings and obtain a court order to implement the Employers Order withholding from Earnings. ii. Notifying the employer: Once the court order is obtained, the creditor must alert the employer of their obligation to withhold a portion of the employee's wages. iii. Calculating the withheld amount: The employer, in accordance with the court order, calculates the maximum amount that can be withheld from the employee's earnings, ensuring compliance with state and federal laws. iv. Withholding from wages: The identified amount is then deducted from the employee's earnings and forwarded to the creditor to settle the outstanding debt. Keywords: court order, notifying the employer, calculating withheld amount, compliance with laws, wage deduction, outstanding debt settlement. 3. Types of Round Rock Texas Employers Order withholding from Earnings: a) Unpaid child support: In cases where employees fail to pay court-ordered child support, the custodial parent or relevant government agency may obtain an Employers Order withholding from Earnings to secure timely child support payments. b) Outstanding loan payments: Financial institutions or private creditors may seek an Employers Order withholding from Earnings when employees default on their loan repayments, ensuring the creditor receives the amount owed directly from the employee's wages. c) Court-ordered restitution: If an employee has been tasked with compensating a victim or paying fines as part of a criminal conviction, the court may authorize an Employers Order withholding from Earnings to ensure compliance with the restitution order. Keywords: unpaid child support, outstanding loan payments, court-ordered restitution, delinquent debts, financial institutions, private creditors, criminal convictions. Conclusion: The Employers Order withholding from Earnings serves as a legal mechanism to facilitate the collection of outstanding debts owed by employees directly from their wages. While the process remains similar for different obligations, such as unpaid child support, outstanding loan repayments, or court-ordered restitution, it is vital for both employers and employees in Round Rock, Texas, to understand their rights and obligations when encountering such orders. Keywords: Employers Order withholding, outstanding debts, legal mechanism, obligations, employees' rights, Round Rock Texas.

Round Rock Texas Employers Order To Withhold From Earnings

State:

Texas

City:

Round Rock

Control #:

TX-CC-21-04

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Employers Order To Withhold From Earnings

Title: Understanding Round Rock Texas Employers Order Withholding From Earnings: A Comprehensive Explanation Introduction: Round Rock, Texas, like many other jurisdictions, has specific laws in place to ensure that certain financial obligations are met by employees. One such legal mechanism is the Employers Order withholding from Earnings, which allows creditors to collect outstanding debts directly from employees' wages. This detailed description aims to provide an in-depth understanding of the concept, its process, and potential variations in Round Rock, Texas. Keywords: Round Rock Texas, Employers Order withholding, Earnings, creditors, outstanding debts, wages, financial obligations. 1. What is an Employers Order withholding from Earnings? The Employers Order withholding from Earnings is a legal directive issued by a court, allowing creditors to collect outstanding debts owed by employees directly from their wages. This order is typically initiated when employees have failed to meet their financial obligations, such as unpaid loans, child support, or court-ordered restitution. Keywords: Employers Order withholding, outstanding debts, financial obligations, court-ordered restitution, unpaid loans, child support. 2. Process of Implementing an Employers Order withholding from Earnings: i. Obtaining a court order: First, the creditor must initiate legal proceedings and obtain a court order to implement the Employers Order withholding from Earnings. ii. Notifying the employer: Once the court order is obtained, the creditor must alert the employer of their obligation to withhold a portion of the employee's wages. iii. Calculating the withheld amount: The employer, in accordance with the court order, calculates the maximum amount that can be withheld from the employee's earnings, ensuring compliance with state and federal laws. iv. Withholding from wages: The identified amount is then deducted from the employee's earnings and forwarded to the creditor to settle the outstanding debt. Keywords: court order, notifying the employer, calculating withheld amount, compliance with laws, wage deduction, outstanding debt settlement. 3. Types of Round Rock Texas Employers Order withholding from Earnings: a) Unpaid child support: In cases where employees fail to pay court-ordered child support, the custodial parent or relevant government agency may obtain an Employers Order withholding from Earnings to secure timely child support payments. b) Outstanding loan payments: Financial institutions or private creditors may seek an Employers Order withholding from Earnings when employees default on their loan repayments, ensuring the creditor receives the amount owed directly from the employee's wages. c) Court-ordered restitution: If an employee has been tasked with compensating a victim or paying fines as part of a criminal conviction, the court may authorize an Employers Order withholding from Earnings to ensure compliance with the restitution order. Keywords: unpaid child support, outstanding loan payments, court-ordered restitution, delinquent debts, financial institutions, private creditors, criminal convictions. Conclusion: The Employers Order withholding from Earnings serves as a legal mechanism to facilitate the collection of outstanding debts owed by employees directly from their wages. While the process remains similar for different obligations, such as unpaid child support, outstanding loan repayments, or court-ordered restitution, it is vital for both employers and employees in Round Rock, Texas, to understand their rights and obligations when encountering such orders. Keywords: Employers Order withholding, outstanding debts, legal mechanism, obligations, employees' rights, Round Rock Texas.

Free preview

How to fill out Round Rock Texas Employers Order To Withhold From Earnings?

If you’ve already used our service before, log in to your account and save the Round Rock Texas Employers Order To Withhold From Earnings on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Round Rock Texas Employers Order To Withhold From Earnings. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!