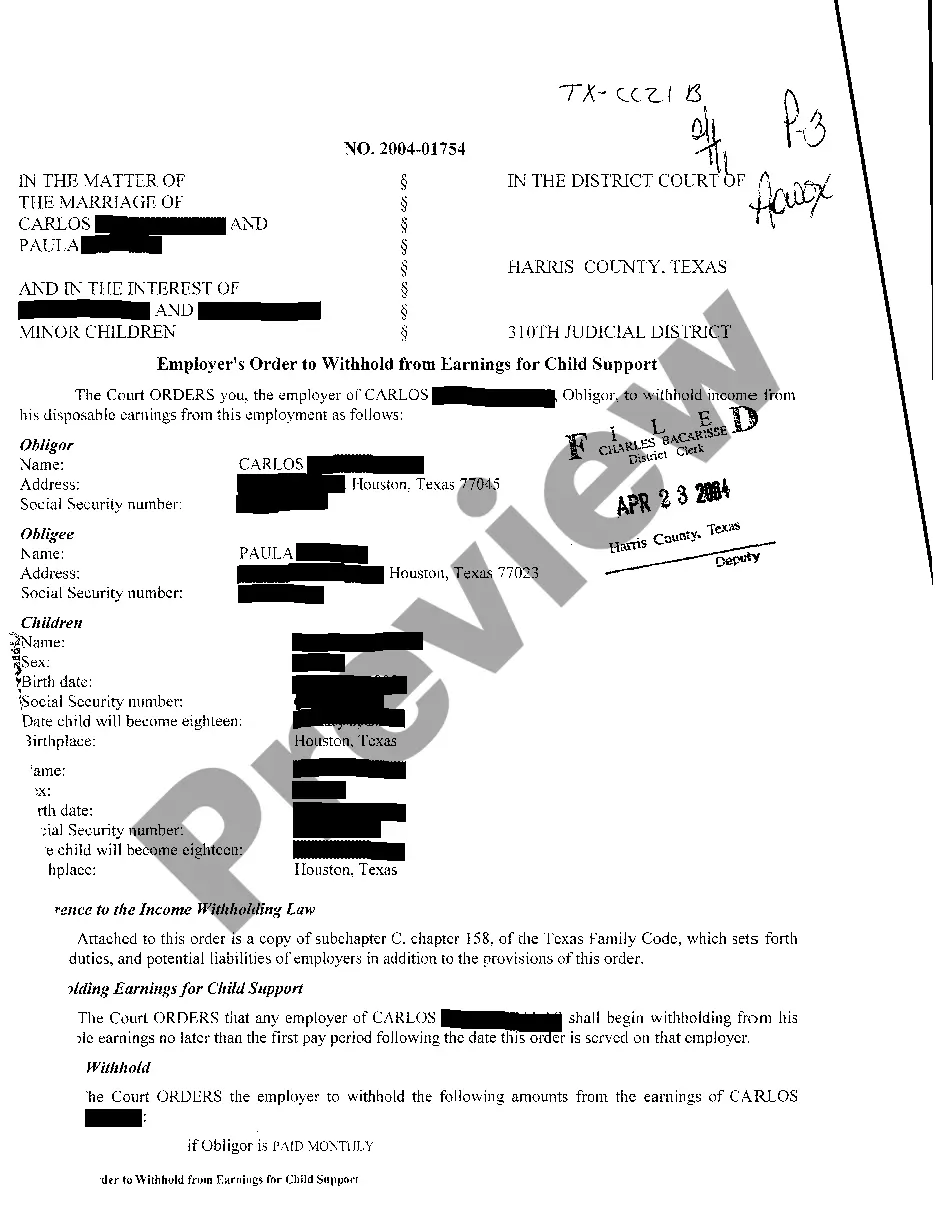

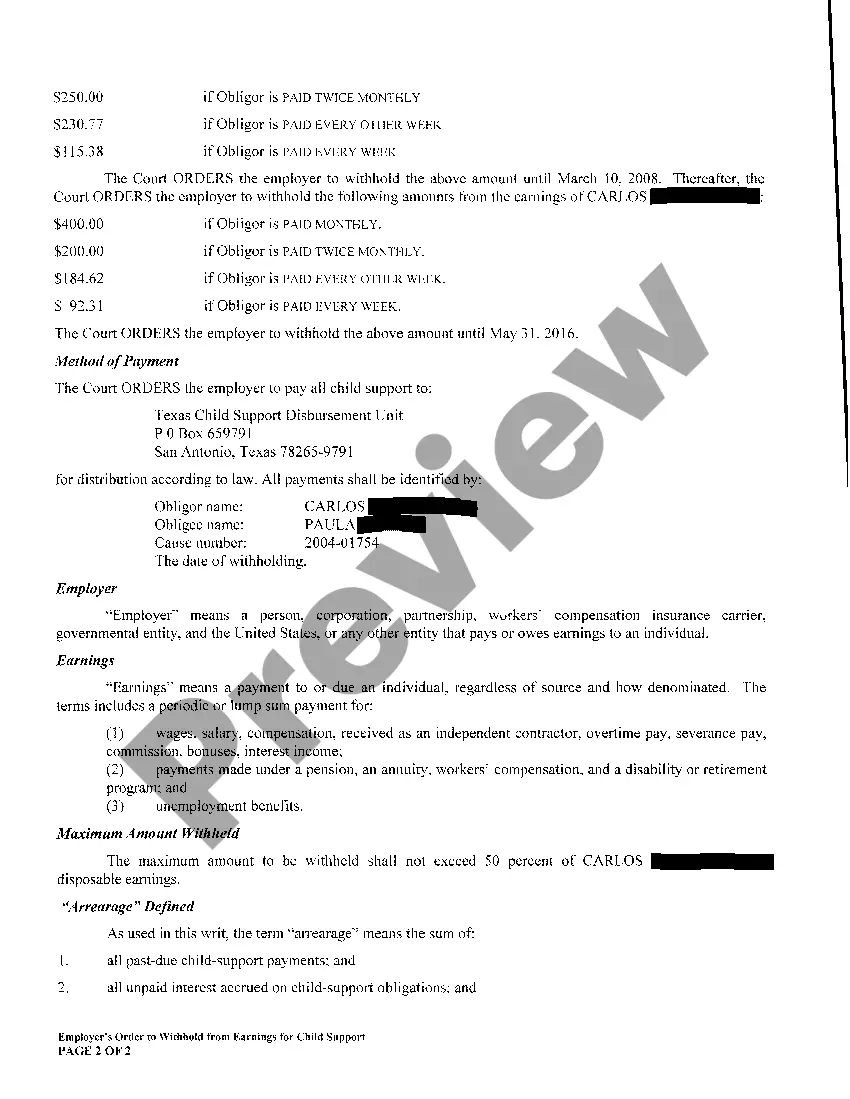

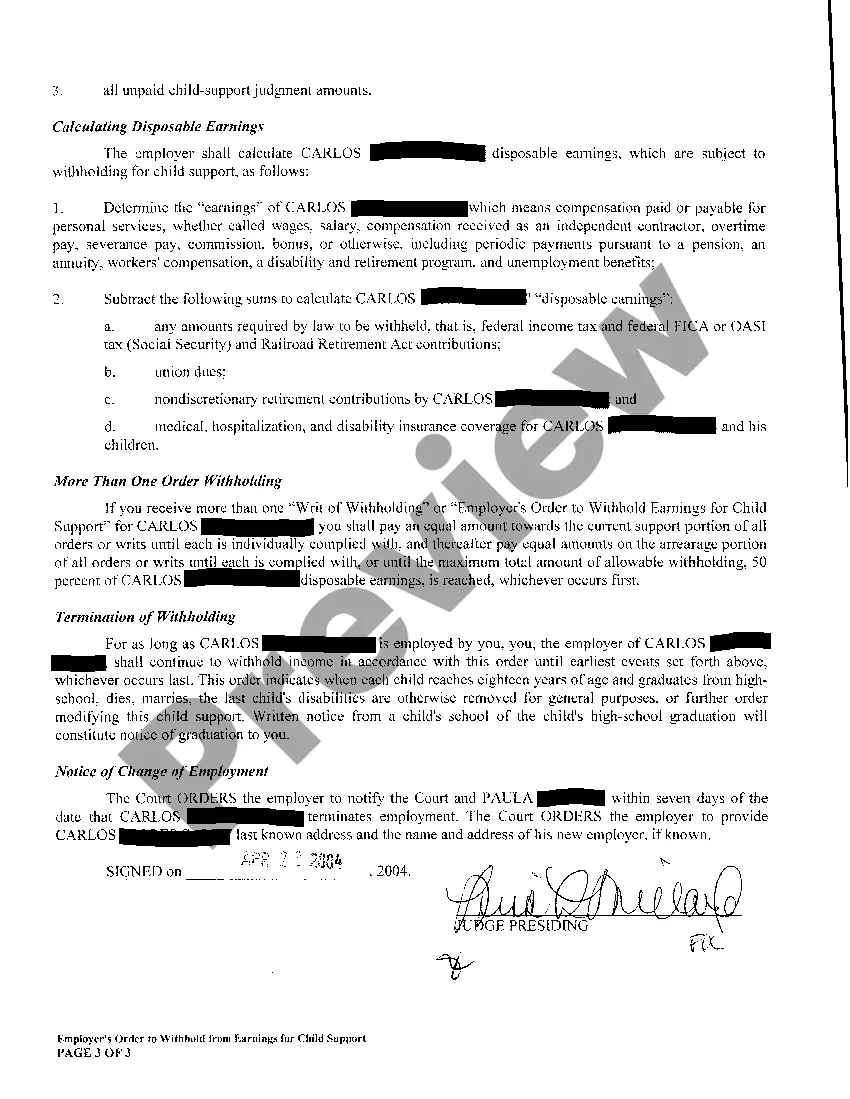

Title: Understanding Waco Texas Employers Order Withholding From Earnings in Detail Keywords: Waco Texas, Employer's Order, Withhold from Earnings, Wage Garnishment, Child Support, Student Loans, Debt Repayment Introduction: In Waco, Texas, employers may receive orders known as Waco Texas Employers Order Withholding From Earnings, which legally require them to deduct a portion of an employee's earnings for various purposes. This process, commonly referred to as wage garnishment, ensures the timely repayment of debts owed to specific entities or individuals. This article aims to provide a comprehensive understanding of Waco Texas Employers Order Withholding From Earnings, its various types, and the context in which they are implemented. 1. Child Support Withholding Orders: One type of Waco Texas Employers Order Withholding From Earnings pertains to child support obligations. When a parent fails to meet their child support obligations, a court may issue an order to their employer, instructing them to withhold a certain amount from the employee's earnings to cover the overdue child support payments. These orders aim to ensure the financial well-being of the child by enforcing consistent support from the parent. 2. Student Loan Withholding Orders: Another common type of Waco Texas Employers Order Withholding From Earnings is related to student loan repayment. If an individual defaults on their student loans, the loan service or the government may obtain a withholding order against the borrower's employer, compelling them to withhold a predetermined portion from the employee's earnings to repay the outstanding student loan debt. 3. Debt Repayment Withholding Orders: Waco Texas Employers Order Withholding From Earnings may also be issued to enforce debt repayment for various types of consumer debt. This can include orders related to credit card debt, medical bills, personal loans, or other outstanding debts. These orders are typically initiated by lenders or collection agencies, seeking to recoup the owed funds by deducting a portion from the employee's wages until the debt is fully repaid. It is important to note that the specific conditions, limitations, and procedures for Waco Texas Employers Order Withholding From Earnings may vary depending on the type of withholding order, the entity seeking the order, and the applicable laws. Employers are legally bound to comply with these orders and must follow the appropriate procedures for withholding and remitting the deducted amounts to the appropriate recipient. Conclusion: Waco Texas Employers Order Withholding From Earnings refers to legal orders that require employers in Waco, Texas, to deduct a portion of an employee's wages for specific purposes such as child support, student loan repayment, or debt recovery. These orders aim to ensure the fulfillment of financial obligations and provide a mechanism for timely and consistent repayment. Employers must adhere to the relevant laws and guidelines when implementing and executing wage garnishments, respecting both the rights of the employee and the obligations set forth by the court or relevant entities.

Waco Texas Employers Order To Withhold From Earnings

Description

How to fill out Waco Texas Employers Order To Withhold From Earnings?

If you are looking for a pertinent form template, it’s hard to locate a more suitable location than the US Legal Forms website – likely the largest online repositories.

Here you can access a vast array of templates for business and personal objectives by categories and regions, or keywords.

With the enhanced search functionality, obtaining the latest Waco Texas Employers Order To Withhold From Earnings is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and save it to your device.

- Moreover, the significance of each document is validated by a team of experienced attorneys who regularly review the templates on our site and update them according to the most recent state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Waco Texas Employers Order To Withhold From Earnings is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have selected the form you need. Review its details and utilize the Preview feature to inspect its contents. If it doesn’t meet your requirements, use the Search bar at the top of the page to locate the necessary document.

- Verify your selection. Click the Buy now button. After that, select your preferred pricing option and provide your information to create an account.

Form popularity

FAQ

Termination of an order to withhold tax refers to the end of the legal requirement for an employer to deduct a certain amount from an employee's wages. In the context of Waco Texas Employers Order To Withhold From Earnings, this could occur when the obligation is satisfied, or the court revokes the order. It's important to inform your employer and check for new legal directives after such termination. Uslegalforms provides necessary templates and advice for this process.

While withholding and garnishment are related concepts, they are not identical. Withholding typically refers to deductions made directly from an employee's earnings as per a legal order, such as a Waco Texas Employers Order To Withhold From Earnings. Garnishment, on the other hand, often involves a court order for a creditor to claim those earnings. Understanding the differences can help you navigate your financial responsibilities more effectively, and uslegalforms offers useful resources to clarify this for you.

Withholdings from earnings are amounts deducted from an employee's paycheck for various purposes, including taxes, benefits, and court-ordered payments. These deductions often arise from a Waco Texas Employers Order To Withhold From Earnings, ensuring that obligations are met efficiently. Understanding your paycheck and the basis for these withholdings can empower you as an employee or employer. For specific forms and guidance, check out uslegalforms.

An earning withholding order serves a similar purpose as an earnings withholding order, instructing an employer to deduct a specified amount from an employee's paycheck. This deduction can cover debts such as child support or other legally mandated obligations. For Waco Texas Employers Order To Withhold From Earnings, it is crucial to know your rights and obligations regarding these deductions. Utilize resources from uslegalforms for clarification on this legal process.

An earnings withholding order is a legal directive that instructs an employer to withhold a portion of an employee's earnings for the payment of debts or obligations. This order often relates to child support, taxes, or other court-ordered payments. For Waco Texas Employers Order To Withhold From Earnings, understanding the nature of these orders can help ensure compliance and avoid penalties. You can explore uslegalforms for more information on these legal documents.

The duration for processing an income withholding order through Waco Texas Employers Order To Withhold From Earnings can vary. Typically, employers are required to begin withholding earnings within seven business days of receiving the order. However, the exact timing may depend on the employer's payroll schedule and other factors. If you need assistance navigating this process, uslegalforms can provide helpful resources.

The reasons the state will hold funds are: An enforcement action is under review. The payer submits a support check totaling $5,000 or more. The payer's previous checks have bounced.

Although some might think it limitless, there are caps set for child support payments. For one child, the maximum child support payment is capped at 20% of the payer's income for 2021. Child support increases depending on the number of children involved.

Turn in your completed Petition to Terminate Withholding for Child Support form at the district clerk's office in the county where your current order was made. Get a copy for both you and the other party. The clerk will ?file-stamp? your forms with the date and time and return the copies to you.

§ 1673). In Texas, up to 50% of your disposable earnings may be garnished to pay domestic support obligations such as child support or alimony. (Tex. Fam.